Mosaic Minerals Corp Appoints New Chief Executive Officer and Directors

31 August 2021 - 9:00PM

The management of Mosaic Minerals Corp. (“Mosaic” or the “Company”)

(CSE: MOC) is pleased to announce the nomination of Mr. Jonathan

Hamel as President and Chief Executive Officer effective

immediately.

Mr Hamel is President and CEO at Bullion Gold

Resources Corporation (TSX-V : BGD), Secretary of the Board of

Vanstar Mining Resources Inc (TSX-V : VSR) since 2020. He acted as

Interim President and CEO during management transition in 2020. He

was also a Director at Vanstar from 2018 to 2021. In addition to

his 20 years of management experience, Mr. Hamel sits on the Board

of Directors of the Montreal Economic Institute, a globally

recognized independent public policy think tank focused on

proposing reforms based on market principles and entrepreneurship

as well as Guest Lecturer at École des dirigeants – HEC Montréal.

Mr Hamel served on the Financial Technology Innovation Committee of

L’Autorité des Marchés Financiers (Québec) from 2017 to 2020. Mr.

Hamel will also join the Board of Directors of The Company

replacing Mr. Guy Morissette who will continues to advise the

Company as an external consultant.

The management is also pleased to announce the

nomination of Mr. Jean Rainville as Director of The Company. Mr.

Rainville has over 40 years of experience in the mining industry

and financial markets. From 2008, his principal occupation was

President and CEO of Blackrock Metals Inc. In 2018, Mr. Rainville

ceased to serve as CEO, while retaining his position as President

until late 2019, at which time he became a consultant. Previously,

Mr. Rainville worked as an engineer, a fund manager and a director

of corporate finance and has also served as a director or advisor

for several public companies including Bonterra Resources Inc

(TSX-V : BTR) and Fokus Mining Inc. (TSX-V: FKM). He holds

bachelor’s degrees in Mining Engineering and Commerce, both from

McGill University.

Grant of Stock OptionsThe Company also announces

that incentive stock options have been granted to directors,

officers, and consultants to purchase up to 1,100,000 common shares

at a price of $0.095 per share for five years, pursuant to its

Stock Option Plan. The Company currently has 42,678,500 shares

issued and outstanding, along with 4,050,000 options (including the

options described above) and 9,924,500 warrants outstanding.

Related-Party Transaction

An Insider of the Corporation subscribed for an

aggregate of 100,000 Units for gross proceeds of $7,000.00 under

the Private Placement (the 'Insider Subscriptions') disclosed on

August 26, 2021. The Insider Subscriptions constitute 'related

party transactions' within the meaning of Multilateral Instrument

61-101 - Protection of Minority Securityholders in Special

Transactions ('MI 61-101'). The Corporation has relied on the

exemptions from the formal valuation and minority shareholder

approval requirements of MI 61-101 contained in Sections 5.5(a) and

5.7(1)(a), respectively, of MI 61-101 in respect of the Insider

Subscriptions.

About Mosaic Minerals CorporationMosaic Minerals

Corp. is a Canadian mineral exploration company listed on the

Canadian Security Exchange (CSE: MOC) now focusing on the

exploration for future strategic Copper-Nickel-Zinc deposits in

priority on the Quebec Province territory which have a long and

successful history of base metal production principally in the

Rouyn-Noranda, Matagami, Vald’Or and Chibougamau mining

camps.Exploring for base metal was put on hold a few decades ago to

the profit of exploring for gold but thepotential for discovering

large Cu, Zn, Ni deposits is still very present.

On Behalf of the BoardM. Jonathan HamelPresident

& CEOjhamel@mosaicminerals.ca

This release contains certain “forward-looking

information” under applicable Canadian securities laws concerning

the Arrangement. Forward-looking information reflects the Company’s

current internal expectations or beliefs and is based on

information currently available to the Company. In some cases,

forward-looking information can be identified by terminology such

as “may”, “will”, “should”, “expect”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “projects”, “potential”,

“scheduled”, “forecast”, “budget” or the negative of those terms or

other comparable terminology. Assumptions upon which such

forward-looking information is based includes, among others, that

the conditions to closing of the Arrangement will be satisfied and

that the Arrangement will be completed on the terms set out in the

definitive agreement. Many of these assumptions are based on

factors and events that are not within the control of the Company,

and there is no assurance they will prove to be correct or

accurate. Risk factors that could cause actual results to differ

materially from those predicted herein include, without limitation:

that the remaining conditions to the Arrangement will not be

satisfied; that the business prospects and opportunities of the

Company will not proceed as anticipated; changes in the global

prices for gold or certain other commodities (such as diesel,

aluminum and electricity); changes in U.S. dollar and other

currency exchange rates, interest rates or gold lease rates; risks

arising from holding derivative instruments; the level of liquidity

and capital resources; access to capital markets, financing and

interest rates; mining tax regimes; ability to successfully

integrate acquired assets; legislative, political or economic

developments in the jurisdictions in which the Company carries on

business; operating or technical difficulties in connection with

mining or development activities; laws and regulations governing

the protection of the environment; employee relations; availability

and increasing costs associated with mining inputs and labour; the

speculative nature of exploration and development; contests over

title to properties, particularly title to undeveloped properties;

and the risks involved in the exploration, development and mining

business. Risks and unknowns inherent in all projects include the

inaccuracy of estimated reserves and resources, metallurgical

recoveries, capital and operating costs of such projects, and the

future prices for the relevant minerals. The Canadian Securities

Exchange does not accept responsibility for the adequacy or

accuracy of this release.

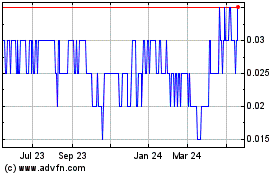

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Nov 2024 to Dec 2024

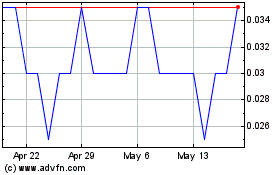

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Dec 2023 to Dec 2024