FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

Of The Securities Exchange Act of 1934

For the month of August, 2014

MAX RESOURCE CORP.

(SEC File No. 0-30780)

2300 – 1066 West Hastings Street

Vancouver, B.C. V6E 3X2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under Cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No x

![[form6kjune2014q001.jpg]](form6kjune2014q001.jpg)

Condensed Interim Consolidated Financial Statements

For the six months ended June 30, 2014

(Unaudited)

Expressed in Canadian Dollars

These unaudited condensed interim consolidated financial statements of Max Resource Corp. for the six months ended June 30, 2014 have been prepared by management and approved by the Board of Directors. These unaudited condensed interim consolidated financial statements have not been reviewed by the Company’s external auditors.

Max Resource Corp.

Condensed interim consolidated statements of financial position

(Expressed in Canadian dollars - unaudited)

As at

| | | |

|

Notes

|

June 30,

2014

| December 31,

2013

|

ASSETS

| | | |

Current assets

| | | |

Cash

| | $

140,077

| $

203,229

|

Prepaids

| | 4,223

| 4,223

|

Taxes recoverable

| | 4,742

| 128

|

| | 149,042

| 207,580

|

Non-current assets

| | | |

Equipment

| 3

| 597

| 765

|

Reclamation deposits

| 4

| 53,498

| 32,097

|

Exploration and evaluation assets

| 4

| 2,385,267

| 2,138,969

|

| | 2,439,362

| 2,171,831

|

TOTAL ASSETS

| | $

2,588,404

| $

2,379,411

|

| | | |

LIABILITIES

| | | |

Current liabilities

| | | |

Trade payables and accrued liabilities

| 5

| $

322,616

| $

306,728

|

| | | |

SHAREHOLDERS’ EQUITY

| | | |

Share capital

| 6

| 14,059,099

| 13,754,038

|

Share purchase warrant reserve

| 7

| 292,851

| 288,562

|

Share-based payment reserve

| 7

| 2,077,281

| 1,997,335

|

Deficit

| | (14,163,443)

| (13,967,252)

|

| | 2,265,788

| 2,072,683

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

| | $

2,588,404

| $

2,379,411

|

Nature and continuance of operations (Note 1)

Commitments (Note 4)

See accompanying notes to the condensed interim consolidated financial statements

4

Max Resource Corp.

Condensed interim consolidated statements of loss and comprehensive loss

(Expressed in Canadian dollars - unaudited)

| | | | | |

|

Notes

| Three Months Ended

June 30,

2014

| Three Months Ended

June 30,

2013

| Six Months Ended

June 30,

2014

| Six Months Ended

June 30,

2013

|

| | | | | |

Expenses

| | | | | |

Amortization

| | $

85

| $

85

| $

168

| $

168

|

Consulting

| 8

| 7,899

| 22,102

| 13,466

| 34,348

|

Management fees

| 8

| -

| 30,000

| -

| 60,000

|

Office and miscellaneous

| | 8,558

| 5,591

| 16,949

| 17,126

|

Foreign exchange (gain) loss

| | (3,406)

| -

| 6,429

| -

|

Professional fees

| | 20,882

| 17,074

| 23,438

| 37,584

|

Stock-based compensation

| 6

| 79,946

| -

| 79,946

| -

|

Transfer agent, filing fees and

shareholder relations

| | 22,985

| 36,195

| 52,442

| 81,737

|

Travel and related costs

| | -

| 3,028

| 3,353

| 10,790

|

| | (136,949)

| (114,075)

| (196,191)

| (241,753)

|

| | | | | |

Other item

| | | | | |

Interest income

| | -

| 1,030

| -

| 2,196

|

| | -

| 1,030

| -

| 2,196

|

| | | | | |

Loss and comprehensive loss for the

period

|

| $

(136,949)

| $

(113,045)

| $

(196,191)

| $

(239,557)

|

| | | | | |

| | | | | |

Loss per share – basic and diluted

| 6

| $

(0.00)

| $

(0.00)

| $

(0.01)

| $

(0.01)

|

See accompanying notes to the condensed interim consolidated financial statements

5

Max Resource Corp.

Condensed interim consolidated statement of changes in equity

(Expressed in Canadian dollars - unaudited)

| | | | | | | | |

| | Share capital

| | Reserves

| | |

| | Number of

shares

| Amount

| | Share purchase warrant reserve

| Share-based payment reserve

| Deficit

| Total

|

Balance at December 31, 2012

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (12,872,731)

| $ 3,167,204

|

Comprehensive loss:

| |

| | | | | | |

Loss and comprehensive loss for the period

| | -

| -

| | -

| -

| (239,557)

| (239,557)

|

Balance at June 30, 2013

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (13,112,288)

| $ 2,927,647

|

Balance at December 31, 2013

| | 24,505,985

| $ 13,754,038

| | $ 288,562

| $ 1,997,335

| $ (13,967,252)

| $ 2,072,683

|

Comprehensive loss:

| |

| | | | | | |

Loss and comprehensive loss for the period

| | -

| -

| | -

| -

| (196,191)

| (196,191)

|

Transactions with owners, in their capacity as owners, and other transfers:

| |

| | | | | | |

Shares issued for cash

| | 6,320,000

| 316,000

| | -

| -

| -

| 316,000

|

Share issuance costs – finders’ warrants

| | -

| (4,289)

| | 4,289

| -

| -

| -

|

Share issuance costs - cash

| | -

| (6,650)

| | -

| -

| -

| (6,650)

|

Stock-based compensation

| | -

| -

| | -

| 79,946

| -

| 79,946

|

Balance at June 30, 2014

| | 30,825,985

| $ 14,059,099

| | $ 292,851

| $ 2,077,281

| $ (14,163,443)

| $ 2,265,788

|

See accompanying notes to the condensed interim consolidated financial statements

6

Max Resource Corp.

Condensed interim consolidated statements of cash flows

(Expressed in Canadian dollars - unaudited)

| | |

| Six-months ended

|

| June 30,

2014

| June 30,

2013

|

| | |

Operating activities

| | |

Loss for the period

| $

(196,191)

| $

(239,557)

|

Items not involving cash:

| | |

Amortization

| 168

| 168

|

Stock-based compensation

| 79,946

| -

|

Changes in non-cash working capital items:

| | |

Increase in prepaids

| -

| (3,531)

|

Decrease (increase) in taxes recoverable

| (4,614)

| 18,135

|

Increase in trade payables and accrued liabilities

| 15,888

| 82,864

|

Net cash flows used in operating activities

| (104,803)

| (141,921)

|

| | |

Investing activities

| | |

Expenditures on exploration and evaluation assets

| (246,298)

| (33,655)

|

Recovery of reclamation bonds

| -

| 19,128

|

Additions to reclamation bonds

| (21,401)

| -

|

Net cash flows used in investing activities

| (267,699)

| (14,527)

|

| | |

Financing activities

| | |

Shares issued for cash

| 316,000

| -

|

Share issuance costs

| (6,650)

| -

|

Net cash flows provided by financing activities

| 309,350

| -

|

Decrease in cash

| (63,152)

| (156,448)

|

Cash, beginning of period

| 203,229

| 510,288

|

Cash , end of period

| $

140,077

| $

353,840

|

Supplemental disclosure with respect to cash flows (Note 11)

See accompanying notes to the condensed interim consolidated financial statements

7

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

1.

