CANADA CARBON ANNOUNCES COMPLETION OF MAIDEN RESOURCE ESTIMATION FOR ITS ASBURY GRAPHITE PROJECT IN NOTRE-DAME-DU-LAUS MUNICIPALITY, LAURENTIDES, QUEBEC

03 April 2024 - 10:00PM

Canada Carbon Inc. (the "Company" or "Canada

Carbon" or "CCB") (TSX-V:CCB),(FF:U7N1) is very pleased to announce

a Maiden Mineral Resource Estimate (MRE) for its flagship 100%

owned Asbury Graphite Project located

80 kilometres (“km”)

NNE of Gatineau, near Notre-Dame-du-Laus, Québec. The

Resource Estimate was prepared pursuant to Canadian Securities

Administrators’ National Instrument 43-101 (“NI 43-101”) by the

independent firm SGS Canada Inc. (“SGS”) of Blainville, Quebec. The

Maiden Resource Estimate consists of an inferred resource of 4.14

Mt with an average grade of 3.05% Cg, within the boundaries of an

optimized open pit model. A Technical Report supporting the

Resource Estimate will be filed to SEDAR within 45 days, as

required by NI 43-101.

TABLE 1: GRAPHITE MINERAL

RESOURCES

|

Cut-off Grade (%Cg) |

Resource Category |

Tonnage (Mt) |

Average Grade (%Cg) |

Contained Graphite (t) |

|

1.00 |

Inferred |

4.14 |

3.05 |

126,000 |

- The classification of the current Mineral Resource Estimation

into Inferred is consistent with current 2014 CIM Definition

Standards – For Mineral Resources and Mineral Reserves

- A fixed density of 2.80 t/m3 was used to estimate the tonnage

from block model volumes.

- Resources are constrained by the pit shell and the topography

of the overburden layer.

- The results from the pit optimization are used solely for the

purpose of testing the “reasonable prospects for economic

extraction” by an open pit and do not represent an attempt to

estimate mineral reserves. There are no mineral reserves on the

Property. The results are used as a guide to assist in the

preparation of a Mineral Resource statement and to select an

appropriate resource reporting cut-off grade.

- Mineral resources which are not mineral reserves do not have

demonstrated economic viability. An Inferred Mineral Resources has

a lower level of confidence than that applying to a Measured and

Indicated Resources and must not be converted to a Mineral

Reserves. It is reasonably expected that the majority of Inferred

Mineral Resources could be upgraded to Indicated Mineral Resources

with continued exploration.

- All figures are rounded to reflect the relative accuracy of the

estimate and numbers may not add due to rounding.

- Effective date March 28th 2024.

- The estimate of mineral Resources may be materially affected by

environmental, permitting, legal, title, taxation, socio-political,

marketing or other relevant issues.

The Company has thus far completed sufficient

diamond drilling and bedrock channel sampling to result in a

resource estimation with a maximal depth of the pit at 135 vertical

meters. Geological modeling based on the drill results, surface

trenching and mapping indicates that the deposit remains open at

depth and on both strike extensions. The geological model also

provides multiple exploration targets with the potential to further

expand the graphite mineral resources. The portion of the

Asbury Project which is the subject of the Resource Estimate

occupies only about 7 % of the geophysical anomaly on the Asbury

claim area held by the Company.

Canada Carbon Chief Executive Officer, Mr.

Ellerton Castor remarked, “The substantial resource identified by

the targeted drill programs of 2022 and 2023 reveals a promising

scope for extensive mineralization across the claim area. The

initial resource model will provide a robust foundation for all

future exploration efforts on the Property. This MRE demonstrates

the significant exploration upside available at Asbury. We have

always believed that the Asbury Project has the potential to be a

large, scalable deposit with the capacity to provide a long-term,

secure source of supply to a myriad of industries participating in

the green energy economy. We will continue to prove that out, with

future de-risking initiatives such as a bulk sample program and

battery cell testing.”

Mineral Resource Estimation

Parameters

The Mineral Resources were estimated by Yann

Camus, P.Eng., of SGS with an effective date of March 28, 2024.

This estimate is the first Mineral Resource Estimate on the Asbury

property. The Mineral Resources were estimated using the following

geological and resource block modeling parameters which are based

on geological interpretations, geostatistical studies and best

practices in mineral estimation:

Graphite Mineral Resources

-

Mineral Resources were estimated from the diamond drill holes and

channels analytical results completed by Canada Carbon in 2022 and

2023, along with two nearby 1988 drill holes. A total of 17 drill

holes (11 from 2023, 4 from 2022, 2 from 1988) and 1 channel were

used for the MRE, comprising 1,309 assay intervals. The complete

database consists of 101 drill holes (including 13 from 2023 and 6

from 2022) and 14 channels/trenches (including 11 channels from

2022), comprising 2,158 assays.

-

The 3-D modeling of the graphite Mineral Resource was conducted

using a minimum cut-off grade of 0.50 %Cg over a 5 m length. All

modeling and estimations were done using SGS’s proprietary modeling

software Genesis©.

