Amended Statement of Ownership: Solicitation (sc 14d9/a)

22 September 2016 - 6:55AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE

14D-9

(RULE 14d-101)

(Amendment No. 8)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(D)(4) OF THE SECURITIES 1934 ACT OF 1934

AVG TECHNOLOGIES N.V.

(Name of Subject Company)

AVG

TECHNOLOGIES N.V.

(Name of Person(s) Filing Statement)

Ordinary Shares, Nominal Value €0.01 Per Share

(Title of Class of Securities)

N07831105

(CUSIP Number

of Class of Securities)

Harvey J. Anderson

AVG Technologies N.V.

Gatwickstraat 9-39

1043

GL Amsterdam

Netherlands

+31-20-5226210

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With a copy to:

Peter M. Lamb

Richard V.

Smith

Orrick, Herrington & Sutcliffe LLP

1000 Marsh Road

Menlo

Park, California 94205

(650) 614-7400

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Amendment No. 8 to Schedule 14D-9 (this “

Amendment

”) amends and

supplements the Solicitation/Recommendation Statement on Schedule 14D-9 originally filed with the U.S. Securities and Exchange Commission (the “

SEC

”) on July 29, 2016 (together with the exhibits and annexes thereto and as

amended or supplemented hereby and as previously and as may be further amended from time to time, the “

Schedule 14D-9

”) by AVG Technologies N.V., a public limited liability company (

naamloze vennootschap

) organized under the

laws of The Netherlands (the “

Company

” or “

AVG

”). The Schedule 14D-9 relates to the tender offer by Avast Software B.V., a private company with limited liability

(besloten vennootschap met beperkte

aansprakelijkheid)

(“

Purchaser

”) organized under the laws of The Netherlands and a direct wholly owned subsidiary of Avast Holding B.V., a private company with limited liability (

besloten vennootschap met beperkte

aansprakelijkheid

) organized under the laws of The Netherlands (“

Parent

” or “

Avast

”), to purchase all of the outstanding ordinary shares, nominal value €0.01 per share, of the Company (the

“

Shares

”) at a purchase price of $25.00 per Share (the “

Offer Price

”), in cash, without interest and less any applicable withholding taxes or other taxes, upon the terms and subject to the conditions set forth in

the Offer to Purchase dated July 29, 2016 (as may be amended or supplemented from time to time, the “

Offer to Purchase

”) and the related Letter of Transmittal (as may be amended and supplemented from time to time,

the “

Letter of Transmittal

,” which, together with the Offer to Purchase, constitute the “

Offer

”).

Capitalized terms used, but not otherwise defined, in this Amendment shall have the meanings ascribed to them in the Schedule 14D-9.

Except as set forth below, the information set forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference as

relevant to the items in this Amendment.

|

Item 8.

|

Additional Information

|

The disclosure in Item 8 of the Schedule 14D-9 under the

heading “(b)

Regulatory and Other Approvals

” is hereby amended and supplemented by deleting the third paragraph under the heading “Committee on Foreign Investment in the United States” in its entirety and replacing it with

the following:

“On August 4, 2016, the parties submitted a voluntary pre-filing draft notice to CFIUS pursuant to FINSA. Having implemented

comments from CFIUS on that draft, on August 16, 2016 the parties officially filed a joint voluntary notice with CFIUS. On September 20, 2016, the parties received written confirmation from CFIUS that it has completed its review of the

transactions contemplated by the Purchase Agreement under FINSA and determined that there are no unresolved national security concerns with respect to the transactions contemplated by the Purchase Agreement. The Offer continues to be subject to

other conditions set forth in Section 15 — “Certain Conditions of the Offer” of the Offer to Purchase.”

The exhibit list in Item 9 of the Schedule 14D-9 is hereby amended and

supplemented by adding the following exhibit:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(5)(M)

|

|

Joint Press Release issued by Avast Holding B.V. and AVG Technologies N.V. on September 21, 2016 (incorporated by reference to Exhibit

(a)(5)(M) to Schedule TO of Avast Holding B.V. (file no. 005-87064) filed with the Securities and Exchange Commission in Amendment No. 8 to Schedule TO of Avast Holding B.V. on September 21, 2016).

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

AVG TECHNOLOGIES N.V.

|

|

|

|

|

By:

|

|

/s/ Gary Kovacs

|

|

|

|

Name:

|

|

Gary Kovacs

|

|

|

|

Title:

|

|

Chief Executive Officer

|

|

|

|

|

By:

|

|

/s/ Jeffrey Ross

|

|

|

|

Name:

|

|

Jeffrey Ross

|

|

|

|

Title:

|

|

Chief Financial Officer

|

Dated: September 21, 2016

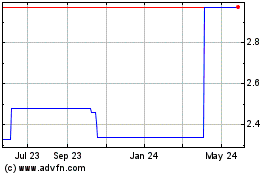

Avi Global (PK) (USOTC:AVGTF)

Historical Stock Chart

From Dec 2024 to Jan 2025

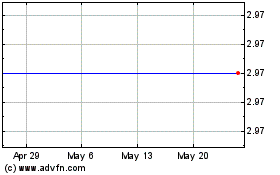

Avi Global (PK) (USOTC:AVGTF)

Historical Stock Chart

From Jan 2024 to Jan 2025