UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended July 31, 2020

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to ________

Commission

file number: 001-36564

Healthcare

Integrated Technologies, Inc.

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

|

|

85-1173741

|

|

(State

or Other Jurisdiction of

Incorporation

or Organization)

|

|

(I.R.S.

Employer

Identification

No.)

|

1462

Rudder Lane

Knoxville,

TN 37919

(Address

of Principal Executive Offices)

Registrant’s

telephone number, including area code: (865) 719-8160

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to section 12(g) of the Act:

Common

Stock, $0.001 par value

(Title

of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

[ ]

|

Accelerated

filer

|

[ ]

|

|

Non-accelerated

filer

|

[ ]

|

Smaller

reporting company

|

[X]

|

|

(Do

not check if a smaller reporting company)

|

Emerging

growth company

|

[ ]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No

[X]

The

aggregate market value of the outstanding common stock, other than shares held by persons who may be deemed affiliates of the

registrant, computed by reference to the closing sales price for the registrant’s common stock on January 31, 2020 (the

last business day of the registrant’s most recently completed second quarter), as reported on the OTC Pink market, was approximately

$12,995,000. As of October 16, 2020, there were 36,637,235 shares of common stock of the registrant outstanding.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of

the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical

facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,”

“believe,” “estimate,” “intend,” “could,” “should,” “would,”

“may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,”

“project,” “forecast,” “potential,” “continue”, negatives thereof or similar expressions.

These forward-looking statements are found at various places throughout this Annual Report and include information concerning:

possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives

of management; any other statements regarding future operations, future cash needs, business plans and future financial results;

and any other statements that are not historical facts.

From

time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases,

in our presentations, on our website and in other materials released to the public. Any or all the forward-looking statements

included in this Annual Report and in any other reports or public statements made by us are not guarantees of future performance

and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions

and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of

our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking

statements. Considering these risks, uncertainties and assumptions, the events described in the forward-looking statements might

not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date of this Annual Report. All subsequent written and

oral forward-looking statements concerning other matters addressed in this Annual Report and attributable to us or any person

acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual

Report.

Except

to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or

otherwise.

For

discussion of factors that we believe could cause our actual results to differ materially from expected and historical results

see “Item 1A - Risk Factors” below.

PART

I

ITEM

1. BUSINESS.

Overview

Healthcare

Integrated Technologies, Inc. and its subsidiaries (collectively the “Company,” “we,” “our”

or “us”) is a healthcare technology company based in Knoxville, Tennessee. We are creating a diversified spectrum

of healthcare technology solutions to integrate and automate the continuing care, home care and professional healthcare spaces.

Our

initial product, SafeSpace, is an ambient fall detection solution designed for continuing care communities and at home use. SafeSpace

includes wall mounted devices utilizing radar technology and state of the art software to effectively monitor a person remotely.

In continuing care communities, SafeSpace detects resident falls and generates alerts to a centralized, intelligent dashboard

without the use of wearable devices or any action by the resident. In the home, SafeSpace detects falls and sends alerts directly

to designated individuals.

In

addition to SafeSpace, we are creating a home concierge healthcare service application to provide a virtual assisted living experience

for seniors, recently released postoperative patients and others. The concierge application will enable the consumer to obtain

home healthcare services and health and safety monitoring equipment to improve quality of life. We are also working to develop

a fully integrated solution for the professional healthcare community that integrates electronic health records, remote patient

monitoring, telehealth, and other items where integration is beneficial.

Our

History

The

Company has had three distinct businesses. First, we were incorporated in the state of Nevada on June 25, 2013 as Tomichi Creek

Outfitters, aiming to provide professionally guided big game hunts in Sargents, Colorado which is approximately four hours southwest

from Denver. This area of the country is home to trophy size Elk and Mule Deer. Our secondary business included offering guided

scenic tours on the western slopes of the Rocky Mountains. Every season offers a diversified plethora of wildlife and stunning

scenic views. Our Chief Executive Officer (“CEO”) and sole director at that time was Jeremy Gindro. These operations

were discontinued in 2015.

Second,

on March 2, 2015, the Company entered into a Business Acquisition Agreement and share exchange under which we acquired the business

and assets of Grasshopper Staffing, Inc. (“Grasshopper Colorado”), formed in the state of Colorado on January 13,

2015. The exchange for $10,651 was represented by 250,000 shares of the Company’s common stock in exchange for all the outstanding

shares of Grasshopper Colorado. The assets purchased include the trademark and website, office supplies and office furniture.

On November 2, 2015 we filed a Certificate of Amendment to our Articles of Incorporation changing the name of our Company from

Tomichi Creek Outfitters to Grasshopper Staffing, Inc. Grasshopper Colorado was operating as a wholly-owned subsidiary of the

Company and was the primary operation of our business until the acquisition of IndeLiving Holdings Inc., on March 13, 2018. Our

management consisted of Melanie Osterman as CEO, and Jeremy Gindro who was our sole director. The operations of Grasshopper Colorado

were discontinued in February 2019.

Third,

we acquired IndeLiving Holdings, Inc. (“IndeLiving”) on March 13, 2018 and changed our name to Healthcare Integrated

Technologies, Inc. Our current operations are described above. With the acquisition of IndeLiving, we had another change in management,

and Scott M. Boruff became CEO and sole director of the Company.

Employees

At

July 31, 2020, we had 3 employees.

At

July 31, 2019, we had 1 employee.

Available

Information

We

electronically file certain documents with the Securities and Exchange Commission (the SEC). We file annual reports on Form 10-K;

quarterly reports on Form 10-Q; and current reports on Form 8-K (as appropriate); along with any related amendments and supplements

thereto. From time-to-time, we may also file registration statements and related documents in connection with equity or debt offerings.

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington,

DC 20549. You may obtain information regarding the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the

SEC maintains an internet website at www.sec.gov that contains reports and other information regarding registrants that

file electronically with the SEC.

ITEM

1A. RISK FACTORS.

Risks

Related to Economic and Market Conditions

General

Economic and Financial Conditions

The

success of any investment activity is influenced by general economic and financial conditions, all of which are beyond the control

of the Company. These conditions, such as the recent global economic crisis and significant downturns in the financial markets,

may materially adversely affect our operating results, financial condition and ability to implement our business strategy and/or

meet our return objectives.