Nature and continuance of operations

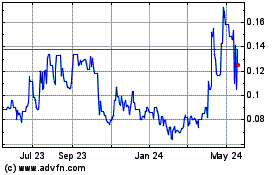

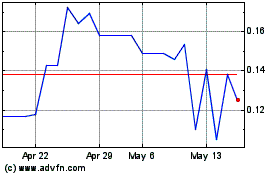

Max Resource Corp. (the “Company”) was incorporated on April 25, 1994, under the laws of the province of Alberta, Canada, and its principal activity is the acquisition and exploration of mineral properties in Canada and the United States. The Company’s shares are traded on the TSX Venture Exchange (“TSX-V”) under the symbol “MXR”.

The Company’s head office is located at #2300 – 1066 West Hastings Street, Vancouver, British Columbia, Canada, V6E 3X2 and its registered and records office is located at 700 - 9th Avenue S.W.

Calgary, Alberta, Canada, T2P 3V4.

These unaudited condensed interim consolidated financial statements have been prepared on the assumption that the Company will continue as a going concern, meaning that it will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the ordinary course of operations. Different bases of measurement may be appropriate if the Company is not expected to continue operations for the foreseeable future. As at June 30, 2014, the Company had an accumulated deficit of $14,163,443 and a working capital deficit of $173,574 and, to date, the Company has not generated any revenues to meet its operating and administrative expenses or its other obligations. As at June 30, 2014, the Company had not advanced its properties to commercial production and is not able to finance day to day activities through operations. The Company’s continuation as a going concern is dependent upon the successful results from its mineral property exploration activities, the recovery of the carrying value of its assets, and its ability to attain profitable operations and generate funds therefrom and/or raise equity capital or borrowings sufficient to meet current and future obligations. These uncertainties cast a significant doubt on the ability of the Company to continue operations as a going concern. Management intends to finance operating costs over the next twelve months with funds on hand, proceeds from private placements of the Company’s common shares and loan proceeds from related parties.

2.

Statement of compliance and adoption of new accounting standards

These unaudited condensed interim consolidated financial statements were authorized for issue on August 18, 2014 by the directors of the Company.

Statement of compliance with International Financial Reporting Standards

These unaudited condensed interim consolidated financial statements, including comparatives, have been prepared in accordance with International Accounting Standard 34 “Interim Financial Reporting” (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and Interpretations of the IFRS Interpretations Committee.

These unaudited condensed interim consolidated financial statements do not include all of the information required of a full annual financial report and is intended to provide users with an update in relation to events and transactions that are significant to an understanding of the changes in financial position and performance of the Company since the end of the last annual reporting period. It is therefore recommended that this financial report be read in conjunction with the audited annual consolidated financial statements of the Company for the year ended December 31, 2013.

2.

Statement of compliance and adoption of new accounting standards (cont’d)

Adoption of new accounting standards

On January 1, 2014, the Company adopted the “Amendment to IAS 32 Financial Instruments: Presentation”. There were no adjustments required on the adoption of this amendment.

Other accounting standards or amendments to existing accounting standards that have been issued but have future effective dates are either not applicable or are not expected to have a significant impact on the Company’s financial statements.

3.

Equipment

| |

Cost:

| |

At December 31, 2013 and June 30, 2014

| $

5,148

|

Amortization:

| |

At December 31, 2012

| 4,045

|

Charge for the year

| 338

|

At December 31, 2013

| 4,383

|

Charge for the period

| 168

|

At June 30, 2014

| 4,551

|

Net book value:

| |

At December 31, 2013

| $

765

|

At June 30, 2014

| $

597

|

8

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

4.

Exploration and evaluation assets

| | | | | | |

| Balance

December 31, 2012

|

Additions

|

Write-offs

| Balance

December 31,

2013

|

Additions

| Balance

June 30,

2014

|

Acquisition costs:

| | | | | | |

| | | | | | |

Diamond Peak, NV

| $ 47,308

| $ -

| $ (47,308)

| $ -

| $ -

| $ -

|

East Manhattan, NV

| 268,642

| 32,882

| -

| 301,524

| -

| 301,524

|

Table Top, NV

| 79,738

| -

| (79,738)

| -

| -

| -

|

Majuba Hill, NV

| 298,192

| 58,703

| -

| 356,895

| 90,410

| 447,305

|

| 693,880

| 91,585

| (127,046)

| 658,419

| 90,410

| 748,829

|

| | | | | | |

Exploration costs:

| | | | | | |

| | | | | | |

Diamond Peak, NV

| 62,286

| -

| (62,286)

| -

| -

| -

|

East Manhattan, NV

| 110,568

| 33,200

| -

| 143,768

| 8,007

| 151,775

|

Table Top, NV

| 475,162

| -

| (475,162)

| -

| -

| -

|

Majuba Hill, NV

| 1,272,556

| 64,226

| -

| 1,336,782

| 147,881

| 1,484,663

|

| 1,920,572

| 97,426

| (537,448)

| 1,480,550

| 155,888

| 1,636,438

|

| $ 2,614,452

| $ 189,011

|

$ (664,494)

| $ 2,138,969

| $ 246,298

| $ 2,385,267

|

9

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

4.

Exploration and evaluation assets (cont’d)

Diamond Peak, Nevada, United States

On May 9, 2006, the Company entered into an Option Agreement, as amended June 30, 2010, to acquire a 100% interest in the claims in Eureka County, Nevada, the “Diamond Peak Property”, from The Wendt Family Trust. The Wendt Family Trust is controlled by Clancy J. Wendt, the Vice President of Exploration for the Company. The terms of the Option Agreement required the issuance to the Wendt Family Trust of 100,000 shares (issued) of the Company with a fair value of $40,000 at date of issue and certain rental payments.

During the year ended December 31, 2012, the Company incurred $1,823 for geological consulting on the Diamond Peak project and received a refund on state property fees in the amount of $3,417. During the year ended December 31, 2013, the Company decided to no longer proceed with the property and, as a result, wrote off $109,594 to the consolidated statement of loss and comprehensive loss.

At June 30, 2014, the BLM holds a $15,809 reclamation bond (December 31, 2013 - $15,809) from the Company to guarantee reclamation of the property.

East Manhattan, Nevada, United States

On November 11, 2007, as amended December 4, 2008 and December 21, 2010, the Company entered into an option agreement with MSM Resource LLC (“MSM”), a Nevada corporation, for the acquisition of a 100% interest in the East Manhattan Wash mineral claims located in Nye County, Nevada.

The terms of the option agreement with MSM call for the payment of $27,874 (US$28,000) on execution of the agreement (paid), $25,029 (US$20,000) by December 4, 2008 (paid), $26,603 (US$25,000) by. December 4, 2009 (paid), $40,560 (US$40,000) by December 4, 2010 (paid), US$50,000 by December 4, 2011 and US$100,000 by December 12, 2012, subject to securing a drill permit, which has been applied for but not yet been received. During the year ended December 31, 2013, the Company paid $20,714 (2012 - $19,788) (US$20,000) while waiting to receive the drill permit for the property.

