CTG to Drop EDP Pursuit if Voting Rights Cap Is Maintained

23 April 2019 - 5:17PM

Dow Jones News

By Nathan Allen

China Three Gorges Corp. said Monday that it will abandon its

9.07 billion euro ($10.20 billion) takeover bid for EDP-Energias de

Portugal SA (EDP.LB) if shareholders vote to maintain a 25% cap on

voting rights at the forthcoming general meeting.

Portugal's market regulator, the CMVM, had previously said that

if the takeover is to proceed, EDP's shareholders must vote in

favor of a motion proposed by activist investor Elliott Management

Corp. to scrap the voting-rights limit.

China Three Gorges said it would abide by the CMVM's ruling and

will remain a strategic partner to the company regardless of the

vote's outcome.

The Chinese state-owned energy group, which holds a stake of

around 23% in EDP, launched its offer to take over the remaining

equity last May, but it has been dismissed by EDP's board and

Elliott Management, which holds a 2.9% stake, as too low.

Regulators in the U.S. and the European Union have also voiced

concerns about handing over control of power-generation assets to a

Chinese state company.

EDP's shareholders will vote on the motion on Wednesday.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

April 23, 2019 03:02 ET (07:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

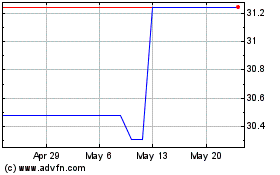

EDP Renovaveis (PK) (USOTC:EDRVY)

Historical Stock Chart

From Jan 2025 to Feb 2025

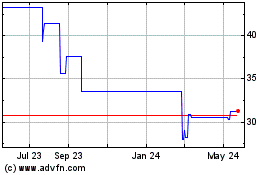

EDP Renovaveis (PK) (USOTC:EDRVY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about EDP Renovaveis SA (PK) (OTCMarkets): 0 recent articles

More Edp Renovaveis (GM) News Articles