Nevada Zinc Announces Definitive Agreement for Sale and Option of Nevada Mineral Claims

25 July 2024 - 10:25AM

Nevada Zinc Corporation (“

Nevada Zinc” or the

“Company”)

(TSX-V: NZN) is

pleased to announce that the Company has entered into a definitive

agreement dated July 24, 2024 (the “

Agreement”)

with an arm’s length third party (the “

Purchaser”)

pursuant to which the Company agreed to sell a portion of its

interest in its mineral claims located in Eureka County, Nevada

(the “

Property”).

The Property is made up of 203 mineral claims

located in Eureka County, Nevada (the “Property”) which are

comprised of:

|

(i) |

1

patented claim and 26 unpatented lode claims, all of which are 100%

legally and beneficially owned by the Company’s wholly owned

subsidiary, Lone Mountain Zinc Ltd. (collectively, the

“Owned Claims”); and |

|

|

|

|

(ii) |

176 unpatented lode claims (the

“Leased Claims”) held by the Company through a

long-term lease agreement (the “Lease”). |

| |

|

Pursuant to the terms of the Agreement, the

Purchaser agreed to purchase and the Company agreed to sell a 25%

beneficial interest in the Company’s rights and interests in and to

the Lease in respect of the Leased Claims and the Company agreed to

record a deed of trust against the Owned Claims in favour of the

Purchaser, for cash consideration of US$116,908, which was paid to

the owner of the Lease for the purpose of keeping the Lease in good

standing.

Additionally, pursuant to the terms of the

Agreement the Company will also grant the Purchaser an exclusive

option (the “Option”) to acquire: (i) 100% of the

Company’s right, title and interest in and to the Owned Claims; and

(ii) 100% of the Company’s rights and interests in and to the Lease

in respect of the Leased Claims. Under the terms of the Agreement,

the Purchaser can exercise the Option by:

|

(i) |

issuing to the Company that number of common shares in the capital

of the Purchaser (the “Consideration Shares”) having an aggregate

value of $1,000,000 based on the 10-day volume weighted average

trading price of the common shares of the Purchaser; and |

|

|

|

|

(ii) |

paying to the Company a cash fee

in the amount of $100,000. |

|

|

|

The grant of the Option constitutes a

“Reviewable Disposition” as defined in Policy 5.3 – Acquisitions

and Dispositions of Non-Cash Assets of the TSX Venture Exchange

(the “TSXV”). As such, the Option is subject to

approval by the TSXV and is and is also expected to be subject to

approval by the Company's shareholders. If shareholder approval is

required, the Company intends to seek such approval at a special

meeting of its shareholders (the “Meeting”).

Further information regarding the transaction will be contained in

an information circular that the Company will prepare, file and

mail to the shareholders of Nevada Zinc in connection with the

Meeting.

There are no finder’s fees payable in connection

with this transaction.

About Nevada Zinc

The Company is exploring strategic alternatives

for enhancing shareholder value.

Additional information about the Company is

available on the Company’s SEDAR+ profile at www.sedarplus.ca.

For further information please contact:

Mike Wilson, President & CEOT: (416)

574-9075Email: wilson.h.mike@gmail.com

Don Christie, CFOT: (416)

409-8441Email: don@nevadazinc.com

Caution Regarding Forward-Looking

Statements

This news release may contain forward-looking

statements including but not limited to comments regarding the

timing and terms of agreements, regulatory approvals, shareholder

approvals, obligations under existing and future agreements,

expected share issuances and ownership positions, expected returns

and profits from application of unproven chemical processes to the

Company’s mineral projects, partnerships and joint ventures,

potential mineral recovery processes, etc. Forward-looking

statements address future events and conditions and therefore,

involve inherent risks and uncertainties. Actual results relating

to, among other things, completion of proposed transactions,

regulatory approvals, expected proceeds from transactions, results

of exploration, project development, reclamation and capital costs

of the Company's mineral properties, and the Company's financial

condition and prospects, could differ materially from those

currently anticipated in such statements. These and other factors

should be considered carefully and readers should not place undue

reliance on the Company's forward-looking statements. The Company

does not undertake to update any forward-looking statement that may

be made from time to time by the Company or on its behalf, except

in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) has reviewed or accepts

responsibility for the adequacy or accuracy of this news

release.

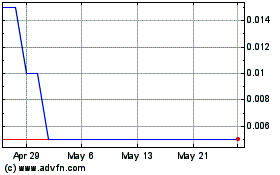

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Nov 2024 to Dec 2024

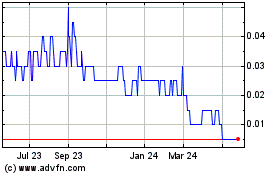

Nevada Zinc (TSXV:NZN)

Historical Stock Chart

From Dec 2023 to Dec 2024