UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

þ Filed

by the Registrant ¨ Filed

by a Party other than the Registrant

| Check

the appropriate box: |

| ¨ |

Preliminary

Proxy Statement |

| ¨ |

Confidential,

for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive

Proxy Statement |

| þ |

Definitive

Additional Materials |

| ¨ |

Soliciting

Material under §240.14a-12 |

FuelCell Energy,

Inc.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| þ |

No

fee required. |

| ¨ |

Fee

paid previously with preliminary materials. |

| ¨ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Supplement to Definitive Proxy Statement

For the 2024 Annual Meeting of Stockholders

To be Held on April 4, 2024

On February 16, 2024, FuelCell Energy, Inc. (the

“Company”) filed with the Securities and Exchange Commission a definitive proxy statement on Schedule 14A (the “Proxy

Statement”) relating to the Company’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on

Thursday, April 4, 2024 at 1:00 p.m. Eastern Daylight Time. The Company is providing this supplement to the Proxy Statement (this “Supplement”)

to correct certain inadvertent and immaterial errors and supplement information included in the Proxy Statement, as described below. The

Company urges you to read the Proxy Statement and this Supplement in their entirety. Except as specifically supplemented or amended by

the information contained herein, all information set forth in the Proxy Statement remains unchanged.

Capitalized terms used but

not otherwise defined in this Supplement shall have the meanings assigned to such terms in the Proxy Statement.

Outstanding Shares and Security Ownership of Certain

Beneficial Owners and Management

As disclosed in the Proxy Statement, the Board

of Directors of the Company (the “Board”) set the close of business on February 5, 2024 as the record date (the “Record

Date”) for the determination of holders of the Company’s common stock, par value $0.0001 per share (“common stock”),

who are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. In the Proxy Statement,

the Company inadvertently reported an incorrect number of shares of the Company’s common stock outstanding as of the Record Date.

The correct number of shares of common stock outstanding as of the Record Date is 451,862,054 (rather than 450,684,628 as reported in

the Proxy Statement).

The Company is providing this Supplement to correct

the number of shares of the Company’s common stock outstanding as of the Record Date, which appears on pages 1, 62, and 81 of the

Proxy Statement (the “Outstanding Share Correction”), and to reflect the effect of the Outstanding Share Correction on the

percentage ownership of common stock outstanding for the two stockholders who beneficially own more than 5 percent of the outstanding

common stock of the Company reported in the table on page 62 of the Proxy Statement (the “Beneficial Ownership Table”).

The revised Beneficial Ownership Table, which reflects

the Outstanding Share Correction, is set forth below. In the revised Beneficial Ownership Table, the percentage ownership of BlackRock,

Inc. is 7.75% (rather than 7.77% as reported in the Proxy Statement) and the percentage ownership of The Vanguard Group is 9.42% (rather

than 9.44% as reported in the Proxy Statement).

| |

|

|

|

Number of Shares |

|

Percentage |

|

| Name |

|

Position |

|

Beneficially Owned(1) |

|

Beneficially Owned |

|

| Directors and Named Executive Officers |

|

|

|

|

|

|

|

| Jason Few |

|

President, Chief Executive Officer and Director |

|

831,258 |

|

* |

|

| Michael S. Bishop |

|

Executive Vice President, Chief Financial Officer and Treasurer |

|

172,556 |

|

* |

|

| Michael J. Lisowski |

|

Executive Vice President and Chief Operating Officer |

|

149,288 |

|

* |

|

| Joshua Dolger |

|

Executive Vice President, General Counsel and Corporate Secretary |

|

20,083 |

|

* |

|

| Mark Feasel |

|

Executive Vice President and Chief Commercial Officer |

|

80,850 |

|

* |

|

| James H. England(2) |

|

Director |

|

8,836 |

|

* |

|

| Matthew F. Hilzinger(3) |

|

Director |

|

277 |

|

* |

|

| Natica von Althann(4) |

|

Director |

|

4,167 |

|

* |

|

| Cynthia Hansen(5) |

|

Director |

|

18,579 |

|

* |

|

| Donna Sims Wilson(6) |

|

Director |

|

8,143 |

|

* |

|

| Betsy Bingham(7) |

|

Director |

|

— |

|

* |

|

| ALL DIRECTORS AND EXECUTIVE OFFICERS AS A GROUP (12 PERSONS) |

|

— |

|

1,409,732 |

|

* |

|

|

Greater than 5% Stockholders |

|

|

|

|

|

|

|

| BlackRock, Inc.(8) |

|

— |

|

35,027,576 |

|

7.75% |

|

| The Vanguard Group – 23-1945930(9) |

|

— |

|

42,555,798 |

|

9.42% |

|

*Less

than one percent.

| (1) | Unless

otherwise noted, each person identified possesses sole voting and investment power with respect

to the shares listed. |

| (2) | Mr.

