TSX VENTURE COMPANIES

BE RESOURCES INC. ("BER")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced May 6, 2010:

Number of Shares: 10,000,000 shares

Purchase Price: $0.30 per share

Warrants: 5,000,000 share purchase warrants to purchase

5,000,000 shares

Warrant Exercise Price: $0.50 for a two year period

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Carmelo Marrelli Y 33,333

Agent's Fee: An aggregate of $240,000 in cash and

1,000,000 broker warrants payable to

MGI Securities Inc., Mackie Research

Capital Corp., Jennings Capital Inc.,

Scotia Capital Inc., D&D Securities Company,

Canaccord Genuity Corp. and GMP Securities

LP. Each broker warrant entitles the holder

to acquire one unit at $0.30 for a two year

period.

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For further details, please refer to the Company's news release dated June

18, 2010.

TSX-X

---------------------------------------------------------------------

BLACK ISLE RESOURCES CORPORATION ("BIT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced April 1, 2010 and May 18, 2010:

Number of Shares: 1,800,000 shares

Purchase Price: $0.05 per share

Warrants: 1,800,000 share purchase warrants to purchase

1,800,000 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Donald MacDonald Y 400,000

iO Corporate Services Ltd.

(Marion McGrath) Y 100,000

Robert Browne P 200,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------

CACHE EXPLORATION INC. ("CAY")

BULLETIN TYPE: Property-Asset or Share Purchase Amending Agreement

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation that was filed

in connection with an Option Agreement dated April 30, 2010 between Arthur

Hamilton, Lorena Hamilton and the Company whereby the Company has been

granted an option to acquire a 100% interest in the Long Lake Property

that is located in New Brunswick. The aggregate consideration is $50,000,

250,000 common shares and $400,000 in exploration expenditure over a three

year period. From the fourth year onward, the Company will pay annual

advance royalty payments of $5,000 per year. The property is subject to a

2.5% NSR of which the Company may purchase 1% for $1,000,000 subject to

further Exchange review and acceptance.

TSX-X

---------------------------------------------------------------------

CHINA COAL CORPORATION ("CKO")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

Effective at the opening, June 29, 2010, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

---------------------------------------------------------------------

CRIMSON FALCON CAPITAL CORP. ("CFC.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated May 31, 2010 has been

filed with and accepted by TSX Venture Exchange and the British Columbia

and Alberta Securities Commissions effective June 1, 2010, pursuant to the

provisions of the British Columbia and Alberta Securities Acts. The Common

Shares of the Company will be listed on TSX Venture Exchange on the

effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$250,000 (2,500,000 common shares at $0.10 per share).

Commence Date: At the opening Wednesday, June 30, 2010, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: unlimited common shares with no par value of

which 4,700,000 common shares are issued and

outstanding

Escrowed Shares: 2,200,000 common shares

Transfer Agent: Valiant Trust Company

Trading Symbol: CFC.P

CUSIP Number: 22662T109

Sponsoring Member: PI Financial Corp.

Agent's Options: 250,000 non-transferable stock options. One

option to purchase one share at $0.10 per

share up to 24 months.

For further information, please refer to the Company's Prospectus dated

May 31, 2010.

Company Contact: Gee Ming Chiang, CEO and Director

Company Address: Suite 300 - 6300 River Road

Richmond, BC V6X 1X5

Company Phone Number: (604) 288-2756

Company Fax Number: (604) 909-5199

Company Email Address: gmingchiang@gmail.com

Seeking QT primarily in these sectors: not known

TSX-X

---------------------------------------------------------------------

DIADEM RESOURCES LTD. ("DRL")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 949,820 shares at deemed values of $0.20 and $0.25 per share to

settle outstanding debt for CDN$198,249.

Number of Creditors: 3 Creditors

For further details, please refer to the Company's news release dated June

22, 2010.

