Amended Current Report Filing (8-k/a)

28 October 2022 - 12:09AM

Edgar (US Regulatory)

0000835662

true

0000835662

2022-07-19

2022-07-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

(Amendment

No. 3)

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (date of earliest event reported): July 19, 2022

AIXIN

LIFE INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

| Colorado |

|

0-17284 |

|

84-1085935 |

| State

of |

|

Commission |

|

IRS

Employer |

| Incorporation |

|

File

Number |

|

Identification

No. |

Hongxing

International Business Building 2, 14th FL, No. 69

Qingyun South Ave., Jinjiang

District

Chengdu

City, Sichuan Province, China

(Address

of principal executive offices)

86-313-6732526

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

AIXN |

|

OTCQX |

Cautionary

Note Regarding Forward-Looking Statements:

Any

statements contained in this Current Report on Form 8-K that are not historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identifiable by use of the words

“believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,”

“projects,” or similar expressions. Such statements may include, but are not limited to, statements about the Registrant’s

planned acquisitions, the purchase price to be paid for such acquisitions and the future performance of the businesses to be acquired,

and other statements that are not historical facts. Such statements are based upon the beliefs and expectations of the Company’s

management as of this date only and are subject to risks and uncertainties that could cause actual results to differ materially. Therefore,

investors are cautioned not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise

or publicly release the results of any revision to these forward-looking statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

Item

1.01 Entry into a Material Definitive Agreement.

Pursuant

to a Supplementary Agreement to the Equity Transfer Agreement dated July 19, 2022, with Yunnan Sheng Shengyan Technology Co., Ltd. and

Chen Yun (collectively, the “Sellers”) we, Aixin Life International, Inc., waived certain conditions to closing and assumed

operational control of Yunnan Runcansheng Technology Company Limited (“Yunnan Runcansheng”). Subsequent thereto, we and the

Sellers agreed that the aggregate price to be paid for our acquisition of 100% of the shares of Yunnan Runcangsheng was to be reduced

from RMB 45,082,600 to RMB 31,557,820 (approx. US$4,554,000). This was confirmed by our entry into a second Supplementary Agreement to

the Equity Transfer Agreement (“Supplement 2”) with the Sellers, a copy of which is annexed hereto as Exhibit 10.1.

In

the first Supplementary Agreement all parties agreed that the remaining balance of the purchase price, now as adjusted, due pursuant

to the Equity Transfer Agreement will be paid within 10 working days after completion of the industrial and commercial change and registration

of equity and legal representative with the local governmental authorities. We anticipate that this registration will be completed within

two weeks, though governmental actions in Chengdu are being delayed by lockdowns in response to COVID-19, at which time we will pay to

the Sellers the RMB 26,707,820 (approx. US$3,750,000,000) remaining to be paid pursuant to the Equity Transfer Agreement.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

AiXin

Life International, Inc. |

| |

|

|

| Date:

October 26, 2022 |

By: |

/s/

Quanzhong Lin |

| |

|

Quanzhong

Lin |

| |

|

Chief

Executive Officer |

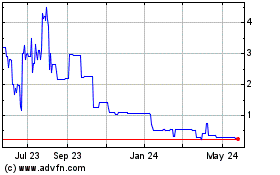

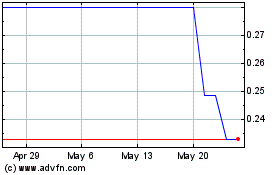

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Nov 2024 to Dec 2024

AiXin Life (QB) (USOTC:AIXN)

Historical Stock Chart

From Dec 2023 to Dec 2024