UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): June 30, 2015

iWallet Corporation

(Exact name of small business issuer

as specified in its charter)

| Nevada |

27-1830013 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

| 7394 Trade Street, San Diego, California 92121 |

| (Address of principal executive offices) |

| 1-800-508-5042 |

| (Issuer’s telephone number) |

|

_____________________________________________________

(Former name or former address, if changed

since last report) |

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[ ] Written communications pursuant to

Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 3 – Securities and Trading

Markets

Item 3.02. Unregistered Sales of Equity Securities

On June 30, 2015, we approved an issuance of Secured Convertible

Debentures (the “Debentures”) totaling $120,000 to a total of four (4) investors, including one affiliate who subscribed

for a $50,000 Debenture. The sale of these debentures was a follow-on offering to the $372,500 in Debentures we issued on May 7,

2015. The terms of the Debentures issued in this offering are identical to those of the Debentures issued on May 7, 2015. The Debentures

bear interest at a rate of eight percent (8%) per year, with interest payments due semi-annually beginning on October 31, 2015.

The Debentures mature on April 30, 2017. The Debentures are convertible at any time, in whole, to shares of our common stock at

a conversion price of $0.15 per share. The conversion price is subject to adjustment for stock splits, stock dividends, and other

capital reorganizations. Under the terms of the Debentures, we may not pay dividends or incur aggregate additional indebtedness

in excess of $50,000 without the consent of the Debenture holders. The Debentures are secured by a security interest in substantially

all of our assets, including our intellectual property. The form of the Debentures is filed herewith as Exhibit 10.1 and should

be reviewed in its entirety for additional information.

Our offer and sale of the Debentures was exempt from registration

under Rule 903 of Regulation S. The Debentures were offered solely to residents of Canada and all sales were made to buyers located

in Canada. No directed selling efforts were made in the United States by us, a distributor, or any of our respective affiliates

or anyone acting on their behalf. In Canada, the offer and sale of the Debentures was exempt from registration under National Instrument

45-106 and was made solely to accredited investors as defined thereunder.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iWallet Corporation

/s/ Jack Chadsey

Jack Chadsey

Chief Executive Officer

Date: July 13, 2015

UNLESS

PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS DEBENTURE MUST NOT TRADE THE DEBENTURE BEFORE THE DATE THAT IS 4 MONTHS

AND A DAY AFTER THE LATER OF (I) <INSERT CLOSING DATE> AND (II) THE DATE

THE CORPORATION BECOMES A REPORTING ISSUER IN ANY PROVINCE OR TERRITORY

THE

SECURITIES REPRESENTED BY THIS DEBENTURE, AND THE SECURITIES INTO WHICH IT IS CONVERTIBLE, HAVE NOT BEEN REGISTERED UNDER THE

SECURITIES ACT OF 1933, AS AMENDED, OR REGISTERED OR QUALIFIED UNDER ANY STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE SOLD,

TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS SUCH SALE, TRANSFER, PLEDGE OR HYPOTHECATION IS IN ACCORDANCE WITH SUCH ACT AND APPLICABLE

STATE SECURITIES LAWS.

SECURED

CONVERTIBLE DEBENTURE

| Principal Amount: US <INSERT AMOUNT> |

Maturity Date: April 30, 2017 |

1.

Promise to Pay. FOR VALUE RECEIVED, the undersigned, iWallet Corporation (the “Company”)

promises to pay to or to the order of <INSERT NAME AND ADDRESS> (the “Holder”), or such other place and/or

person as the Holder may by notice in writing to the Company direct, the principal amount of <INSERT AMOUNT> in lawful money

of the United States of America (the “Principal Amount”), together with all other moneys which may from time

to time be owing hereunder or pursuant hereto, as hereinafter provided on and subject to the following terms and conditions:

2. Definitions.

As used herein, the following terms shall have the following respective meanings, unless the context otherwise requires:

“Business

Day” means any day except Saturday, Sunday or any other day on which chartered banks in the City of Toronto are generally

not open for business.

“Capital

Reorganization” has the meaning ascribed thereto in Section 8 hereof.

“Common

Shares” means the common shares in the capital of the Company as such shares exist at the close of business on the date

of execution and delivery of this Debenture; provided that in the event of a change, subdivision, reclassification or consolidation

thereof or successive changes, subdivisions, reclassifications or consolidations, then, subject to adjustments, if any, having

been made in accordance with Section 6, “Common Shares” shall thereafter mean the shares resulting from such change,

subdivision, reclassification or consolidation.

“Common

Share Reorganization” has the meaning ascribed thereto in Section 8 hereof.

“Company”

means iWallet Corporation, a corporation incorporated under the laws of the State of California.

“Conversion

Date” means the date on which this Debenture is surrendered for conversion.

“Conversion

Price” means USD$0.15 per Common Share.

“Debenture”

means this convertible debenture as it may be amended or supplemented from time to time.

“Encumbrance”

means any mortgage, charge, hypothec, pledge, security interest, encumbrance, lien or deposit arrangement or any other arrangement

or condition that in substance secures the payment of any indebtedness or liability or the observance or performance of any obligation,

regardless of form and whether consensual or arising from law, statutory or otherwise;

“Event

of Default” means any one or more of the events described in Section 15 hereof.