In addition, the Company must make exploration expenditures totaling US$700,000 on the claims including the following minimum expenditures (subject to receipt of drill permits and securing a drill rig, which to the date of these financial statements has not been received):

(i)

on or before the second anniversary, US$50,000 (completed);

(ii)

on or before the fourth anniversary, a further US$150,000 (deferred until drill permit received);

(iii)

on or before the fifth anniversary, a further US$200,000 (deferred until drill permit received); and

(iv)

on or before the sixth anniversary, a further US$300,000 (deferred until drill permit received).

The East Manhattan Property is subject to a 3% NSR royalty. Upon full exercise of the option, the Company will own 100% of the project.

During the year ended December 31, 2012, the Company incurred geological consulting of $2,387 and received a refund of state property fees of $3,773 on the East Manhattan project. During the year ended December 31, 2013, the Company incurred $28,653 for geological consulting, $2,534 for assaying and field expenses of $2,013 on the East Manhattan project. During the six months ended June 30, 2014, the Company incurred $5,567 for geological consulting and $2,440 for assaying on the East Manhattan Project.

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

4.

Exploration and evaluation assets (cont’d)

East Manhattan, Nevada, United States (cont’d)

During the six months ended June 30, 2014, the Company paid $20,754 (US$18,800) to the Bureau of Land Management (“BLM”) for a reclamation bond (December 31, 2013 - $Nil) to guarantee reclamation of the property.

Table Top, Nevada, United States

On August 31, 2009, the Company entered into an option agreement with Energex to acquire a 100% interest in the Table Top claims in Humboldt County Nevada.

The terms of the Option Agreement with Energex required the payment of $5,400 (US$5,000) upon execution of the Agreement (paid), US$25,000 on the first anniversary of the Agreement (deferred), US$35,000 on the second anniversary of the Agreement and US$50,000 on each anniversary thereafter for a term of ten years, subject to renewal. The Company could have purchased the property at any time for US$300,000, at which point the annual payments would have ceased. The Table Top property was subject to a 3% NSR royalty. Upon full exercise of the option agreement, the Company would have owned 100% of the project.

During the year ended December 31, 2013, the Company decided not to proceed with the property and expensed $554,900 to the statement of loss and comprehensive loss.

Majuba Hill, Nevada, United States

On March 4, 2011, the Company entered into an option agreement (“Agreement”) to acquire up to a 75% interest in the Majuba Hill property in Pershing County, Nevada from Claremont Nevada Mines LLC., (“Claremont”) of Nevada. The terms of the Agreement with Claremont allowed the Company to earn an initial 60% interest in the property over six years by spending US$6,500,000 on exploration of the property.

The Company could increase its interest in the property to 75% by spending a further US $3,500,000 on exploration over a subsequent two-year period. The Majuba Hill property would be subject to a 3% NSR payable to the vendor, 1.5% of which could be purchased at any time for US$1,500,000.

On December 3, 2012, the Company entered into a Mining Lease and Option to Purchase Agreement (the “Lease Agreement”) with Claremont and JR Exploration LLC of Utah, as amended on December 3, 2013 and February 13, 2014. Under the terms of this new Lease Agreement, which replaces the previous Agreement with Claremont referenced above, the Company can acquire a 100% interest in the Majuba Hill property by the payment to Claremont of US$1,000,000 over a four year period, with US$200,000 having been paid on signing and the balance payable over a four year period as follows:

(i)

US$40,000 on or before December 3, 2013 (paid);

(ii)

US$10,000 on or before February 14, 2014 (paid);

(iii)

US$15,000 on or before March 31, 2014 (paid);

(iv)

US$16,000 on or before April 30, 2014 (paid);

(v)

US$17,000 on or before May 31, 2014 (paid);

(vi)

US$24,755 on or before June 30, 2014 (paid);

(vii)

US$59,500 on or before October 31, 2014;

(viii)

US$17,000 on or before November 30, 2014;

(ix)

US$200,000 on or before December 3, 2014;

(x)

US$200,000 on or before December 3, 2015; and

(xi)

US$200,000 on or before December 3, 2016.

4.

Exploration and evaluation assets (cont’d)

Majuba Hill, Nevada, United States (cont’d)

Under the terms of this new Lease Agreement, there will be no annual work commitments and the NSR will be reduced from 3% to 1%.

On April 9, 2012, the Company entered into a mineral lease with New Nevada Resources LLC (“NNR”) for 560 acres of mineral rights immediately adjacent of its Majuba Hill project in Nevada. The mineral lease with NNR is for a term of 20 years and calls for annual lease payments of $15 per acre in the first year increasing incrementally to $30 per acre in year four and subsequent years. NNR has the right to retain a 15% working interest or it can convert it to a net smelter return of 0.5% on base metals and 1% on precious metals in addition to retaining an overriding NSR of 1.75% on base metals and 3% on precious metals. During the year ended December 31, 2013, the Company terminated the lease.

During the year ended December 31, 2012, the Company paid $244,996 (US$228,400) in lease payments on the Majuba Hill property and received a refund of state property fees in the amount of $1,330.

During the year ended December 31, 2012, the Company incurred $181,781 for geological consulting fees, $204,469 for drilling and $57,588 for field expenses on the Majuba Hill project. During the year ended December 31, 2013, the Company incurred $49,914 for geological consulting fees, $7,381 for assaying and $6,931 for field expenses on the Majuba Hill project. During the six months ended June 30, 2014, the Company incurred $45,060 for geological consulting, $74,937 for assaying, and field expenses of $27,884 on the Majuba Hill property.

At June 30, 2014, the BLM holds a $16,935 reclamation bond (December 31, 2013 - $16,288) from the Company to guarantee reclamation of the property. The Company increased its reclamation bond by $647 during the six months ended June 30, 2014.

4.

Trade payables and accrued liabilities

The components of trade payables and accrued liabilities are as follows:

| | |

| June 30, 2014

| December 31, 2013

|

Trade payables

| $

51,033

| $

22,753

|

Amounts due to related parties (Note 8)

| 271,583

| 268,975

|

Accrued liabilities

| -

| 15,000

|

| $

322,616

| $

306,728

|

11

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

6.

Share capital

Authorized share capital

Unlimited number of common shares without par value.

Issued share capital

At June 30, 2014, there were 30,825,985 issued and fully paid common shares (December 31, 2013 – 24,505,985).

During the six months ended June 30, 2014, the Company completed a non-brokered private placement of 6,320,000 units at $0.05 per unit for gross proceeds of $316,000. Each unit is comprised of one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share at a price of $0.12 per share until March 26, 2016. If at any time prior to the expiry date of the warrants, the closing price of the common shares of the Company on the TSX-V is equal to or greater than $0.25 for 30 consecutive days, then the Company may elect to provide notice to the warrant holders that the warrants will expire 30 days from the date of the notice. Finders’ fees of $6,650 and 133,000 share purchase warrants, valued at $4,289, were paid in connection with this private placement. Each share purchase warrant is exercisable at $0.12 into one common share until March 26, 2016. The fair value of the share purchase warrants was determined using the Black-Scholes option-pricing model with the following assumptions: expected life - two years; volatility – 129%; dividend rate – nil; risk free interest rate – 1.06%.

