Decklar Resources Inc. (TSX-V: DKL) (OTCQX: DLKRF) (FSE:

A1U1) (the “Company” or “Decklar”) is

pleased to announce the closing of a Share Purchase Agreement to

purchase all of the issued and outstanding ordinary shares of

Purion Energy Limited (“Purion”), a Nigerian entity that has

entered into a Risk Finance and Technical Services Agreement

(“RFTSA”) with Prime Exploration and Production Limited (“Prime”),

the Operator of the Asaramatoru Field, to participate in the

continued development of the oil resources in the field. The

Asaramatoru Field is located in OML 11, the same block where

Decklar is also currently developing the Oza Field.

Share Purchase Agreement between Purion

and Decklar

Decklar and Purion previously signed a Share

Purchase Agreement (“SPA”) with respect to the acquisition by

Decklar of all of the issued and outstanding ordinary shares of

Purion (the “Purion Shares”). Purion has separately entered into a

RFTSA with Prime with respect to the 51% equity interest that was

awarded to Prime in the Asaramatoru Field. Further, Decklar is

aware that Purion is also seeking to enter a RFTSA with Suffolk

Petroleum (“Suffolk”) in respect of Suffolk’s 49% interest in the

Asaramatoru Field.

The SPA terms are based on the issuance of up to

5,500,000 common shares of Decklar (“Decklar Shares”), as

consideration for the acquisition of all the issued and outstanding

Purion Shares. An initial issuance of 3,750,000 shares has been

completed, and in the event Purion enters an RFTSA in respect of

the Suffolk interest, an additional 1,750,000 Decklar Shares will

be issued to the shareholders of Purion.

The Asaramatoru Field

The Asaramatoru Field, operated and owned 51% by

Prime and owned 49% by Suffolk Petroleum Limited (“Suffolk”), is

situated onshore in the southern swamp section of OML 11 in the

Eastern Niger Delta area, which is one of the largest onshore oil

producing blocks in all of Nigeria, spanning the coastal swampy

section in the south to dry land in the north. The Asaramatoru

Field is situated in the vicinity of Andoni Local Government Area

in mangrove forested terrain and is approximately 45 km S/SE of the

oil city of Port Harcourt in Rivers State and approximately 40 km

south of the Oza Field. The Bonny Oil Export Terminal and Bonny LNG

plant are located approximately 15 km south of the Asaramatoru

field.

The Asaramatoru Field was awarded to Prime and

Suffolk by the Federal Government of Nigeria in 2004 as part of the

first Marginal Field Program. A subsidiary of Prime was appointed

operator of the field. Prime and Suffolk re-entered the existing

two wells and commenced initial production testing activities in

2014. The wells produced an average of 2,700 barrels oil per day

during intermittent production over three years, with the crude

production being barged to an offshore facility for storage and

export. The two wells have been shut in since late 2018 due to

lower oil prices and logistics connected with barging and export

activities, and limited storage facilities at the well

locations.

Decklar and Prime’s next planned stages for

development of the Asaramatoru Field include pulling out the

existing tubing from the AST-1 and AST-2 wells, running cement bond

logs and cased hole reservoir saturation logs, and running new

dual-string completions in both existing wells. It is then

anticipated that an additional seven wells will be drilled for full

field development, and production facilities, flow lines, and

export facilities will be installed in phases as the field

development progresses.

The full field development plan will include the

expansion of the processing facilities to enable handling and

processing of up to 20,000 barrels of crude per day for the

expected peak production levels including installing a 10 km export

flow-line from the Asaramatoru Field to a tie-in point at the Oloma

Flow Station, which is connected to the nearby Bonny Oil Export

Terminal.

Duncan Blount, CEO of Decklar, stated,

“Finalizing our participation in the proven Asaramatoru Field is

another significant milestone for Decklar in our growth strategy of

acquiring and developing near-term cash flow generating assets in

Nigeria’s Niger Delta region. This field has been on our radar for

quite some time, so we eagerly anticipate getting to work on its

development. With the acquisition of the interest in the

Asaramatoru Field, we expect that Decklar will be producing from

two oil fields, the Oza Field and the Asaramatoru Field, in the

near future.”

For further information:

Duncan T. BlountChief Executive Officer Telephone: +1 305 890

6516Email: dblount@decklarresources.com

David HalpinChief Financial Officer Telephone: +1 403 816

3029Email: david.halpin@decklarresources.com

Investor Relations: info@decklarresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Language

Certain statements made and information

contained herein constitute "forward-looking information" (within

the meaning of applicable Canadian securities legislation),

including entering into definitive agreements in respect of the

Transaction and satisfaction of conditions precedent to completion

of the Transaction. All statements in this news release, other than

statements of historical facts, are forward-looking statements.

Such statements and information (together, "forward looking

statements") relate to future events or the Company's future

performance, business prospects or opportunities. There is no

certainty that definitive agreements in respect of the Transaction

will be entered into, or that any conditions precedent contained

therein will be satisfied on terms satisfactory to the parties or

at all.

All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect, "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions) are not statements of historical

fact and may be "forward-looking statements". Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. The Company believes that the expectations reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

The Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. These forward-looking statements involve risks and

uncertainties relating to, among other things, changes in oil

prices, results of exploration and development activities,

uninsured risks, regulatory changes, defects in title, availability

of materials and equipment, timeliness of government or other

regulatory approvals, actual performance of facilities,

availability of financing on reasonable terms, availability of

third party service providers, equipment and processes relative to

specifications and expectations and unanticipated environmental

impacts on operations. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

The Company provides no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

does not assume the obligation to revise or update these

forward-looking statements after the date of this document or to

revise them to reflect the occurrence of future unanticipated

events, except as may be required under applicable securities

laws.

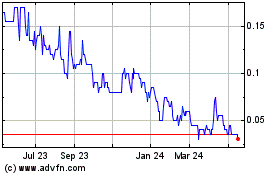

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Oct 2024 to Nov 2024

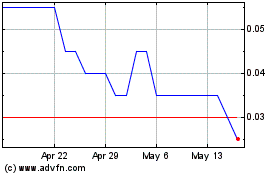

Decklar Resources (TSXV:DKL)

Historical Stock Chart

From Nov 2023 to Nov 2024