Itafos Provides Overview of the Phosphate Market and Key Value Drivers

17 April 2023 - 10:30PM

Itafos Inc. (TSX-V: IFOS) (“Itafos” or the “Company”) announced

today that it has posted a corporate presentation on the Company’s

website, which can be found at this link:

https://itafos.com/investors/presentations-fact-sheets/, containing

an overview of the phosphate market and key value drivers for

Itafos including:

- Mega-trends driving long-term

phosphate demand

- Current industry capacity additions

insufficient to meet global growth

- Scaled and highly cash-generative

North American phosphate operations at Conda

- Strategic location West of the

Mississippi

- Husky 1 / North Dry Ridge mine life

extension and development underway with preliminary mineral

resource mine life to 2037; potential for additional mineral

resources through leases and third-party agreements(1)

- Current scarcity of global

phosphate mineral resources expected to drive attractive potential

upside from Itafos’ portfolio of overseas assets

- Proven management team with a

history of delivering value for stakeholders

David Delaney, Chief Executive Officer of

Itafos, commented: “The Company is well positioned to capitalize on

a number of global mega-trends. Itafos’ portfolio of attractive

assets, supplemented by the mine life extension project at Conda

which remains on track, strongly positions the Company for the

future.”

About Itafos

The Company is a phosphate and specialty

fertilizer company. The Company’s businesses and projects are as

follows:

- Conda – a vertically integrated

phosphate fertilizer business located in Idaho, US with production

capacity as follows:

- approximately 550kt per year of monoammonium phosphate (“MAP”),

MAP with micronutrients (“MAP+”), superphosphoric acid (“SPA”),

merchant grade phosphoric acid (“MGA”) and ammonium polyphosphate

(“APP”); and

- approximately 27kt per year of hydrofluorosilicic acid

(“HFSA”);

- Arraias – a vertically integrated

phosphate fertilizer business located in Tocantins, Brazil with

production capacity as follows:

- approximately 500kt per year of single superphosphate (“SSP”)

and SSP with micronutrients (“SSP+”); and

- approximately 40kt per year of excess sulfuric acid (220kt per

year gross sulfuric acid production capacity);

- Farim – a high-grade phosphate mine

project located in Farim, Guinea-Bissau;

- Santana – a vertically integrated

high-grade phosphate mine and fertilizer plant project located in

Pará, Brazil; and

- Araxá – a vertically integrated

rare earth elements and niobium mine and extraction plant project

located in Minas Gerais, Brazil.

In addition to the businesses and projects

described above, the Company also owns Mantaro (Junin, Peru), a

phosphate mine project that is in the process of being wound

down.

The Company is a Delaware corporation that is

headquartered in Houston, TX. The Company’s shares trade on the TSX

Venture Exchange (“TSX-V”) under the ticker symbol “IFOS”. The

Company’s principal shareholder is CL Fertilizers Holding LLC

(“CLF”). CLF is an affiliate of Castlelake, L.P., a global private

investment firm.

For more information, or to join the Company’s

mailing list to receive notification of future news releases,

please visit the Company’s website at www.itafos.com.

Note (1): Timeline based on management

estimates and subject to certain assumptions, including successful

permitting and development activities. The Husky 1 / North Dry

Ridge mine life extension with expected preliminary mineral

resource mine life to 2037 is based on a Preliminary Economic

Assessment (“PEA”) included in the Conda Technical Report (as

defined below). The PEA on the H1 and NDR properties is preliminary

in nature and includes inferred mineral resources that are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

PEA will be realized. Readers are referred to the Conda Technical

Report for the applicable qualifications and assumptions in

connection with its PEA. The Company is in the process of

completing a pre-feasibility study in connection with the H1 and

NDR deposits, which is currently expected to be published in Q4

2023.