The

recent global outbreak of COVID-19 (more commonly known as the Coronavirus) has disrupted economic markets and the prolonged economic

impact is uncertain. Some economists and major investment banks have expressed concern that the continued spread of the virus

globally could lead to a world-wide economic downturn. Many manufacturers of goods in China and other countries have seen a downturn

in production due to the suspension of business and temporary closure of factories in an attempt to curb the spread of the illness.

As the impact of the Coronavirus spreads to other parts of the world, similar impacts may occur with respect to affected countries.

Risks

Related to Our Business

The

Company’s industry is highly competitive and we have less capital and resources than many of our competitors which may give

them an advantage in developing and marketing products similar to ours or make our products obsolete.

We

are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods

or approaches, who may have far greater resources, more experience, and personnel perhaps more qualified than we do. Such resources

may give our competitors an advantage in developing and marketing products similar to ours or products that make our products

obsolete. There can be no assurance that we will be able to successfully compete against these other entities.

The

Company may be unable to respond to the rapid technological change in its industry and such change may increase costs and competition

that may adversely affect its business

Rapidly

changing technologies, frequent new product and service introductions and evolving industry standards characterize the Company’s

market. The continued growth of the Internet and intense competition in the Company’s industry exacerbate these market characteristics.

The Company’s future success will depend on its ability to adapt to rapidly changing technologies by continually improving

the performance features and reliability of its products and services. The Company may experience difficulties that could delay

or prevent the successful development, introduction or marketing of its products and services. In addition, any new enhancements

must meet the requirements of its current and prospective users and must achieve significant market acceptance. The Company could

also incur substantial costs if it needs to modify its products and services or infrastructures to adapt to these changes.

The

Company also expects that new competitors may introduce products, systems or services that are directly or indirectly competitive

with the Company. These competitors may succeed in developing, products, systems and services that have greater functionality

or are less costly than the Company’s products, systems and services, and may be more successful in marketing such products,

systems and services. Technological changes have lowered the cost of operating communications and computer systems and purchasing

software. These changes reduce the Company’s cost of providing services but also facilitate increased competition by reducing

competitors’ costs in providing similar services. This competition could increase price competition and reduce anticipated

profit margins.

The

Company’s services are new and its industry is evolving.

You

should consider the Company’s prospects considering the risks, uncertainties and difficulties frequently encountered by

companies in their early stage of development. To be successful in this industry, the Company must, among other things:

|

|

●

|

develop

and introduce functional and attractive services;

|

|

|

|

|

|

|

●

|

attract

and maintain a large base of customers;

|

|

|

|

|

|

|

●

|

increase

awareness of the Company brand and develop consumer loyalty;

|

|

|

|

|

|

|

●

|

respond

to competitive and technological developments;

|

|

|

|

|

|

|

●

|

build

an operations structure to support the Company business; and

|

|

|

|

|

|

|

●

|

attract,

retain and motivate qualified personnel.

|

The

Company cannot guarantee that it will succeed in achieving these goals, and its failure to do so would have a material adverse

effect on its business, prospects, financial condition and operating results.

The

Company’s products and services are new and are in the early stages of development. The Company is not certain that these

products and services will function as anticipated or be desirable to its intended market. Also, some of the Company’s products

and services may have limited functionalities, which may limit their appeal to consumers and put the Company at a competitive

disadvantage. If the Company’s current or future products and services fail to function properly or if the Company does

not achieve or sustain market acceptance, it could lose customers or could be subject to claims which could have a material adverse

effect on the Company business, financial condition and operating results.

Risks

Related to Our Company

Uncertainty

of profitability

Our

business strategy may result in increased volatility of revenues and earnings. As we will only develop a limited number of products

and services at a time, our overall success will depend on a limited number of products and services, which may cause variability

and unsteady profits and losses depending on the products and services offered.

Our

revenues and our profitability may be adversely affected by economic conditions and changes in the market. Our business is also

subject to general economic risks that could adversely impact the results of operations and financial condition.

Because

of the anticipated nature of the products and services that we will attempt to develop, it is difficult to accurately forecast

revenues and operating results and these items could fluctuate in the future due to several factors. These factors may include,

among other things, the following:

|

|

●

|

Our

ability to raise sufficient capital to take advantage of opportunities and generate sufficient revenues to cover expenses.

|

|

|

|

|

|

|

●

|

Our

ability to source strong opportunities with sufficient risk adjusted returns.

|

|

|

|

|

|

|

●

|

Our

ability to manage our capital and liquidity requirements based on changing market conditions generally.

|

|

|

●

|

The

acceptance of the terms and conditions of our licenses and/or the acceptance of our royalties and fees.

|

|

|

|

|

|

|

●

|

The

amount and timing of operating and other costs and expenses.

|

|

|

|

|

|

|

●

|

The

nature and extent of competition from other companies that may reduce market share and create pressure on pricing and investment

return expectations.

|

|

|

|

|

|

|

●

|

Adverse

changes in the national and regional economies in which we will participate, including, but not limited to, changes in our

performance, capital availability, and market demand.

|

|

|

|

|

|

|

●

|

Adverse

changes in the projects in which we plan to invest which result from factors beyond our control, including, but not limited

to, a change in circumstances, capacity and economic impacts.

|

|

|

|

|

|

|

●

|

Changes

in laws, regulations, accounting, taxation, and other requirements affecting our operations and business.

|

|

|

|

|

|

|

●

|

Our

operating results may fluctuate from year to year due to the factors listed above and others not listed. At times, these fluctuations

may be significant.

|

Our

independent auditors’ report for the fiscal years ended July 31, 2020 and 2019 have expressed doubts about our ability to

continue as a going concern

Due

to the uncertainty of our ability to meet our current operating and capital expenses, in our audited annual financial statements

as of and for the years ended July 31, 2020 and 2019 our independent auditors included a note to our financial statements regarding

concerns about our ability to continue as a going concern. We have incurred recurring losses and have generated limited revenue

since inception. These factors and our need for additional financing to effectively execute our business plan, raise substantial

doubt about our ability to continue as a going concern. The presence of the going concern note to our financial statements may

have an adverse impact on the relationships we are developing and plan to develop with third parties as we continue the commercialization

of our products and could make it challenging and difficult for us to raise additional financing, all of which could have a material

adverse impact on our business and prospects and result in a significant or complete loss of your investment.