Basic and diluted loss per share

The calculation of basic and diluted loss per share for the six months ended June 30, 2014 was based on the loss attributable to common shareholders of $196,191 (2013 - $239,557) and the weighted average number of common shares outstanding of 27,858,029 (2013 – 24,505,985). Diluted loss per share did not include the effect of 4,250,000 (2013 – 2,680,000) outstanding stock options and 6,453,000 (2013 – nil) warrants as they are anti-dilutive.

Stock options

The Company has adopted an incentive stock option plan, which provides that the Board of Directors of the Company may from time to time, in its discretion, and in accordance with the TSX-V requirements, grant to directors, officers, employees and technical consultants to the Company, non-transferable stock options to purchase common shares, provided that the number of common shares reserved for issuance will not exceed 20% of the Company’s issued and outstanding common shares to a maximum of 6,165,197. Such options will be exercisable for a period of up to 5 years from the date of grant. Options granted typically vest on the grant date.

12

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

6.

Share capital (cont’d)

Stock options (cont’d)

The changes in options during the year ended December 31, 2013 and six months ended June 30, 2014 are as follows:

| | |

| |

| Number of options

| Weighted average exercise price

|

Options outstanding, December 31, 2012

| 3,280,000

| $

0.26

|

Options expired

| (1,080,000)

| 0.29

|

Options outstanding, December 31, 2013

| 2,200,000

| 0.24

|

Options cancelled

| (250,000)

| 0.25

|

Options granted

| 2,300,000

| 0.10

|

Options outstanding, June 30, 2014

| 4,250,000

| $

0.17

|

Options exercisable, June 30, 2014

| 3,800,000

| $

0.18

|

Details of options outstanding as at June 30, 2014 are as follows:

| | |

Exercise price

| Number of options

outstanding

| Expiry Date

|

$

0.24

| 1,525,000

| August 17, 2014*

|

0.25

| 425,000

| February 22, 2015

|

0.10

| 2,300,000

| May 7, 2016

|

| 4,250,000

| |

*Subsequent to June 30, 2014, these options expired unexercised.

The weighted average remaining contractual life of stock options outstanding at June 30, 2014 is 1.11 years.

During the six months ended June 30, 2014, the Company granted 1,700,000 (2013 – nil) stock options to directors, officers, and consultants of the Company. The Company’s investor relations firm was also granted 600,000 options. The fair value of all the options granted during the period is $97,619 (2013 - $nil), based on the Black-Scholes option pricing model, with the following assumptions: risk free rate 1.07%; volatility of 136.20%; dividend rate 0%; forfeiture rate 0%; and expected life of 2 years. Stock-based compensation expense of $79,946 (2013 - $nil) was recognized on options that vested during the six months ended June 30, 2014.

13

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

6.

Share capital (cont’d)

Warrants

The changes in warrants during the year ended December 31, 2013 and the six months ended June 30, 2014 are as follows:

| | |

| |

| Number of warrants

| Weighted average exercise price

|

Warrants outstanding, December 31, 2012

| 2,016,755

| $

0.38

|

Warrants expired

| (2,016,755)

| 0.38

|

Warrants outstanding, December 31, 2013

| -

| -

|

Warrants issued

| 6,4533,000

| 0.12

|

Warrants outstanding, June 30, 2014

| 6,453,000

| $

0.12

|

7.

Reserves

Share based payment reserve and share purchase warrant reserve

The reserves record items recognized as stock-based compensation expense until such time that the stock options or warrants are exercised, at which time the corresponding amount will be transferred to share capital.

8.

Related party transactions

The following amounts due to related parties are included in trade payables and accrued liabilities:

| | |

| June 30,

2014

| December 31,

2013

|

Company controlled by a director of the Company

| $

131,011

| $

130,000

|

Director of the Company

| 140,572

| 138,975

|

| $

271,583

| $

268,975

|

These amounts are unsecured, non-interest bearing and have no fixed terms of repayment.

Key management personnel compensation

| | |

| Six months ended

|

| June 30,

2014

| June 30,

2013

|

Short-term employee benefits:

| | |

Management fees

| $ -

| $ 60,000

|

Consulting

| 13,466

| -

|

Geological consulting

| 50,626

| 60,000

|

Stock-based compensation

| 25,466

| -

|

| $ 89,558

| $ 120,000

|

9.

Financial risk and capital management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors the risk management processes. The type of risk exposure and the way in which such exposure is managed is provided as follows:

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Company’s primary exposure to credit risk is on its cash held in bank accounts. The majority of cash is deposited with major banks in Canada. As most of the Company’s cash is held by two banks there is a concentration of credit risk. This risk is managed by using major banks that are high credit quality financial institutions as determined by rating agencies. The Company’s secondary exposure to risk is on its taxes recoverable. This risk is considered to be minimal.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company has a planning and budgeting process in place to help determine the funds required to support the Company’s normal operating requirements on an ongoing basis. The Company ensures that there are sufficient funds to meet its short-term business requirements, taking into account its anticipated cash flows from operations and its holdings of cash and cash equivalents.

Historically, the Company's primary source of funding has been the issuance of equity securities for cash, primarily through private placements. The Company’s access to equity financing is dependent upon market conditions and market risks. There can be no assurance of continued access to significant equity funding.

Foreign exchange risk

Foreign currency risk is the risk that the fair values of future cash flows of a financial instrument will fluctuate because they are denominated in currencies that differ from the respective functional currency. The Company is exposed to currency risk as it incurs expenditures that are denominated in United States dollar while its functional currency is the Canadian dollar. The Company does not hedge its exposure to fluctuations in foreign exchange rates. The majority of cash is held in Canadian dollars.

The following is a summary of Canadian dollar equivalent financial assets and liabilities that are denominated in United States dollars:

| | |

| June 30,

2014

| December 31, 2013

|

Cash

| $

35,428

| $

14,335

|

Trade payables and accrued liabilities

| (143,900)

| (138,975)

|

| $

(108,472)

| $

(124,640)

|

Based on the above net exposures, as at June 30, 2014, a 10% change in the United States dollar to Canadian dollar exchange rate could impact the Company’s net loss by $10,847 (December 31, 2013 - $12,464).

9.

Financial risk and capital management (cont’d)

Interest rate risk

Interest rate risk is the risk due to variability of interest rates. The Company is exposed to interest rate risk on its bank account. The income earned on the bank account is subject to the movements in interest rates. The Company has cash balances and no-interest bearing debt, therefore, interest rate risk is nominal.

Capital Management

The Company's policy is to maintain a capital base sufficient to maintain investor and creditor confidence and to sustain future development of the business. The capital structure of the Company consists of working capital and share capital. There were no changes in the Company's approach to capital management during the year. The Company is not subject to any externally imposed capital requirements.

Classification of financial instruments

Financial assets included in the statement of financial position are as follows:

| | |

| June 30,

2014

| December 31,

2013

|

Cash

| $

140,077

| $

203,229

|

Loans and receivables:

| | |

Prepaids

| 4,223

| 4,223

|

Taxes recoverable

| 4,742

| 128

|

Reclamation deposits

| 53,498

| 32,097

|

| $

202,540

| $

239,677

|

Financial liabilities included in the statement of financial position are as follows:

| | |

| June 30,

2014

| December 31,

2013

|

Non-derivative financial liabilities:

| | |

Trade payables

| $ 51,033

| $ 22,753

|

Amounts due to related parties

| 271,583

| 268,975

|

| $ 322,616

| $ 291,728

|

Fair value

The fair value of the Company’s financial assets and liabilities approximates the carrying amount.