TSX-X

---------------------------------------------------------------------

EXCEL GOLD MINING INC. ("EGM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement announced on June 9, 2010:

Number of Shares: 4,600,000 common shares

Purchase Price: $0.05 per common share

Warrants: 4,600,000 warrants to purchase 4,600,000

common shares

Warrant Exercise Price: $0.10 for a 24-month period

Finder's Fees: Allyson Taylor Partners Inc. received $23,000

in cash and 460,000 warrants to purchase

common shares, each exercisable at a price of

$0.10 per share over a period of 24 months

following the closing of the Private

Placement.

The Company has confirmed the closing of the above-mentioned Private

Placement via the issuance of a news release.

LES MINES D'OR EXCEL INC. ("EGM")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 29 juin 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 9

juin 2010 :

Nombre d'actions : 4 600 000 actions ordinaires

Prix : 0,05 $ par action ordinaire

Bons de souscription : 4 600 000 bons de souscription permettant de

souscrire a 4 600 000 actions ordinaires

Prix d'exercice des bons : 0,10 $ pour une periode de 24 mois

Honoraires

d'intermediation : Allyson Taylor Partners Inc. a recu 23 000 $

en especes et 460 000 bons de souscription,

chacun permettant d'acquerir une action

ordinaire de la societe au prix de 0,10 $

l'action pendant une periode de 24 mois

suivant la cloture du placement prive.

La societe a confirme la cloture du placement prive precite par voie d'un

communique de presse.

TSX-X

---------------------------------------------------------------------

FIRST STAR RESOURCES INC. ("FS")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a purchase and sale agreement

(the "Agreement"), dated February 9, 2010, between a wholly owned

subsidiary of First Star Resources Inc. (the "Company") and Antelope

Resources Inc. ("Antelope") pursuant to which Antelope will acquire all of

the Company's interest in certain lands and related oil and gas leases

(the "Mosser Property") located in Yellowstone County, Montana, USA.

The aggregate compensation payable by Antelope to the Company over a

twenty month period is US$300,000 cash payable in monthly installments of

US$15,000 cash.

Insider / Pro Group

Participation: N/A

For further details, please refer to the Company's press release dated May

6, 2010.

TSX-X

---------------------------------------------------------------------

GMV MINERALS INC. ("GMV")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced May 10, 2010 and amended on June

15, 2010:

Number of Shares: 19,611,732 shares

Purchase Price: $0.15 per share

Warrants: 9,805,867 share purchase warrants to purchase

9,805,867 shares

Warrant Exercise Price: $0.25 for a two year period

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ian Klassen Y 133,333

Alistair MacLennan Y 133,333

Gordon Medland P 100,000

Libra Advisors, LLC Y 10,000,000

Agent's Fee: $235,340.78 and 1,961,173 broker warrants,

exercisable at $0.15 into one common share

for a two year period, payable to Max Capital

Markets Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

---------------------------------------------------------------------

KLONDIKE SILVER CORP. ("KS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the second and final tranche of a Non-Brokered Private Placement announced

June 1, 2010:

Number of Shares: 2,900,000 flow-through shares

2,800,000 non flow-through shares

Purchase Price: $0.05 per share

Warrants: 5,700,000 share purchase warrants to purchase

5,700,000 shares

Warrant Exercise Price: $0.10 for a two year period

$0.15 in the third year (non flow-through

warrants only)

$0.20 in the fourth and fifth year (non

flow-through warrants only)

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Hastings Management Corp. Y 300,000

Brandon Munday Y 200,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

---------------------------------------------------------------------

MAX MINERALS LTD. ("MJM")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing, a Share Purchase Agreement

dated May 26, 2010, between the Company, Varenna Energy Ltd. ("Varenna"),

and all of the shareholders of Varenna whereby the Company will acquire

all of the issued and outstanding shares of Varenna for the consideration

of the issuance of 11,331,750 common shares at a deemed price of $0.36 per

share.

Insider / Pro Group

Participation: N/A

For further information, please refer to the Company's news release dated

June 1, 2010.