COVID-19

could adversely impact our business

On

January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain

of coronavirus originating in Wuhan, China (the “COVID-19 outbreak”) and the risks to the international community

as the virus spreads globally beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic,

based on the rapid increase in exposure globally. The full impact of the COVID-19 outbreak continues to evolve as of the date

of this report. As such, it is uncertain as to the full magnitude that the pandemic will have on the Company’s future financial

condition, liquidity, and results of operations. Management is actively monitoring the impact of the global situation on its financial

condition, liquidity, operations, suppliers, industry, and workforce. Given the daily evolution of the COVID-19 outbreak and the

global responses to curb its spread, the Company is not able to estimate the effects of the COVID-19 outbreak on its results of

operations, financial condition, or liquidity for fiscal year 2021.

Management

of growth will be necessary for us to be competitive

Successful

expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships,

and shareholders. Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships

to navigate shifts in the general economic environment. Expansion has the potential to place significant strains on financial,

management, and operational resources, yet failure to expand will inhibit our profitability goals.

We

are entering a potentially highly competitive market

The

markets for the healthcare and senior monitoring industries are competitive and evolving. We face strong competition from larger

companies that may be in the process of offering similar products and services to ours. Many of our current and potential competitors

have longer operating histories, significantly greater financial, marketing and other resources and larger client bases than we

have (or may be expected to have).

Given

the rapid changes affecting the global, national, and regional economies generally, and the healthcare industry specifically,

we may not be able to create and maintain a competitive advantage in the marketplace. Our success will depend on our ability to

keep pace with any market, legal and regulatory changes as well as competitive pressures. Any failure by us to anticipate or respond

adequately to such changes could have a material adverse effect on our financial condition, operating results, liquidity and cash

flow.

If

we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results

accurately or to prevent fraud. Any ability to report and file our financial results accurately and timely could harm our reputation

and adversely impact the future trading price of our common stock.

Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial

reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment

existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control

deficiencies may adversely affect our financial condition, results of operation and access to capital.

We

currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements

and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing

the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather,

analyze and report information relative to the financial statements.

Because

of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation

of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting

in a situation where limitations on segregation of duties exist. In order to remedy this situation, we would need to hire additional

staff.

The

Company’s failure to continue to attract, train, or retain highly qualified personnel could harm the company’s business.

The

Company’s success also depends on the Company’s ability to attract, train, and retain qualified personnel, specifically

those with management and product development skills. In particular, the Company must hire additional skilled personnel to further

the Company’s research and development efforts. Competition for such personnel is intense. If the Company fails in attracting

new personnel or retaining and motivating the Company’s current personnel, the Company’s business could be harmed.

Risks

Related to Our Common Stock

Because

we will likely issue additional shares of our common stock, investment in our Company could be subject to substantial dilution.

Investors’

interests in our company will be diluted and investors may suffer dilution in their net book value per share when we issue additional

shares. We are authorized to issue 200,000,000 shares of common stock, $0.001 par value per share. As of October 16, 2020,

there were 36,637,235 shares of our common stock issued and outstanding. We anticipate that all or at least some of our

future funding, if any, will be in the form of equity financing from the sale of our common stock. If we do sell more common stock,

investors’ investment in our company will likely be diluted. Dilution is the difference between what you pay for your stock

and the net tangible book value per share immediately after the additional shares are sold by us. If dilution occurs, any investment

in our company’s common stock could seriously decline in value.

Trading

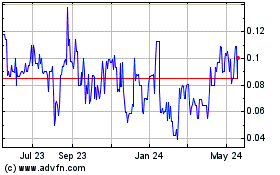

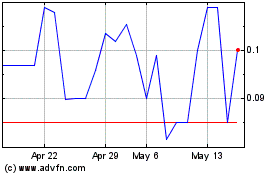

in our common stock on the OTC Pink has been subject to wide fluctuations.

Our

common stock is currently quoted for public trading on the OTC Pink. The trading price of our common stock has been subject to

wide fluctuations. Trading prices of our common stock may fluctuate in response to several factors, many of which will be beyond

our control. The stock market has generally experienced extreme price and volume fluctuations that have often been unrelated or

disproportionate to the operating performance of companies with no current business operation. There can be no assurance that

trading prices and price earnings ratios previously experienced by our common stock will be matched or maintained. These broad

market and industry factors may adversely affect the market price of our common stock, regardless of our operating performance.

In the past, following periods of volatility in the market price of a company’s securities, securities class-action litigation

has often been instituted. Such litigation, if instituted, could result in substantial costs for us and a diversion of management’s

attention and resources.

Our

Certificate of Incorporation and by-laws provides for indemnification of officers and directors at our expense and limit their

liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be

expended for the benefit of officers and/or directors.

Our

Certificate of Incorporation and By-Laws include provisions that fully eliminate the personal liability of our directors for monetary

damages to the fullest extent possible under the laws of the State of Nevada or other applicable law. These provisions eliminate

the liability of our directors and our shareholders for monetary damages arising out of any violation of a director of his fiduciary

duty of due care. Under Nevada law, however, such provisions do not eliminate the personal liability of a director for (i) breach

of the director’s duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing

violation of law, (iii) payment of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction

from which the director derived an improper benefit. These provisions do not affect a director’s liabilities under the federal

securities laws or the recovery of damages by third parties.

We

do not intend to pay dividends on any investment in the shares of stock of our Company and any gain on an investment in our Company

will need to come through an increase in our stock’s price, which may never happen.

We

have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent

that we require additional funding currently not provided for in our financing plan, our funding sources may prohibit the payment

of a dividend. Because we do not intend to declare dividends, any gain on an investment in our company will need to come through

an increase in the stock’s price. This may never occur and investors may lose all their investment in our company.

Because

our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our

shares as penny stocks, are covered by Section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice

requirements on broker/dealers who sell our company’s securities including the delivery of a standardized disclosure document;

disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly

account statements. These rules apply to companies whose shares are not traded on a national stock exchange, trade at less than

$5.00 per share, or who do not meet certain other financial requirements specified by the Securities and Exchange Commission.

These

rules require brokers who sell “penny stocks” to persons other than established customers and “accredited investors”

to complete certain documentation, make suitability inquiries of investors, and provide investors with certain information concerning

the risks of trading in such penny stocks. These rules may discourage or restrict the ability of brokers to sell our shares of

common stock and may affect the secondary market for our shares of common stock. These rules could also hamper our ability to

raise funds in the primary market for our shares of common stock.