“Holder”

means the holder of this Debenture specified on the cover page of the Debenture, and “Holders” mean the

holder of all Debentures issued pursuant to an agency agreement between the Company and the First Republic Capital Corporation,

dated <INSERT CLOSING DATE>.

“Intellectual

Property Rights” means the intellectual property set out in Schedule C.

“Maturity

Date” means April 30, 2017.

“Official

Body” means any government or political subdivision or any agency, authority, bureau, central bank, commission, department

or instrumentality of either, or any court, tribunal, grand jury or arbitrator, whether foreign or domestic;

“Person”

includes an individual, a trust, a partnership, a body corporate or politic, a syndicate, a joint venture, a company, an association

and any other form of incorporated or unincorporated organization or entity.

“Permitted

Encumbrances” means collectively:

(a) liens

for taxes, assessments and governmental charges not yet due or, if due, the validity of which is being diligently contested in

good faith and by appropriate proceedings and in respect of which adequate provision has been made on the books of the Company;

(b) mechanics',

workers', repairers' or other like possessory liens in respect of any personal property, arising in the ordinary course of business

for amounts the payment of which is either not yet due or, if due, representing, in the aggregate, less than Ten Thousand Dollars

($10,000) or, if greater than such amount, the validity of

which

is being contested in good faith and by appropriate proceedings and in respect of which adequate provision has been made on the

books of the Company;

(c) liens

arising out of judgments or awards representing, in the aggregate, less than Ten Thousand Dollars ($10,000) or, if greater than

such amount, with respect to which at any time an appeal or proceeding for review is being prosecuted in good faith and by appropriate

proceedings and in respect of which adequate provision has been made on the books of the Company, and with respect to which there

shall have been secured a stay of execution pending such appeal or proceeding for review;

(d) servitudes,

easements, restrictions, rights-of-way and other similar rights in real or immovable property or any interest therein which will

not in the aggregate materially impair any Encumbrance on such property in favour of the Holder or the value or use of such property;

(e) the

liens resulting from the deposits of cash or securities in connection with contracts, tenders or compensation, surety or appeal

bonds or costs of litigation when required by law;

(f) liens

given to a public utility or any municipality or governmental or other public authority when required to obtain the services of

such utility or other authority in connection with the operations of the Company in the ordinary course of its business;

(g) purchase

money security interests and capital leases entered into by the Company in the ordinary course of business; and

| (h) | the

Encumbrances set out on Schedule B

or the continued existence of which have been consented

to by the Holder, including the renewal, extension or refinancing of any such Encumbrance

and of the Debt secured thereby upon the same property provided that such Debt and the

security therefor are not increased thereby. |

“Pledged

Assets” has the meaning attributed thereto in Section 13.

“Principal

Amount” has the meaning ascribed thereto in Section 1 hereof.

“Special

Distribution” has the meaning ascribed thereto in Section 8 hereof.

3. Interest.

Interest shall accrue on any Principal Amount outstanding hereunder at 8% per annum, payable semi-annually, with the first

payment on October 31, 2015.

4. Payment.

Except for any Principal Amount converted into Common Shares in accordance with Section 5 or Section 6 hereof, the Company

shall pay in full the Principal Amount outstanding as of the Maturity Date, on the Maturity Date.

5.

Conversion at Option of Holder

1. The

Holder shall have the right at any time to require the conversion of this Debenture, in whole, including any accrued interest,

into fully paid and non-assessable Common Shares of the Company at the Conversion Price.

2.

To exercise its right to require the conversion of this Debenture pursuant to section 5 hereof, the Holder shall provide the Company

with written notice specifying the effective date of the conversion, the applicable Conversion Price and the number of Common

Shares issuable on the conversion, in the form attached hereto as Exhibit “A”, and the Holder shall surrender this

Debenture to the Company for conversion. As soon as practicable after the receipt of this Debenture, the Company shall issue Common

Shares to the Holder in accordance with section 8 hereof.

6. Regulatory

Approval. The conversion of any Principal Amount or accrued interest owing under this Debenture shall be conditional

upon the Company obtaining all necessary regulatory approvals required in connection therewith.

7. Issue

of Common Shares Upon Conversion.

| (a) | Issue

of Common Shares. Upon conversion of this Debenture in accordance with the terms

hereof, the Company shall issue to the Holder, or to its written order, certificates

representing such number of Common Shares as are issuable in accordance with the provisions

hereof. The Principal Amount of this Debenture shall be deemed to be repaid in full by

the issuance of the Common Shares. |

| (b) | Reservation

of Common Shares. The Company shall at all times so long as any portion of this Debenture

remains outstanding ensure that there remains available out of its authorized but unissued