Financial instruments measured at fair value are classified into one of three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

·

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

·

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and

·

Level 3 – Inputs that are not based on observable market data.

14

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

9.

Financial risk and capital management (cont’d)

The following is an analysis of the Company’s financial assets measured at fair value as at June 30, 2014 and December 31, 2013:

| | | |

| As at June 30, 2014

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

140,077

| $

-

| $

-

|

| | | |

| As at December 31, 2013

|

| Level 1

| Level 2

| Level 3

|

Cash

| $

203,229

| $

-

-

| $

-

|

9.

Segmented information

The primary business of the Company is the acquisition and exploration of mineral properties in the United States.

10.

Supplemental cash flow information

During the six months ended June 30, 2014 and 2013, the Company incurred the following non-cash transactions that are not reflected in the statement of cash flows:

| | |

| Six months ended

|

| June 30,

2014

| June 30,

2013

|

Net deferred exploration costs for exploration and evaluation assets included in trade payables and accrued liabilities

| $ -

| $ 26,806

|

Finders warrants issued in connection with a private placement

| $ 4,289

| $ -

|

15

Max Resource Corp.

Notes to the Condensed Interim Consolidated Financial Statements

(Expressed in Canadian dollars - unaudited)

For the six months ended June 30, 2014

MAX RESOURCE CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL POSITION AND RESULTS OF OPERATIONS

For the six months ended June 30, 2014

The following discussion and analysis should be read in conjunction with the unaudited condensed interim consolidated financial statements and related notes for Max Resource Corp. (“MAX” or the “Company”) for the six months ended June 30, 2014. All dollar amounts are stated in Canadian funds. This discussion is based on information available as at August 18, 2014.

Management is responsible for the preparation and integrity of the unaudited condensed interim consolidated financial statements, including the maintenance of appropriate information systems, procedures and internal controls. Management is also responsible for ensuring that information disclosed externally, including the unaudited condensed interim consolidated financial statements and Management Discussion and Analysis (“MD&A”), is complete and reliable.

The accompanying June 30, 2014 unaudited condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) applicable to the preparation of financial statements. All amounts are expressed in Canadian dollars, unless otherwise stated.

Certain statements made may constitute forward-looking statements. Such statements involve a number of known and unknown risks, uncertainties and other factors. Actual results, performance and achievements may be materially different from those expressed or implied by these forward-looking statements. Additional information about MAX is available at www.sedar.com.

Overview

Exploration and Evaluation Assets

Majuba Hill copper/gold/silver property, Pershing County, Nevada

During the period under review, MAX continued preparations for a development drill program at Majuba Hill designed to follow up on drilling success achieved in 2011 and 2012. Drilling commenced in late May, 2014 with one hole drilled and the assay results announced on June 25, 2014. This hole, MMX-24, was drilled to a depth of 365.8 metres (“m”) and intercepted 222.6 m @ 0.27% Cu and 10.1 g/t Ag, inclusive of 117.4 m @ 0.43% Cu and 12.0 g/t Ag. MMX-24 was drilled roughly parallel to and 85 m northwest and 25 m below the collar of MAX’s hole MM-21, drilled in 2012, which intersected 332 m @ 0.13% Cu and 12 g/t Ag.

Exploration History

On December 3, 2012, MAX entered into a Mining Lease and Option to Purchase Agreement (the “Lease Agreement”) with Claremont Nevada Mines LLC of Nevada and JR Exploration LLC of Utah whereby MAX can acquire a 100% interest in the Majuba Hill Silver/Copper/Gold property in Pershing County, Nevada by the payment to Claremont of US$1 Million over a four year period, with $200,000 having been paid on signing. This new Lease Agreement replaced the previous Option Agreement with Claremont dated March 4, 2011 whereby MAX can earn up to a 75% interest in the Majuba Hill project by spending US$10 Million over an eight year period, subject to a 3% NSR payable to the vendor. Under the terms of this new Lease Agreement, there will be no annual work commitments and the NSR has been reduced from 3% to 1%.

Majuba Hill is the site of numerous past producing mines, with historic production reported of 12% Cu (Mason Valley Copper, 1918) and silver grades up to 40 oz/t Ag. Majuba Hill encompasses 2,568 acres of surface and mineral rights that includes patented lode mining claims and is located approximately halfway between the Florida Canyon Mine (Jipangju) and the Hycroft Mine (Allied Nevada Corporation). The property is easily accessed via 23 miles of well-maintained dirt roads leading from U.S. Interstate 80, and lies 30 miles northwest of Coeur d'Alene Rochester silver mine, which contains a NI 43-101 compliant Measured and Indicated Resource of 263.9 million tons grading 0.46 oz/ton Ag and 0.004 oz/ton Au. (The Coeur d’Alene Mines Corp. (TSX:CDM) Technical Report on the Rochester Mine is available on SEDAR).

During 2012, MAX drill tested the southeast extension of near surface high grade supergene oxide mineralization identified during Phase I drilling at the historic Majuba Hill mine during 2011, and conducted follow-up drilling at the DeSoto discovery zone 1.4 km to the northwest. A total of eight holes were completed during 2012, with initial assay results reported in September that included 4.6 m @ 58.0 g/t Ag and 7.6 m @ 0.80% copper within an overall mineralized intercept of 332 m @ 12.0 g/t Ag and 0.13% Cu (23.9 g/t AgEq) in oxides in hole MM-21.

During Phase I and II drilling completed in 2011, MAX intercepted high grade copper/silver oxide mineralization near surface over long intervals at the past producing Majuba Hill mine site and the DeSoto zone. Highlights of this prior drilling included:

Majuba Hill Mine:

·

96 m of 39.2 g/t Ag, 0.57% Cu and 0.10 g/t Au (98.3 g/t AgEq) in hole MM-06

·

50.3 m of 50.8 g/t Ag, 0.31% Cu and 0.31 g/t Au (86.7 g/t AgEq) in MM-07

·

42.7 m of 37.5 g/t Ag and 0.38% Cu (73.0 g/t AgEq) in hole MM-03

DeSoto:

·

29.2 m of 30.5 g/t Ag and 0.69% Cu (98.3 g/t AgEq) in hole MM-18

Note: Silver equivalent is calculated based on 100% metallurgical recovery and five-year historic metal prices of $24 U.S. for silver, $3 U.S. per pound for Cu and $1,200 US per ounce for gold.

MAX believes that Majuba Hill is a newly-defined copper/silver/gold porphyry system that is highly prospective for a bulk-tonnage, open pit deposit.

Exploration and historic production data available on Majuba Hill outline excellent potential for the discovery of new economic zones of silver/copper and gold mineralization in a near surface environment. Production reported from historic underground mines in the project area (see Nevada Bureau of Mines and Geology Bulletin 86) included:

·

184,000 ounces of silver

·

5,800 ounces of gold

·

2.8 million lbs of copper

In September 2011, MAX received and mapped the results of an extensive soil sampling program at Majuba Hill. A total of 834 soil samples were taken across a surface area in excess of 5,000 by 2,500 meters (m) with assay results obtained as high as 1.53% Cu and 209 g/t Ag.