FINRA

sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In

addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (known as “FINRA”)

has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds

for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial

status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there

is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements

make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability

to buy and sell our stock and have an adverse effect on the market for our shares.

There

could be unidentified risks involved with an investment in our securities

The

foregoing risk factors are not a complete list or explanation of the risks involved with an investment in the securities. Additional

risks will likely be experienced that are not presently foreseen by the Company. Prospective investors must not construe this

information provided herein as constituting investment, legal, tax or other professional advice. Before making any decision to

invest in our securities, you should read this entire prospectus and consult with your own investment, legal, tax and other professional

advisors. An investment in our securities is suitable only for investors who can assume the financial risks of an investment in

the Company for an indefinite period and who can afford to lose their entire investment. The Company makes no representations

or warranties of any kind with respect to the likelihood of the success or the business of the Company, the value of our securities,

any financial returns that may be generated or any tax benefits or consequences that may result from an investment in the Company.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

Not

applicable.

ITEM

2. PROPERTIES.

None.

ITEM

3. LEGAL PROCEEDINGS.

The

Company is currently not involved in any litigation that the Company believes could have a materially adverse effect on the Company’s

financial condition or results of operations. On January 2, 2020, a sworn account lawsuit was filed against our IndeLiving Holdings,

Inc. (“IndeLiving”) subsidiary and our CEO Scott M. Boruff by our previous Certified Public Accounting Firm, RBSM

LLP demanding payment of $28,007 for services rendered. We have filed our Answer and IndeLiving filed a breach of contract Counterclaim

on February 24, 2020 demanding repayment of a $7,500 retainer paid to RBSM LLP by IndeLiving for services that we allege were

not provided. Given the early state of the proceedings in this case, we currently cannot assess the probability of losses, but

we can reasonably estimate that the range of losses in this case will be immaterial since the full amount of the lawsuit has previously

been recorded in the consolidated financial statements.

ITEM

4. MINE SAFETY DISCLOSURES.

Not

applicable.

PART

II

ITEM

5. MARKET FOR OUR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

(a)

Market Information

Our

common stock is quoted on the OTC Pink under the symbol “HITC”. The OTC Pink is a quotation service that displays

real-time quotes, last-sale prices, and volume information in over-the-counter equity securities.

The

following table shows, for the periods indicated, the high and low bid prices per share of the Company’s common Stock as

reported by the OTC Pink quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions,

and may not necessarily represent actual transactions.

|

|

|

High

|

|

|

Low

|

|

|

Fiscal Year 2019

|

|

|

|

|

|

|

|

|

|

First quarter ended October 31, 2018

|

|

$

|

0.65

|

|

|

$

|

0.30

|

|

|

Second quarter ended January 31, 2019

|

|

$

|

0.45

|

|

|

$

|

0.30

|

|

|

Third quarter ended April 30, 2019

|

|

$

|

0.47

|

|

|

$

|

0.12

|

|

|

Fourth quarter ended July 31, 2019

|

|

$

|

0.20

|

|

|

$

|

0.12

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year 2020

|

|

|

|

|

|

|

|

|

|

First quarter ended October 31, 2019

|

|

$

|

0.42

|

|

|

$

|

0.15

|

|

|

Second quarter ended January 31, 2020

|

|

$

|

0.42

|

|

|

$

|

0.40

|

|

|

Third quarter ended April 30, 2020

|

|

$

|

0.50

|

|

|

$

|

0.18

|

|

|

Fourth quarter ended July 31, 2020

|

|

$

|

0.48

|

|

|

$

|

0.19

|

|

(b)

Holders

As

of October 16, 2020, there were 62 stockholders of record. Because shares of the Company’s common stock are

held by depositaries, brokers and other nominees, the number of beneficial holders of the Company’s shares is larger than

the number of stockholders of record.

(c)

Dividends

We

have never declared or paid dividends on our common stock. We do not intend to declare dividends in the foreseeable future because

we anticipate that we will reinvest any future earnings into the development and growth of our business. Any decision as to the

future payment of dividends will depend on our results of operations and financial position and such other factors as our Board

of Directors in its discretion deems relevant.

(d)

Securities Authorized for Issuance under Equity Compensation Plan

The

Company does not have in effect any compensation plans under which the Company’s equity securities are authorized for issuance.

Transfer

Agent

Our

transfer agent is VStock, LLC located at 18 Lafayette Place, Woodmere, NY 11598.

Recent

Sales of Unregistered Securities

During

the years ended July 31, 2020 and 2019, we have not issued any securities which were not registered under the Securities Act and

not previously disclosed in the Company’s Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

Rule

10B-18 Transactions

During

the years ended July 31, 2020 and 2019, there were no repurchases of the Company’s common stock by the Company.

ITEM

6. SELECTED FINANCIAL DATA.

Not

applicable

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

THE

FOLLOWING DISCUSSION OF OUR PLAN OF OPERATION AND RESULTS OF OPERATIONS SHOULD BE READ IN CONJUNCTION WITH THE FINANCIAL STATEMENTS

AND RELATED NOTES TO THE FINANCIAL STATEMENTS INCLUDED ELSEWHERE IN THIS REPORT. THIS DISCUSSION CONTAINS FORWARD-LOOKING STATEMENTS

THAT RELATE TO FUTURE EVENTS OR OUR FUTURE FINANCIAL PERFORMANCE. THESE STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES

AND OTHER FACTORS THAT MAY CAUSE OUR ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS TO BE MATERIALLY DIFFERENT

FROM ANY FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS.

THESE RISKS AND OTHER FACTORS INCLUDE, AMONG OTHERS, THOSE LISTED UNDER “FORWARD-LOOKING STATEMENTS” AND “RISK

FACTORS” AND THOSE INCLUDED ELSEWHERE IN THIS REPORT.

This

discussion summarizes the significant factors affecting the consolidated financial statements, financial condition, liquidity,

and cash flows of Healthcare Integrated Technologies, Inc, for the fiscal years ended July 31, 2020 and 2019 and the interim periods

included herein. The following discussion and analysis should be read in conjunction with the consolidated financial statements

and notes included elsewhere in this Form 10-K.