Common Shares, for the purpose of effecting the conversion of this Debenture, such number

of Common Shares as shall from time to time be sufficient to effect the conversion of

this Debenture. The Company covenants that all Common Shares which shall be issued on

conversion of this Debenture, shall be duly and validly issued as fully paid and non-assessable

shares. As a condition precedent to the taking of any action which would result in an

adjustment to the Conversion Price, the Company shall take any corporate action which

may be necessary in order that the securities to which the Holder is entitled on the

full exercise of its conversion rights in accordance with the provisions hereof shall

be available for such purpose and that such shares may be validly and legally issued

as fully paid and non-assessable shares. |

| (a) | No

Requirement to Issue Fractional Shares. No fractional Common Share or scrip representing

fractional shares shall be issued upon the conversion of this Debenture. If any fractional

interest in a Common Share would, except for the provisions of this Section, be deliverable

upon conversion, the Company shall pay to the Holder an amount in cash equal (to the

nearest cent) to the appropriate fraction of the Conversion Price. |

| (b) | Fully

Paid Shares. The Company covenants that all Common Shares which shall be issued in

accordance with the terms of this Debenture shall be duly and validly issued as fully

paid and non-assessable shares. |

8. Anti-Dilution

Provisions

| (a) | Adjustment

to Conversion Price. The Conversion Price in effect at any date shall be subject

to adjustment from time to time as follows: |

(i) If and whenever at any time while any

portion of this Debenture remains outstanding the Company shall (i) subdivide its then outstanding Common Shares into a greater

number of Common Shares, (ii) consolidate its then outstanding Common Shares into a lesser number of Common Shares, or (iii) issue

Common Shares (or securities exchangeable for or convertible into Common Shares) to the holders of all or substantially all of

the outstanding Common Shares by way of stock dividend (any of such events in these clauses (i), (ii) and (iii) being called a

“Common Share Reorganization”), then the Conversion Price shall be adjusted effective immediately on the effective

date of the event in (i) or (ii) above or the record date at which the holders of Common Shares are determined for the purposes

of any such dividend or distribution in (iii) above, as the case may be, by multiplying the Conversion Price in effect immediately

prior to such effective date or record date, as the case may be, by a fraction, the numerator of which shall be the number of

outstanding Common Shares on such effective date or record date, as the case may be, before giving effect to such Common Share

Reorganization and the denominator of which shall be the number of outstanding Common Shares after giving effect to such Common

Share Reorganization including, in the case where securities exchangeable for or convertible into Common Shares are distributed,

the number of Common Shares that would have been outstanding had such securities been exchanged for or converted into Common Shares.

Such adjustment shall be made successively whenever any such effective date or record date shall occur; and any such issue of

Common Shares by way of stock dividend or other distribution shall be deemed to have been made on the record date for the stock

dividend or other distribution for the purpose of calculating the number of outstanding Common Shares under this Section 9.

(ii) If and whenever at any time while any

portion of this Debenture is outstanding the Company distributes to all or substantially all the holders of its outstanding Common

Shares of (i) shares of any class other than Common Shares, (ii) rights, options or warrants to acquire Common Shares or securities

exchangeable for or convertible into Common Shares or property or other assets of the Company, (iii) evidence of indebtedness,

or (iv) any property or other assets, if such distribution

does

not constitute (a) a dividend paid in the ordinary course, (b) a Common Share Reorganization, or (c) a rights offering (any of

such non-excluded events herein called a “Special Distribution”), the Conversion Price shall be adjusted

effective immediately after the record date at which holders of Common Shares are determined for purposes of the Special Distribution

to be a price determined by multiplying the Conversion Price in effect on such record date by a fraction, of which the numerator

shall be the number of Common Shares outstanding on such record date multiplied by the Conversion Price on such record date, less

the fair market value of such shares, rights, options, warrants, evidences of indebtedness or property or other assets issued

or distributed (as determined conclusively by the auditors of the Company), and of which the denominator shall be the number of

Common Shares outstanding on such record date multiplied by such Conversion Price; any Common Shares owned by or held for the

account of the Company or any subsidiary thereof shall be deemed not to be outstanding for the purpose of any such computation.

(iii) If and whenever at any time while any

portion of this Debenture is outstanding there is a capital reorganization of the Company or a reclassification of the Common

Shares or other change of the Common Shares (other than a Common Share Reorganization) or a consolidation or an amalgamation or

merger of the Company with or into any other corporation (other than a consolidation, amalgamation or merger which does not result

in a reclassification of the outstanding Common Shares or a change of the Common Shares into other securities), or a transfer

of all or substantially all of the undertaking or assets of the Company to another corporation or other entity in which the holders

of Common Shares are entitled to receive shares or other securities or property (any of such events being a “Capital

Reorganization”), the Holder thereafter shall, upon converting this Debenture, be entitled to receive, and shall accept,

in lieu of the number of Common Shares to which it was theretofore entitled upon such conversion, the kind and amount of shares

and other securities or property which the Holder would have been entitled to receive as a result of such Capital Reorganization,

on the effective date thereof, the Holder had been the registered holder of the number of Common Shares to which it was theretofore

entitled upon conversion.

(iv) There will be no adjustment of the Conversion

Price in respect of any event described in clause (i) (ii) or (iii) of this subsection 9(a) if the Holder is entitled to participate

in such event on the same terms mutatis mutandis as if it had converted its Debenture prior to or on the applicable record

date.

