China's Evergrande Moves to Calm Nervous Investors

07 June 2021 - 10:52PM

Dow Jones News

By Xie Yu

China Evergrande Group was forced to defend itself against

online allegations and dwindling investor confidence for the second

time in less than a year, saying its business was operating

normally and threatening individuals who spread unfounded rumors

with legal action.

Shares of Evergrande, one of China's biggest and most indebted

property developers, have fallen in recent months, nearing lows hit

in March 2020. Its bonds also have dropped in price in recent

weeks, sending yields soaring, with the yield on one bond due in

January 2024 topping 20% on Monday, according to Tradeweb.

Last week, internet users shared posts describing deep discounts

offered by Evergrande. A May 27 article by Caixin, a Chinese

financial-media outlet, said regulators were likely to scrutinize

Evergrande's dealings with Shengjing Bank Co., a bank in which it

owns a major stake,

On Monday, Evergrande said it hadn't adjusted prices, discounts

or payment plans for its regular apartments, leaving aside a

"periodic mega-promotion." It said it would repay a small amount of

overdue commercial paper it owed a few companies, and said all its

dealings with Shengjing Bank were in accordance with the law.

"All of our operations are running normally," Evergrande said on

its website, adding that it hadn't missed an interest or principal

payment in the 25 years since its founding.

Evergrande's Hong Kong-traded stock closed up 3.2% Monday,

trimming its year-to-date losses to about 21%, according to

FactSet.

The company also said Monday that it would seek to hold people

who spread "malicious rumors" legally accountable.

Chinese regulators have tried to calm the country's property

markets after years of rapid price rises, placing a ceiling on

banks' lending to the sector, and requiring weaker real-estate

companies to deleverage.

Evergrande suffered from an earlier bout of market jitters in

September last year, focused on a potential cash crunch, but it was

able to secure the support of major investors to quell those

concerns.

In its first-quarter results, Evergrande touted 18%

year-over-year growth in cash collection, to 134.3 billion yuan,

equivalent to about $21 billion. The company's contracted sales

grew 4% to 153.2 billion yuan.

As well as pursuing rapid growth in its core business,

Evergrande has also expanded into other areas, such as making

electric cars.

Write to Xie Yu at Yu.Xie@wsj.com

(END) Dow Jones Newswires

June 07, 2021 08:41 ET (12:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

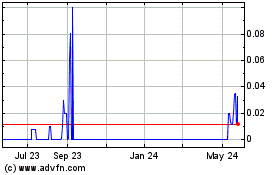

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

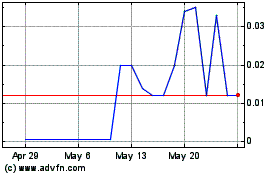

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Feb 2024 to Feb 2025