Friendly Hills Bank (the "bank") (OTCBB: FHLB) reported results for

the third quarter of 2012. For the nine month period ending

September 30, 2012, the bank reported a profit of $313,000 or $0.19

per diluted share of common stock. The bank reported a profit of

$6,000 or zero dollars per diluted share of common stock for the

nine months ended September 30, 2011.

As of September 30, 2012, the bank reported total assets of

$100.1 million, a 1% decrease from $100.9 million as of September

30, 2011. The bank's loan portfolio, net of unearned income,

decreased 5% from $61.1 million as of September 30, 2011, to $58.3

million as of September 30, 2012. The portfolio remains diversified

with $27.9 million or 47% in Commercial & Industrial Loans to

local businesses (including $16.5 million in Owner Occupied

Commercial Real Estate Loans), $16.0 million or 27% in Residential

Real Estate Loans to investors and $10.5 million or 18% in

Commercial Real Estate Loans to investors. The bank has an

additional $15.0 million in unfunded loan commitments.

The bank's overall deposit base has decreased by 2% in the

twelve months ended September 30, 2012, from $79.4 million as of

September 30, 2011, to $77.9 million as of September 30, 2012.

Non-interest bearing deposits continue to form a substantial part

of the deposit base (39.6%), growing from $28.2 million to $30.9

million as of September 30, 2012. During the same time period

interest-bearing deposits decreased from $51.2 million to $47.0

million on September 30, 2012. The bank has no deposits which were

sourced through brokers or other wholesale funding sources.

At September 30, 2012, shareholders' equity was $13.1 million

and the bank's total risk-based capital ratio was 20.4%,

significantly exceeding the minimum "well-capitalized" level of 10%

prescribed under regulatory requirements. The bank also continues

to maintain substantial liquidity positions, retaining significant

balances of liquidity as well as available collateralized

borrowings and other potential sources of liquidity.

"During this most recently completed quarter the bank recognized

six full years of serving the communities of Southern California,"

commented Jeffrey K. Ball, Chief Executive Officer. "While we never

could have anticipated the economic conditions we face today, we

are proud of our achievements while providing the communities that

we serve with a meaningful alternative to the larger institutions.

As market conditions continue to present unique challenges we have

selectively decreased the size of the bank while maintaining

profitability. This prudent decrease in interest-bearing deposits

corresponds to a reduction in loan assets primarily associated with

lower utilization of committed lines of credit by our clients. We

remain focused on expense management during this period of

contraction while maintaining a consistent underwriting approach

with our relationship focused approach to banking. The bank is well

positioned in terms of capital, liquidity and reserves to properly

address the current market conditions while maintaining an

appropriate interest rate risk profile. We are appreciative of our

shareholders, clients and employees as we strive to deliver

shareholder value through our effective delivery of the many

positive attributes associated with a community bank model."

Company Profile: Friendly Hills Bank is a

community bank which was formed to primarily serve the Southern

California communities of eastern Los Angeles County and northern

Orange County. The bank was established in 2006 by prominent

members of the local community who were seeking an alternative to

the larger financial institutions in the area. The bank is

headquartered at 16011 E. Whittier Blvd. in Whittier, California

with an additional branch office at 12070 East Telegraph Road,

Suite #100 in Santa Fe Springs, California. For more information on

the bank, please visit www.friendlyhillsbank.com or call

562-947-1920.

Forward-Looking Statements: The numbers in

this press release are unaudited. Statements such as those

regarding the anticipated development and expansion of Friendly

Hills Bank's business, and the intent, belief or current

expectations of the bank, its directors or its officers, are

"forward-looking" statements (as such term is defined in the

Private Securities Litigation Reform Act of 1995). Because such

statements are subject to risks and uncertainties, actual results

may differ materially from those expressed or implied by such

forward-looking statements. These risks and uncertainties include,

but are not limited to, risks related to the local and national

economy, the bank's performance, including its ability to generate

loan and deposit growth, changes in interest rates, and regulatory

matters.

----------------------------------------------------------------------------

Friendly Hills Bank

Balance Sheets (Unaudited)

(in thousands, except per share information)

----------------------------------------------------------------------------

9/30/12 12/31/11 9/30/11

--------- --------- ---------

ASSETS

Cash and due from banks $ 2,327 $ 2,305 $ 3,183

Interest bearing deposits with other

financial institutions 3,607 4,575 16,936

--------- --------- ---------

Cash and Cash Equivalents 5,934 6,880 20,119

Investment securities available-for-sale 32,571 26,826 19,348

Federal Home Loan Bank stock 605 610 610

Loans, net of unearned income 58,321 60,916 61,145

Allowance for loan losses (1,572) (1,677) (1,708)

--------- --------- ---------

Net Loans 56,749 59,239 59,437

Premises and equipment, net 662 739 752

Accrued interest receivable and other

assets 3,588 3,673 661

--------- --------- ---------

Total Assets $ 100,109 $ 97,967 $ 100,927

========= ========= =========

LIABILITIES AND SHAREHOLDERS' EQUITY

Liabilities

Deposits

Noninterest-bearing deposits $ 30,887 $ 27,111 $ 28,241

Interest-bearing deposits 47,029 49,269 51,201

--------- --------- ---------

Total Deposits 77,916 76,380 79,442

FHLB advances 8,750 8,750 8,750

Accrued interest payable and other

liabilities 315 247 239

--------- --------- ---------

Total Liabilities 86,981 85,377 88,431

Shareholders' Equity

Common stock, no par value, 10,000,000

shares authorized:

1,616,000 shares issued and outstanding 15,958 15,958 15,958

Additional paid-in-capital 1,073 1,053 1,041

Accumulated deficit (4,500) (4,813) (4,956)

Accumulated other comprehensive income 597 392 453

--------- --------- ---------

Total Shareholders' Equity 13,128 12,590 12,496

--------- --------- ---------

Total Liabilities and Shareholders'

Equity $ 100,109 $ 97,967 $ 100,927

========= ========= =========

Book Value Per Share $ 8.12 $ 7.79 $ 7.73

========= ========= =========

----------------------------------------------------------------------------

Friendly Hills Bank

Statements of Operations (Unaudited)

(in thousands, except per share information)

----------------------------------------------------------------------------

For the nine For the nine

months ended months ended

9/30/12 9/30/11

------------ ------------

Interest Income $ 3,143 $ 3,536

Interest Expense 377 473

------------ ------------

Net Interest Income 2,766 3,063

Provision for Credit Losses (84) 169

------------ ------------

Net Interest Income after Provision for Credit

Losses 2,850 2,894

Other Income 207 133

Operating Expenses 2,785 2,779

Gain (Loss) on Securities & Hedging Contracts 42 (216)

------------ ------------

Earnings before Provision for Income Taxes 314 32

Income Tax Expense (1) (26)

------------ ------------

Net Earnings $ 313 $ 6

------------ ------------

Basic and Diluted Earnings Per Share $ 0.19 $ ---

============ ============

Friendly Hills Bancorp (PK) (USOTC:FHLB)

Historical Stock Chart

From May 2024 to Jun 2024

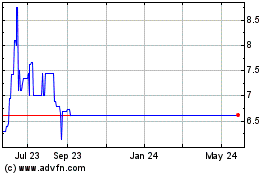

Friendly Hills Bancorp (PK) (USOTC:FHLB)

Historical Stock Chart

From Jun 2023 to Jun 2024