On the northwest side of the Majuba Hill property, on unpatented land, assay results in soils ranged from 1.8 ppm Cu to 15,300 ppm (1.53%) Cu and from nil to 209 g/t Ag at the “DeSoto” zone. Sampling undertaken on the newly identified “Ball Park” target area 1 km east of the Copper Stope target area (the site of MAX’s Phase I drill program completed in August 2011) returned values from 61.2 ppm to 132 ppm Cu and from 0.16 ppm to 2.5 g/t silver. Both of these areas are identified on the soil geochemistry maps available on our web site at www.maxresource.com, with the target areas outlined in black. MAX drilled both of these areas during a Phase II drill program that was completed in December 2011.

During the summer of 2011, MAX drilled eight core holes on patented land at the site of the past producing Majuba Hill mine. This drilling confirmed higher results for both copper and silver than reported by previous operators due to the improved sample recovery provided by core drilling, with significant gold (Au) values encountered in all drill holes; no gold assays had previously been reported, nor finding native gold in the holes as we have.

The complete assay results from the eight hole Phase I drill program at Majuba Hill are as follows:

| | | | | | | | | |

Hole

| Azimuth

| Angle

| Total Depth

| From (m)

| To

(m)

| Thickness (m)

| Cu

(%)

| Au

(g/t)

| Ag

(g/t)

|

MM-07

| 290

| -45

| 146.4 m

| 76.2

| 126.5

| 50.3 m

| 0.31%

| 0.31

| 50.8

|

includes

| | | | 106.7

| 126.5

| 19.8 m

| 0.53%

| 0.56

| 100.1

|

| | | | | | | | | |

MM-06

| -

| 90

| 119.8 m

| 1.5

| 97.5

| 96.0 m

| 0.57%

| 0.10

| 39.2

|

includes

| | | 119.8 m

| 1.5

| 45.7

| 44.2 m

| 1.14%

| 0.15

| 71.0

|

| | | | | | | | | |

MM-02

| 243

| -70

| 122.8 m

| 68.6

| 114.3

| 45.7 m

| 0.56%

| 0.07

| 15.4

|

includes

| | | | 105.2

| 114.3

| 9.1 m

| 0.54%

| 0.11

| 39.3

|

17

| | | | | | | | | |

MM-03

| 263

| -70

| 158.6 m

| 91.5

| 134.1

| 42.7 m

| 0.38%

| | 37.5

|

includes

| | | | 102.1

| 112.8

| 10.7 m

| 0.93%

| | 90.2

|

| | | | | | | | | |

MM-05

| 279

| -45

| 89.3 m

| 0

| 89.3

| 89.3 m

| 0.28%

| | 16.5

|

includes

| | | | 1.5

| 15.2

| 13.7 m

| 0.47%

| | 30.0

|

| | | | | | | | | |

MM-13

| 298

| -56

| 135 m

| 0

| 135.0

| 135 m

| 0.02%

| | 3.0

|

| | | | | | | | | |

MM-15

| 255

| -45

| 257 m

| 0

| 257.0

| 257 m

| 0.05%

| | 4.3

|

includes

| | | | 137.2

| 161.6

| 24.4 m

| 0.09%

| | 12.3

|

| | | | | | | | | |

MM-16

| 042

| -45

| 111.2 m

| 0

| 111.2

| 111.2 m

| 0.06%

| -

| 3.08

|

In October 2011, MAX commenced a Phase II core drilling program at Majuba Hill. Four holes were drilled to test new target areas identified during mapping, data compilation and soil sampling conducted over a surface area in excess of 5,500 by 2,500 m during 2011. The first hole of the Phase II program, MM-17 was drilled 730 m southeast of Phase I drilling (see the listing of drill results in the table above) and intercepted 42.7 m of 16.8 g/t Ag, 13.7 m of 15.9 g/t Ag and 6.16 m of 51.0 g/t Ag, indicating that this target area may be the extension of the high grade supergene oxide mineralization identified during Phase I drilling.

Two drill holes, MM-18 and MM-19, were drilled 1.4 km to the northwest of Phase I drilling to follow up on a high grade copper/silver soil anomaly approximately 1.5 km long by 500 m wide identified near the past producing DeSoto silver mine that returned values as high as 1.53% Cu and 209 g/t Ag in soils. Hole MM-18 was drilled to a depth of 146 m and intercepted 29.2 meters of 30.5 g/t Ag and 0.69% Cu starting at 21.9 m from surface. Hole MM-19 was drilled at the same location as hole MM-18 at an angle of –45 to the southeast, whereas hole MM-18 was drilled at the same angle to the northwest, and intercepted 3.6 m of 14.3 g/t Ag and 0.45% Cu within ten feet of surface.

The final hole of the Phase II program, MM-20, intercepted 293 m of 5.49 g/t Ag, 0.10 g/t Au and 0.09% Cu in sulfide mineralization in a porphyry-style alteration zone below the high grade Ag/Cu/Au oxide zone identified during Phase I drilling. Gold mineralization grading 0.145 g/t Au, along with 6.3 g/t Ag and 0.13% Cu, was intercepted over the final 116 m of Hole MM-20, which was still in mineralization when terminated at the planned target depth. The increase in gold, copper and molybdenum mineralization at depth and the long intersections of mineralization add more evidence that Majuba Hill is an extensive copper/silver/gold porphyry system.

Having discovered the primary zone of porphyry mineralization below Majuba Hill, MAX concentrated its 2012 exploration activity on defining the high grade supergene (oxide) system located above this zone. The initial hole of the Phase III program, MM-21, was drilled to a depth of 351 m and tested a ridge of high grade oxide mineralization identified during geologic exploration in 2011 that appears to extend a further 500 m to the southeast to the “Ball Park” area, where hole MM-17 intercepted 42.7 m of 16.8 g/t Ag, 13.7 m of 15.9 g/t Ag and 6.16 m of 51.0 g/t Ag. On completion of hole MM-21, the drill rig was moved to the DeSoto zone 1.4 km to the northwest and seven holes were drilled to follow-up on the discovery hole at DeSoto, MM-18. Core from this program was split, logged and submitted to Inspectorate in Reno for assay.

Assays results from the first hole of the program, MM-21, were announced on September 11, 2012. Hole MM-21 intercepted 4.6 m @ 58.0 g/t Ag and 7.6 m @ 0.80% Cu within an overall mineralized intercept of 332 m @ 12 g/t Ag and 0.13% Cu (23.9 g/t silver equivalent (“AgEq”)) in oxides that began within 12 m of surface. Hole MM-21 was collared approximately 250 m southeast of the middle portal of the past-producing Majuba Hill mine, where Phase I drilling by MAX in 2011 intercepted long intervals of high grade silver and copper mineralization near surface.

Hole MM-21 confirms that a southeast trending ridge of high-grade oxide mineralization extends a further 500 m to the southeast from the Majuba Hill mine to the Ball Park target area. A map showing drilling locations from the 2011 exploration programs at Majuba Hill, as well as the location of MM-21, is available on our web site at www.maxresource.com.

