THIS NEWS RELEASE IS NOT FOR DISTRIBUTION IN THE UNITED STATES OR OVER UNITED

STATES NEWSWIRES.

Copper Fox Metals Inc. ("Copper Fox" or the "Company") (TSX VENTURE:CUU) is

pleased to announce that it has, through its wholly owned subsidiary Desert Fox

Copper Inc. ("Desert Fox"), entered into a Subscription Agreement with Carmax

Mining Corp. ("Carmax") (TSX VENTURE:CMX), whereby Desert Fox will subscribe,

via a non-brokered private placement, for 20,000,000 units of Carmax for an

aggregate subscription price of $1,000,000. Units (each a "Unit") will be

subscribed for at a price of $0.05 per Unit and will consist of one previously

unissued common share ("Share") of Carmax and one common share purchase warrant

("Warrant"). The private placement is subject to the approval of the TSX Venture

Exchange and Carmax Shareholders. The private placement will close as soon as

practicable after such approvals are obtained, provided that they are obtained

on or before May 29, 2014.

In connection with the private placement, Carmax will grant Desert Fox certain

rights, including, but not limited to:

-- The right to nominate two members to the Board of Carmax at each annual

meeting of Carmax's shareholders;

-- The pre-emptive right to participate in any equity financing of Carmax,

so as to maintain its pro rata percentage shareholding in Carmax; and

-- The right to make top-up investments in Carmax, by way of future private

placements, so as to maintain its pro rata percentage shareholding in

Carmax.

The aforementioned rights are, however, subject to Desert Fox, Copper Fox and

their affiliates maintaining ownership of 20% of Carmax's issued and outstanding

common shares.

Each Warrant will be exercisable for a period of 24 months from the closing date

of the applicable private placement and will entitle the holder, on exercise, to

purchase one additional common share of Carmax at a price of $0.075 per share.

Under the subscription agreement with Desert Fox, Carmax has agreed to use the

proceeds of the private placement to carry out a field program on the Eaglehead

property this upcoming summer.

On June 29 2012, Carmax filed a National Instrument 43-101 - Standards for

Disclosure for Mineral Projects ("NI 43-101") technical report on SEDAR at

www.sedar.com entitled "Technical Report on the Eaglehead Cu-Mo-Au Project,

British Columbia, Canada", which was prepared by Roscoe Postle Associates Inc.

("RPA") and dated June 29, 2012 (the "Eaglehead Technical Report"). The

Qualified Persons (as defined under NI 43-101) who prepared the Eaglehead

Technical Report were Barry McDonough, P.Geo., and David W. Rennie P.Eng. The

results of the Eaglehead Technical Report were reported by Carmax in a news

release dated July 4, 2012 and entitled "Carmax files Technical Report for the

Eaglehead Pophyry Copper-Molybdenum Project on SEDAR" (the "News Release"), a

copy of which is available on SEDAR at www.sedar.com. Highlights of the

Eaglehead property and rationale for the investment in Carmax are as follows:

Highlights:

a. The Eaglehead property has a current Inferred Mineral Resource of 102.5

million tonnes at an average grade of 0.29% copper, 0.010% molybdenum

and 0.08g/t gold (containing 663 million pounds copper, 22.07 million

pounds molybdenum and 265,600 ounces gold within conceptual open pit

limits);

b. The mineralization on the Eaglehead property contains silver; the

content of which was not included in the resource estimate due to the

assay methodology;

c. The Inferred Mineral Resource is contained in two of the six zones of

mineralization identified to date on the Eaglehead property, all zones

of mineralization are open along strike and at depth;

d. The mineralization is characterized by strong, pervasive alteration,

quartz veining and consists of disseminated and veinlet chalcopyrite-

bornite-molybdenite and pyrite;

e. Alteration associated with the mineralization consists of pervasive

potassic, chlorite-sericite, sericite, propylitic alteration and

carbonate assemblages;

f. A number of the diamond drill holes intersected intervals of high-grade

copper mineralization with associated molybdenum-gold-silver

mineralization over significant intervals (see Table-3 below); and

g. The Eaglehead Technical Report, a copy of which is available on SEDAR at

www.sedar.com, provides detailed information about the Eaglehead

property.