Executive

Overview

We

are a healthcare technology company based in Knoxville, Tennessee. Our business is creating a diversified spectrum of healthcare

technology solutions to integrate and automate the continuing care, home care and professional healthcare spaces. Since the acquisition

of our IndeLiving subsidiary in March 2018, we changed our business focus to the healthcare technology sector and discontinued

the operations of our Grasshopper Colorado subsidiary in February 2019.

Our

initial product, SafeSpace, is an ambient fall detection solution designed for continuing care communities and at home use. SafeSpace

includes wall mounted devices utilizing radar technology and state of the art software to effectively monitor a person remotely.

In continuing care communities, SafeSpace detects resident falls and generates alerts to a centralized, intelligent dashboard

without the use of wearable devices or any action by the resident. In the home, SafeSpace detects falls and sends alerts directly

to designated individuals.

In

addition to SafeSpace, we are creating a home concierge healthcare service application to provide a virtual assisted living experience

for seniors, recently released postoperative patients and others. The concierge application will enable the consumer to obtain

home healthcare services and health and safety monitoring equipment to improve quality of life. We are also working to develop

a fully integrated solution for the professional healthcare community that integrates electronic health records, remote patient

monitoring, telehealth, and other items where integration is beneficial.

Strategy

Our

mission is to grow a profitable healthcare technology company by focusing on our core product, continuing the development of our

proprietary software and developing new uses and product lines for our technology. Our management team is focused on maintaining

the financial flexibility and assembling the right complement of personnel and outside consultants required to successfully execute

our mission.

Financial

and Operating Results

We

continue to utilize funds raised from private sales of our common stock and short-term advances from related parties to provide

cash for our operations, which allowed us to continue refining our initial product and readying it for pilot testing, developing

our future product offerings and adding talented individuals to our management team. In addition, we reduced our debt obligations

by converting certain 5% Convertible Promissory Notes it into common stock. Highlighted achievements for the fiscal year ended

July 31, 2020 include:

|

|

●

|

On

October 8, 2019, Charles B. Lobetti, III was appointed CFO and entered into a three-year employment agreement with the Company.

The employment agreement provides for a base salary of $52,000 per annum (on a part-time basis), a monthly automobile allowance

of $400 and 600,000 options to purchase the Company’s common stock at an exercise price of $0.15 per share with 25%

immediately vested and exercisable on the grant date and the remaining options vesting equally over a period of three (3)

years from the grant date. The value of the options on the grant date was estimated using the Black-Scholes pricing model

and is being recognized as an expense over the vesting term. Effective May 1, 2020, Mr. Lobetti’s base salary was increased

to $104,000 to reflect an increased time commitment and he received a restricted stock grant of 500,000 shares, of which 200,000

shares vested on the date of the grant.

|

|

|

|

|

|

|

●

|

On

February 11, 2020, we completed a private placement of 1,000,000 shares of our common stock at a price of $0.10 per share

resulting in net proceeds to the Company of $100,000. We incurred no cost related to the private placement.

|

|

|

|

|

|

|

●

|

On

March 18, 2020, we completed a private placement of 200,000 shares of our common stock at a price of $0.10 per share resulting

in net proceeds to the Company of $20,000. We incurred no cost related to the private placement.

|

|

|

|

|

|

|

●

|

On

March 21, 2020, we executed an agreement with BrandMETTLE, LLC (“BrandMETTLE”) to serve as our advertising agency

for IndeLiving. Pursuant to the terms of the agreement, we issued 250,000 shares of our common stock to certain principals

of BrandMETTLE at an estimated value of $0.18 per share. BrandMETTLE focuses on providing branding, advertising, marketing

and strategy development for senior targeted healthcare technology firms, senior living communities, pharmaceutical concerns

and lifestyle brands for the age 55+ consumer.

|

|

|

|

|

|

|

●

|

On

April 22, 2020, we executed an agreement with Jurgen Vollrath to act as our outside counsel for Intellectual Property (“IP”).

Pursuant to the terms of the agreement, we issued 1,250,000 warrants to purchase the Company’s common stock at an exercise

price of $0.23 per share with 250,000 warrants immediately vested and exercisable on the grant date and the remaining options

vesting equally over a period of three (3) years from the grant date. Mr. Vollrath, who has spent the last 30 years working

with technology firms ranging from startups to Fortune 100 companies, is recognized as a leading IP strategist.

|

|

|

|

|

|

|

●

|

On

April 30, 2020, we closed an SBA guaranteed PPP loan with Mountain Commerce Bank resulting in $41,667 in loan proceeds to

the Company. We expect to use the loan proceeds as permitted under the program and apply for and receive forgiveness for the

entire loan amount. As of July 31, 2020, we are still awaiting the SBA’s issuance of final

rules for forgiveness of the loan balance prior to submitting our application for forgiveness.

|

|

|

|

|

|

|

●

|

On

June 15, 2020, Kenneth M. Greenwood was appointed CTO and entered into a three-year employment agreement with the Company.

The employment agreement provides for a base salary of $257,000 per annum (on a part-time basis), and 2,000,000 options to

purchase the Company’s common stock at an exercise price of $0.30 per share with 25% immediately vested and exercisable

on the grant date and the remaining options vesting equally over a period of three (3) years from the grant date. The value

of the options on the grant date was estimated using the Black-Scholes pricing model and is being recognized as an expense

over the vesting term.

|

|

|

|

|

|

|

●

|

On

July 8, 2020, we issued 56,048 shares of common stock to the holder of a $25,000 5% Convertible Promissory Note (the “Note”)

in exchange for the Note plus accrued interest of $3,024 through the conversion date. Under the terms of the Note, the shares

were issued at a conversion price of $0.50 per share.

|

|

|

|

|

|

|

●

|

On

July 8, 2020, we completed a private placement of 1,000,000 shares of our common stock at a price of $0.10 per share resulting

in net proceeds to the Company of $100,000. We incurred no cost related to the private placement.

|

|

|

●

|

On

July 13, 2020, we completed a private placement of 250,000 shares of our common stock at a price of $0.10 per share resulting

in net proceeds to the Company of $25,000. We incurred no cost related to the private placement.

|

|

|

|

|

|

|

●

|

On

July 16, 2020, we completed two (2) private placements totaling 500,000 shares of our common stock, each at a price of $0.10

per share, resulting in net proceeds to the Company of $50,000. We incurred no cost related to the private placements.