TSX-X

---------------------------------------------------------------------

MINERAL MOUNTAIN RESOURCES LTD. ("MMV")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated June 2,

2010, has been filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the British Columbia Securities Commission on June

3, 2010, pursuant to the provisions of the British Columbia Securities

Act.

The gross proceeds received by the Company for the Offering were

$3,162,500 (6,650,000 Units at $0.25 per Unit and 5,000,000 Flow-through

common shares at $0.30 per share). Each Unit is comprised of one share and

one-half of a share purchase warrant for a term of two years. Each whole

warrant is exercisable into one common share at an exercise price of $0.35

per share up to the first year and at $0.40 per share in the second year.

The Company is classified as a 'mineral exploration and development'

company.

Commence Date: At the opening on Wednesday, June 30, 2010,

the Common shares will commence trading on

TSX Venture Exchange.

Corporate Jurisdiction: Business Corporations Act (British Columbia)

Capitalization: Unlimited common shares with no par value of

which 29,301,667 common shares are issued and

outstanding

Escrowed Shares: 5,833,333 common shares

Transfer Agent: CIBC Mellon Trust Company (Vancouver)

Trading Symbol: MMV

CUSIP Number: 602896 10 2

Agent(s)/Underwriter(s): Canaccord Genuity Corp.

Greenshoe Option: The Agent/Underwriter has over-allotted the

Offering to the extent of 1,650,000 Units.

Agent's Compensation: (a) 873,750 non-transferable share purchase

warrants with a two year term. One warrant to

purchase one share at $0.35 per share up to

year one and at $0.40 per share in year two;

(b) a cash commission of $237,187.50; and

(c) a corporate finance fee comprised of

150,000 Units having the same terms as the

Units; and (d) an administrative work fee of

$5,000.

For further information, please refer to the Company's Prospectus dated

June 2, 2010 and news release dated June 28, 2010.

Company Contact: Marshall Bertram, President & CEO

Company Address: Suite 201, 1416 West 8th Avenue

Vancouver, BC V6H 1E1

Company Phone Number: (604) 639-4455

Company Fax Number: (604) 639-4451

TSX-X

---------------------------------------------------------------------

NEW WEST ENERGY SERVICES INC. ("NWE")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated June 23, 2010, the

Exchange has accepted an amendment with respect to a Non-Brokered Private

Placement announced May 3, 2010. The following Insiders and Pro-Group

members participated in the private placement. All other aspects of the

original Bulletin remain the same.

Insider=Y /

Name ProGroup=P / # of Shares

Craig Bishop P 500,000

Robert Chase Y 1,000,000

Michael Marosits P 500,000

William A. Rand Y 2,000,000

TSX-X

---------------------------------------------------------------------

NSGOLD CORPORATION ("NSX")

(formerly Kermode Capital Ltd. ("KER.P"))

BULLETIN TYPE: Qualifying Transaction-Completed, Resume Trading, Private

Placement- Brokered, Private Placement- Brokered, Name Change

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

Qualifying Transaction:

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction ("QT") described in its Filing Statement dated June 3, 2010.

As a result, at the opening Wednesday, June 30, 2010, the Company will no

longer be considered as a Capital Pool Company.

The QT consists of the acquisition of all the issued and outstanding

securities of NSGold Corporation ("NSGold") through the issuance of

11,000,000 shares of the Company to NSGold shareholders at a deemed issue

price of $0.25 per share.

NSGold acquired from Globex Mining Enterprises Inc. (TSX: GMX) a 100%

interest in the Mooseland Gold Property and other secondary properties in

consideration of cash payments of $750,000 as follows:

(i) $250,000 by June 30, 2010;

(ii) $250,000 by September 1, 2010; and

(iii) $250,000 on the earlier of 30 days after commencement of production

or September 1, 2011.

