Trending: Glencore Bids for Teck's Coal Unit, Plans Spin-Off

12 June 2023 - 8:07PM

Dow Jones News

0935 GMT - Glencore is among the most mentioned companies across

news items over the past 12 hours, according to Factiva data after

the company confirmed its bid for coal unit of Canadian miner Teck

Resources. The Anglo-Swiss mining giant said the approach presents

Teck an alternative to Glencore's previous merger offer of $23

billion, which is still on the table. The alternative approach--a

non-disclosed cash-consideration--would allow for a demerger of the

two companies' combined coal and carbon steel materials business

Coalco. The move suggests that Glencore wants to quarantine the

rest of its assets from coal, AJ Bell analyst Russ Mould wrote in a

research note. "There's a merry-go-round of coal assets in the

industry as companies don't want to be left holding what is seen as

a dirty fuel," Mould said. In April, Glencore valued Teck's coal

unit at $8.2 billion. In its statement Monday, the company said the

potential spin-off would take up to two years after transaction

close. Dow Jones & Co. owns Factiva.

(christian.moess@wsj.com)

(END) Dow Jones Newswires

June 12, 2023 05:52 ET (09:52 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

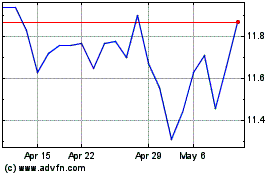

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2024 to May 2024

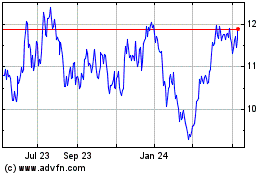

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From May 2023 to May 2024