The Marketing Alliance, Inc. (Pink Sheets: MAAL) (�TMA�), a

consortium of independent life insurance brokerage general agencies

located throughout the United States, today announced financial

results for its fiscal fourth quarter and year ended March 31,

2008. Timothy M. Klusas, TMA�s President, stated, �We are very

pleased with our operating results for the fourth quarter and

fiscal year ended March 31, 2008. We posted double-digit percentage

increases in revenue and operating income for the fiscal 2008

fourth quarter and year. Fiscal 2008 also marked the third

consecutive year of operating margin improvement, reflecting

further realization of the benefits of a streamlined

infrastructure. We believe that our expanding carrier network and

balance sheet at March 31, 2008, have put us is in position to have

the opportunity to capitalize on future growth initiatives.� Mr.

Klusas continued, �With regards to our annuity business (TMAM), our

wide range of annuity products, service options, and overall

flexibility seem to appeal to agencies looking to expand their

annuity business without incurring significant start-up costs or

capital expenditures. Our new platform, launched in March 2007,

continues to engage agencies as it encourages them to increase

focus on developing their annuity businesses. During the past

fiscal year, we continued to work with existing carriers to further

grow the business and enhance these supplier relationships. We are

now very excited to announce the additions of Prudential Financial

and Transamerica, both of which were added to our network

subsequent to the close of our reporting period. We look forward to

working with these carriers to fully integrate them into our

network, which we have found can take up to 24 months. We remain

encouraged by the recent growth in our life and annuity businesses,

and will continue to strive to nurture new revenue streams that

also create value for our customers.� Mr. Klusas concluded, �Our

investment portfolio has grown substantially over the years, and

our gains in past years and periods have roughly offset our current

losses. While these recent losses impact our earnings, so far they

have not meaningfully impacted our ability to execute our strategic

initiatives. We continue to monitor our investment holdings and are

adjusting for the changing economic environment in an attempt to

reduce the volatility of our returns. Despite this effect on our

earnings, we feel fortunate to have a strong balance sheet in this

economy and operating environment.� FISCAL 2008 FOURTH QUARTER

REVIEW Total revenues for the three-month period ended March 31,

2008 increased 34% to $4.3 million from $3.2 million for the

three-month period ended March 31, 2007. The increase in revenues

was due to favorable timing as well as increased revenues from new

additions to the Company�s carrier network in the last three years.

Distributor bonus and commissions increased to $1.6 million from

$690,000 in the same period last year, due primarily to increases

in revenue and customers thriving in new incentive programs.

Benefits and processing expenses declined to $702,000, or 16.4% of

revenues, from $746,000, or 23.3% of revenues, in the fourth

quarter of fiscal 2007, due to TMA�s continued focus on

centralization and economies of scale. Net operating revenue (gross

profit) grew 14% to $2.0 million from $1.8 million in the

comparable fiscal 2007 period. Operating expenses as a percentage

of revenues declined to 19.7% from 25.7% in the prior year�s fourth

quarter, as higher revenues and lower processing costs offset the

rise in bonuses and commissions. Operating income rose 23% to $1.2

million, or 27.1% of revenues, from operating income of $941,000,

or 29.4% of revenues for the prior fourth quarter. Realized and

unrealized loss on investments of $602,000 compared to a realized

and unrealized loss of $35,000 for the fourth quarter of fiscal

2007. The wider loss in the current year period was attributable to

current market conditions. Net income for the fiscal 2008 fourth

quarter was $342,000, or $0.18 per share, based on 1.95 million

shares outstanding, as compared to net income of $637,000, or $0.32

per share, based on 2.0 million shares outstanding, for the fiscal

2007 fourth quarter. The decrease in shares outstanding is due to

the Company�s execution of its share repurchase program. FISCAL

2008 ANNUAL REVIEW As a result of the factors listed above, total

revenues for fiscal 2008 increased 10% to $16.6 million versus

$15.0 million in fiscal 2007. Distributor and bonus commissions

rose to $9.3 million from $8.0 million. Benefits and processing

expenses declined to $2.5 million, or 15.2% of revenues, from $2.8

million, or 18.8% of revenues last year. Fiscal 2008 net operating

revenue (gross profit) increased to $4.8 million, or 28.7% of

revenues, from $4.2 million, or 28.2% of revenue. Fiscal 2008

operating income increased 53% to $2.1 million, or 12.4% of

revenues, from $1.3 million, or 9.0% of revenues, in fiscal 2007.

