Aldebaran Resources Inc.

(“

Aldebaran” or the “

Company”)

(TSX-V: ALDE, OTCQX: ADBRF) is pleased to announce

that it has entered into an option to joint venture agreement (the

“

Option Agreement”) with Nuton

Holdings Ltd. (“

Nuton”), a Rio Tinto venture,

whereby Nuton can acquire a 20% indirect interest in the Altar

project by making staged payments totaling US$250 Million.

Highlights

- Non-dilutive financing with an upfront payment of US$10

M

- US$20 M projected for Q4-2024 after the publication of

an updated mineral resource estimate, if Nuton elects to

proceed

- US$30 M payment projected for Q2/Q3-2025 after the

publication of a Preliminary Economic Assessment (“PEA”) that

includes a Nuton case, if Nuton elects to proceed

- Final Payment of US$190 M would be made after the

publication of a Pre-Feasibility Study (“PFS”) that includes a

Nuton case, expected in 2026, if Nuton elects to exercise the

option

- Aldebaran is collaborating with Nuton to evaluate a

NutonTM Technologies sulphide

leaching option in the upcoming PEA and PFS

- Nuton’s sulphide leaching technologies have the

potential to materially improve the economics of the

project

- Aldebaran remains the operator of the Altar

project

John Black, Chief Executive Officer of

Aldebaran, commented: “We’re pleased to have entered into

this agreement with Nuton. This deal has many benefits to Aldebaran

shareholders in that it provides for non-dilutive capital

injections to fund future work programs on the Altar project

through to completion of a PFS, if Nuton proceeds through each

milestone. As well, Nuton’s proprietary sulphide leaching

technologies could add significant value to the Altar project by

reducing the costs and capital required for development. Our

current plan for the PEA and PFS is to show both Nuton and

non-Nuton cases.”

Adam Burley, Chief Executive Officer of

Nuton, commented: “We’re pleased to enter into this

agreement with Aldebaran, which provides us with an option to

acquire an interest in a very large copper project in Altar.

Successful deployment of Nuton Technologies at Altar has the

potential to materially enhance the economic and environmental

performance of the project.”

Status of Earn-In Agreement with

Sibanye-Stillwater

The Altar project is owned by Peregrine Metals

Ltd. (“Peregrine”), a private Canadian incorporated company.

Aldebaran currently owns a 60% interest in Peregrine. In August

2023, the Company informed Sibanye-Stillwater that it had met its

commitments to complete the acquisition of an additional 20%

interest in Peregrine from Sibanye-Stillwater (see Company news

release dated August 14, 2023). The process of finalizing the

additional acquisition is ongoing and an official announcement is

expected in Q4 of this year. Upon finalizing the acquisition,

Aldebaran will hold an 80% interest in Peregrine, with

Sibanye-Stillwater holding the remaining 20%. Both Aldebaran and

Sibanye-Stillwater will need to fund future work programs based on

their equity interest in Peregrine.

Transaction Details

Aldebaran has entered into an Option to Joint

Venture Agreement with Nuton, whereby Nuton has the exclusive right

to acquire a 20% interest in Peregrine in exchange for the

following payments:

- US$10 Million

upon signing (“Signing Payment”)

- US$20 Million

upon delivery of an updated mineral resource estimate (“MRE

Payment”)

- Mineral resource

estimate expected to be completed in November 2024

- US$30 Million upon delivery of a Preliminary Economic

Assessment (“PEA Payment”)

- PEA expected to

be completed in Q2-2025

- US$190 Million upon delivery of a Pre-Feasibility Study

(“PFS Payment”)

- PFS expected to be completed in

2026

The payments by Nuton will be made as follows:

90% will be paid directly to Peregrine and 10% will be paid

directly to Aldebaran, as directed by Peregrine. The payments made

to Peregrine will be utilized to fund Aldebaran’s portion of

ongoing and future work programs at Altar.

Upon completion of the PFS Payment, Nuton will

acquire a 20% interest in Peregrine and have a 20% indirect

interest in the Altar project. Altar would then be owned as

follows: Aldebaran 60%, Sibanye-Stillwater 20%, and Nuton 20%, with

Aldebaran operating the project.

If Nuton elects not to proceed after the

issuance of the MRE, PEA or PFS, the Option Agreement will be

terminated, Aldebaran will retain its 80% interest in the project,

and Aldebaran and Peregrine will retain any cash payments made

prior to the termination unless there is an uncured material breach

of the agreement by Aldebaran or Peregrine.

