Current Report Filing (8-k)

07 April 2016 - 9:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2016

______________

LOGICQUEST TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

______________

|

|

|

|

Nevada

|

000-22711

|

76-0640970

|

|

(State or Other Jurisdiction

|

(Commission

|

(I.R.S. Employer

|

|

of Incorporation)

|

File Number)

|

Identification No.)

|

410 Park Avenue, 15

th

Floor #31, New York, NY 10022

(Address of Principal Executive Office) (Zip Code)

212-231-0033

(Registrant’s telephone number, including area code)

n/a

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On March 31, 2016, our company entered a memorandum of understanding (“

MOU

)”) with Logicquest Technology Limited (“

Logicquest

”) pursuant to which we shall effect a business combination (the “

Transaction

”). The Transaction may be effected in one of several different ways, including an asset acquisition, merger of Logicquest and us, or a share purchase whereby we purchase the shares of Logicquest from its shareholders for cash and/or for shares of our company.

We will pay aggregate of USD$3,000,000 to the shareholders of Logicquest for all issued and outstanding share of Logicquest, payable as follows:

(a)

$1,000,000 on closing of the Transaction;

(b)

$1,000,000 six months from closing of the Transaction; and

(c)

$1,000,000 on the first anniversary of the closing of the Transaction.

The definitive agreement under which the parties will agree to carry out the Transaction will contain provisions that are customary for a transaction of this nature, including, but not be limited to,

(a)

approvals of the boards of directors of Logicquest and us and shareholders of Logicquest;

(b)

obtaining all required consents of third parties;

(c)

completion of all required audited and unaudited financial statements of Logicquest, prepared in accordance with US GAAP and audited and by a PCAOB registered audit firm;

(d)

no adverse material change in the business or financial condition of Logicquest or us since the execution of the Transaction Agreement; and

(e)

closing of Transaction by June 30, 2016.

The foregoing description of the MOU is qualified in its entirety by reference to the complete copy of the MOU, which is attached as Exhibit 10.1 to this Current Report.

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

|

10.1

|

Memorandum of Understanding between our company and Logicquest.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

LOGICQUEST TECHNOLOGY INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ang Woon Han

|

|

|

|

Ang Woon Han

CEO, President and Director

|

|

|

|

|

|

|

April 5, 2016

|

3

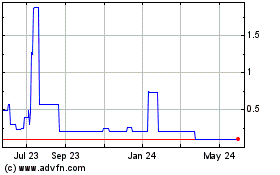

Logicquest Technology (PK) (USOTC:LOGQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

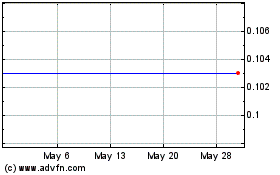

Logicquest Technology (PK) (USOTC:LOGQ)

Historical Stock Chart

From Nov 2023 to Nov 2024