Glencore 1Q Met Guidance; Backs Full-Year Outlook

21 April 2023 - 4:54PM

Dow Jones News

By Joe Hoppe

Glencore PLC said Friday that first-quarter production largely

met its expectations, with declines across copper, zinc, nickel and

coal, and backed its full-year guidance.

The FTSE 100-listed commodity mining and trading company said

copper production declined 5% to 244,100 tons, largely due to

planned lower grades in line with a pit phasing and delays

associated with adverse weather.

Zinc production declined 15% to 205,300 tons, reflecting the

disposal of South American zinc operations, and the closure of the

Matagami project, along with adverse weather and planned temporary

use of lower-grade feedstocks at McArthur River.

Nickel production declined 32% to 20,900 tons, primarily

reflecting INO prioritizing third party feed, and coal production

fell 6% to 26.9 million tons, largely due to the short term effect

of a community blockade and mining around geological anomalies in

South Africa.

Ferrochrome production rose 3% to 400,000 tons.

The company retained its full-year production guidance given in

December. Copper guidance for 2023 stands at 1.0 million metric

tons, plus or minus 30,000 tons.

In addition, Chief Executive Gary Nagle said extrapolating the

marketing segment's first-quarter performance, the division's 2023

earnings are on track to exceed the top-end of the long-term

guidance range of $2.2 billion-$3.2 billion adjusted earnings

before interest and tax.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

April 21, 2023 02:39 ET (06:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

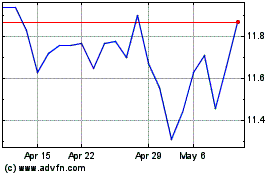

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

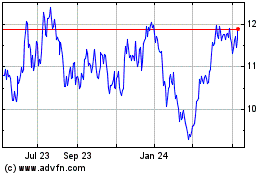

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024