18

Significant intervals from hole MM-21 are summarized in the following table:

| | | | | | | | | |

Hole

| Azimuth

| Angle

| Total Depth

| From (m)

| To

(m)

| Thickness (m)

| Cu

(%)

| Ag

(g/t)

| AgEq

(g/t)

|

MM-21

| 068

| -44

| 351.4 m

| 12.2

| 344.5

| 332.3 m

| 0.13%

| 12.0

| 23.9

|

includes

| | | | 50.3

| 131.1

| 80.8

| | 19.2

| |

includes

| | | | 56.4

| 61.0

| 4.6

| | 58.0

| |

includes

| | | | 259.1

| 266.7

| 7.6

| 0.80%

| 10.8

| |

includes

| | | | 263.7

| 266.7

| 3.0

| 1.16%

| 10.1

| |

includes

| | | | 242.4

| 291.1

| 48.7

| 0.32%

| 16.5

| 47.1

|

Note: Silver equivalent is calculated based on 100% metallurgical recovery and five-year historic metal prices of $24 U.S. for silver and $3 U.S. per pound for Copper.

In addition, MAX was able to acquire some of the data from drilling completed by the Minefinders Exploration group at Majuba Hill in 1974-5. This information was obtained from a reliable source but readers are cautioned that this information predates NI 43-101 and is not NI 43-101 compliant; it is provided for information purposes only and should not be relied upon. This data included Minefinders hole MF-01, which was drilled a further 250 meters to the southeast of hole MM-21 at an azimuth of 288 and a -54 angle to a total depth of 707 meters. Hole MF-01 was assayed on 3 meter intervals and contained 155.4 m @ 9.23 g/t Ag and 0.221% Cu starting at a down hole depth of 220 meters. Minefinders hole MF 2 was drilled at the same location as MAX’s hole MM-17 to a depth of 387 m and intercepted 30.5 m @ 0.60% Cu from 85.3 m to 115.8m. It also contained 91.4 m @ 11.2 g/t Ag from 42.7 m to 134.1 m, inclusive of 9.1 m @ 53.0 g/t. These drill results, combined with the results from our hole MM-21, serve to expand the known mineralized silver/copper zone for 500 m to the southeast and to a depth of at least 350 m from surface. We now believe that Majuba Hill is a significant porphyry system with a chalcocite blanket; the next phase of drilling at Majuba Hill will focus on the expansion of the known mineralized zone within this target area, now referred to as the “Majuba Ridge”.

In October, 2012, MAX announced assays from the seven core holes (521 m) drilled at the high grade silver/copper DeSoto soil anomaly, 1.4 km to the northwest of the main mineralized zone at the historic Majuba Hill mine in Nevada. These shallow step-out holes were drilled to test the extension of near-surface oxide mineralization at DeSoto, where the discovery hole, MM-18, intercepted 29.2 m of 30.5 g/t Ag and 0.69% Cu (98.3 g/t silver equivalent(“AgEq”)) in the fall of 2011. Significant copper and silver mineralization was intercepted in four of the seven holes drilled, confirming DeSoto as the second highly prospective mineralized zone to be identified by MAX at Majuba Hill project. Highlights of this drilling at DeSoto included 7.8 m @ 28.0 g/t Ag and 0.57% Cu (81.5 AgEq) in hole DSM-02 and 6.4 m @ 38.8 Ag and 0.70% Cu (105.1 g/t AgEq) in DSM-06.

Significant intervals from the DeSoto drilling are summarized in the following table:

| | | | | | | | | |

Hole

| Azimuth

| Angle

| Total Depth

| From (m)

| To

(m)

| Thickness (m)

| Cu

(%)

| Ag

(g/t)

| AgEq

(g/t)

|

DSM-01

| 059

| -45

| 128.8

| 71.6

| 73.1

| 1.5

| .50%

| 36.4

| 92.3

|

| | | | | | | | | |

DSM-02

| 125

| -45

| 66.3

| 3.0

| 4.7

| 2.7

| 0.58%

| 17.7

| 72.7

|

| | | | 46.5

| 54.3

| 7.8

| 0.57%

| 28.0

| 81.5

|

Includes

| | | | 52.8

| 54.3

| 1.5

| 2.13%

| 101.9

| 342.2

|

| | | | | | | | | |

DSM-04

| 310

| -64.3

| 16

| 9.1

| 10.7

| 1.6

| 0.34%

| 18.5

| 50.6

|

| | | | | | | | | |

DSM-06

| 115

| -45

| 31.0

| 6.1

| 7.6

| 1.5

| 0.39%

| 26.0

| 63.2

|

| | | | 19.5

| 25.9

| 6.4

| 0.70%

| 38.8

| 105.1

|

Includes

| | | | 19.5

| 21.0

| 1.6

| 1.26%

| 81.7

| 200.8

|

Includes

| | | | 24.1

| 25.9

| 1.8

| 1.47%

| 65.6

| 204.6

|

Note: Silver equivalent is calculated based on 100% metallurgical recovery and five-year historic metal prices of $24 U.S. for silver and $3 U.S. per pound for Copper.

Hole DSM-02 was drilled 200 m northwest of the DeSoto discovery hole, MM-18, and intercepted 7.8 m @ 28 g/t Ag and 0.57% Cu (81.5 g/t AgEq), inclusive of 1.5 m of 101.9 g/t Ag and 2.13 % Cu. A further 310 m to the northwest, hole DSM-06 intersected a separate mineralized zone that included intervals of 1.6 m @ 81.7 g/t Ag and 1.26% Cu and 1.8 m @ 65.6 g/t Ag and 1.47% Cu within 26 m of surface. This initial shallow drilling indicates the presence of high grade copper and silver mineralization in the Auld Lang Syne formation at DeSoto and has provided us with a better understanding of the structural fabric of the system and the depositional environment. We believe that DeSoto is a replacement system within the Auld Lang Syne formation; detailed structural mapping and sampling will focus on the direction and mineralogy of mineralization at DeSoto and its relationship to the Majuba diking and main intrusive system on the Majuba property prior to resumption of drilling.

Analysis was performed by Inspectorate American Corp. Laboratories, an ISO certified facility in Reno, Nevada, using fire assay and multi-element (ICP-ES) techniques producing assays for a 49 element suite of minerals. Standards, duplicates and blanks were used for quality control of the samples. After the core is logged for each drill hole, the location of each site is located using a GPS in UTM coordinates using NAD 27 datum. The core is then split and put into a sample bag which is labelled for each interval and a sample card tag put in each sample bag and taken from the core facility to the Inspectorate Laboratories.

On March 4 2013, the Company announced the preliminary report by John Fox, P.Eng., Consulting Metallurgical Engineer of Laurion Consulting Inc., on the test work carried out on samples from Majuba Hill by Inspectorate Exploration & Mining Services in Richmond, B.C.

A total of fourteen samples of assay sample reject material (crushed to 6 mesh) were received at Inspectorate and these were made into a single composite weighing 58 kg. A sub sample was taken for head analysis and indicated a grade of 0.62% Cu and 34.6 g/t Ag.

A series of bottle roll acid tests were carried out with sulphuric acid at pH 1.3 on material running 6 mesh and on material ground to 200 mesh. After 14 days of leaching the copper extraction was 81.1% and 84.6% respectively. These results indicate the potential for heap leaching copper in a relatively short leach cycle, with acid consumption modest at 25kg/t, which is in line with expectations.

