FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule

13a-16 or 15d-16 of

the Securities

Exchange Act of 1934

For the month of

December, 2023

Commission File

Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its

charter)

Ciudad Grupo

Santander

28660 Boadilla

del Monte (Madrid) Spain

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Banco Santander,

S.A.

TABLE OF CONTENTS

Item |

|

| |

|

| 1 |

Press Release dated December 20, 2023 |

Item

1

Santander adapts

past financial disclosures to reflect

new primary segments

| · | Santander has today published

adapted financial disclosures for the past seven quarters to reflect the new operating model announced in September, in which the bank’s

five global businesses will become the new primary reporting segments. The group’s consolidated results are not affected. |

| · | From the first quarter of 2024,

the group’s activities will be reported under five global businesses, further aligning the bank’s operating model to its strategy

and simplifying its business. This change will help the bank achieve the group’s strategic

goals outlined at its Investor Day in February. |

Madrid, 20 December 2023 - PRESS RELEASE

Santander has today published adapted financial

disclosures for the past seven quarters to reflect the new operating model announced in September, in which the bank’s five global

businesses will become the new primary reporting segments. Under the model, the bank’s activities will be consolidated from 2024

under:

| · | Retail & Commercial Banking: a new

business area with all the bank’s retail and business banking globally. |

| · | Digital Consumer Bank: consumer finance

activity worldwide. |

| · | Payments: PagoNxt and Global Cards. |

| · | Corporate & Investment Banking (Santander

CIB): already a global business. |

| · | Wealth Management & Insurance: already

a global business. |

To facilitate year-on-year comparisons and analysis,

the bank is adapting its financial reporting for the last seven quarters for each of these global businesses. These changes do not affect

regions and countries, nor do they impact the group’s consolidated earnings.

According to the new reporting model, the five

global areas will become the bank’s primary reporting segments from the first quarter of 2024, and regions and countries will continue

to be reported publicly, but as secondary segments. The group’s 2023 annual earnings, to be announced on 31 January 2024, will be

disclosed under both the current and new model to facilitate the transition.

Santander’s new operating model further aligns

all the bank’s businesses to its strategy, while improving customer service as well as extracting the full potential of the bank’s

global and in-market value, and running the bank through a simpler and more efficient operating model.

Santander’s group strategic goals remain

unchanged and include achieving a return on tangible equity (RoTE) of 15-17% in 2023-2025 and an efficiency ratio of c.42% by 2025; maintaining

a fully-loaded CET1 above 12%; and delivering double-digit average annual growth in tangible net asset value (TNAV) per share plus dividend

per share through the cycle.

With the new model, results from activities related

to financial management that are currently in the countries are fully allocated to the global businesses and the revenue sharing criteria

have been reviewed to better reflect the value added by the bank’s branch network. Consequently, global businesses’ results

are different to previous financial reports as reflected below.

Corporate

Communications

Ciudad Grupo Santander, edificio Arrecife, planta 2

28660 Boadilla del Monte (Madrid)

comunicacion@gruposantander.com

www.santander.com -

Twitter: @bancosantander

Breakdown of main financial impacts by attributable profit

and business

Note:

-In line with our

usual financial reporting, segments are reported on an underlying basis.

-To reach Group’s

total attributable profit, the Corporate Centre’s negative results (-€1,084mn) need to be deducted.

(*) Attributable

profits under the new global business perimeters do not exactly match figures reported in Q3’23 due to non-material changes related

to other minor global platforms that are not detailed here.

Main financial figures by global businesses

Note:

-In line with our

usual financial reporting, segments are reported on an underlying basis.

-To reach Group’s

total attributable profit, the Corporate Centre’s negative results (-€1,084mn) need to be deducted.

(1) As % of total

operating areas.

(2) 12m cost of

risk. Changes versus Dec-22. Negative CoR in WMI indicates releases.

(3) Adjusted RoTE

based on Group’s deployed capital.

(4) End of period.

Changes in euros.

A presentation with more details about this announcement,

and income statements and other key metrics of the last seven quarters for every global business, is available at CNMV and santander.com.