England’s shareholdings include options to purchase 8,558 shares of common stock, which

are currently exercisable. His shareholdings as reported do not include 126,474 vested deferred

shares of common stock and 134,144 vested deferred stock units. |

| (3) | Mr.

Hilzinger’s shareholdings include options to purchase 277 shares of common stock, which

are currently exercisable. His shareholdings do not include 13,222 vested deferred shares

of common stock and 134,144 vested deferred stock units. |

| (4) | Ms.

von Althann’s shareholdings include options to purchase 277 shares of common stock,

which are currently exercisable. Her shareholdings do not include 36,926 vested deferred

shares of common stock and 113,493 vested deferred stock units. |

| (5) | Ms.

Hansen shares voting and dispositive power with her spouse with respect to all 18,579 shares.

Her shareholdings do not include 46,114 vested deferred shares of common stock and 62,377

vested deferred stock units. |

| (6) | Ms.

Wilson’s shareholdings do not include 62,377 vested deferred stock units. |

| (7) | Ms.

Bingham's shareholdings do not include 23,732 vested deferred shares of common stock and

65,444 vested deferred stock units. |

| (8) | The

number of shares beneficially owned is as of December 31, 2023, as reported by BlackRock,

Inc. in Amendment No. 5 to Schedule 13G filed with the SEC on January 26, 2024. The address

for BlackRock, Inc. is 50 Hudson Yards, New York, NY 10001. BlackRock, Inc. has sole power

to vote or direct the vote with respect to 34,121,712 of these shares and sole power to dispose

or to direct the disposition of 35,027,576 of these shares. |

| (9) | The

number of shares beneficially owned is as of December 29, 2023, as reported by The Vanguard

Group — 23-1945930 in Amendment No. 3 to Schedule 13G filed with the SEC on February 13,

2024. The address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard

Group has shared power to vote or direct the vote with respect to 274,908 of these shares,

sole power to dispose or to direct the disposition of 41,859,689 of these shares, and shared

power to dispose or to direct the disposition of 696,109 of these shares. The Vanguard Group

does not have the sole power to vote or direct the vote with respect to any of these shares. |

Equity Plan Shares and Dilution

As disclosed in Proposal 3 of the Proxy Statement,

the Board is asking stockholders to approve the amendment and restatement of the Company’s Third Amended and Restated 2018 Omnibus

Incentive Plan (as previously amended and restated, the “Plan”). In Proposal 3 of the Proxy Statement, the Company inadvertently

reported incorrect amounts for certain of the line items in the table that appears in Proposal 3 on page 70 of the Proxy Statement (the

“Equity Plan and Dilution Table”), in footnote 5 to the Equity Plan and Dilution Table, and in the second paragraph following

the Equity Plan and Dilution Table (also on page 70 of the Proxy Statement).

The Company is providing this Supplement to correct

the number of Outstanding Time-Vesting Restricted Stock Units (“RSUs”) in the Equity Plan and Dilution Table (which is 8,125,850,

rather than 8,291,471 as reported in the Proxy Statement) and, as a result of such correction, the number of Total Shares Subject to Outstanding

RSUs and PSUs in the Equity Plan and Dilution Table and in footnote 5 to the Equity Plan and Dilution Table (which is 16,649,935, rather

than 16,815,556 as reported in the Proxy Statement) (collectively, the “Outstanding Time-Vesting RSU Corrections”).

In addition, the Company is providing this Supplement

to correct the number of Shares Available for Future Awards under Equity-Based Plans Prior to Amendment of Plan/Approval of Proposal 3

in the Equity Plan and Dilution Table and in footnote 5 to the Equity Plan and Dilution Table (which is 2,909,776, rather than 3,309,677

as reported in the Proxy Statement) and the related dilution percentage in the Equity Plan and Dilution Table (which is 0.6%, rather than

0.7% as reported in the Proxy Statement) (collectively, the “Shares Available for Future Awards Corrections”).

As a result of the Outstanding Time-Vesting RSU

Corrections and the Shares Available for Future Awards Corrections, the Company is also providing this Supplement to correct the Total

Available, Outstanding and Proposed Additional Shares in the Equity Plan and Dilution Table (which is 34,050,738, rather than 34,616,260

as reported in the Proxy Statement) and the related dilution percentage in the Equity Plan and Dilution Table (which is 7.5%, rather than

7.7% as reported in the Proxy Statement) (collectively, the “Related Corrections”).

