AB Foods Fiscal Year 2022 Pretax Profit Rose on Robust Pricing; Launches GBP500 Million Share Buyback

08 November 2022 - 7:02PM

Dow Jones News

By Michael Susin

Associated British Foods PLC said Tuesday that pretax profit for

fiscal 2022 rose on robust pricing amid a normalization of customer

behavior, and raised its dividend payout and launched a buyback

program.

The British conglomerate, which owns the Primark fashion

retailer, made a pretax profit for the year ended Sept. 17 of 1.08

billion pounds ($1.24 billion), up from GBP725 million in fiscal

2021.

The company said it will launch a GBP500 million share buyback

program to be completed in fiscal 2023. It also increased its final

dividend to 29.9 pence a share, bringing the total dividend to 43.7

pence a share and compared with a total payout of 40.5 pence a

share a year prior.

Adjusted operating profit--the company's preferred metric which

strips out exceptional and other one-off items--rose 42% to GBP1.43

billion.

Primark reported sales in line with its previous guidance of

GBP7.7 billion, while an operating profit margin improved to 9.8%

from the expectations of 9.6%.

Total group's revenue increased to GBP17 billion from GBP13.88

billion. This compares with a forecast of GBP16.75 billion taken

from FactSet based on 18 analysts' estimation.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

November 08, 2022 02:47 ET (07:47 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

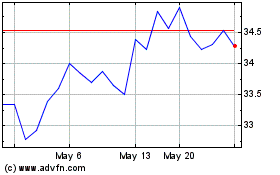

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

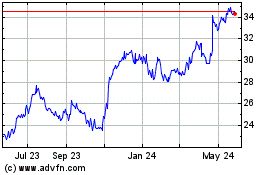

Associated British Foods (PK) (USOTC:ASBFY)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Associated British Foods Plc (PK) (OTCMarkets): 0 recent articles

More Associated British Foods Plc (PK) News Articles