GE Hires Maersk CFO Carolina Dybeck Happe as New CFO--2nd Update

26 November 2019 - 8:19AM

Dow Jones News

By Thomas Gryta

General Electric Co. said it hired an executive at A.P.

Moeller-Maersk A/S as its next chief financial officer, tapping

another outsider to help the American conglomerate turn around its

operations.

Carolina Dybeck Happe, who has been the Danish shipping giant's

finance chief less than a year, will join GE next year. Previously,

she spent 16 years at Assa Abloy AB, a Swedish maker of door locks.

She succeeds Jamie Miller, who had been GE's CFO for about two

years and will leave the company after the transition.

GE CEO Larry Culp, the first outsider to run the conglomerate,

said in July he was looking to hire a new finance chief. The

company is trying to turn around its business after two difficult

years that forced it to slash its dividend and shed businesses.

The CFO change comes while GE's accounting practices are under

investigation by the Justice Department and the Securities and

Exchange Commission. GE is also considering switching its auditor,

after working with KPMG LLP for more than a century.

Ms. Dybeck Happe is "a proven global CFO who knows how to

deliver results and create value," Mr. Culp said in an interview.

He praised her performance at Assa Abloy, which he said delivered

strong shareholder returns with a small central management team and

decentralized structure. "That is the frame that would work well

with us at GE," he said.

The GE boss said he had never met Ms. Dybeck Happe until the

search process, which he said had been his priority in recent

months. GE worked with a recruiting firm and considered several

candidates but Mr. Culp called Ms. Dybeck Happe "a kindred

spirit."

GE and Maersk had differing accounts Monday of when Ms. Dybeck

Happe would move to the U.S. company. GE said she would join in

early 2020, while Maersk told investors she could leave as late as

November 2020.

People familiar with the matter said she is under contract but

would be released to join GE when Maersk names a replacement as

CFO. Ms. Dybeck Happe is the second senior executive to set plans

to leave Maersk this month, after its chief operating officer

resigned and joined a rival.

Wall Street analysts long suspected that Mr. Culp, who took over

in October 2018, would want to have his own CFO in place, but Ms.

Miller held on for more than a year before her boss decided to make

a change.

In July, GE announced the plan for a CFO change without having a

successor ready to step up, an unusual move at a company once known

for its elite management development and deep bench of capable of

executives.

Ms. Miller was the first woman in the CFO role at GE. She was

promoted into the job in October 2017 after former CFO Jeff

Bornstein abruptly announced his retirement. Within weeks, GE

slashed its financial forecasts and its dividend as problems in its

power business and financial services arm came to light. Within

months, GE revealed a $15 billion hole in its legacy insurance

holdings and the regulatory probes.

"Jamie Miller walked into an impossible situation when given the

job," said Melius Research analyst Scott Davis when her departure

was announced in July. "But textbook turnarounds almost always

include a new finance staff."

Ms. Dybeck Happe faces challenge of cutting costs and continuing

GE restructuring, while helping GE reduce its pile of debt. Under

Mr. Culp, GE has pushed a style of lean management processes that

emulate Toyota with rigorous reviews of operations and decision

making, on a daily basis in some cases. He has also said GE's

turnaround would take years.

Ms. Dybeck Happe, 47 years old, will be based in Boston and

oversee global finance organization as well as digital technology

and global operations functions. A native of Sweden, she currently

serves on the boards of French industrial company Schneider

Electric SE and German electric utility E.ON.

In addition to the federal probes and potential auditor change,

the new finance chief will face several challenges. She will have

to quickly become acquainted with GE's complex finances and find

ways to cut costs and boost efficiency at plants, said John Inch, a

managing director at Gordon Haskett Research Advisors.

GE is selling off assets, including a pending $21 billion sale

of a biotech business to Danaher Corp., to reduce its debt levels.

Management's long-term goal is to lower GE's net debt to less than

$30 billion. GE had net debt of $49 billion at the end of the third

quarter.

GE submits thousands of tax filings annually, according to Mr.

Inch, and in 2017 agreed to move more than 600 tax employees over

to PricewaterhouseCoopers LLP as part of a slimming down exercise.

"As new CFO, you will have to deal with a very complex tax

structure," Mr. Inch said.

--Nina Trentmann and Costas Paris contributed to this

article.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

November 25, 2019 16:04 ET (21:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

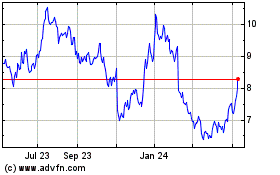

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

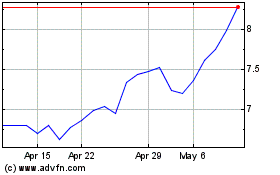

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025