-

Assay data was composited to about 2 m without leaving

remainders.

-

The interpolation was conducted using inverse distance

squared.

-

The block model was defined with a block size of 5 m long by 1 m

wide by 2 m thick and covers a strike length of approximately 1050

m to a maximal depth of 175 m below surface. The modeled graphite

mineralization is open both at depth and strike.

-

The Mineral Resources were constrained within the boundaries of an

optimised pit shell using the parameters stated in Table 2 below.

All parameters are derived from similar graphite projects. Any

interpolated blocks of the resource model located outside of the

optimised pit shell are not included in the Mineral Resources

Estimate.

-

All dollar values in Table 2 are expressed in Canadian dollars,

except for the revenue value for the thermally treated graphite,

assumed to be US$ 40,000/tonne.

TABLE 2: PARAMETERS USED TO MODEL

OPTIMIZED GRAPHITE RESOURCES

|

Parameters |

Value |

Unit |

|

Mining Cost – Mineralized Material |

5.00 |

CDN$/t mined |

|

Mining Cost – Waste |

4.00 |

CDN$/t mined |

|

Mining Dilution |

5 |

% |

|

Mining Recovery |

95 |

% |

|

Processing + G&A Costs |

13.65 |

CDN$/t milled |

|

Metal Price |

2,500.00 |

CDN$/tonne |

|

Concentration Recovery |

90 |

% |

|

Pit Slopes |

50 |

degrees |

|

Density of Mineralized Material |

2.80 |

t/m3 |

|

Density of Waste |

2.80 |

t/m3 |

Asbury Project Overview

The 100%-owned Asbury Graphite Project is a past

producing property made up of 25 claims with a total surface area

of 1,384.59 ha. It is located 8.1 km northeast of

Notre-Dame-Du-Laus in the Laurentides Region of southern Quebec.

The property is accessible via gravel roads from Provincial Road

309 and Chemin du Ruisseau Serpent in the Notre-Dame-du-Laus area.

A power transmission line runs through the property. Mont-Laurier,

located approximately 44 km north, provides all amenities needed to

perform basic mineral exploration, such as a hospital,

accommodations, restaurants, groceries and other primary services.

Additional amenities for exploration, and a seasoned mining and

exploration workforce, are available from nearby towns of Gatineau

to the south.

Qualified Person

Mr. Yann Camus, P.Eng., from SGS Geological

Services, an independent Qualified Person as defined by National

Instrument 43-101 guidelines and has reviewed and approved the

technical related content of this news release.

CANADA CARBON INC. “Ellerton

Castor”Chief Executive Officer and Director Contact Information

E-mail inquiries: info@canadacarbon.com P: (905) 407-1212

FORWARD LOOKING INFORMATION

This press release contains statements that constitute

“forward-looking information” (“forward-looking information”)

within the meaning of the applicable Canadian securities

legislation. All statements, other than statements of historical

fact, are forward-looking information and are based on

expectations, estimates and projections as at the date of this

press release. Any statement that discusses predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often but not always using phrases

such as “expects”, or “does not expect”, “is expected”,

“anticipates” or “does not anticipate”, “plans”, “budget”,

“scheduled”, “forecasts”, “estimates”, “believes” or “intends” or

variations of such words and phrases or stating that certain

actions, events or results “may” or “could”, “would”, “might” or

“will” be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking information.

Forward-looking information in this press release includes

statements regarding the development of the Company’s Miller

deposit and financing thereof, the entering of the joint venture

with Irondequoit Offering, future production from the Company’s

Miller deposit, sales agreements and other matters related thereto.

In disclosing the forward-looking information contained in this

press release, the Company has made certain assumptions. Although

the Company believes that the expectations reflected in such

forward-looking information are reasonable, it can give no

assurance that the expectations of any forward-looking information

will prove to be correct. Known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward-looking information. Such factors include but are not

limited to: compliance with extensive government regulations;

financial abilities; the ability to develop the Miller deposit;

domestic and foreign laws and regulations adversely affecting the

Company’s business and results of operations; the impact of

COVID-19; and general business, economic, competitive, political,

and social uncertainties. Accordingly, readers should not place

undue reliance on the forward-looking information contained in this

press release. Except as required by law, the Company disclaims any

intention and assumes no obligation to update or revise any

forward-looking information to reflect actual results, whether as a

result of new information, future events, changes in assumptions,

changes in factors affecting such forward-looking information or

otherwise.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

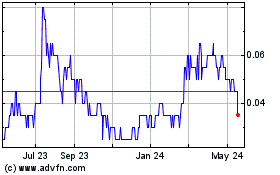

Canada Carbon (TSXV:CCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

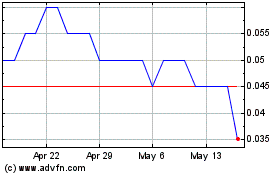

Canada Carbon (TSXV:CCB)

Historical Stock Chart

From Jan 2024 to Jan 2025