(v) In any case in which this subsection 9(a)

shall require that an adjustment shall become effective immediately after a record date for an event referred to herein, the Company

may defer, until the occurrence of such event, issuing to the Holder in the event this Debenture is converted after such record

date and before the occurrence of such event the additional Common Shares issuable upon such conversion by reason of the adjustment

required by such event before giving effect to such adjustment; provided, however, that the Company shall deliver to the Holder

an appropriate instrument evidencing the Holder’ right to receive such additional Common Shares upon the occurrence of the

event requiring such adjustment and the right to receive any distributions made on such additional Common Shares declared in favour

of holders of record of Common Shares on and after the Conversion Date or such later date as the Holder would, but for the provisions

of this clause (vi), have become the Holder of record of such additional Common Shares.

(vi) The adjustments provided for in this

subsection 9(a) are cumulative, shall be computed to the nearest one tenth of one cent and shall be made successively whenever

an event referred to therein shall occur, provided, that, notwithstanding any other provision of this subsection 9(a), no adjustment

of the Conversion Price shall be required unless such adjustment would require an increase or decrease of at least 1% in the Conversion

Price then in effect; provided however, that any adjustments which by reason of this clause (vii) are not required to be made

shall be carried forward and taken into account in any subsequent adjustment.

(vii) No adjustment of the Conversion Price

shall be made pursuant to this subsection 9(a) in respect of the issue from time to time of Common Shares pursuant to this Debenture

or pursuant to any stock option or stock purchase plan(s) in force from time to time for officers, employees or consultants of

the Company or shareholders of the Company who exercise an option to receive substantially equivalent dividends in Common Shares

in lieu of receiving a cash dividend paid in the ordinary course, and any such issue shall be deemed not to be a Common Share

Reorganization.

(viii) In the event of any question arising

with respect to the adjustments provided in this subsection 9(a), such question shall be conclusively determined by a firm of

chartered accountants acceptable to the Company and the Holder. Such accountants shall have access to all necessary records of

the Company and such determination shall be binding upon the Company and the Holder.

| (b) | Notice

of Adjustment of Conversion Price, etc.. If there shall be any adjustment as provided

in subsection 9(a) above, the Company shall forthwith cause written notice thereof to

be sent to the Holder, which notice shall be accompanied by a |

certificate

of the President of the Company setting forth in reasonable detail the basis of such adjustment.

(c) Notice

of Certain Events. In the event that:

(ix) the Company shall declare on its Common

Shares any dividend or make any other distribution on its Common Shares;

(x) there shall be an amalgamation or merger

of the Company with or into any other corporation or a sale, transfer or other disposition of all or substantially all of the

assets of the Company; or

(xi) there shall be a voluntary or involuntary

dissolution, liquidation or winding up of the Company;

then,

and in each of such cases, the Company shall cause notice thereof to be given to the Holder at least 10 Business Days prior to

the date on which the books of the Company shall close or a record date shall be taken for such dividend, distribution, stock

split or combination or issue of rights or to vote upon such capital reorganization, reclassification, change, consolidation,

merger or sale of properties and assets, as the case may be, and shall specify such record date or dates for the closing of the

transfer books.

9. Representations

and Warranties. The Company represents and warrants to the Holder as follows:

| (a) | it

has been incorporated and is validly subsisting as a corporation under the laws of the

State of California, and has the power and authority to enter into and perform its obligations

under this Debenture and to own its property and carry on its business as currently conducted; |

| (b) | the

execution, delivery and performance of this Debenture has been duly authorized by all

requisite corporate action; this Debenture and all instruments and agreements delivered

pursuant hereto have been duly executed and delivered by the Company and constitute valid

and binding obligations of the Company enforceable against the Company in accordance

with their terms; |

| (c) | neither

the execution nor delivery of this Debenture or any agreements or instruments delivered

pursuant hereto, the consummation of the transactions herein and therein contemplated,

nor compliance with the terms, conditions and provisions hereof or thereof conflicts

with or will conflict with, or results or will result in any material breach of, or constitutes

a default under any of the provisions of the constating documents or by-laws of the Company

any law, rule or regulation having the force of law applicable to the Company, including

applicable securities laws, rules, policies and regulations or any contract or agreement

binding upon or to which the Company is a party; |

| (d) | no

event has occurred which constitutes, or with notice or lapse of time or both, would

constitute an Event of Default; |

(e) the

execution and delivery of this Debenture by the Company and the performance by the Company of its obligations hereunder have been

duly authorized by all necessary corporate action; no consent, approval, order, authorization, licence, exemption or designation

of or by any Official Body is required in connection with the execution, delivery and performance by the Company of its obligations

under this Debenture and no registration, qualification, designation, declaration of filing with any Official Body is or was necessary

to enable or empower the Company to enter into and to perform its obligations under this Debenture except such as have been made

or obtained and are in full force and effect, unamended, on the Closing Date;

(f) the

Company is the sole and beneficial owner of all of the Pledged Assets (except any leased assets) and, where applicable, are duly

registered as the owner thereof, with a good and marketable title thereto, free and clear of all Encumbrances except for Permitted

