IBEX Reports Results for the Second Quarter and the Six Months

Ended January 31, 2014

MONTREAL, QUEBEC--(Marketwired - Mar 25, 2014) - IBEX

Technologies Inc. (TSX-VENTURE:IBT) today reported its financial

results for the six months ended January 31, 2014.

"Business conditions continue to be challenging for IBEX, due

primarily to one major customer's purchasing hiatus and the

on-going post-acqusition investment in Bio-Research Products" said

Paul Baehr, IBEX President and CEO, "but our financial position

continues to be sound. The effect of cost containment measures at

BRP should begin to materialize in the upcoming quarters".

SECOND QUARTER FISCAL 2014 FINANCIAL RESULTS

Sales for the quarter ended January 31, 2014 totaled $922,007

compared to $741,666 in the same period of the prior year. The

current period included IBEX Pharma sales of $745,250 (compared to

$635,026 in the year ago period) and Bio-Research Products Inc.

(BRP) sales of $176,757 (compared to $106,640 in the year ago

period, which included only one month of BRP sales).

The loss for the period was $2,922 compared to a loss of

$468,277 in the year ago period. The reduction in loss is mainly

attributable to IBEX Pharma which had net earnings of $168,273,

offset by a loss in BRP of $171,195. The BRP operating loss for

this period included three months' activity compared to one month's

activity for the same period year ago.

FINANCIAL RESULTS FOR THE SIX MONTHS ENDED JANUARY 31, 2014

Sales for the six months ended January 31, 2014 totaled

$1,801,123, an increase of 20% compared to the same period in 2013

($1,496,004). IBEX Pharma sales were $1,342,245 compared to

$1,389,364 in the year ago period. BRP sales were $458,878 compared

to $106,640 in the year ago period, however this result includes

six months of sales from BRP compared to one month of sales for the

same period year ago.

The Company recorded a net loss of $406,941 compared to a net

loss of $399,607 for the same period year ago. The principle part

of this loss derived from BRP which had an operating loss of

$375,604.

|

Operating Summary for the Six Months Ended |

January 31, 2014 |

|

January 31, 2013 |

|

|

Revenues |

$1,801,123 |

|

$1,496,004 |

|

|

(Loss) before interests, tax, depreciation & amortization |

($184,603 |

) |

($305,753 |

) |

|

Depreciation & amortization |

$202,992 |

|

$102,910 |

|

|

Net (loss) |

($406,941 |

) |

($399,607 |

) |

|

(Loss) per share basic and diluted |

($0.02 |

) |

($0.02 |

) |

Cash and cash equivalents decreased $190,377 during the six

months ended January 31, 2014 as compared to the year ended July

31, 2013. The Company's net working capital decreased by $199,303

during the six months ended January 31, 2014 as compared to same

period year ago.

|

Balance Sheet Summary as at |

January 31, 2014 |

July 31, 2013 |

|

Cash and cash equivalents |

$1,389,262 |

$1,579,639 |

|

Working capital |

$2,313,604 |

$2,512,907 |

|

Outstanding shares at report date (Common shares) |

24,703,244 |

24,703,244 |

LOOKING FORWARD

Fiscal 2014 and Fiscal 2015 will be challenging years for the

Company. As previously announced, there is a hiatus in sales from

one of our major customers (due to excess inventory on their side)

resulting in a cut back in their purchases over the next two years.

In the event the Company is not able to replace the sales from this

major customer with new contracts, it will not be in a cash flow

positive position in Fiscal 2014, and possibly in Fiscal 2015.

The Company has been working on a number of projects with major

customers, some of which it hopes will result in significant

revenue in Fiscal 2015. However, we cannot be certain that any of

these projects will in fact come to fruition.

Management believes that the Company has sufficient funds to

meet its obligations and planned expenditures for the ensuing

twelve months as they fall due. In assessing whether the going

concern assumption is appropriate, management takes into account

all available information about the future, which is at least, but

not limited to, twelve months from the end of the reporting

period.

ABOUT IBEX

IBEX, through its wholly owned subsidiaries IBEX Pharmaceuticals

Inc. (Montreal, QC) and Bio-Research Products, Inc. (North Liberty,

IA), manufactures and markets proteins for biomedical use. IBEX

Pharmaceuticals Inc. also manufactures and markets a series of

arthritis assays which are widely used in osteoarthritis

research.

For more information, please visit the Company's website at

www.ibex.ca.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Safe Harbor Statement

All of the statements contained in this news release, other

than statements of fact that are independently verifiable at the

date hereof, are forward-looking statements. Such statements, as

they are based on the current assessment or expectations of

management, inherently involve numerous risks and uncertainties,

known and unknown. Some examples of known risks are: the impact of

general economic conditions, general conditions in the

pharmaceutical industry, changes in the regulatory environment in

the jurisdictions in which IBEX does business, stock market

volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual

future results may differ materially from the anticipated results

expressed in the forward-looking statements. IBEX disclaims any

intention or obligation to update these statements, except if

required by applicable laws.

In addition to the risk factors identified above, IBEX is,

and has been in the past, heavily reliant on a few key products and

customers, the loss of any of which could have a material effect on

profitability.

Paul BaehrPresident & CEOIBEX Technologies Inc.514-344-4004

x 143

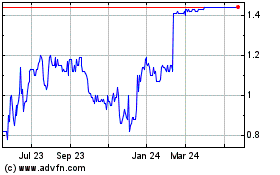

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

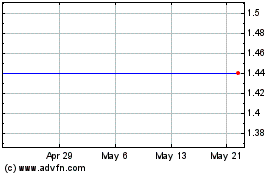

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025