Nuton and Aldebaran have agreed to a work

program for the 2024/2025 field season to ensure that Nuton’s

proprietary sulphide leaching technology can be evaluated in both

the PEA and PFS. This work program involves drilling several new

“twin-holes1” of existing drill holes to acquire large-diameter

PQ-sized drill core to be utilized in Nuton’s Phase 2 testing

program (see below for details). The cost of this drill program

will be paid from Nuton’s US$10 Million Signing Payment. If the

drill program exceeds US$5 Million, as mutually agreed, Nuton will

advance those costs from the PEA Payment. All costs associated with

the actual testing of the Altar drill core with the Nuton

technologies will be borne by Nuton. The Phase 1 program is ongoing

(see below for details).

Aldebaran will also conduct additional work

programs at Altar during the 2024-25 field season to advance the

PEA and PFS and potentially explore other areas of interest on the

Altar property.

As part of the agreement, Nuton will have

exclusivity over any novel, trade secret or patented copper

heap-leach related technology to be tested or deployed at the Altar

project for a period of two years.

Phase 1 Nuton Program

Ten (10) samples, totaling approximately 2,100

kg, were shipped to Nuton earlier in 2024. All samples were taken

from previously drilled, well preserved, PQ-sized whole core stored

in the Company’s San Juan warehouse. The samples were shipped to

SGS laboratories in Santiago, Chile for further sample preparation

according to Nuton specifications and protocols. The prepared

materials were then shipped from Chile to Denver, Colorado, and

placed into several columns with a height of 1 m, with each column

under different controlled Nuton operational conditions. Results

from Phase 1 are expected in Q2-2025 and will be utilized in the

PEA.

Phase 2 Nuton Program

Aldebaran will complete large diameter PQ-sized

drilling this coming field season to provide Nuton with material to

be placed into full-height, 10 m columns. The 10 m height columns

are designed to simulate a typical 10 metre “lift” height in an

operational heap-leach pad. The scale-up from 1 m to 10 m height

columns will provide valuable data that will be utilized in the

Nuton case in the Altar PFS. It is anticipated that the final

results will be ready approximately two years after

the delivery of the rock material. Nuton has informed

Aldebaran that interim results, which will be available in 2026,

should be representative and can be utilized in the PFS.

The Altar Project

The Altar copper-gold project hosts a cluster of

porphyry deposits in San Juan, Argentina, which Aldebaran is

expanding through exploration to deliver to the rising copper

market. The 2021 pit-constrained resource estimate showed 11.4B lb

Cu and 3.4Moz Au in the Measured and Indicated categories, plus

1.7B lb Cu and 0.4Moz Au Inferred. Since the last resource update,

the Company has completed more than 63,000 m of drilling and

discovered an additional porphyry centre called Altar United. The

Company is completing an updated resource estimate, which will be

completed in November of 2024. The Company has engaged SRK

Consulting as Lead to complete a PEA in Q2-2025 and a PFS in 2026,

with Knight Piesold as a sub-contractor.

Webinar

For more context, please join the Company in a

live event on Friday, November 8th, at 11:00 am EDT / 8:00 am PDT.

Q&A will follow the presentation. Click here to

register: https://6ix.com/event/aldebaran-presents-corporate-update.

Qualified Person

The scientific and technical data contained in

this news release has been reviewed and approved by Dr. Kevin B.

Heather, B.Sc. (Hons), M.Sc, Ph.D, FAusIMM, FGS, Chief Geological

Officer and director of Aldebaran, who serves as the qualified

person (QP) under the definitions of National Instrument

43-101.

ON BEHALF OF THE ALDEBARAN

BOARD(signed) “John Black”John BlackChief Executive

Officer and DirectorTel: +1 (604) 685-6800Email:

info@aldebaranresources.com

Please click here and subscribe to

receive future news releases:

https://aldebaranresources.com/contact/subscribe/

For further information, please consult

our website at www.aldebaranresources.com

or contact:

Ben CherringtonManager, Investor RelationsPhone:

+1 347 394-2728 or +44 7538 244 208Email:

ben.cherrington@aldebaranresources.com

About Aldebaran Resources

Inc.

Aldebaran is a mineral exploration company that

was spun out of Regulus Resources Inc. in 2018 and has the same

core management team. Aldebaran holds a 60% interest in the Altar

copper-gold project in San Juan Province, Argentina and can earn an

additional 20% interest in the project by completing a further $25

million in expenditures at Altar over the next three years. The

Altar project hosts multiple porphyry copper-gold deposits with

potential for additional discoveries. Altar forms part of a cluster

of world-class porphyry copper deposits which includes Los

Pelambres (Antofagasta Minerals), El Pachón (Glencore), and Los

Azules (McEwen Copper). In March 2021 the Company announced an

updated mineral resource estimate for Altar, prepared by

Independent Mining Consultants Inc. and based on the drilling

completed up to and including 2020 (independent technical report

prepared by Independent Mining Consultants Inc., Tucson, Arizona,

titled “Technical Report, Estimated Mineral Resources, Altar

Project, San Juan Province, Argentina”, dated March 22, 2021 - see

news release dated March 22, 2021).