Encumbrances;

(g) there

are no actions, suits, grievances or proceedings threatened or taken before or by any Official Body or by any elected or appointed

public official or private person, which challenges the validity or propriety of the transactions contemplated under this Debenture

or any of the documents, instruments and agreements executed or delivered in connection therewith or related thereto which could

be reasonably anticipated to have a material adverse effect on the business, operations, properties, assets, capitalization, financial

condition or prospects of the Company;

| (h) | the

Company is not in default under any material applicable statute, rule, order, decree

or regulation of any Official Body having jurisdiction over it or any of the Pledged

Assets; and |

| (i) | to

the best of the knowledge of the Company, the Company has complied and is complying in

all material respects with all federal, provincial and local laws, rules, regulations,

notices, approvals, ordinances and orders applicable to its business, property, assets

and operations. |

10. Survival

of Representations and Warranties. The representations and warranties herein set forth or contained in any certificates

or documents delivered to the Holder shall survive the execution and delivery of this Debenture until all obligations of the Company

to the Holder Party herein have been fully satisfied, which, for greater certainty, shall include, without limitation, the conversion

of this Debenture pursuant to the terms hereof.

11. Affirmative

Covenants. The Company covenants and agrees with the Holder that, so long as this Debenture is outstanding and in force

and except as otherwise permitted by the prior written consent of the Holder, it will:

| (a) | do

or cause to be done all things necessary to keep in full force and effect its corporate

existence and all qualifications to carry on its business in each jurisdiction in which

it owns property or carries on business from time to time; |

| (b) | comply

with all applicable governmental laws, restrictions and regulations and orders; |

| (c) | pay

or cause to be paid all taxes, government fees and dues levied, assessed or imposed upon

it and its property or any part thereof, as and when the same become due and payable,

unless any such taxes, fees, dues, levies, assessments or imposts are in good faith contested

by it; |

| (d) | forthwith

notify the Holder of the occurrence of any Event of Default or any event of which it

is aware which with notice or lapse of time or both would constitute an Event of Default;

and |

| (e) | it

shall duly and pay or cause to be paid to the Holder the Principal Amount and all other

moneys payable on or pursuant to this Debenture on the dates, at the places and in the

manner set forth herein. |

12. Negative

Covenants. The Company covenants and agrees with the Holder that, so long

as this Debenture is outstanding and in force and except as otherwise permitted by the prior written consent of the Holder, it

will not:

| (a) | Encumbrances,

etc. - Create or suffer to exist any Encumbrance to secure or provide for the payment

of any Debt or any other obligation other than Permitted Encumbrances. |

| (b) | Mergers,

etc. - Enter into any transaction (whether by way of reconstruction, reorganization,

arrangement, consolidation, amalgamation, merger, joint venture, transfer, sale, lease

or otherwise) whereby any material part of the Pledged Assets would become the property

of any Person other than the Company or whereby all or any material part of the undertaking,

property and assets would become the property of any Person other than the Company or

in the case of any amalgamation involving the Company would become the property of any

other person other than the Company by virtue of such Person's direct or indirect ownership

interest in the continuing Debtor resulting therefrom. |

| (c) | Sale

of the Company - Enter into any transaction for the Sale of the Company. |

| (d) | Financial

Internal Controls - Signing Officers – The Company will have no less than 3

signing officers with the ability to transfer funds. As a financial internal control

mechanism, any payment amounts of $10,000 or more must be authorized and signed by 2

signing officers. No payee can receive more than $10,000 from the Company in one week

without at least 2 signing officers authority simultaneously. The Company will not change

the signing officers without prior written consent of the Holder. Standard public company

internal control practices of the Company are material factors in the Holder’s

willingness to institute and maintain a lending relationship with the Company. |

| (e) | Dividends,

Etc. – The Company shall not declare nor pay any dividend of any kind, in cash

or in property, nor make

any distribution of any kind in respect thereof, nor make any return of capital to shareholders

without the prior written consent of the Holder. |

| (f) | Guaranties,

Loans - Except in the

ordinary course of business, the Company shall not guarantee nor be liable in any manner,

whether directly or indirectly, or become contingently liable after the date of this

Debenture in connection with the obligations or indebtedness of any person or persons,

except for the endorsement of negotiable instruments payable to the Company for deposit

or collection in the ordinary course of business. The Company shall not make any loan,

advance or extension of credit to any person other than in the normal course of its business. |

| (g) | Debt

- The Company shall

not create, incur, assume or suffer to exist any additional indebtedness of any description

whatsoever in an aggregate amount in excess of $50,000 (excluding any indebtedness of

the Company to the Holder, trade accounts payable and accrued expenses incurred in the

ordinary course of business and the endorsement of negotiable instruments payable to

the Company, respectively for deposit or collection in the ordinary course of business). |

13. Grant

of Mortgages, Charges and Security Interests

13.1 Security

As

security for the due payment of the Principal Amount, interest thereon and all other indebtedness and liability from time to time

payable hereunder and for the fulfillment of its obligations of the Company hereunder, the Company hereby:

