Asian Shares Broadly Lower

24 November 2016 - 4:20PM

Dow Jones News

Asian markets were broadly lower Thursday, in response to strong

economic data out of the U.S. overnight that pointed to rate

increases, continued strength for the dollar and more capital

flight from Asia.

Durable goods orders in the U.S. rose 4.8% in October from a

month earlier, well above the 2.7% gain predicted by economists

surveyed by The Wall Street Journal. In addition, a measure of U.S.

consumer sentiment rose in November, signaling rising confidence in

the economy.

Australia's S&P/ASX 200 was recently down 0.1%, Hong Kong's

Hang Seng Index was 0.5% lower and South Korea's Kospi sank 0.5%.

Japan's Nikkei, however, was 1% higher.

On the plus side, however, the data pointed to improved U.S.

demand for goods and commodities from the Asia-Pacific region.

"I was very surprised to see strong European PMIs [purchasing

managers indexes] and very strong U.S. data as well…it's boding

well for risk appetite," said Christoffer Moltke-Leth, director of

global sales trading at Saxo Capital Markets.

But more significantly, the data also raised worries about

emerging economies in the region.

"There are concerns about emerging markets," said Mr.

Moltke-Leth, pointing to Malaysia, Indonesia and the

Philippines.

Minutes from the U.S. Federal Reserve's November meeting

indicated officials believe a rate increase could become

appropriate "relatively soon" if data continued to show an

improving economy. This has given the U.S. dollar strength against

most currencies in Asia.

The Korean won fell 0.2% against the dollar Thursday, the

Indonesian rupiah was off 0.4%, the Japanese yen slipped 0.1% and

the Malaysian ringgit was 0.4% lower.

Japanese stocks benefited from the weaker yen, which boosts the

competitiveness of the country's exporters.

A weaker yen is expected to continue being "very favorable" for

equities, said Hisao Matsuura, chief strategist at Nomura. As a

result, earnings revisions are expected as early as next quarter

from exporters such as car companies. "How much they recover will

show how much things have improved," Mr. Matsuura said.

Hong Kong stocks slid as currency headwinds hurt offshore

interest in Chinese companies listed in the city.

China's central bank fixed the yuan 0.26% weaker against the

U.S. dollar Thursday. It has guided the currency weaker for most of

this month, as the U.S. dollar has experienced a broad-based

rally.

"The [yuan] depreciation will be more negative to Chinese

companies that have offshore [listings]," said Alexander Lee,

research director at DBS Vickers. "These tend to be China

properties, airlines and some of the environmental companies."

Singapore stocks also fell after the city-state narrowed its

growth forecast for this year. The FTSE Straits Times Index was

down 0.2%.

Jingyi Pan, market strategist at IG, said the manufacturing and

construction sectors were growing slower, on a year-over-year

basis, while the services sector saw no growth.

"The wholesale trade and finance and insurance sectors could

continue to face external headwinds," Singapore's Ministry of Trade

and Industry said.

Among major Singapore stocks, DBS Group Holdings was down 0.4%

and United Overseas Bank was 1% lower.

Suryatapa Bhattacharya, Saumya Vaishampayan, Saurabh Chaturvedi,

Anjie Zheng and Ese Erheriene contributed to this article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

November 24, 2016 00:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

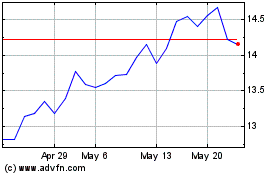

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

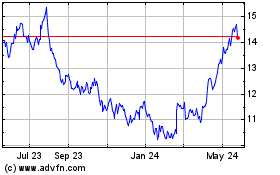

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024