Form 8-K - Current report

16 December 2023 - 9:00AM

Edgar (US Regulatory)

false

0000886128

0000886128

2023-12-11

2023-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 11, 2023

FUELCELL ENERGY, INC.

(Exact Name of Registrant as Specified

in its Charter)

| Delaware |

|

1-14204 |

|

06-0853042 |

|

(State or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

| |

|

3 Great Pasture Road

Danbury, Connecticut |

|

06810 |

| |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (203) 825-6000

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

FCEL |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

(e)

2024 Long Term Incentive Plan Awards

On December 11, 2023, the Compensation Committee

(the “Compensation Committee”) of the Board of Directors (the “Board”) of FuelCell Energy, Inc. (the “Company”)

approved the specific components of, and the payout calibration for, certain awards to be made under the Company’s Long Term Incentive

Plan (the “LTI Plan”) for fiscal year 2024. The LTI Plan is a sub-plan consisting of awards made under the Company’s

2018 Omnibus Incentive Plan, as amended and restated (the “Omnibus Incentive Plan”). The participants in the LTI Plan include

the Company’s named executive officers identified in the table below (the “NEOs”).

The

Compensation Committee also approved grants to the NEOs other than the Chief Executive Officer of the Company (the “CEO”),

and the independent members of the Board approved a grant to the CEO, in each case under the LTI Plan for fiscal year 2024 (collectively,

the “FY 2024 LTI Grants”), consisting of two award components: (1) relative total shareholder return (“TSR”)

performance shares (50% of the target long-term incentive award value) and (2) time-vesting restricted stock units (50% of the target

long-term incentive award value).

The TSR performance shares granted in fiscal year

2024 will be earned over the three-year performance period ending on October 31, 2026, but will remain subject to a continued service-based

vesting requirement until the third anniversary of the date of grant. The performance measure for the relative TSR performance shares

is the TSR of the Company relative to the TSR of the Russell 2000 from October 31, 2023 through October 31, 2026. For purposes of calculating

TSR, the Company’s stock price will be measured using the average closing price over the 20 consecutive trading days preceding the

measurement date.

The

award of the relative TSR portion of the FY 2024 LTI Grants is contingent upon approval by the Company’s stockholders of the authorization

of sufficient additional shares of common stock under the Omnibus Incentive Plan at the Company’s 2024 Annual Meeting of Stockholders

(the “Annual Meeting”) to accommodate all of the shares of the Company’s common stock potentially issuable pursuant

to the relative TSR portion of the FY 2024 LTI Grants. If such stockholder approval is not obtained at the Annual Meeting, then

the award of the relative TSR portion of the FY 2024 LTI Grants will be immediately cancelled.

The time-vesting restricted stock units granted

in fiscal year 2024 will vest at a rate of one-third (1/3) of the total number of restricted stock units on each of the first three anniversaries

of the date of grant.

None of the FY 2024 LTI Grants include any dividend

equivalent or other stockholder rights. To the extent the awards are earned, they may be settled in shares or cash of an equivalent value.

The Form of Performance Share Award Agreement used

for the contingent relative TSR performance shares is filed herewith as Exhibit 10.1 and the Form of Restricted Stock Unit Award Agreement

(U.S. Employees) used for the time-vesting restricted stock units was previously filed as Exhibit 10.3 to the Company’s Current

Report on Form 8-K filed on April 6, 2018.

The target award values of the FY 2024 LTI Grants

to the NEOs are as follows:

| Named Executive Officer |

Target 2024 LTI Plan Award |

Jason Few

President and Chief Executive Officer |

$2,574,000

|

Michael S. Bishop

Executive Vice President, Chief Financial Officer and Treasurer |

$1,000,000

|

Joshua Dolger

Executive Vice President, General Counsel and Corporate Secretary |

$550,000 |

Michael J. Lisowski

Executive Vice President and Chief Operating Officer |

$550,000

|

Mark Feasel

Executive Vice President and Chief Commercial Officer |

$550,000 |

The

number of time-vesting restricted stock units granted to the NEOs as of December 11, 2023, and the

target number of performance shares granted to the NEOs on a contingent basis as of December 11, 2023, were each determined

by dividing one-half of the target award values included in the table above by the average closing price of the Company’s common

stock over the 60 consecutive trading days preceding the grant date.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FUELCELL ENERGY, INC. |

| |

|

|

| Date: December 15, 2023 |

By: |

/s/ Michael S. Bishop |

| |

|

Michael S. Bishop |

| |

|

Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 10.1

FuelCell Energy,

Inc.