Elmer B. Stewart, President and CEO of Copper Fox stated, "The investment in

Carmax provides Desert Fox exposure to a large, advanced

copper-molybdenum-gold-silver property in northern British Columbia. The number

of zones of mineralization located to date along with the

copper-gold-molybdenum-silver assemblage, host rock and alteration (including

carbonate alteration) suggests many similarities to the Schaft Creek

copper-gold-molybdenum-silver project also located in northern British Columbia.

The objectives of the 2014 exploration program consisting of geophysical

exploration and diamond drilling is to further define the extensions of the

known mineralized zones and to assess the potential of the un-explored portions

of the Eaglehead property. It is noteworthy that the characteristics of the

mineralization located to date are interpreted to represent the upper portion of

a porphyry system."

Rationale for Investment in Carmax:

1. Resource Estimate

The current mineral resource was estimated for two of the six zones of

mineralization located to date on the property using criteria consistent with

the CIM Definitions Standards for Mineral Resources and Mineral Reserves (2010)

and in conformity with CIM "Estimation of Mineral Resources and Mineral Reserves

Best Practice" (2003) guidelines. The numbers presented in the following table

have been rounded to reflect "Best Practice Principals" as established by the

CIM. The estimated current mineral resource used a 0.16% Cu Eq. cut-off grade

and are categorized and tabulated in Table-1.

Table-1: Mineral Resource Estimate - Eaglehead Project

Effective Date: May 14th, 2012

----------------------------------------------------------------------------

Zone Resource Copper Molybdenum Gold

Name Category Tonnes (%) (%) (g/t)

----------------------------------------------------------------------------

East Inferred 61,600,000 0.28 0.011 0.06

----------------------------------------------------------------------------

Bornite Inferred 40,900,000 0.32 0.008 0.11

----------------------------------------------------------------------------

Total Inferred 102,500,000 0.29 0.010 0.08

----------------------------------------------------------------------------

----------------------------------------------------

Contained Metal

------------------------------------

Zone Molybdenum Gold

Name Cu (Lbs) (Lbs) (ozs)

----------------------------------------------------

East 376,000,000 14,900,000 126,000

----------------------------------------------------

Bornite 287,000,000 7,170,000 139,600

----------------------------------------------------

Total 663,000,000 22,070,000 265,600

----------------------------------------------------

The current mineral resources are contained within two conceptual open pits, the

East and Bornite zones, and constitute approximately 69% of total mineralization

above the 0.16% CuEq grade cut-off.

Cautionary Note to Investors

While the term "inferred mineral resource" is recognized and required by NI

43-101, investors are cautioned that except for that portion of mineral

resources classified as mineral reserves, mineral resources do not have

demonstrated economic viability. Additionally, investors are cautioned that

inferred mineral resources have a high degree of uncertainty as to their

existence, as to whether they can be economically or legally mined, or will ever

be upgraded to a higher category. United States investors are advised that

current Mineral Resources are not current Mineral Reserves and do not have

demonstrated economic viability. Moreover, all mineral resource estimates and

other information about the Eaglehead property contained in this news release

have been derived from, and are qualified in their entirety by, the Eaglehead

Technical Report and the News Release, a copies of which are available on SEDAR

at www.sedar.com.

The mineral resource estimate was carried out using a block model constrained by

3D wireframe models of the principal mineralized domains. Grades for copper,

molybdenum, and gold were interpolated into the blocks using Inverse Distance to

the Third Power (ID3) weighting. The estimate was further constrained by a

Whittle pit shell, generated to demonstrate that the mineralized bodies have a

reasonable probability of economic extraction, as stipulated in NI 43-101 and

the CIM Definitions Standards for Mineral Resources and Mineral Reserves (2010).

The effective date of the estimate is May 14, 2012.

