Enel CFO Says Effect "Marginal" If Credit Rating Cut To BBB+

08 March 2012 - 10:20PM

Dow Jones News

Enel SpA (ENEL.MI) isn't concerned by the possibility of its

credit rating being downgraded by one notch, as the effects would

be "marginal," said Luigi Ferraris, chief financial officer of

Europe's most indebted utility, Thursday.

Should Enel's rating drop to BBB+ from A- then effects on the

cost of debt are estimated at between 15 and 20 basis points, said

the CFO, at a presentation in Rome of the company's new 2012-2016

growth plan.

Italy's former monopoly became Europe's most indebted utility

after taking over Spain's Endesa SA (ELE.MC) in 2007.

The debt costs of such a downgrade are calculated at about EUR50

million, said Chief Executive Fulvio Conti, indicating that is a

totally manageable figure.

The company's new dividend payout policy of 40% of ordinary net

profit, which excludes special items, is "decent," said CEO Conti.

He added it represents a dividend yield of between 4% and 5%.

-By Liam Moloney, Dow Jones Newswires; +39 06 6976 6924;

liam.moloney@dowjones.com

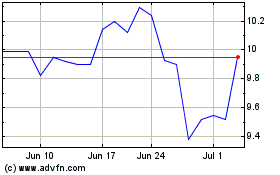

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jun 2024 to Jul 2024

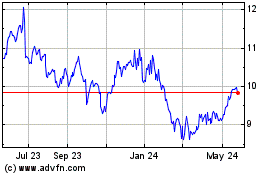

Endesa (PK) (USOTC:ELEZY)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Endesa SA (PK) (OTCMarkets): 0 recent articles

More Endesa S.A. ADS News Articles