BlackRock Canada Launches the iShares MSCI Europe IMI Index ETF

(XEU) and the iShares MSCI Europe IMI Index ETF (CAD-Hedged) (XEH)

Offering Diversified Exposure to European Equities

New iShares Funds With Exposure to European Equities Complement

Launch of iShares Core Series; Makes "Core and

Explore" Allocation Strategies More Efficient for Canadian

Investors

TORONTO, ONTARIO--(Marketwired - Apr 23, 2014) - iShares, the

industry-leading exchange-traded fund (ETF) business at BlackRock

Asset Management Canada Limited (BlackRock Canada)

(TSX:XEU)(TSX:XEH), an indirect, wholly-owned subsidiary of

BlackRock, Inc. (BlackRock), announced the launch of two iShares

funds to access European exposure while, in the case of XEH,

hedging exposure to foreign currencies. The iShares MSCI Europe IMI

Index ETF seeks to track the MSCI Europe IMI while the iShares MSCI

Europe IMI Index ETF (CAD-Hedged) seeks to track the MSCI Europe

IMI 100% Hedged to CAD Index. Both indices capture large, mid and

small-cap representation across the developed countries in Europe,

and include 1,315 constituent equities (as of January 31, 2014).

XEH's index is hedged back to Canadian dollars. The new funds'

management fees are 0.25% and were launched under the tickers

(TSX:XEU) and (TSX:XEH), respectively. XEU began trading on April

22nd and XEH is expected to begin trading on April 24th.

"Canadian investors are increasingly using iShares funds to

express their views, and our new options for Europe provide

low-cost access to equity exposure outside of North America," said

Mary Anne Wiley, Managing Director, Head of iShares Canada. "We

believe investors should focus on areas of relative value like

markets in Europe as diversifiers to their asset allocation

strategy."

Make Europe Part of Your Plans: European Fundamentals Attractive

Relative to Canada and the U.S.

Diversification beyond North America is one of the key themes

BlackRock has identified as vital to investors for 2014. With

Canadian and U.S. equity markets on track for modest growth this

year, investors should consider looking beyond the familiar as they

seek opportunities to grow their portfolios. European developed

markets offer equity prices that look reasonably valued compared to

North American equities, and dividend yields are an attractive

growth opportunity for Canadian investors. The MSCI Europe IMI's

current price-to-equity ratio (P/E) stands at 17.71, compared with

a P/E of 19.9 for the MSCI USA IMI and 20.7 for the MSCI Canada

IMI. Meanwhile, dividend yield for the MSCI Europe IMI stands at

3.09%, compared with 1.91% and 2.87% for the U.S. and Canada MSCI

indexes, respectively.1

While providing exposure to growth outside of North America, XEU

and XEH offer significant diversification opportunities to Canadian

investors who may be heavily weighted in domestic equities. The

Canadian stock market is highly concentrated in three sectors:

financials, energy and materials. By contrast, the MSCI Europe IMI

covers key economic sectors that are underweighted in Canadian

indexes, including industrials (e.g. Siemens AG, Airbus Group N.V.

and Rolls-Royce Holdings PLC), healthcare (e.g. Roche Holding AG,

Novartis AG, GlaxoSmithKline PLC) and consumer discretionary (e.g.

BMW AG, Daimler AG). The iShares funds track indexes that cover

approximately 99% of free float-adjusted market capitalization

across European developed-market countries, allowing investors to

explore ex-North America growth, and mitigate cyclical and economic

risk through geographic and sector diversification.

As the ETF market leader, with a 15-year history in ETFs in

Canada and over $43 billion in assets under management, iShares

Canada is committed to serving the evolving needs of investors.

Earlier this year, the iShares Core Series for Canadian

investors was launched - a suite of nine low-cost funds that cover

key assets classes used by Canadian investors in their portfolios

today (domestic equities, dividends and bonds, as well as U.S. and

international equities) to form the core of their ETF portfolios.

At BlackRock, we believe investors should strengthen the core of

their portfolios with low-cost, efficient products such as the

iShares Core Series and complement their asset allocation

strategies with outcome-based solutions designed to address more

specific needs, from earning income in retirement to capitalizing

on short-term market opportunities. As the first funds to be

launched following the iShares Core Series debut, XEU and

XEH provide a new way to complement core holdings, by offering

diversified, outcome-based exposure to an important international

market.

"Investors now have greater flexibility to complement the core

of their portfolio with the diversification they need," adds

Wiley.

1. Source: MSCI Inc., as of 03/31/14.

About BlackRock

BlackRock is a leader in investment management, risk management

and advisory services for institutional and retail clients

worldwide. At March 31, 2014, BlackRock's AUM was US$4.401

trillion. BlackRock helps clients meet their goals and overcome

challenges with a range of products that include separate accounts,

mutual funds, iShares® (exchange-traded funds), and other pooled

investment vehicles. BlackRock also offers risk management,

advisory and enterprise investment system services to a broad base

of institutional investors through BlackRock Solutions®.

Headquartered in New York City, as of March 31, 2014, the firm had

approximately 11,500 employees in more than 30 countries and a

major presence in key global markets, including North and South

America, Europe, Asia, Australia and the Middle East and Africa.

For additional information, please visit the Company's website at

www.blackrock.com.

About iShares ETFs

The iShares business is a global product leader in exchange

traded funds with over 600 funds globally across equities, fixed

income and commodities, which trade on 20 exchanges worldwide. The

iShares funds are bought and sold like common stocks on securities

exchanges. The iShares funds are attractive to many individual and

institutional investors and financial intermediaries because of

their relative low cost, tax efficiency and trading flexibility.

Investors can purchase and sell securities through any brokerage

firm, financial advisor, or online broker, and hold the funds in

any type of brokerage account. The iShares customer base consists

of the institutional segment of pension plans and fund managers, as

well as the retail segment of financial advisors and individual

investors.

iShares Funds are managed by BlackRock Asset Management Canada

Limited. Commissions, trailing commissions, management fees and

expenses all may be associated with investing in iShares Funds.

Please read the relevant prospectus before investing. The funds are

not guaranteed, their values change frequently and past performance

may not be repeated. Tax, investment and all other decisions should

be made, as appropriate, only with guidance from a qualified

professional.

© 2014 BlackRock Asset Management Canada Limited. All rights

reserved. iSHARES® and BLACKROCK® are registered trademarks of

BlackRock, Inc., or its subsidiaries in the United States and

elsewhere. Used with permission.

Contact for Media:Maeve

Hannigan416-643-4058Maeve.Hannigan@blackrock.comwww.blackrock.com

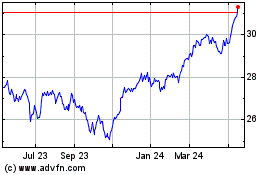

iShares MSCI Europe IMI ... (TSX:XEU)

Historical Stock Chart

From Jun 2024 to Jul 2024

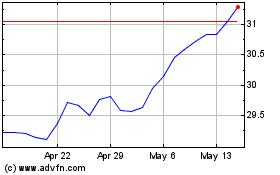

iShares MSCI Europe IMI ... (TSX:XEU)

Historical Stock Chart

From Jul 2023 to Jul 2024