Corporate

Communications

Ciudad Grupo Santander, edificio Arrecife, planta 2

28660 Boadilla del Monte (Madrid)

comunicacion@gruposantander.com

www.santander.com -

Twitter: @bancosantander

Important information

Non-IFRS and alternative performance measures

This document contains financial information prepared

according to International Financial Reporting Standards (IFRS) and taken from our consolidated financial statements, as well as alternative

performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets

Authority (ESMA) on 5 October 2015, and other non-IFRS measures. The APMs and non-IFRS measures were calculated with information from

Grupo Santander; however, they are neither defined or detailed in the applicable financial reporting framework nor audited or reviewed

by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider them to

be useful metrics for our management and investors to compare operating performance between periods. APMs we use are presented unless

otherwise specified on a constant FX basis, which is computed by adjusting comparative period reported data for the effects of foreign

currency translation differences, which distort period-on-period comparisons. Nonetheless, the APMs and non-IFRS measures are supplemental

information; their purpose is not to substitute IFRS measures. Furthermore, companies in our industry and others may calculate or use

APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. APMs using ESG labels have not been calculated

in accordance with the Taxonomy Regulation or with the indicators for principal adverse impact in SFDR. For further details on APMs and

Non-IFRS Measures, including their definition or a reconciliation between any applicable management indicators and the financial data

presented in the consolidated financial statements prepared under IFRS, please see the 2022 Annual Report on Form 20-F filed with the

U.S. Securities and Exchange Commission (the SEC) on 1 March 2023 (https://www.santander.com/content/dam/santander-com/en/documentos/informacion-sobre-resultados-semestrales-y-anuales-suministrada-a-la-sec/2023/sec-2022-annual-20-f-2022-en.pdf),

as well as the section “Alternative performance measures” of Banco Santander, S.A. (Santander) Q3 2023 Financial Report, published

on 25 October 2023 (https://www.santander.com/en/shareholders-and-investors/financial-and-economic-information#quarterly-results).

Underlying measures, which are included in this document, are non-IFRS measures.

The businesses included in each of our geographic

segments and the accounting principles under which their results are presented here may differ from the businesses included and local

applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown

for our geographic segments may differ materially from those of such subsidiaries.

Forward-looking statements

Santander hereby warns that this document contains

“forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such statements

can be understood through words and expressions like “expect”, “project”, “anticipate”, “should”,

“intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”,

“target”, “goal”, “objective”, “estimate”, “future”, “commitment”,

“commit”, “focus”, “pledge” and similar expressions. They include (but are not limited to) statements

on future business development, shareholder remuneration policy and NFI.

While these forward-looking statements represent

our judgement and future expectations concerning our business developments and results may differ materially from those anticipated, expected,

projected or assumed in forward-looking statements.

In particular, forward looking statements are based

on current expectations and future estimates about Santander’s and third-parties’ operations and businesses and address matters

that are uncertain to varying degrees and may change, including, but not limited to (a) changes in rules and regulations, regulatory requirements

and internal policies, including those related to climate-related initiatives; (b) our own decisions and actions including those affecting

or changing our practices, operations, priorities, strategies, policies or procedures; and (c) the uncertainty over the scope of actions

that may be required by us, governments and others to achieve goals relating to climate, environmental and social matters, as well as

the evolving nature of underlying science and industry and governmental standards and regulations.

In addition, the important factors described in

this report and other risk factors, uncertainties or contingencies detailed in our most recent Form 20-F and subsequent 6-Ks filed with,

or furnished to, the SEC, as well as other unknown or unpredictable factors, could affect our future development and results and could

lead to outcomes materially different from what our forward-looking statements anticipate, expect, project or assume.

Forward-looking statements are therefore aspirational,

should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this report, are informed

by the knowledge, information and views available on such date and are subject to change without notice. Santander is not required to

update or revise any forward-looking statements, regardless of new information, future events or otherwise, except as required by applicable

law. Santander does not accept any liability in connection with forward-looking statements except where such liability cannot be limited

under overriding provisions of applicable law.

Not a securities offer

This report and the information it contains does

not constitute an offer to sell nor the solicitation of an offer to buy any securities.

Past performance does not indicate future outcomes

Statements about historical performance or growth

rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will necessarily

be the same or higher than in a previous period. Nothing in this report should be taken as a profit and loss forecast.

Corporate

Communications

Ciudad Grupo Santander, edificio Arrecife, planta 2

28660 Boadilla del Monte (Madrid)

comunicacion@gruposantander.com

www.santander.com -

Twitter: @bancosantander

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

Banco Santander, S.A. |

| |

|

|

| |

|

|

| Date: |

December 20, 2023 |

|

By: |

/s/ Pedro de Mingo Kaminouchi |

| |

|

|

|

Name: |

Pedro de Mingo Kaminouchi |

| |

|

|

|

Title: |

Head of Regulatory Compliance |

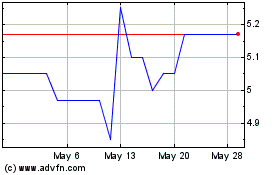

Banco Santander (PK) (USOTC:BCDRF)

Historical Stock Chart

From Apr 2024 to May 2024

Banco Santander (PK) (USOTC:BCDRF)

Historical Stock Chart

From May 2023 to May 2024