|

|

|

|

|

|

|

●

|

On

July 16, 2020, we issued 200,000 shares of common stock to an employee upon the vesting of a portion of a restricted stock

grant. The grant date fair value of the shares issued was $0.35 per share.

|

|

|

|

|

|

|

●

|

On

July 17, 2020, we executed an agreement with Haygood Moody Hodge PLC (“HMH”) to provide general legal services

to the Company. Pursuant to the terms of the agreement, we issued 250,000 shares of our common stock to a principal of HMH

for prepaid legal services at an estimated value of $0.20 per share.

|

|

|

|

|

|

|

●

|

On

July 24, 2020, we issued 56,176 shares of common stock to the holder of a $25,000 5% Convertible Promissory Note (the “Note”)

in exchange for the Note plus accrued interest of $3,088 through the conversion date. Under the terms of the Note, the shares

were issued at a conversion price of $0.50 per share.

|

|

|

|

|

|

|

●

|

On

July 29, 2020, we issued 224,887 shares of common stock to the holder of a $100,000 5% Convertible Promissory Note (the “Note”)

in exchange for the Note plus accrued interest of $12,444 through the conversion date. Under the terms of the Note, the shares

were issued at a conversion price of $0.50 per share.

|

Results

of Operations

Revenues

Our

only source of revenue in fiscal 2019 was derived from our Grasshopper Colorado subsidiary, the operations of which were discontinued

in February 2019. We had no revenues in fiscal 2020. The net loss incurred by Grasshopper Colorado is presented separately as

discontinued operations.

Loss

from our Grasshopper Colorado subsidiary’s discontinued operations consisted of the following at July 31, 2020 and 2019:

|

|

|

July 31, 2020

|

|

|

July 31, 2019

|

|

|

Net revenue

|

|

$

|

-

|

|

|

$

|

27,909

|

|

|

Operating expenses

|

|

|

(719

|

)

|

|

|

(35,969

|

)

|

|

Interest expense

|

|

|

(802

|

)

|

|

|

(7,534

|

)

|

|

Loss from discontinued operations

|

|

$

|

(1,521

|

)

|

|

$

|

(15,594

|

)

|

An

analysis or discussion of our revenues does not provide any useful information since we discontinued the operations of our only

revenue source during fiscal 2019.

Selling,

General and Administrative Expenses

The

table below presents a comparison of our selling, general and administrative expenses for the years ended July 31, 2020 and 2019:

|

|

|

July 31, 2020

|

|

|

July 31, 2019

|

|

|

Officer’s salaries

|

|

$

|

423,371

|

|

|

$

|

336,965

|

|

|

Stock-based compensation

|

|

|

407,613

|

|

|

|

294,510

|

|

|

Advertising, marketing and product demonstration expenses

|

|

|

66,948

|

|

|

|

90,212

|

|

|

Professional fees

|

|

|

110,271

|

|

|

|

44,129

|

|

|

Other

|

|

|

7,601

|

|

|

|

18,177

|

|

|

Total selling, general and administrative expenses

|

|

$

|

1,015,804

|

|

|

$

|

783,993

|

|

Officer’s

salaries were $423,371 in fiscal 2020, representing an increase of $86,406 over the fiscal 2019 amount. The increase in Officer’s

salaries results from the hiring of our new CFO and CTO during the period.

Stock-based

compensation increased $113,103 over the prior fiscal year. The increase is a result of the addition of the expense related to

stock option and restricted stock grants to our new CFO and CTO during the period. Fiscal 2019 stock-based compensation consisted

entirely of the expense related to stock options previously granted to our CEO.

Advertising,

marketing and product demonstration expenses decreased $23,264 as compared to the fiscal 2019 amount. The net decrease is the

result of a reduction in sales force payroll expense of $54,274 and a reduction in product demonstration expense of $11,171, which

were partially offset by an increase in advertising and marketing expenses of $42,180. The increase in advertising and marketing

expense is primarily related to the BrandMETTLE agreement discussed above.

Professional

fees increased $66,142 in fiscal 2020 as compared to fiscal 2019. The increase is primarily related to the audit, legal and other

professional fees associated with the filing of our comprehensive annual report in March 2020.

Interest

Expense

Interest

expense increased $1,831 for fiscal 2020 as compared to fiscal 2019. Interest expense is primarily related our 5% Convertible

Promissory Notes. The net increase in interest expense is due to the compounding impact of the interest calculation, which was

partially offset by a decrease in the expense from the conversion of certain notes in the last month of the fiscal period.

Liquidity

and Capital Resources

Working

Capital

The

following table summarizes our working capital for the fiscal years ending July 31, 2020 and 2019:

|

|

|

July 31, 2020

|

|

|

July 31, 2019

|

|

|

Current assets

|

|

$

|

125,010

|

|

|

$

|

725

|

|

|

Current liabilities

|

|

|

(1,982,603

|

)

|

|

|

(1,787,413

|

)

|

|

Working capital deficiency

|

|

$

|

(1,857,593

|

)

|

|

$

|

(1,786,688

|

)

|

Current

assets for the year ended July 31, 2020 increased as compared to July 31, 2019 due to an increase in cash and prepaid legal fees

resulting from the issuance of common stock for cash and prepaid legal services.

Current

liabilities for the year ended July 31, 2020 also increased as compared to July 31, 2019. The increase is primarily due to an

increase in accrued officer’s payroll, which was partially offset by a net decrease in related party accounts payable and

accrued expenses, and a decrease in our 5% convertible promissory notes and related accrued interest expense due to conversion

of the notes into common stock.

Net

Cash Used by Operating Activities

Since

we discontinued the operations of our Grasshopper Colorado subsidiary in February 2019, we no longer have a revenue source and

will continue to have negative cash flow from operations for the near future. The factors in determining operating cash flows

are largely the same as those that affect net earnings, except for non-cash expenses such as depreciation and stock-based compensation,

which affect earnings but do not affect cash flow. Net cash used by operating activities was $188,655 for the year ended July

31, 2020 compared to $99,443 for the year ended July 31, 2019. The increase in cash used during fiscal 2020 is attributable to

cash paid for audit, legal and other professional fees associated with the filing of our comprehensive annual report in March

2020.