Scientific and Technical Information

The scientific and technical information

contained in this news release has been reviewed and approved by

Jerry DeWolfe, Professional Geologist (P.Geo.) with the Association

of Professional Engineers and Geoscientists of Alberta. Mr. DeWolfe

is a full-time employee of Golder Associated Ltd. and is

independent of the Company.

The Company’s latest technical report in respect

of Conda is entitled, “NI 43-101 Technical Report on Itafos Conda

and Paris Hills Mineral Projects, Idaho, USA,” with an effective

date of July 1, 2019 (the “Conda Technical Report”) and is

available under the Company’s website at www.itafos.com and under

the Company’s profile on SEDAR at www.sedar.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information (“FLI”). Except for

statements of historical fact relating to the Company, information

contained herein may constitute FLI, including any information

related to the Company’s mission, strategy, outlook, plans or

future operational and financial performance. The use of any of the

words “intend”, “anticipate”, “plan”, “continue”, “estimate”,

“expect”, “may”, “will”, “project”, “should”, “would”, “believe”,

“predict” and “potential” and similar expressions are intended to

identify forward-looking information. FLI in this news release

includes, but is not limited to, statements with respect to:

industry dynamics; economic factors; the life of mine of Itafos’

assets, including Conda; the potential for additional mineral

resources; the future demand for and production of P2O5; future

investments in P2O5 projects; global capacity, production and

operating rates; and the timing and costs of future P2O5

projects.

The FLI contained in this news release is based

on the opinions, assumptions and estimates of management set out

herein, which management believes are reasonable as at the date the

statements are made. Those opinions, assumptions and estimates are

inherently subject to a variety of risks and uncertainties and

other known and unknown factors that could cause actual events or

results to differ materially from those projected in the FLI. These

include the Company’s expectations and assumptions with respect to

the following: commodity prices; operating results; safety risks;

changes to the Company’s mineral reserves and resources; risk that

timing of expected permitting will not be met; risk that

optionality for further mine life extension through ownership of

the H2/Freeman Ridge leases and potential third-party mineral

purchase agreements do not come to fruition; changes to mine

development and completion; foreign operations risks; changes to

regulation; environmental risks; the impact of adverse weather and

climate change; general economic changes, including inflation and

foreign exchange rates; the actions of the Company’s competitors

and counterparties; financing, liquidity, credit and capital risks;

the loss of key personnel; impairment risks; cybersecurity risks;

risks relating to transportation and infrastructure; changes to

equipment and suppliers; adverse litigation; changes to permitting

and licensing; loss of land title and access rights; changes to

insurance and uninsured risks; the potential for malicious acts;

market volatility; changes to technology; changes to tax laws; the

risk of operating in foreign jurisdictions; and the risks posed by

a controlling shareholder and other conflicts of interest. Readers

are cautioned that the foregoing list of risks, uncertainties and

assumptions is not exhaustive.

Although the Company has attempted to identify

crucial factors that could cause actual actions, events or results

to differ materially from those described in FLI, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

FLI will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

The reader is cautioned not to place undue reliance on FLI. The

Company undertakes no obligation to update forward-looking

statements if circumstances or management’s estimates, assumptions

or opinions should change, except as required by applicable

securities law. Risks and uncertainties affecting the FLI contained

in this news release are described in greater detail in the

Company’s current Annual Information Form and current Management’s

Discussion and Analysis available under the Company’s profile on

SEDAR at www.sedar.com and on the Company’s website at

www.itafos.com. The FLI included in this news release is expressly

qualified by this cautionary statement and is made as of the date

of this news release.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX-V)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please contact:

Matthew O’Neill Itafos Investor Relations investor@itafos.com

713-242-8446

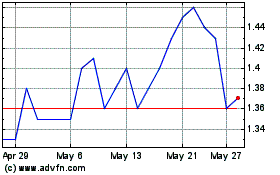

Itafos (TSXV:IFOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Itafos (TSXV:IFOS)

Historical Stock Chart

From Dec 2023 to Dec 2024