Power Nickel Prices Approximately C$40 Million Best Efforts Private Placement

13 February 2025 - 1:24AM

Power Nickel Inc. (the "Company" or “Power Nickel”) (TSXV: PNPN)

(OTCBB: PNPNF) (Frankfurt: IVV) has announced today the pricing of

its previously announced “best efforts” private placement offering

(the “Offering”) for a total of 14,135,000 Quebec flow-through

shares (the "FT Shares"), at a price of C$2.83 for each FT Share,

for the aggregate proceeds of approximately C$40 million.

BMO Capital Markets and Hannam & Partners

are acting as the joint bookrunners for the Offering, together with

a syndicate of agents (the “Agents”).

Terry Lynch, CEO of Power Nickel, commented "The

company is thrilled to announce and appreciates the continued

support of Robert Friedland and Rob McEwen among other current

shareholders in this placement as it looks forward to the exciting

winter 2025 drill program and the summer 2025 program. This raise

will allow Power Nickel to expand the number of rigs exploring the

Nisk Project across the already discovered zones such as Nisk and

Lion along with the untested EM targets within the project area. We

cannot wait to see what this year brings and the reception it has

received from existing shareholders along with new institutional

shareholders both encourages and humbles the entire team.

Incredible shareholders expect incredible effort and performance,

and we don't take that responsibility lightly."

The gross proceeds received by the Company from

the sale of the FT Shares will be used to incur expenses described

in paragraph (f) of the definition of "Canadian exploration

expense" ("CEE") in subsection 66.1(6) of the Tax Act and paragraph

(c) of the definition of CEE in section 395 of the QTA, and will be

renounced in favour of the relevant purchasers by no later than

December 31, 2025, pursuant to the terms of the subscription and

renunciation agreement to be entered into between the Company and

such purchasers of FT Shares. Such expenses will also qualify as

"flow-through mining expenditures" as defined in subsection 127(9)

of the Tax Act for the purposes of the federal tax credit described

in paragraph (a.2) of the definition of "investment tax credit" in

subsection 127(9) of the Tax Act.

For purchasers of FT Shares resident in the

Province of Québec, 10% of the amount of the CEE will be eligible

for inclusion in the deductible "exploration base relating to

certain Québec exploration expenses" and 10% of the amount of the

CEE will be eligible for inclusion in the deductible "exploration

base relating to certain Québec surface mining exploration

expenses" (as such terms are defined in sections 726.4.10 and

726.4.17.2 of the QTA, respectively, for the purposes of the

deductions described in section 726.4.9 and 726.4.17.1 of the QTA),

giving rise to an additional 20% deduction for Québec tax

purposes.

In the event that the Company is unable to

renounce CEE, effective on or prior to December 31, 2025, in favour

of the purchasers of FT Shares in an aggregate amount not less than

the gross proceeds raised from the issue of FT Shares, the Company

will indemnify each purchaser of FT Shares for the additional taxes

payable by such subscriber as a result of the Company's failure to

renounce the CEE as agreed.

The offering is expected to close on or about

February 27, 2025 and is subject to the Company receiving all

necessary regulatory approvals, including the approval of the TSX

Venture Exchange.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

About Power Nickel Inc.Power

Nickel is a Canadian exploration company focusing on developing the

High-Grade Nickel Copper PGM, Gold and Silver Nisk project into

potentially Canada's next poly metallic mine.

On February 1, 2021, Power Nickel (then called

Chilean Metals) completed the acquisition of its option to acquire

up to 80% of the Nisk project from Critical Elements Lithium

Corp.

The NISK property comprises a large land

position (20 kilometres of strike length) with numerous high-grade

intercepts. Power Nickel is focused on expanding the high-grade

nickel-copper PGM, Gold and Silver mineralization with a series of

drill programs designed to test the initial Nisk discovery zone,

the Lion discovery zone and to explore the land package for

adjacent potential poly metallic deposits.

Contact Information

Mr. Duncan Roy, VP Investor

Relations416-580-3862duncan@powernickel.com

Cautionary Note Regarding

Forward-Looking Statements

This message contains certain statements that

may be deemed "forward-looking statements" concerning the Company

within the meaning of applicable securities laws. Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects,"

"plans," "anticipates," "believes," "intends," "estimates,"

"projects," "potential," "indicates," "opportunity," "possible" and

similar expressions, or that events or conditions "will," "would,"

"may," "could" or "should" occur. Although the Company believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance, are subject to risks and uncertainties, and

actual results or realities may differ materially from those in the

forward-looking statements. Such material risks and uncertainties

include, but are not limited to, among others; the timing for

various drilling plans; the ability to raise sufficient capital to

fund its obligations under its property agreements going forward

and conduct drilling and exploration; to maintain its mineral

tenures and concessions in good standing; to explore and develop

its projects; changes in economic conditions or financial markets;

the inherent hazards associates with mineral exploration and mining

operations; future prices of nickel and other metals; changes in

general economic conditions; accuracy of mineral resource and

reserve estimates; the potential for new discoveries; the ability

of the Company to obtain the necessary permits and consents

required to explore, drill and develop the projects and if

accepted, to obtain such licenses and approvals in a timely fashion

relative to the Company's plans and business objectives for the

applicable project; the general ability of the Company to monetize

its mineral resources; and changes in environmental and other laws

or regulations that could have an impact on the Company's

operations, compliance with environmental laws and regulations,

dependence on key management personnel and general competition in

the mining industry.

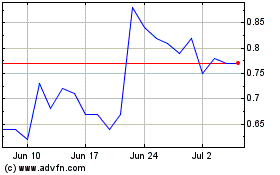

Power Metallic Mines (TSXV:PNPN)

Historical Stock Chart

From Feb 2025 to Mar 2025

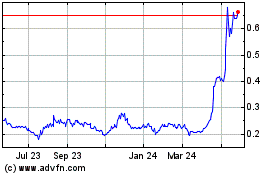

Power Metallic Mines (TSXV:PNPN)

Historical Stock Chart

From Mar 2024 to Mar 2025