Cairn Energy Has Resources to Cover North Sea Development Costs--Update

19 January 2016 - 8:51PM

Dow Jones News

By Alex MacDonald

LONDON--Cairn Energy PLC (CNE.LN) said Tuesday it has the

financial resources to deliver its exploration program and bring

its North Sea projects into production in 2017.

The oil and gas firm said in a trading update ahead of its

full-year results on March 15 that it plans to spend $492 million

this year and next to start generating cashflow from its Catcher

and Kraken development projects in the U.K. North Sea, lower than

brokerage firm Stifel's expectation of $600 million.

It also plans to spend another $122 million on exploration,

predominantly in Senegal where the company is drilling the SNE-3

well after the SNE-2 well showed earlier this month that the SNE

field was commercially viable.

The company had net cash of $603 million as of the end of

December, beating RBC Capital's year-end cash balance forecast of

$460 million.

At 0909 GMT, Cairn Energy's shares were up 2.3% at 131.5 pence a

share. "We think this is a neutral to slightly positive update,"

said Stifel analysts in a note.

Cairn Energy also said that the international arbitration

proceedings to resolve the retrospective tax issue in India have

now formally started following an agreement between Cairn and the

Indian government on the appointment of a panel of three

international arbitrators under the terms of the U.K.-India

Investment Treaty.

Cairn said it has a high level of confidence that it will be

able to defend itself against the $1.6 billion tax charge related

to Cairn India Ltd. (532792.BY) and will in turn seek damages of

about $1 billion, equal to the value of Cairn Energy's residual

shareholding in Cairn India at the time that the government made

its tax claim.

The arbitration is expected to take about 12 months or more to

complete, a person familiar with the matter said.

Indian tax authorities charged Cairn India in March last year

for failing to pay witholding taxes on gains made by its former

parent Cairn Energy in a share transfer transaction about eight

years before. Cairn Energy transferred shares internally as part of

a group restructuring that laid the ground work for the public

listing of Cairn India's shares in 2007.

Cairn Energy said that its 9.8% stake in Cairn India is now

worth $384 million.

-Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

January 19, 2016 04:36 ET (09:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

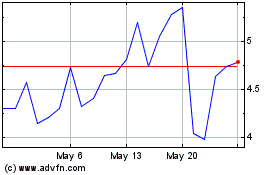

Capricorn Energy (PK) (USOTC:CRNCY)

Historical Stock Chart

From May 2024 to Jun 2024

Capricorn Energy (PK) (USOTC:CRNCY)

Historical Stock Chart

From Jun 2023 to Jun 2024