(a) mortgages

and charges as and by way of a fixed and specific mortgage and charge to and in favour of the Holder, and grants to the Holder

a security interest in, all real and immoveable property (including, by way of sub-lease) any leased premises now or hereafter

owned or acquired by the Company and all buildings erections, improvements, fixtures and plants now or hereafter owned or acquired

by the Holder (whether the same form part of the realty or not) and all appurtenances to any of the foregoing; for the purposes

of this subsection 13.1(a), all references to "real and immoveable property" shall be read to include any estate or

interest in or right with respect to real and immoveable property;

(b) mortgages

and charges to the Holder and grants to the Holder a security interest in, all its present and future equipment, and all fixtures,

plant, machinery, tools and furniture now or hereafter owned or acquired by them;

(c) mortgages

and charges to and in favour of the Holder, and grants to the Holder a security interest in, all its present and future inventory,

including, without limiting the generality of the foregoing, all raw materials, goods in process, finished goods

and

packaging material and goods acquired or held for sale or furnished or to be furnished under contracts of rental or service;

(d) grants

to the Holder a security interest in, all its present and future intangibles, including, without limiting the generality of the

foregoing, all its present and future book debts, accounts and other amounts receivable, contract rights and chooses in action

of every kind or nature including insurance rights arising from or out of any insurance now or hereafter placed on or in respect

of the assets referred to in subsections 13.1(a), (b) or (c), goodwill, chattel paper, instruments of title, investments, money,

securities and all Intellectual Property Rights;

(e) charges

in favour of the Holder as and by way of a floating charge, and grants to the Holder a security interest in, its business and

undertaking and all of its property and assets, real and personal, moveable or immoveable, of whatsoever nature and kind, both

present and future (other than property and assets hereby validly assigned or subjected to a specific mortgage, charge or security

interest by this subsections 13.1(a), (b), (c) or (d) and subject to the exceptions hereinafter contained);

(f) assigns,

mortgages and charges to and in favour of the Holder, and grants to the Holder a security interest in, the proceeds arising from

any of the assets referred to in this Section 13.1;

(g) grants

to the Holder a security interest in the right, title and interest the Company has to the Intellectual Property Rights;

all

of which present and future property and assets of the Company referred to in the foregoing subparagraphs of this Section 13.1

are hereinafter collectively called the "Pledged Assets".

13.2 The

security interest of all Holders shall rank pari passu with each other. The Company shall cause any party which holds security

or a security interest against the Company to postpone and subordinate in favour of the Holder and all other Holders.

13.3 The

Holder shall have all of the rights and remedies provided by law, including, without limitation, those under the Uniform Commercial

Code (“UCC”). The Company will execute or deliver this Debenture and any other document delivered in connection herewith,

including, without limitation, any UCC Financing Statements required by the Holder to which it is or will be a party, or perform

any of its obligations hereunder.

13.4 Location

of the Pledged Assets

The

Company hereby represents and warrants to the Holder that the Pledged Assets are on the date hereof primarily situate or located

at the locations set out in Schedule A. The Company shall notify the Holder of any other premises where the Pledged Assets are

located. In the event the Pledged Assets are moved, the Company will notify the Holder in writing prior to moving

the

Pledged Assets and providing all details of where the Pledged Assets will be. In no event can the Pledged Assets be moved outside

of the United States of America unless they are sold.

14. Remedies

| (a) | Upon

the occurrence and continuation of an Event of Default which has not been remedied, the

Holder may proceed to realize upon the Security granted hereby and under the Security

and to enforce its rights by: |

(i) entry

or taking into possession of all or any part of the Pledged Assets;

| (ii) | the

appointment by instrument in writing of a receiver or receivers of the Pledged Assets

or any part thereof (which receiver or receivers may be any person or persons, whether

an officer or officers or employee or employees of the Holder or not, and the Holder

may remove any receive or receivers so appointed and appoint another or others in his

or her stead); |

(iii) proceedings

in any court of competent jurisdiction for the appointment of a receiver or receivers or for the sale of the Pledged Assets or

any part thereof;

(iv) any

other action, suit, remedy or proceeding authorized or permitted hereby or by law or by equity;

(v) collecting

any proceeds arising in respect of the Pledged Assets;

(vi) collecting,

realizing upon or selling or otherwise dealing with any accounts of the Company; or

(vii) preparing

for the disposition of the Pledged Assets, whether on the premises of the Company or otherwise.

| (b) | In

addition, the Holder may file such proofs of claim and other documents as may be necessary

or advisable in order to have its claim lodged in any bankruptcy, winding-up or other

judicial proceedings relative to the Company. |

15. Events

of Default and Remedies.

| (a) | Events

of Default. Any one or more of the following events shall constitute an Event

of Default hereunder: |

(i) Default in Principal - If the

Company fails to repay the Principal Amount then outstanding on the Maturity Date.

(ii) Default hereunder - If the

Company materially defaults in the performance or observance of any term, condition or covenant contained in this Debenture and

such default continues for a period of 15 Business

Days

or more after written notice thereof has been delivered by the Holder to the Company.

