Current Report Filing (8-k)

03 June 2022 - 12:46AM

Edgar (US Regulatory)

false0000008328UT

0000008328

2022-05-31

2022-05-31

SECURITIES AND EXCHANGE COMMISSION

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): |

|

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

1200 Silver City Road, PO Box 432, Eureka, UT |

|

|

(Address of principal executive offices) |

|

|

|

|

|

|

|

|

|

|

|

|

(Issuer’s Telephone Number, Including Area Code) |

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230-425) |

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240-14a-12) |

|

|

|

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

On May 31, 2022, Applied Minerals, Inc. (“AMI”) and BMI Minerals Company (“BMCO”) entered into an Iron Sale Agreement and a Mining Operations Agreement. Also on May 31, 2022, AMI and Brady McCasland, Inc. (“BMI”), a manufacturer of products for the oil & gas industry, entered into a Mill Sale Agreement and a Milling Operations Agreement. BMCO and BMI are related companies. Upon the closing of the Iron Sale Agreement and the Mill Sale Agreement (the “Asset Sale Agreements”) BMCO and BMI will pay AMI a total of $2,000,000, less a $100,000 deposit, and, in turn, AMI will (i) transfer to BMCO title to the rights of the iron oxide minerals that exist on the patented and unpatented mining claims of the Dragon Mine property, (ii) transfer to BMI the processing and related equipment needed to mill the iron oxide minerals (“Mill”), and (iii) issue to BMCO 20 million restricted shares of common stock under Rule 144. Upon the closing of the Asset Sale Agreements, the Mining Operating Agreement and the Milling Operating Agreement (the “Operating Agreements”) will become effective.

The closing of the Asset Sale Agreements is conditioned upon, among other things, AMI entering into agreements with the majority holders of its Series A Notes and Series 2023 Notes that result in the elimination of the outstanding balances of both series of notes. The combined principal balance of both series of notes was $48,117,033 as of May 31, 2022.

If the closing conditions of the Asset Sale Agreements are not met within a reasonable amount of time, the Asset Sale Agreements will terminate without closing, BMCO and BMI will not pay the $1,900,000 to AMI, and the Operating Agreements will not become effective. Per a Letter Agreement between AMI and BMI, BMI will then have the option to (i) purchase up to an aggregate of 75,000 tons of AMIRON H40 iron oxide from AMI, milled and packaged to BMI’s specifications, over a period of 15 years with no more than a maximum of 15,000 tons supplied to BMI within any one year or (ii) have its $100,000 deposit returned and receive a warrant to purchase 10 million restricted shares of AMI common stock for $0.01 per share. Furthermore, if BMI elects option (i), BMI does not expect to purchase any AMIRON H40 for at least the first three years of the supply agreement.

If the closing conditions of the Iron Sale Agreement are satisfied, AMI will (i) transfer to BMCO title to the rights of the iron oxide minerals that exist on the patented and unpatented mining claims of the Dragon Mine property and (ii) issue to BMCO 20 million restricted shares of common stock under Rule 144.

If the Mining Operations Agreement becomes effective, AMI will be required to extract, haul, store and prepare for processing the

i

ron

o

xide

m

inerals (“Mining”) for BMCO. BMCO will reimburse AMI for all direct Mining costs and pay AMI 10% of the labor costs included in the Mining costs as a fee. AMI will have direct oversight over all Mining activities including the activities of contract labor that may be utilized for Mining. The Mining Operations Agreement will require AMI to make available to BMCO iron mining equipment owned by AMI. Under the Mining Operations Agreement, BMCO will pay AMI, depending on the sale price, either 20% or 25% of the gross profit of any sales of crushed, screened or milled iron to four Qualified Customers that have been developed by AMI.

If the closing conditions of the Mill Sale Agreement are satisfied, AMI will sell the Mill to BMI.

If the Milling Operations Agreement becomes effective, AMI will be required to mill, package and prepare for shipping (“Milling”) the iron oxide minerals for BMI. BMI will reimburse AMI for any costs it incurs directly related to Milling of iron oxide minerals for BMI. BMI will also pay AMI 10% of the labor costs included in the Milling costs as a fee. AMI will have direct oversight over all Milling activities including the activities of any contract labor that may be utilized for Milling. As part of the Milling Operations Agreement, BMI will agree to allow AMI to utilize any excess capacity of the Mill. BMI and AMI will each pay its share of the maintenance expense of the Mill based on the volume of minerals each processes through the Mill. AMI will maintain ownership of the laboratory equipment located in the Mill and allow BMI to use the equipment for a fee.

AMI’s halloysite resource and related milling assets are not part of the proposed transactions described above.

In accordance with the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ CHRISTOPHER T. CARNEY |

|

|

|

|

|

By: Christopher T. Carney |

|

|

|

|

|

President and Chief Executive Officer |

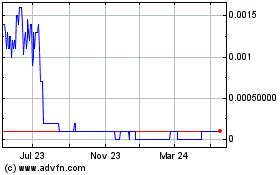

Applied Minerals (CE) (USOTC:AMNL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Applied Minerals (CE) (USOTC:AMNL)

Historical Stock Chart

From Nov 2023 to Nov 2024