THIRD AMENDED

AND RESTATED 2018 OMNIBuS INCENTIVE PLAN

PERFORMANCE

SHARE Award

(RELATIVE TSR)

Dear _________,

You have been granted an award (an “Award”)

of performance shares of FuelCell Energy, Inc., a Delaware corporation (the “Company”), which are subject to the terms

of the FuelCell Energy, Inc. 2018 Omnibus Incentive Plan (as amended and restated, the “Plan”) and this Performance

Share Award Agreement (this “Agreement”). Capitalized terms used but not defined in this Agreement shall have the meanings

set forth in the Plan.

| Grant Date: |

|

______________, 20__ |

| |

|

|

| Number of Performance Shares: |

|

Target Performance Shares: ________ Maximum Performance Shares: 200% of Target |

| |

|

|

| Performance Period: |

|

November 1, 2023 through October 31, 2026 |

| |

|

|

| Performance Vesting for Performance Shares: |

|

The performance metric that will determine the number of Performance Shares you earn will be the Company’s total shareholder

return (“TSR”) over the performance period specified above (the “Performance Period”) relative

to the Russell 2000 index composite TSR (“Relative TSR”). |

| |

|

|

| |

|

The Company’s TSR is calculated by subtracting the Beginning Stock Price from the Ending Stock Price (as each term is defined below) for the Performance Period, adding any dividends during the period, and then dividing the result by the Beginning Stock Price. |

| |

|

|

| |

|

“Beginning Stock Price” shall mean the average closing price of the Company’s common stock over the 20 consecutive trading days immediately prior to October 31, 2023. |

| |

|

|

| |

|

“Ending Stock Price”

shall mean the average closing price of the Company’s common stock over the 20 consecutive trading days ending on October 31, 2026. |

| |

|

|

| |

|

The number of Performance Shares earned

will be as follows: |

| · | 100% plus or minus 0.5x the difference between the Company’s

TSR and the Russell 2000 index composite TSR |

| · | Payout is capped at 200% of the target number of Performance

Shares |

| · | Payout is capped at 100% of the target number of Performance

Shares if the Company’s absolute TSR over the Performance Period is negative |

| |

|

Any Performance Shares that are earned

based on performance will be earned on the date that the Administrator certifies the achievement of the applicable level of Relative

TSR. Any Performance Shares that are not earned on such date shall be forfeited. |

| |

|

Performance Shares earned on the

basis of Relative TSR performance remain subject to vesting based on continued service until the third anniversary of the Grant Date. |

| |

|

|

| |

|

If your employment or service with the Company and its Affiliates terminates (voluntarily or involuntarily) before

the third anniversary of the Grant Date, all Performance Shares will be immediately and automatically forfeited. |

| |

|

|

| Change of Control: |

|

Upon a Change of Control, your Performance Shares will be treated in accordance with Section 19 of the Plan. |

| |

|

|

| Settlement: |

|

As soon as practicable after the third anniversary of the Grant Date (but no later than two-and-one-half months from the end of the fiscal year in which the Performance Shares vest), the Company will settle any earned Performance Shares by electing either to (i) issue in your name certificate(s) or make an appropriate book entry for a number of Shares equal to the number of Performance Shares that have vested or (ii) deliver an amount of cash equal to the Fair Market Value, determined as of the vesting date, of a number of Shares equal to the number of Performance Shares that have vested. |

| |

|

|

| Rights as Stockholder: |

|

You will not be deemed for any purposes to be a stockholder of the Company with respect to any of the Performance Shares unless and until Shares are issued to you upon settlement of this Award. |

| |

|

|

| Restrictions on Transferability: |

|

Except as provided in the Plan, you may not sell, transfer, assign, pledge, or otherwise alienate this Award, and any attempt to do so shall be null and void. |

| |

|

|

| Tax Withholding: |

|

You understand that you (and not the Company) shall be responsible for your own federal, state, local, or foreign tax liability

and any of your other tax consequences that may arise as a result of this Award, and that you should rely solely on the determinations

of your tax advisors or your own determinations, and not on any statements or representations by the Company or any of its agents with

regard to all tax matters.