Globex holds a gross metal royalty equal to four percent (4%) of all

metals produced from the Mooseland Gold Property and the secondary

properties as delivered by an arm's-length refinery or smelter. In

addition, Globex has the right to receive a five percent (5%) interest in

the then-issued and outstanding share capital of NSGold in the event that

any of the Mooseland Gold Property or the secondary properties, as

applicable, enters into production.

A total of 11,000,000 common shares, issued to NSGold' shareholders are

escrowed pursuant to an Exchange Tier 2 Value Escrow Agreement.

The Company is classified as a "Gold and Silver Ore Mining" Issuer (NAICS

Number: 212220).

For further information, please refer to the Company's Filing Statement

dated June 3, 2010, available on SEDAR.

Resume Trading:

Further to TSX Venture Exchange's Bulletin dated March 9, 2010, trading in

the securities of the Resulting Issuer will resume at the opening

Wednesday, June 30, 2010.

Private Placement- Brokered:

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement announced on March 8 and June 23,

2010:

Number of Shares: 6,880,731 Flow-Through Common Shares

Purchase Price: $0.30 per Flow-Through Common Shares

Warrants: 3,440,365 warrants to purchase 3,440,365

common shares.

Warrant Exercise Price: $0.50 per share until June 18, 2011

Number of Placees: 30 placees

Insider / Pro Group Participation:

Insider=Y /

Name Pro Group=P Number of Shares

Glenn A. Holmes Y 575,000

Agents: Citadel Securities Limited

Agent's Fee: See below

Private Placement- Brokered:

TSX Venture Exchange has accepted for filing the documentation with

respect to a Brokered Private Placement announced on March 8 and June 23,

2010:

Number of Shares: 8,225,140 Common Shares

Purchase Price: $0.25 per Common Shares

Warrants: 4,112,570 warrants to purchase 4,112,570

common shares.

Warrant Exercise Price: $0.50 per share until June 18, 2011

Number of Placees: 40 placees

Insider / Pro Group Participation:

Insider=Y /

Name Pro Group=P Number of Shares

Caddis Holdings Limited

(Grant Loon) Y 200,000

Van Hoof Industrial Holdings Ltd.

(Johannes H.C. Van Hoof) Y 1,400,000

Agents: Citadel Securities Limited

Agent's Fee: A total cash commission (for the

"Flow-Through" and "Hard Cash" financings)

of $280,564.35 and Agent's options to

purchase 1,018,643 units at a price of $0.25

per unit until June 18, 2011. Each unit

consists of one common share and one-half

warrant. Each whole warrant entitles the

holder to acquire one common share at a price

of $0.50 per share until June 18, 2011. The

agent also received a cash payment of $15,000

as 'due diligence fees' and 600,000 warrants

as 'facilitation fees'. Each warrant entitles

the holder to acquire one common share at an

exercise price of $0.25 per share until June

18, 2012.

Name Change:

Pursuant to a resolution passed by the board of directors on June 17,

2010, the Company has changed its name from "Kermode Capital Ltd." to

"NSGold Corporation". There is no consolidation of capital.

Effective at the opening Wednesday, June 30, 2010, the common shares of

"NSGold Corporation." will commence trading on TSX Venture Exchange, and

the common shares of "Kermode Capital Ltd." will be delisted.

Capitalization: Unlimited common shares with no par value

of which 30,105,871 shares will be issued

and outstanding.

Escrow: 13,000,000 common shares, of which

1,300,000 common shares are released at the

date of this bulletin.

Transfer Agent: Computershare Trust Company of Canada -

Toronto & Vancouver

Trading Symbol: NSX (new)

CUSIP Number: 62942A108 (new)

The Exchange has been advised that the above transactions have been

completed.