(iii) Winding-up, etc. - If

an order is made or an effective resolution passed for the winding-up, liquidation or dissolution of the Company.

(iv) Insolvency, etc. - If the

Company consents to or makes a general assignment for the benefit of creditors or makes a proposal under Bankruptcy Act (Canada),

the Companies’ Creditors Arrangement Act (Canada) or any other bankruptcy, insolvency or analogous laws, or is declared

bankrupt, or if a liquidator, trustee in bankruptcy, custodian or receiver and manager or other officer with similar powers is

appointed of the Company or of its property or any part thereof which in the opinion of the Holder, acting reasonably, is a substantial

part thereof and such appointment is not being contested in good faith by the Company.

(v) Encumbrancers - If an encumbrancer

takes possession of the property of the Company or any part thereof which in the opinion of the Holder, acting reasonably, is

a substantial part thereof, or if a distress or execution or any similar process is levied or enforced against such property and

remains unsatisfied for such period as would permit such property or such part thereof to be sold thereunder, provided that such

possession or process has not been stayed and is not being contested in good faith by the Company.

| (b) | Acceleration.

Upon the occurrence of any one or more of the Events of Default, all indebtedness of

the Company to the Holder hereunder shall, at the option of the Holder, immediately become

due and payable without presentment, demand, protest or other notice of any kind, all

of which are expressly waived by the Company, and all collateral and securities shall

thereupon become enforceable by the Holder or its duly authorized agent. |

(c) Remedies

Cumulative. The rights and remedies of the Holder hereunder are cumulative and in addition to and not in substitution

for any rights or remedies provided by law.

16. Further

Assurances. The Company shall from time to time forthwith on the Holder’ request do, make and execute all such further

assignments, documents, acts, matters and things as may be required by the Holder with respect to this Debenture or any part hereof

or thereof or as may be required to give effect to these presents.

17. Dealings

by the Holder. the Holder may grant extensions of time and other indulgences, take and give up securities, accept compositions,

grant releases and discharges and otherwise deal with the Company, debtors of the Company, sureties and others and with the Security

and other securities as the Holder may see fit without prejudice to the liability of the Company hereunder or the Holder’

right to hold and enforce the Security.

18. Notices.

Any notice or communication to be given hereunder may be effectively given by delivering the same at the addresses hereinafter

set forth or by sending the same by facsimile or prepaid registered mail to the parties at such addresses. Any notice so

mailed shall be deemed to have been received on the fifth Business Day next following the mailing thereof provided the postal

service is in operation during such time. Any facsimile notice shall be deemed to have been received on the Business Day

next following the date of transmission. The mailing and facsimile addresses of the parties for the purposes hereof shall

respectively be:

if

the Holder: as set out on the cover page of this Debenture

with

a copy to:

First

Republic Capital Corporation

55

University Avenue, Suite 1003

Toronto,

ON M5J 2H7

Attention:

Richard C. Goldstein, President

if

to the Company:

7968

Arjons Drive

San

Diego, California 92126

Attention:

Jack B. Chadsey, Chief Executive Officer

Either

party may from time to time notify the other party hereto, in accordance with the provisions hereof, of any change of address

which thereafter, until changed by like notice, shall be the address of such party for all purposes of this Agreement.

19. Successors

and Assigns. This Debenture shall be binding upon and shall enure to the benefit of the Company and the Holder and their

respective successors and assigns, provided that the Company shall not assign any of its rights or obligations hereunder without

the prior written consent of the Holder.

20. Governing

Law. This Debenture and all other documents delivered to the Holder hereunder shall be construed and interpreted in accordance

with the laws of Ontario applicable therein. If any provision of this Debenture is invalid, illegal or unenforceable, the balance

of this Debenture shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless

remain applicable to all other persons and circumstances. If it shall be found that any interest or other amount deemed interest

due hereunder shall violate applicable laws governing usury, the applicable rate of interest due hereunder shall automatically

be lowered to equal the maximum permitted rate of interest. The Company covenants (to the extent that it may lawfully do so) that

it shall not at any time insist upon, plead, or in any manner whatsoever claim or take the benefit or advantage of, any stay,

extension or usury law or other law which would prohibit or forgive the Company from paying all or any portion of the principal

of or interest on this Debenture as contemplated herein, wherever enacted, now or at any time hereafter in force, or which may

affect the covenants or the performance of this debenture, and the Company (to the extent it may lawfully do so) hereby expressly

waives all benefits or advantage of any such law, and covenants that it will not, by resort to any such law, hinder, delay or

impeded the execution of any power herein granted to the Holder, but will suffer and permit the execution of every such as though

no such law has been enacted. THE PARTIES HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT ANY OF

THEM

MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON OR ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT

OR ANY TRANSACTION DOCUMENT OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF

ANY PARTY. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE PARTIES’ ACCEPTANCE OF THIS AGREEMENT.

21. Currency.

All dollar amounts herein are expressed in US dollars.

22. Headings.

The headings of the sections of this Debenture are inserted for convenience only and shall not be deemed to constitute a part

hereof.

23. Entire

Agreement. This Debenture constitutes the entire agreement and supercedes all other prior agreements and undertakings,

both written and oral, among the parties with respect of the subject matter hereof.