The 0.16% Cu Eq. cut-off was the minimum grade of copper equivalent estimated by

RPA to complete the Whittle pit shells for the mineralized zones using the

parameters set out in Table-2 below:

The following Table-2 sets out the parameters that were used by RPA to develop

the Whittle Pit shells for the two mineralized zones:

Table-2: Parameters used for Whittle Pit Shell Determination and Copper

Equivalent Grade

Metal Prices: Copper US$4.00 /lb; Molybdenum US$17.00 /lb; Gold US$1,500.00

/oz;

Costs: Mining US$2.00 /tonne; Processing/G&A US$10.00 /tonne

Pit Slopes: 45 degrees in bedrock; 30 degrees in Overburden

Metal Recoveries: Copper 80%; Molybdenum 80%; Gold 67%;

Some of the selected drill hole assays from the Eaglehead property are set out

in Table-3, below:

Table-3: Selected mineralized intervals from the Eaglehead Property:

----------------------------------------------------------------------------

From To Interval Copper Molybdenum Gold Silver

DDH ID Azimuth Dip (m) (m) (m) (%) (%) (g/t) (g/t)

----------------------------------------------------------------------------

DDH0099A 358.2 -63.9 167.0 243.0 76.0 0.34 0.004 0.024 1.57

Including 182.0 203.0 21.0 0.99 0.010 0.063 4.85

----------------------------------------------------------------------------

DDH0100 3.5 -49.9 21.0 519.0 498.0 0.21 0.006 0.031 16.65

Including 232.0 315.0 83.0 0.37 0.007 0.038 1.92

Including 269.0 304.0 35.0 0.57 0.015 0.078 2.72

----------------------------------------------------------------------------

DDH0111 359.4 -46.9 26.0 137.0 111.0 0.53 0.003 0.088 2.97

Including 63.0 98.0 35.0 1.27 0.003 0.161 6.62

----------------------------------------------------------------------------

DDH0112 2.2 -64.4 70.0 171.0 101.0 0.40 0.007 0.210 3.82

Including 71.0 92.0 21.0 0.72 0.009 0.602 6.45

Including 126.0 140.0 14.0 1.02 0.017 0.297 12.65

----------------------------------------------------------------------------

DDH0114 5.2 -61.8 130.0 295.0 165.0 0.53 0.028 0.278 2.28

Including 195.0 248.0 53.0 0.83 0.037 0.394 2.05

----------------------------------------------------------------------------

DDH0116 4.5 -54 135.0 318.4 183.4 0.32 0.013 0.231 1.12

Including 140.0 251.0 111.0 0.47 0.020 0.355 1.54

Including 188.0 215.0 27.0 0.61 0.018 1.194 2.73

----------------------------------------------------------------------------

Note: The above core intervals do not represent true widths to the mineralization

2. Logistics and Access

The Eaglehead property is located approximately 50 km east of Dease Lake,

British Columbia. The property is connected to Dease Lake by road access and

comprises 31 mineral claims covering a total area of approximately 11,410

hectares (ha) in the Liard Mining Division of British Columbia.

3. Style of Mineralization

The mineralization on the Eaglehead property is typical of porphyry Cu-Mo

systems within intermediate volcanic and granodioritic and monzonitic rocks.

Mineralization is contained in altered rocks, which are localized by geological

structures that exhibit quartz stockworks, hydrothermal brecciation and

disseminated and veinlet chalcopyrite-bornite and other sulphide minerals.

Elmer B. Stewart, MSc. P. Geol., President of Copper Fox, is the Company's

nominated Qualified Person pursuant to NI 43-101, Standards for Disclosure for

Mineral Projects, has reviewed the technical information disclosed in this news

release.

About Copper Fox

Copper Fox is a Canadian resource development company listed on the TSX-Venture

Exchange (TSX VENTURE:CUU) with offices in Calgary, Alberta and Miami, Arizona.

In addition to Copper Fox's 25% interest in the Schaft Creek Joint Venture,

Copper Fox holds, through Desert Fox and its wholly-owned subsidiaries, the

Sombrero Butte copper project in the Bunker Hill Mining District, Arizona and

the Van Dyke oxide copper project in the Globe-Miami Mining District, Arizona.