Company Contact: Mr. Glenn A. Holmes, Chief Financial Officer

Company Address: 1055 West Hastings Street, Suite 2200

Vancouver, BC V6E 2E9

Company Phone Number: (902) 483-2308

E-mail Address: glenn.holmes@nsgoldcorp.com

Company Web Site: www.nsgoldcorp.com

TSX-X

---------------------------------------------------------------------

PASSPORT POTASH INC. ("PPI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 27, 2010 and June 16, 2010:

Number of Shares: 4,960,476 shares

Purchase Price: $0.05 per share

Warrants: 4,960,476 share purchase warrants to purchase

4,960,476 shares

Warrant Exercise Price: $0.10 for a two year period

Number of Placees: 20 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Joshua D. Bleak Y 504,394

William Vance P 500,000

Finders' Fees: Mackie Research Capital Corporation

receives $2,400 and 60,000 non-transferable

warrants, each exercisable for one share at

a price of $0.10 per share for a two year

period.

Union Securities Ltd. receives $4,000 and

100,000 non-transferable warrants, each

exercisable for one share at a price of

$0.10 per share for a two year period.

Haywood Securities Inc. receives $2,000 and

50,000 non-transferable warrants, each

exercisable for one share at a price of $0.10

per share for a two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

---------------------------------------------------------------------

PETROGLOBE INC. ("PGB")

BULLETIN TYPE: Resume Trading, Reverse Takeover-Announced

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

Effective at the opening, June 30, 2010 trading in the Company's shares

will resume.

Further to the Company's news release dated June 29, 2010 regarding the

proposed acquisition of ArPetrol Inc.(the 'Reverse Takeover'), the

Exchange has granted an exemption from sponsorship requirements.

This resumption of trading does not constitute acceptance of the Reverse

Takeover, and should not be construed as an assurance of the merits of the

transaction or the likelihood of completion. The Company is required to

submit all of the required initial documentation relating to the Reverse

Takeover within 75 days of the issuance of the news release. IF THIS

DOCUMENTATION IS NOT PROVIDED, OR IS INSUFFICIENT, A TRADING HALT MAY BE

RE-IMPOSED.

Completion of the transaction is subject to a number of conditions,

including but not limited to, Exchange acceptance and shareholder

approval. There is a risk that the transaction will not be accepted or

that the terms of the transaction may change substantially prior to

acceptance. SHOULD THIS OCCUR, A TRADING HALT MAY BE RE-IMPOSED.

TSX-X

---------------------------------------------------------------------

RODINIA LITHIUM INC. ("RM")

(formerly Rodinia Minerals Inc. ("RM"))

BULLETIN TYPE: Name Change

BULLETIN DATE: June 29, 2010

TSX Venture Tier 1 Company

Pursuant to a resolution passed by shareholders June 10, 2010, the Company

has changed its name as follows. There is no consolidation of capital. The

Company has not changed its symbol.

Effective at the opening Wednesday, June 30, 2010, the common shares of

Rodinia Lithium Inc. will commence trading on TSX Venture Exchange, and

the common shares of Rodinia Minerals Inc. will be delisted. The Company

is classified as a 'Junior Natural Resource - Mining' company.

Capitalization: unlimited shares with no par value of which

47,833,412 shares are issued and outstanding

Escrow: nil escrow shares

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: RM (UNCHANGED)

CUSIP Number: 77487T 10 6 (new)

TSX-X

---------------------------------------------------------------------

SCHWABO CAPITAL CORPORATION ("SBO.H")

(formerly Schwabo Capital Corporation ("SBO.P"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change, Remain

Suspended

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

In accordance with TSX Venture Exchange Policy 2.4, Capital Pool

Companies, the Company has not completed a qualifying transaction within

the prescribed time frame. Therefore, effective Wednesday, June 30, 2010,

the Company's listing will transfer to NEX, the Company's Tier

classification will change from Tier 2 to NEX, and the Filing and Service

Office will change from Toronto to NEX.

As of June 30, 2010, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from SBO.P to SBO.H. There

is no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

Further to the TSX Venture bulletin dated March 31, 2010 trading in the

shares of the Company will remain suspended. Members are prohibited from

trading in the securities of the Company during the period of the

suspension or until further notice.