The revised Equity Plan and Dilution Table, which

reflects the Outstanding Time-Vesting RSU Corrections, the Shares Available for Future Awards Corrections, and the Related Corrections,

is set forth below.

| |

|

|

| |

Number of Shares |

Dilution(1) |

| Shares Available for Future Awards under Equity-Based Plans Prior to Amendment of Plan/Approval of Proposal 3 |

2,909,776 |

0.6% |

| Shares Subject to Outstanding Stock Options (2) |

18,291 |

0.0% |

| Weighted average exercise price: $59.63 |

|

|

| Weighted average remaining term: 1.4 Years |

|

|

| Outstanding Time-Vesting Restricted Stock Units (“RSUs”) |

8,125,850 |

1.8% |

| Shares Subject to Outstanding Performance Stock Units (“PSUs”)(3) |

1,271,205 |

0.3% |

| Shares Subject to Outstanding Contingent Time-Vesting RSUs |

3,978,496 |

0.9% |

| Shares Subject to Outstanding Contingent PSUs(3) |

3,274,384 |

0.7% |

| Total Shares Subject to Outstanding RSUs and PSUs(3) |

16,649,935 |

3.7% |

| Proposed Additional Shares Available for Future Awards under the Fourth Amended and Restated Plan(4) |

14,472,736 |

3.2% |

| Total Available, Outstanding and Proposed Additional Shares(5) |

34,050,738 |

7.5% |

| (1) | Basic

dilution calculated by dividing the number of shares by the total number of common shares

outstanding as of February 5, 2024. |

| (2) | Includes

13,750 Shares subject to stock options that remain outstanding under our 2010 Equity Incentive

Plan and 4,451 Shares subject to stock options under the Plan. |

| (3) | Number

of PSUs at 100% of target performance. Does not include the additional shares that would

be issuable if maximum performance at 200% is achieved. |

| (4) | 25,000,000

additional Shares requested less 3,978,496 outstanding contingent time-vesting RSUs, 3,274,384

outstanding contingent PSUs at 100% of target performance, and 3,274,384 outstanding contingent

PSUs reserved for 200% maximum performance. |

| (5) | This

total is the sum of the following items from this table (i) Shares Available for Future Awards

under Equity-Based Plans Prior to Amendment of Plan/Approval of Proposal 3 of 2,909,776,

(ii) Shares Subject to Outstanding Stock Options of 18,291, (iii) Total Shares Subject to

Outstanding RSUs and PSUs of 16,649,935, and (iv) Proposed Additional Shares Available for

Future Awards under the Fourth Amended and Restated Plan of 14,472,736. |

Finally, as a result of the Shares Available for

Future Awards Corrections, the Company is also providing this Supplement to correct (i) the number of Shares available for future grants

if the Fourth Amended and Restated Plan is approved and (ii) the number of shares remaining available for future grants under the Plan

as of the Record Date, in each case in the second paragraph following the Equity Plan and Dilution Table on page 70 of the Proxy Statement.

The number of Shares available for future grants if the Fourth Amended and Restated Plan is approved is 17,382,512 (rather than 17,782,413

as reported in the Proxy Statement), and the number of shares remaining available for future grants under the Plan as of the Record Date

is 2,909,776 (rather than 3,309,677 as reported in the Proxy Statement).

A corrected version of second paragraph following

the Equity Plan and Dilution Table on page 70 of the Proxy Statement is set forth below:

If the Fourth Amended and Restated Plan is approved,

it would bring the total number of Shares available for future grants to 17,382,512, based on the 2,909,776 shares remaining available

for future grants under the Plan as of February 5, 2024 and the fact that a total of 10,527,264 shares must be reserved for settlement

of the Contingent Stock Units upon approval of the Fourth Amended and Restated Plan. If the Fourth Amended and Restated Plan is not approved,

all of the Contingent Stock Units will be immediately cancelled.

Additional Information

This Supplement does not change the proposals to

be acted upon at the Annual Meeting, which are described in the Proxy Statement. Except as specifically supplemented or amended by

the information contained in this Supplement, the information set forth in the Proxy Statement remains unchanged and should be considered

in voting your shares. If you have already submitted your proxy, you do not need to take any action unless you wish to change your

vote.

This Supplement and the Notice of Annual Meeting,

Proxy Statement and Annual Report to Stockholders for the fiscal year ended October 31, 2023 are available at www.proxyvote.com

(using the 16-digit control number included in our notice of internet availability of proxy materials, on your proxy card or in the instructions

that accompanied your proxy materials), as well as on our website at www.fuelcellenergy.com.

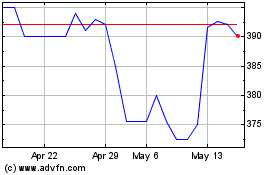

FuelCell Energy (PK) (USOTC:FCELB)

Historical Stock Chart

From Apr 2024 to May 2024

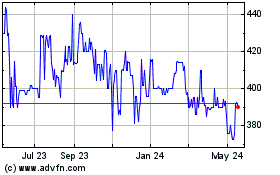

FuelCell Energy (PK) (USOTC:FCELB)

Historical Stock Chart

From May 2023 to May 2024