Desert Fox has opened an operations office in Miami, Arizona to advance the work

required on the Van Dyke copper project to a Preliminary Economic Assessment.

For further information on these projects, please refer to the Company's website

at www.copperfoxmetals.com.

On behalf of the Board of Directors

Elmer B. Stewart, President and Chief Executive Officer

All mineral resource estimates and other information about the Eaglehead

property contained in this news release have been derived from, and are

qualified in their entirety by, the Eaglehead Technical Report and the News

Release, copies of which are available on SEDAR at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an

offer to sell any of the securities in the United States. The securities have

not been and will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state securities laws and

may not be offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of

the Canadian securities laws. Forward-looking information is generally

identifiable by use of the words "believes," "may," "plans," "will,"

"anticipates," "intends," "budgets", "could", "estimates", "expects",

"forecasts", "projects" and similar expressions, and the negative of such

expressions. Forward-looking information in this news release includes, but is

not limited to, the investment to be made by Desert Fox in Carmax by way of a

non-brokered private placement of Units; the size of the investment to be made

in Carmax by Desert Fox; the proposed issuance and terms of the Units, Warrants

and Shares to be issued by Carmax to Desert Fox by way of a non-brokered private

placement; the grant to Desert Fox of certain nomination and anti-dilution

rights in connection with its investment in Carmax and the conditionality of

such rights; the use of the proceeds of the private placement to fund

exploration on the Eaglehead property; statements about the resource estimate

for the Eaglehead property deposit; potential existence and size of

mineralization within the Eaglehead property; estimated timing and amounts of

future expenditures and geological interpretations and potential mineral

recovery processes. Information concerning mineral resource estimates also may

be deemed to be forward-looking information in that it reflects a prediction of

the mineralization that would be encountered if a mineral deposit were developed

and mined.

In connection with the forward-looking information contained in this news

release, Copper Fox has made numerous assumptions, regarding, among other

things: the geological, metallurgical, and engineering, information that Copper

Fox has received is reliable, and is based upon practices and methodologies

which are consistent with industry standards. While Copper Fox considers these

assumptions to be reasonable, these assumptions are inherently subject to

significant uncertainties and contingencies. Additionally, there are known and

unknown risk factors which could cause actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking information contained

herein. Known risk factors include, among others: approval of the TSX Venture

Exchange and/or Carmax shareholders may not be obtained for the private

placement to Desert Fox; investments in Carmax may not be paid in the quantum or

at the times expected, or at all; the actual mineralization in the Eaglehead

property deposit may not be as favorable as suggested by the resource estimate;

the possibility that future drilling and geophysical exploration on the

Eaglehead property may not occur on a timely basis, or at all; fluctuations in

copper and other commodity prices and currency exchange rates; uncertainties

relating to interpretation of drill results and the geology, continuity and

grade of the mineral deposit; uncertainty of estimates of capital and operating

costs, recovery rates, and estimated economic return; the need to obtain

additional financing to develop properties and uncertainty as to the

availability and terms of future financing; the possibility of delay in

exploration or development programs or in construction projects and uncertainty

of meeting anticipated program milestones; and uncertainty as to timely

availability of permits and other governmental approvals.

A more complete discussion of the risks and uncertainties facing Copper Fox is

disclosed in Copper Fox's continuous disclosure filings with Canadian securities

regulatory authorities at www.sedar.com. All forward-looking information herein

is qualified in its entirety by this cautionary statement, and Copper Fox

disclaims any obligation to revise or update any such forward-looking

information or to publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future results, events

or developments, except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Copper Fox Metals Inc.

Investor line

1-866-913-1910

Copper Fox Metals Inc.

Lynn Ball

1-604-689-5080

www.copperfoxmetals.com

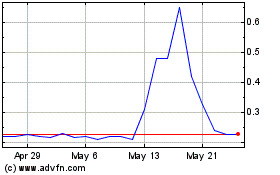

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Apr 2024 to May 2024

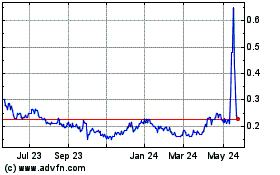

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From May 2023 to May 2024