Net

Cash Provided by Financing Activities

Net

cash provided by financing activities was $266,022 for the year ended July 31, 2020, which represented a $332,756 increase over

the net cash used by financing activities in the prior year. During the period, we raised $295,000 from the sale of common stock

in multiple private transactions as described above. In addition, we raised $41,667 through debt issuances and $77,416 in short-term

loans from related parties. The amounts were partially offset by $147,395 in payments made for amounts owed to related parties.

In fiscal year 2019, we raised cash exclusively from short-term loans from related parties.

At

this time, we cannot provide investors with any assurance that we will be able to obtain sufficient funding from debt financing

and/or the sale of our equity securities to meet our obligations over the next twelve months. We are likely to continue using

short-term loans from management to meet our short-term funding needs. We have no material commitments for capital expenditures

as of July 31, 2020.

Going

Concern Qualification

We

have a history of losses, an accumulated deficit, a negative working capital and have not generated cash from operations to support

a meaningful and ongoing business plan. Our Independent Registered Public Accounting Firm has included a “Going Concern

Qualification” in their report for the years ended July 31, 2020, 2019, 2018, 2017 and 2016. The foregoing raises substantial

doubt about the Company’s ability to continue as a going concern. We intend on financing our future activities and working

capital needs largely from the sale of private and/or public equity securities with additional funding from other traditional

financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital

requirements. There is no guarantee that additional capital or debt financing will be available when and to the extent required,

or that if available, it will be on terms acceptable to us. The consolidated financial statements do not include any adjustments

that might result from the outcome of this uncertainty. The “Going Concern Qualification” might make it substantially

more difficult to raise capital.

Critical

Accounting Policies and Estimates

Our

consolidated financial statements and related public financial information are based on the application of accounting principles

generally accepted in the United States (“U.S. GAAP”). U.S. GAAP requires the use of estimates; assumptions, judgments

and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts

reported. These estimates can also affect supplemental information contained in our external disclosures including information

regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere

to U.S. GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other

assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates

under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial

statements.

Our

significant accounting policies are summarized in Note 1 of our consolidated financial statements.

We

believe the following critical policies impact our more significant judgments and estimates used in preparation of our financial

statements.

Use

of Estimates

We

prepare our financial statements in conformity with U.S. GAAP. These principals require management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements and the reported amounts of revenues and expenses during the reporting period. Management believes that

these estimates are reasonable and have been discussed with the Board; however, actual results could differ from those estimates.

Impairment

of Long-Lived Assets

Long-lived

assets such as property, equipment and identifiable intangibles are reviewed for impairment whenever facts and circumstances indicate

that the carrying value may not be recoverable. When required impairment losses on assets to be held and used are recognized based

on the fair value of the asset. The fair value is determined based on estimates of future cash flows, market value of similar

assets, if available, or independent appraisals, if required. If the carrying amount of the long-lived asset is not recoverable

from its undiscounted cash flows, an impairment loss is recognized for the difference between the carrying amount and fair value

of the asset. When fair values are not available, we estimate fair value using the expected future cash flows discounted at a

rate commensurate with the risk associated with the recovery of the assets. We did not recognize any impairment losses for any

periods presented.

Stock-Based

Compensation

We

issue options and warrants to consultants, directors, and officers as compensation for services. These options and warrants are

valued using the Black-Scholes model, which focuses on the current stock price and the volatility of moves to predict the likelihood

of future stock moves. This method of valuation is typically used to estimate the value of stock options and warrants based on

the price of the underlying stock.

Fair

Value of Financial Instruments

Fair

value estimates used in preparation of the financial statements are based upon certain market assumptions and pertinent information

available to management. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair

values. These financial instruments include cash, accounts payable, note payable and amounts due to related parties. Fair values

were assumed to approximate carrying values for these financial instruments since they are short-term in nature and their carrying

amounts approximate fair values or they are receivable or payable on demand.

Revenue

Recognition

We

adopted ASC 606 effective January 1, 2018 using the modified retrospective method. Under this method, the Company follows the

five-step model provided by ASC Topic 606 in order to recognize revenue in the following manner: 1) Identify the contract; 2)

Identify the performance obligations of the contract; 3) Determine the transaction price of the contract; 4) Allocate the transaction

price to the performance obligations; and 5) Recognize revenue. An entity recognizes revenue for the transfer of promised goods

or services to customers in an amount that reflects the consideration for which the entity expects to be entitled in exchange

for those goods or services. The Company’s revenue recognition policies remained substantially unchanged as a result of

the adoption of ASC 606, and there were no significant changes in business processes or systems.

Temporary

Staffing Revenue

Prior

to the discontinuance of its operations in February 2019, Grasshopper Colorado earned revenue by providing specialized temporary

staffing solutions to the cannabis industry. We provided temporary labor at an agreed upon rate per hour. Billings were invoiced

on a per-hour basis as the temporary staffing services were delivered to the customer. Revenue from the majority of our temporary

staffing services were recognized at a point in time. We applied the practical expedient to recognize revenue for these services

at various intervals based on the number of hours completed and agreed upon rate per hour at that time.

Capital

Resources

We

had no material commitments for capital expenditures as of July 31, 2020.

Off-Balance

Sheet Arrangements

The

Company has no off-balance sheet arrangements as of July 31, 2020 or 2019.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We

do not hold any derivative instruments and do not engage in any hedging activities.

ITEM

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

The

financial statements and supplementary financial information required to be filed under this Item 8 are presented in Part IV,

Item 15 of this Form 10-K and are incorporated herein by reference.

ITEM

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

On

March 6, 2017, Stevenson & Company CPAs, LLP (“Stevenson”) informed the Company that Stevenson was resigning,

effective immediately, as the Company’s independent registered public accounting firm. Stevenson resigned because Stevenson

declined to stand for re-appointment.

During

the fiscal year ended July 31, 2016 and in the subsequent interim period through March 6, 2017, there were (i) no “disagreements”

(as that term is described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and Stevenson

on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to the satisfaction of Stevenson, would have caused Stevenson to make reference to the subject matter of such

disagreements in its reports on the consolidated financial statements for such years, and (ii) no “reportable events”

(as that term is described in Item 304(a)(1)(v) of Regulation S-K).

Stevenson’s

reports on the consolidated financial statements of the Company for the fiscal years ended July 31, 2015 and 2014 did not contain

any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting

principles.

