Hedge Fund Och-Ziff Considered Sale of Part of Firm

19 August 2016 - 7:10AM

Dow Jones News

The largest publicly traded hedge-fund firm in the U.S. explored

a partial sale earlier this year, yet another sign of the difficult

choices facing the troubled industry.

Och-Ziff Capital Management Group LLC representatives spoke to

private-equity firms and asset managers including Pacific

Investment Management Co. about buying part of Och-Ziff's business,

making a so-called strategic investment in the firm or pursuing a

joint venture, people familiar with the matter said.

The talks are no longer active, some of the people said.

"We are not contemplating selling any part of the firm or any

other strategic transactions," Och-Ziff spokesman Joe Snodgrass

said. A Pimco spokeswoman declined to comment.

Och-Ziff considered the sale as it faced a five-year

international bribery investigation in countries including Libya

and client withdrawals. Investors have pulled billions from the

firm in recent months, and Och-Ziff said in its most recent

earnings report "this trend will likely continue to some extent for

some period of time."

Hedge funds are under pressure from all corners, with unhappy

clients demanding their money back amid years of poor

performance.

Och-Ziff has additional troubles. The Wall Street Journal

earlier reported that the Justice Department is pushing Och-Ziff to

agree to a criminal guilty plea. The firm said in its

second-quarter earnings report that it set aside more-than $400

million to resolve the bribery investigations.

Och-Ziff stock was down 37% this year through Wednesday. The

stock was up nearly 7% Thursday as The Journal reported the firm's

earlier consideration of a stake sale.

Och-Ziff ultimately decided to shore up support internally

instead of seeking help from potential buyers or investors, a

person familiar with the matter said. In its second-quarter

earnings report Och-Ziff said its partners, who include chairman

Daniel Och, are likely to invest up to $500 million into the firm

while deferring any repayment or dividend for at least three

years.

That money would be earmarked in part toward the Justice

Department bribery investigation and a related Securities and

Exchange Commission query, the firm said.

Mr. Och, 55, retains majority decision-making power at Och-Ziff

through his 60% ownership of the company's voting shares, as he has

since the firm went public in 2007. Och-Ziff has $39 billion of

assets under management.

Write to Rob Copeland at rob.copeland@wsj.com and Sarah Krouse

at sarah.krouse@wsj.com

(END) Dow Jones Newswires

August 18, 2016 16:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

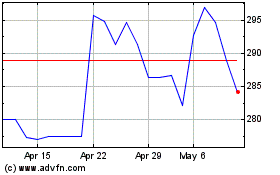

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

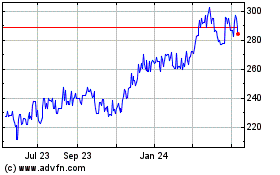

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024