About Nuton

Nuton is an innovative venture that aims to help

grow Rio Tinto’s copper business. At the core of Nuton is a

portfolio of proprietary copper leaching related technologies and

capability – a product of almost 30 years of research and

development. Nuton offers the potential to economically unlock

copper from primary sulfide resources through leaching, achieving

market-leading recovery rates and contributing to an increase in

copper production at new and ongoing operations-. One of the key

differentiators of Nuton is the ambition to produce the world’s

lowest footprint copper while having at least one Positive Impact

at each of our deployment sites, across our five pillars: water,

energy, land, materials and society.

Sampling and Analytical

Procedures

Altar follows systematic and rigorous sampling

and analytical protocols which meet and exceed industry standards.

These protocols are summarized below and are available on the

Aldebaran website at www.aldebaranresources.com. All drill holes

are diamond core holes with PQ, HQ or NQ core diameters. Drill core

is collected at the drill site where recovery and RQD (Rock Quality

Designation) measurements are taken before the core is boxed and

transported to the Altar camp facilities, a short distance away,

where the whole core is photographed under more optimum lighting

conditions and geological quick log is produced. The whole-core is

then marked and sampled into geological defined, systematic 1- to

2-metre sample intervals, unless the geologist determines the

presence of an important geological contact, which should not be

crossed. The whole-core is then cut-in-half with a diamond saw

blade, with half the sample retained in the core box for future

reference and the other half placed into a pre-labelled plastic

bag, sealed with a two plastic security zip ties, and labeled with

a unique sample number. The bagged samples are then placed into

larger plastic sacks and those sacks are sealed with another

plastic security zip tie and labelled for shipment. The sacks are

then placed onto wooden pallets and wrapped in plastic shrink-wrap

and stored in a secure area pending shipment to a certified ALS

laboratory sample preparation facility located in Mendoza,

Argentina, where the samples are dried, crushed, and pulverized.

The resulting sample pulps are sent by batch to the ALS laboratory

in Lima for geochemical assay analysis, including a 30g fire assay

with an atomic absorption (AA) finish analysis for gold and a full

multi-acid digestion (4-acid) with ICP-AES analysis for other

elements. Samples with results that exceed maximum detection values

for gold are re-analyzed by fire assay with a gravimetric finish

and other elements of interest are re-analyzed using precise

ore-grade ICP analytical techniques. Aldebaran independently

inserts certified control standards (Super Certified Reference

Materials (SCRM’s), coarse field blanks, and duplicates into the

sample stream to monitor data quality. These control samples

represent 10-12% of the total samples submitted and are inserted

“blindly” to the laboratory in the sample sequence prior to

departure from the Aldebaran facilities.

Forward-Looking Statements

Certain statements regarding Aldebaran,

including management's assessment of future-plans and operations,

may constitute forward-looking statements under applicable

securities laws and necessarily involve known and unknown risks and

uncertainties, most of which are beyond Aldebaran's control. Often,

but not always, forward-looking statements or information can be

identified by the use of words such as “plans”, “expects” or “does

not expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate” or

“believes” or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved.

Specifically, and without limitation, all

statements included in this press release that address activities,

events or developments that Aldebaran expects or anticipates will

or may occur in the future, including the proposed exploration and

development of the Altar project described herein, and management's

assessment of future plans and operations and statements with

respect to the completion of the anticipated exploration and

development programs, may constitute forward-looking statements

under applicable securities laws and necessarily involve known and

unknown risks and uncertainties, most of which are beyond

Aldebaran's control. These risks may cause actual financial and

operating results, performance, levels of activity and achievements

to differ materially from those expressed in, or implied by, such

forward-looking statements. Although Aldebaran believes that the

expectations represented in such forward-looking statements are

reasonable, there can be no assurance that such expectations will

prove to be correct. The forward-looking statements contained in

this press release are made as of the date hereof and Aldebaran

does not undertake any obligation to publicly update or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

1 A twin-hole is designed to replicate an

existing drill hole and is typically drilled directly beside an

existing hole which acts as a geological control hole. Twin-holes,

drilled with PQ-sized core, allow for the collection of a large

volume of rock material that can be used in metallurgical test

work, such as large 10 m height columns for Nuton, and for other

geotechnical or environmental characterization work.

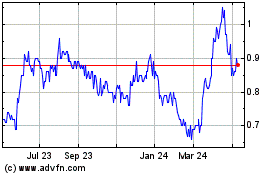

Aldebaran Resources (TSXV:ALDE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Aldebaran Resources (TSXV:ALDE)

Historical Stock Chart

From Dec 2023 to Dec 2024