On

March 7, 2017, the Board of Directors of the Company engaged RBSM, LLP (“RBSM”) as the Company’s new independent

registered public accounting firm.

During

the fiscal year ended July 31, 2016 and in the subsequent interim periods through March 7, 2017, neither the Company nor anyone

acting on its behalf consulted RBSM regarding either (i) the application of accounting principles to a specified transaction,

either completed or proposed; or the type of audit opinion that might be rendered with respect to the consolidated financial statements

of the Company, and neither a written report nor oral advice was provided to the Company by RBSM that RBSM concluded was an important

factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue or (ii) any

matter that was either the subject of a “disagreement” (as that term is used in Item 304(a)(1)(iv) of Regulation S-K

and the related instructions) or a “reportable event” (as that term is defined in Item 304(a)(1)(v) of Regulation

S-K).

On

September 13, 2018, the Company dismissed RBSM LLP, effective September 12, 2018, as our independent registered public accounting

firm. RBSM LLP audited our financial statements for the fiscal years ended July 31, 2016 and 2017. The dismissal of RBSM LLP was

approved by our Board of Directors on September 12, 2018. RBSM LLP did not resign or decline to stand for re-election.

Neither

the report of RBSM LLP dated July 18, 2017 on our consolidated balance sheet at July 31, 2016, and the related consolidated statements

of operations, changes in stockholders’ deficit, and cash flows for the year ended July 31, 2016 nor the report of RBSM

LLP dated November 14, 2017 on our consolidated balance sheets at July 31, 2017 and 2016, and the related consolidated statements

of operations, changes in stockholders’ deficit, and cash flows for the years ended July 31, 2017 and 2016 did not contain

an adverse opinion or a disclaimer of opinion, nor was either such report qualified or modified as to uncertainty, audit scope,

or accounting principles, other than each such report was qualified as to our ability to continue as going concern.

During

the fiscal year ended July 31, 2017 and July 31, 2018 and in the subsequent interim period through September 13, 2018, there were

(i) no “disagreements” (as that term is described in Item 304(a)(1)(iv) of Regulation S-K and the related instructions)

between the Company and RBSM on any matter of accounting principles or practices, financial statement disclosure, or auditing

scope or procedure, which disagreements, if not resolved to the satisfaction of RBSM, would have caused RBSM to make reference

to the subject matter of such disagreements in its reports on the consolidated financial statements for such years, and (ii) no

“reportable events” (as that term is described in Item 304(a)(1)(v) of Regulation S-K).

On

September 13, 2018, the Company engaged Marcum LLP as our independent registered public accounting firm.

During

our two most recent fiscal years and the subsequent interim period prior to retaining Marcum LLP (1) neither we nor anyone on

our behalf consulted Marcum LLP regarding (a) either the application of accounting principles to a specified transaction, either

completed or proposed, or the type of audit opinion that might be rendered on our financial statements or (b) any matter that

was the subject of a disagreement or a reportable event as set forth in Item 304(a)(1)(iv) and (v), respectively, of Regulation

S-K, and (2) Marcum LLP did not provide us with a written report or oral advice that they concluded was an important factor considered

by us in reaching a decision as to accounting, auditing or financial reporting issue.

On

January 7, 2020, the Company dismissed Marcum LLP as our independent registered public accounting firm. The dismissal of Marcum

LLP was approved by our Board of Directors. Marcum LLP did not resign or decline to stand for re-election.

During

the time that Marcum LLP served as our independent registered public accounting firm, we did not timely file financial statements

or provide information for Marcum LLP to be able to complete its audit of our financial statements dated July 31, 2018 or July

31, 2019 and the reviews of any interim financial statements for the quarterly periods of those fiscal years. As a result, no

report of Marcum LLP contained an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainly,

audit scope, or accounting principles, as no reports were filed.

During

our two most recent fiscal years and the subsequent interim period preceding our decision to dismiss Marcum LLP we had no disagreements

with the firm on any matter of accounting principles or practices, financial statement disclosure, or auditing scope of procedure

which disagreement if not resolved to the satisfaction of Marcum LLP would have caused it to make reference to the subject matter

of the disagreement in connection with its report.

On

January 7, 2020, the Company engaged Rodefer Moss & Co. PLLC as our independent registered public accounting firm.

During

the fiscal year ended July 31 2017 and the subsequent interim periods prior to retaining Rodefer Moss & Co. PLLC (1) neither

we nor anyone on our behalf consulted Rodefer Moss & Co. PLLC regarding (a) either the application of accounting principles

to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial

statements or (b) any matter that was the subject of a disagreement or a reportable event as set forth in Item 304(a)(1)(iv) and

(v), respectively, of Regulation S-K, and (2) Rodefer Moss & Co. PLLC did not provide us with a written report or oral advice

that they concluded was an important factor considered by us in reaching a decision as to accounting, auditing or financial reporting

issue.

The

report of Rodefer Moss & Co. PLLC dated March 20, 2020 on our consolidated balance sheets at July 31, 2019 and 2018, and the

related consolidated statements of operations, changes in stockholders’ deficit, and cash flows for the years ended July

31, 2019 and 2018 did not contain an adverse opinion or a disclaimer of opinion, nor was the report qualified or modified as to

uncertainty, audit scope, or accounting principles, other than such report was qualified as to our ability to continue as going

concern.

During

the fiscal years ended July 31, 2020 and July 31, 2019 there were (i) no “disagreements” (as that term is described

in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and Rodefer Moss & Co. PLLC on any

matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to the satisfaction of Rodefer Moss & Co. PLLC, would have caused Rodefer Moss & Co. PLLC to make reference

to the subject matter of such disagreements in its reports on the consolidated financial statements for such years, and (ii) no

“reportable events” (as that term is described in Item 304(a)(1)(v) of Regulation S-K).

ITEM

9A. CONTROLS AND PROCEDURES.

Disclosure

Controls and Procedures

Under

the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer,

we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined

in Rules 13a-15(e) under the Securities Exchange Act of 1934, as amended, at the end of the period covered by this report (the

“Evaluation Date”). In conducting its evaluation, management considered the material weaknesses described below in

Management’s Report on Internal Control over Financial Reporting.

Based

on that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that as of the Evaluation Date we did

not maintain disclosure controls and procedures that were effective in providing reasonable assurances that information required