Nevada Zinc Announces Private Placement Financing

24 August 2023 - 7:00AM

Nevada Zinc Corporation (“

Nevada Zinc" or the

"

Company") (

TSXV: NZN) is pleased

to announce that it plans to raise up to $500,000 in a non-brokered

private placement financing.

The financing will consist of an issue of up to

12,500,000 units ("Units") priced at $0.04 per

Unit. Each Unit will consist of one (1) common share

(“Common Share”) and one (1) common share purchase

warrant (“Warrant”), with each Warrant exercisable

for a common share at $0.10 for a period of eighteen (18) months

from the date of issuance.

The net proceeds from the Financing are expected

to be used to fund the Company's Lone Mountain Zinc project and for

general corporate and working capital purposes.

All common shares issued in connection with the

financing will be subject to a statutory hold period of four months

plus a day from the date of issuance. The Company may pay a

finder's fee to eligible finders. The Offering is subject to the

approval of the TSX Venture Exchange and is anticipated to close in

September 2023.

About Nevada Zinc

Nevada Zinc is a development stage company

focused on the production of zinc-based products including zinc

oxide and zinc based micro nutrient fertilizers from its Lone

Mountain zinc deposit in Nevada. The Company will be focused on

completing project studies for the remainder of 2023 and 2024 in

addition to concurrently beginning the permitting process for a

zinc oxide production plant adjacent to the Lone Mountain

deposit.

For further information please

contact:

Mike Wilson, President & CEO T: (416)

574-9075Email: wilson.h.mike@gmail.com

Don Christie, CFOT: (416) 409-8441Email:

don@nevadazinc.com

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain forward-looking

statements including but not limited to comments regarding the

timing and terms of financings, timing and content of upcoming work

programs, geological interpretations, obligations under existing

and future agreements, expected share issuances and ownership

positions, expected returns and profits from application of

unproven chemical processes to the Company’s mineral projects,

partnerships and joint ventures, potential mineral recovery

processes, etc. Forward-looking statements address future events

and conditions and therefore, involve inherent risks and

uncertainties. Actual results relating to, among other things,

regulatory approvals, proceeds from financings, results of

exploration, project development, reclamation and capital costs of

the Company's mineral properties, and the Company's financial

condition and prospects, could differ materially from those

currently anticipated in such statements. These and other factors

should be considered carefully and readers should not place undue

reliance on the Company's forward-looking statements. The Company

will be required to complete a PEA and pre-feasibility study to

confirm the project’s zinc oxide production flowsheet and project

economics. The Company does not undertake to update any

forward-looking statement that may be made from time to time by the

Company or on its behalf, except in accordance with applicable

securities laws.

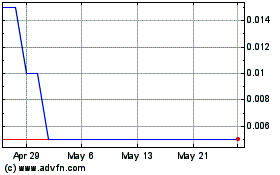

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Nov 2024 to Dec 2024

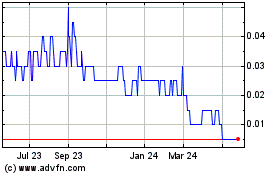

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Dec 2023 to Dec 2024