TSX-X

---------------------------------------------------------------------

SILVERCREST MINES INC. ("SVL")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: November 24, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 5,000,000 bonus warrants to Macquarie Bank Limited in consideration

of a US$12,500,000 project loan facility with an associated hedging

facility and a CAD$3,000,000 bridge finance facility. Each warrant is

exercisable for one share at a price of $0.90 per share for a three year

period.

TSX-X

---------------------------------------------------------------------

SURGE ENERGY INC. ("SGY")

(formerly Zapata Energy Corporation ("ZCO"))

BULLETIN TYPE: Name Change

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders June 25, 2010, the Company

has changed its name as follows. There is no consolidation of capital.

Effective at the opening Wednesday, June 30, 2010, the common shares of

Surge Energy Inc. will commence trading on TSX Venture Exchange and the

common shares of Zapata Energy Corporation will be delisted. The Company

is classified as an "Oil & Gas Exploration/Development" company.

Capitalization: Unlimited shares with no par value of which

31,079,681 shares are issued and outstanding

Escrow: 3,863,636 Escrowed Shares

Transfer Agent: Olympia Trust Company of Canada

Trading Symbol: SGY (new)

CUSIP Number: 86880Y109 (new)

TSX-X

---------------------------------------------------------------------

WAR EAGLE MINING COMPANY INC. ("WAR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced June 17,

2010:

Number of Shares: 9,576,668 shares

Purchase Price: $0.06 per share

Warrants: 4,788,334 share purchase warrants to purchase

4,788,334 shares

Warrant Exercise Price: $0.15 for an eighteen month period

The warrants are subject to an acceleration clause if the common shares of

the Issuer are traded on the Exchange at a price of $0.30 for 20

consecutive trading days.

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Firebird Global Master

Fund Ltd. Y 8,333,334

Simon Anderson Y 400,000

Anthony Dutton Y 500,000

Finder's Fee: $1,648 and 27,466 finder's warrants payable

to Primary Ventures Corporation

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------

WESTERN PLAINS PETROLEUM LTD ("WPP")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to the

Letter Agreement (the "Agreement") between Colac Resources Ltd. and Brahma

Resources Ltd. (collectively, the "Vendors"), along with the Company dated

May 3, 2010 wherein the Company will acquire a 100% working interest in

certain petroleum & natural gas rights in the Lloydminster area of

Saskatchewan. In consideration, the Company will issue 10,000,000 common

shares at a price of $0.15 per share, to be equally divided between the

Vendors.

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of Shares

Brahma Resources Ltd.

(David Forrest) Y 5,000,000

This transaction was announced in the Company's press release dated June

16, 2010.

TSX-X

---------------------------------------------------------------------

WESTMINSTER RESOURCES LTD. ("WMR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: June 29, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 31, 2010:

Number of Shares: 10,267,000 shares

Purchase Price: $0.20 per share

Warrants: 10,267,000 share purchase warrants to purchase

10,267,000 shares

Warrant Exercise Price: $0.35 for a two year period

Number of Placees: 70 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Glen Macdonald Y 50,000

John Griffith P 50,000

Shenaz Devji P 50,000

Kypriaki Norte P 6,000

Brian Paaes-Braga P 40,000

Adam Vorberg P 175,000

W. Brent Walker P 28,000

Finders' Fees: $87,032 payable to Jordan Capital

$5,760 payable to Canaccord Genuity Corp.

$4,000 payable to MacQuarie Private Wealth

Inc.

$4,320 payable to Jones, Gable & Co.

$47,720 payable to Carl Jones.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------

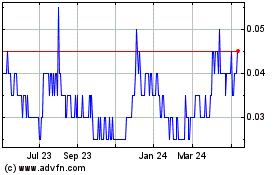

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Nov 2024 to Dec 2024

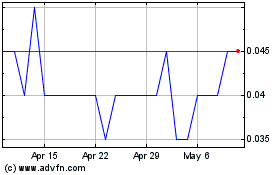

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Dec 2023 to Dec 2024