To the extent that the receipt, vesting or settlement of the Performance Shares, or disposition of any Shares acquired under your Award

results in income to you for national, federal, state, local, foreign, or other tax purposes, the Company may deduct (or require an Affiliate

to deduct) from any payments of any kind otherwise due to you to satisfy such tax or other withholding obligations. Alternatively, the

Company or its Affiliate may require you to pay to the Company or its Affiliate, in cash, promptly on demand, or make other arrangements

satisfactory to the Company or its Affiliate regarding the payment of the withholding amount. |

| |

|

At the Administrator’s discretion, you may be able to satisfy all or a portion of the withholding obligations arising in connection with this Award by electing to (i) have the Company or its Affiliate withhold Shares otherwise due to you upon settlement of this Award, (ii) tender back Shares received upon settlement of this Award, or (iii) deliver other previously owned Shares, in each case having a Fair Market Value equal to the amount to be withheld; provided that the amount to be withheld may not exceed the maximum statutory tax rate associated with the transaction. If an election is provided, the election must be made on or before the date as of which the amount of tax to be withheld is determined and otherwise as the Administrator requires. In any case, the Company and its Affiliates may defer making payment or delivery under this Award until such withholding obligations are paid. |

| |

|

|

| Contingent Nature of Award: |

|

Notwithstanding anything to the contrary in this Agreement, this Award is contingent on, and no Shares may be issued in settlement of this Award prior to, approval by the Company’s stockholders of the authorization of sufficient additional Shares under the Plan at the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to accommodate the Shares subject to this Award and all other awards that are also conditioned on such stockholder approval. If such stockholder approval is not obtained at the Annual Meeting, then this Award shall be immediately cancelled without consideration therefor. |

| |

|

|

| Electronic Communications: |

|

The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means. By accepting this Award, you hereby consent to receive such documents by electronic delivery, and agree to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third-party designated by the Company. You also agree that all on-line acknowledgements shall have the same force and effect as a written signature. |

| Miscellaneous: |

· |

This Award is expressly subject to all the terms and conditions contained in

this Agreement and the Plan, and the terms of the Plan are incorporated herein by reference. |

| |

|

| |

· |

As a condition of the granting of this Award, you agree, for yourself and your

legal representatives or guardians, that this Award shall be interpreted by the Administrator and that any interpretation by the Administrator

of the terms of this Agreement or the Plan and any determination made by the Administrator pursuant to this Award shall be final, binding

and conclusive. |

| |

|

| |

· |

Generally, this Agreement can only be modified or amended by a writing signed

by both you and the Company. However, the Administrator may modify or amend this Award in certain circumstances without your consent

as permitted by the Plan, and the Administrator may adjust, in its sole discretion, the method of calculating Relative TSR. |

| |

· |

The grant of this Award does not provide you with any right to continued employment

or service with the Company or any Affiliate. |

| |

|

| |

· |

The Performance Shares constitute a mere promise by the Company to make specified

payments in the future if such benefits come due under the Award. You will have the status of a general creditor of the Company with

respect to any vested Award. |

| |

|

| |

· |

By accepting this Award, you agree not to sell any Shares acquired under this

Award at a time when applicable laws, Company policies, or an agreement between the Company and its underwriters prohibit a sale. |

| |

|

| |

· |

This Award, and any compensation or benefits that you receive as a result of

this Award, shall be subject to any clawback or recoupment policy that the Company may adopt from time to time. |

The Company has caused this Agreement to be executed by one of its

authorized officers and is effective as of the Grant Date.

| FuelCell Energy, Inc. |

|

| |

|

| |

|

| |

|

| [Name] |

|

| [Title] |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

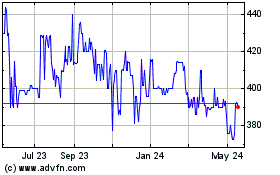

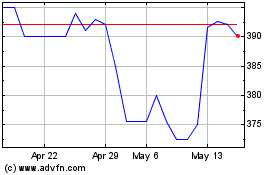

FuelCell Energy (PK) (USOTC:FCELB)

Historical Stock Chart

From Apr 2024 to May 2024

FuelCell Energy (PK) (USOTC:FCELB)

Historical Stock Chart

From May 2023 to May 2024