[signature

appears on the following page]

DATED

as of ______, 2015.

IWALLET

CORPORATION

Per:

Name:

Title:

I

have the authority to bind the Company.

EXHIBIT

“A”

NOTICE

OF CONVERSION

(To

be executed by the Holder in order to convert the Debenture)

To:

The

undersigned hereby irrevocably elects to convert $ of the principal amount of the above Debenture into Common Shares

of iWallet Corporation, according to the conditions stated therein, as of the Conversion Date written below.

| Conversion

Date: |

______________ |

| Amount

to be converted: |

$______________ |

| Amount

of Debenture unconverted: |

$______________ |

| Conversion

Price per Share: |

$______________ |

| Number

of Common Shares to be issued: |

______________ |

|

|

| Please

issue the Common Shares in the following name and to the following address: |

______________ |

| Issue

to: |

______________ |

| Authorized

Signature: |

______________ |

| Name: |

______________ |

| Title: |

______________ |

| Phone

Number: |

______________ |

| Broker

DTC Participant Code: |

______________ |

| Account

Number: |

______________ |

Schedule

A

Location

of Assets

7968

Arjons Drive

San

Diego, California 92126

7394 Trade

Street

San

Diego, California 92121

USA

Schedule B

Encumbrances

None

Schedule

C

Intellectual

Property Rights

PATENTS

AND PATENTS PENDING

SMART

WALLET filed under Utility Patent Application No. 12/125,003 with the United States Patent & Trademark Office;

SMART

WALLET filed under Utility Patent Application No. 2008/299811 with the Australian Patent Office;

SMART

WALLET filed under Utility Patent Application No. 2,702,803 with the Canadian Intellectual Property Office;

SMART

WALLET filed under Utility Patent Application No. 2008/80108371.4 with the State Intellectual Property Office of the People’s

Republic of China;

SMART

WALLET filed under Utility Patent Application No. 658/MUMNP/2010 with the Indian Patent Office;

SMART

WALLET filed under Utility Patent Application No. 2201498 with the European Patent Office;

SMART

WALLET filed under Utility Patent Application No. 2010-524893 with the Japanese Patent Office;

SMART

WALLET filed under Utility Patent Application No. MX2010002874 with the Mexican Intellectual Property Office;

SMART

WALLET filed under Utility Patent Application No. 2010/114728 with the Russian Federal Service for Intellectual Property;

SMART

WALLET filed under Utility Patent Application No. 2010/02561-7 with the Intellectual Property Office of Singapore and Issued as

Patent 160736;

A

DEVICE FOR SECURING A SMART WALLET AND A METHOD THEREOF filed under Utility Patent Application No. 10/0115924 with the Taiwanese

Intellectual Property Office;

SMART

WALLET filed under Design Patent Application 29/394,013 with the United States Patent & Trademark Office;

SMART

WALLET filed under Design Application 001305163 with the Office of Harmonization of the Internal Market (European Union) and Issued

as Registered Community Design 001305163-0001;

SMART

WALLET filed under Industrial Design Application 2011/30467952.1 with the State Intellectual Property Office of the People’s

Republic of China and Issued as Design 2012/042300454730;

SMART

WALLET filed under Industrial Design Application D2011/1472/C with the Intellectual Property Office of Singapore and Issued as

Design D2011/1472/C;

SMART

WALLET filed under Industrial Design Application 100306735 with the Taiwanese Intellectual Property Office and Issued as Design

1012/1061980;

SMART

WALLET filed under Industrial Design Application 143603 with the Canadian Intellectual Property Office and Issued as Design 143603;

SMART

WALLET filed under Industrial Design Application 15707/2011 with the Australian Patent Office and Issued as Design 340320;

SMART

WALLET filed under Industrial Design Application 241379 with the Indian Patent Office;

SMART

WALLET filed under Industrial Design Application 2011-028887 with the Japanese Patent Office and Issued as Design 1444043;

SMART

WALLET filed under Industrial Design Application MX/f/2011/004080 with the Mexican Intellectual Property Office;

SMART

WALLET filed under Industrial Design Application 2011/503884 with the Russian Federal Service for Intellectual Property and Issued

as Design 84009;

TRADEMARKS

IWALLET

filed as Trademark Application No. 77/745,963 with the United States Patent & Trademark Office and issued as Trademark 4,042,510;

IWALLET

filed as Trademark Application No. 85/593,836 with the United States Patent & Trademark Office and issued as Trademark 4,245,653;

IWALLET

filed as Trademark Application No. 85/369,514 with the United States Patent & Trademark Office; and

I-WALLET

filed as Trademark Application No. 77/291,012 with the United States Patent & Trademark Office and issued as Trademark 3,763,757.

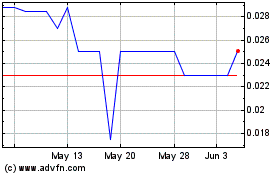

iWallet (PK) (USOTC:IWAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

iWallet (PK) (USOTC:IWAL)

Historical Stock Chart

From Dec 2023 to Dec 2024