TMA reported fiscal 2008 net income of $522,000, or $0.27 per

share, as compared to net income of $888,000, or $0.44 per share,

in fiscal 2007. SELECTED OTHER FINANCIAL INFORMATION TMA�s balance

sheet at March 31, 2008 reflected cash of $1.7 million, working

capital of $3.8 million and no long-term debt. Shareholders� equity

at March 31, 2008 totaled $4.1 million. On January 31, 2008, TMA

paid a $0.21 per share cash dividend for shareholders of record on

December 1, 2007. This is the latest dividend payment to

shareholders and an increase of 24% over last year�s cash dividend

of $0.17 per share. ABOUT THE MARKETING ALLIANCE, INC.

Headquartered in St. Louis, MO, TMA is one of the largest

organizations providing support to independent insurance brokerage

agencies, with a goal of providing members value-added services on

a more efficient basis than they can achieve individually. TMA�s

network is comprised of independent life brokerage and general

agencies in 43 states. Investor information can be accessed through

the shareholder section of TMA�s website at

http://www.themarketingalliance.com/si_who.cfm. TMA stock is quoted

in the �pink sheets� (www.pinksheets.com) under the symbol �MAAL�.

FORWARD LOOKING STATEMENT Investors are cautioned that

forward-looking statements involve risks and uncertainties that may

affect TMA's business and prospects. Any forward-looking statements

contained in this press release represent our estimates only as of

the date hereof, or as of such earlier dates as are indicated, and

should not be relied upon as representing our estimates as of any

subsequent date. These statements involve a number of risks and

uncertainties, including, but not limited to, general changes in

economic conditions. While we may elect to update forward-looking

statements at some point in the future, we specifically disclaim

any obligation to do so. CONSOLIDATED STATEMENT OF OPERATIONS � � �

Quarter Ended Year to Date 3 Months Ended 12 Months Ended 3/31/2008

3/31/2007 3/31/2008 3/31/2007 � Revenues $ 4,278,750 � $ 3,199,947

� $ 16,592,849 � $ 15,002,688 � � Distributor Related Expenses

Distributor bonus & commissions paid 1,573,497 690,194

9,306,398 7,963,988 Distributor benefits & processing � 702,144

� � 746,456 � � 2,523,122 � � 2,814,959 � Total � 2,275,641 � �

1,436,650 � � 11,829,520 � � 10,778,947 � � Net Operating Revenue

2,003,109 1,763,297 4,763,329 4,223,741 � � Operating Expenses �

842,528 � � 822,384 � � 2,699,519 � � 2,875,577 � � Operating

Income 1,160,581 940,913 2,063,810 1,348,164 � Other Income

(Expense) Interest & dividend income [net] 31,341 25,595

103,800 55,733 Realized & unrealized gains [losses]on

investments (net) (601,815 ) (35,150 ) (1,295,397 ) (40,679 ) �

Interest expense � (5,466 ) � (1,354 ) � (7,529 ) � (15,762 ) �

Income (Loss) Before Provision for Income Tax 584,641 930,004

864,684 1,347,456 � Benefit (Provision) for income taxes � (242,844

) � (293,424 ) � (342,244 ) � (459,424 ) � Net Income (Loss) �

341,797 � $ 636,580 � $ 522,440 � $ 888,032 � � Average Shares

Outstanding 1,945,702 2,001,360 1,945,702 2,001,360 � Operating

Income per Share $ 0.60 $ 0.47 $ 1.06 $ 0.67 Net Income (Loss) per

Share $ 0.18 $ 0.32 $ 0.27 $ 0.44 CONSOLIDATED SELECTED BALANCE

SHEET ITEMS � � As of � Assets 3/31/2008 3/31/2007 Current Assets

Cash $ 1,709,172 $ 1,283,240 Receivables 4,529,119 4,389,604

Investments 2,256,120 2,715,997 Other � 421,698 � 140,488 Total

Current Assets 8,916,109 8,529,329 � Other Non Current Assets �

289,792 � 367,570 � Total Assets $ 9,205,901 $ 8,896,899 �

Liabilities & Stockholders' Equity � Total Current Liabilities

$ 5,084,543 $ 4,707,408 � Total Liabilities 5,084,543 4,707,408 �

Stockholders' Equity � 4,121,358 � 4,189,491 � Liabilities &

Stockholders' Equity $ 9,205,901 $ 8,896,899

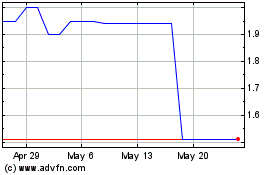

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

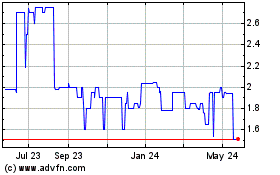

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jul 2023 to Jul 2024