Leach testing was also conducted with thiosulphate over a six hour period and 24 hour period. Leaching was carried out at pH8 on the two samples, 6 mesh (un-ground) and 200 mesh. Silver extraction of 73.4% was achieved on ground material, which was 30% higher than on un-ground material. Thiosulphate leaching is normally very rapid; the difference between ground and un-ground leach recoveries may disappear over a longer leach cycle. Moreover, the silver leach value has not been optimized and it is expected that silver recovery may increase with longer leach times.

While cyanide leaching of sulfuric acid leach residue was also undertaken and gave about a 70% recovery, the thiosulphate leach route may be preferred because of reduced reagent costs (less lime required to neutralize acid to pH8 rather than pH10, and less consumption of lixivient as thiosulphate is not consumed leaching excess copper) as well as for environmental considerations.

On February 5, 2014 MAX announced that it has identified and mapped a ridge of high grade copper/silver mineralization at Majuba Hill that will be drill tested as soon as weather permits. This high grade mineralization sampled at surface and in a short adit has been intersected at depth by MAX during drilling in 2012 (hole MM-21) and Minefinders in 1975 (MF-1) and was identified during review of sampling results recorded by a prior operator, Minterra Resources, in 2007 and never reported in their entirety. MAX has now mapped the high grade samples and they highlight a zone 250 meters across that outcrops on Majuba Ridge. The samples highlighted on this map include:

Sample Number

Cu

Ag

MHR-160

2.9%

32 g/t

MHR-157

3.0%

38 g/t

MHR-158

4.07%

32 g/t

MHR-159

2.95%

29 g/t

MHR-25

7.72%

90 g/t

MHR-26

2.16%

53 g/t

MHR-145

4.16%

174 g/t

MHR-27

1.42%

19.6 g/t

The location of these samples is provided on a map available on our web site at www.maxresource.com.

MAX’s drill hole MM-21 is located approximately 250 m southeast of the middle portal of the past producing Majuba Hill mine, where MAX drilling in 2011 high grade copper/silver supergene oxide mineralization over long intervals. Hole MM-21 was drilled at -45 and an azimuth of 068 and intercepted 332 m @ 12 g/t Ag and 0.13% Cu beginning at 12 m from surface and appears to have intersected the surface mineralization identified above at depth.

According to data obtained by MAX, Minefinders Exploration drilled hole MF-1 a further 250 meters to the southeast of hole MM-21 at an azimuth of 288 and a -54 angle to a total depth of 707 meters. This information was obtained from a reliable source but readers are cautioned that this information predates NI 43-101 and may not be NI 43-101 compliant; it is provided for information purposes only and should not be relied upon. No qualified person has verified the information on behalf of MAX. Hole MF-01 was assayed on 3 meter intervals and contained 155.4 m @ 9.23 g/t Ag and 0.221% Cu starting at a down hole depth of 220 meters. Minefinders hole MF 2 was drilled at the same location as MAX's hole MM-17 to a depth of 387 m and intercepted 30.5 m @ 0.60% Cu from 85.3 m to 115.8m. It also contained 91.4 m @ 11.2 g/t Ag from 42.7 m to 134.1 m, inclusive of 9.1 m @ 53.0 g/t. These drill results, combined with the results from our hole MM-21, serve to expand the known mineralized silver/copper zone for 500 m to the southeast and to a depth of at least 350 m from surface. A map showing drilling locations from previous exploration programs at Majuba Hill, as well as the location of MM-21 and MF-1, is available on our web site at www.maxresource.com.

Twenty nine (29) rock select, chip, and grab samples were taken from outcropping mineralization, historic prospect pits, and an underground adit in this area of Majuba Ridge. Values obtained ranged from 80 ppm Cu and 2.65 ppm Ag to 7.72% Cu and 174 ppm Ag. This sampling was completed in 2007 by Buster Hunsaker, P.Geo, who is a "qualified person" as that term is defined under National Instrument 43-101 and has reviewed the technical information in this news release.

Drilling at Majuba Hill commenced in late May, 2014 with one hole drilled and the assay results announced on June 25, 2014. This hole, MMX-24, was drilled to a depth of 365.8 metres (“m”) and intercepted 222.6 m @ 0.27% Cu and 10.1 g/t Ag, inclusive of 117.4 m @ 0.43% Cu and 12.0 g/t Ag. MMX-24 was drilled roughly parallel to and 85 m northwest and 25 m below the collar of MAX’s hole MM-21, drilled in 2012, which intersected 332 m @ 0.13% Cu and 12 g/t Ag.

Drill hole MMX-24 was drilled from the opposite side of Majuba Ridge as hole MM-21 and successfully tested the down-dip extension of copper/silver mineralization intercepted by MM-21, hole DDH-4 drilled by Freeport in 1940’s, and hole MF-1 drilled by Minefinders in 1974. The alteration of the mineralization is mainly potassium feldspar and quartz and the probable copper mineralization is chalcocite and the silver mineral acanthite and or chloargyrite. Alteration is increasing as the holes are extended to depth and appear to be continuous. MMX-24 and MM-21 both intersected mineralization exposed at surface as copper oxides running as high as 7.72% Cu (see our news release of February 5, 2014).

MMX-24 was collared approximately 415 m east-northeast of the middle portal of the past producing Majuba Hill mine, where MAX drilling in 2011 intercepted high grade copper/silver supergene oxide mineralization over long intervals that included:

·

Hole MM-07: 50.3 m of 50.8 g/t Ag, 0.31 g/t gold and 0.31% Cu

·

Hole MM-06: 96.0 m of 39.2 g/t Ag and 0.57% Cu, including 44.2 m of 71.0 g/t Ag, 0.15 g/t Au and

1.14% Cu

·

Hole MM-03: 42.7 m of 37.5 g/t Ag and 0.38% Cu

Significant intervals from MMX-24 are summarized in the following table:

| | | | | | | | |

Hole

| Azimuth

| Angle

| Total Depth

| From (m)

| To

(m)

| Thickness (m)

| Cu

(%)

| Ag

(g/t)

|

MMX-24

| 235.6

| -43.9

| 365.8 m

| 114.3

| 336.9

| 222.6 m

| 0.27%

| 10.1

|

| | | | | | | | |

includes

| | | | 219.5

| 336.9

| 117.4 m

| 0.43%

| 12.0

|

includes

| | | | 219.5

| 288.1

| 68.6 m

| 0.61%

| 11.6

|

Maps indicating the location of this drill hole as well as locations from previous programs at Majuba Hill are available on our web site at www.maxresource.com.

Analysis was performed by Bureau Veritas (Inspectorate), an ISO certified facility in Reno, Nevada, using multi-element method MA330 (ICP-ES) techniques producing assays for a 30 element suite of minerals. Over-limit analyses were performed according to procedure MA410. No analysis was conducted for gold. Standards, duplicates and blanks were used for quality control of the samples. After the core is logged for each drill hole, the location of each site is located using a GPS in UTM coordinates using NAD 83 datum. The core is then hydraulically split and put into a sample bag which is labelled for each interval and taken from the core facility to the Bureau Veritas laboratory.

During the year ended December 31, 2013, the Company incurred $49,914 for geological consulting fees, $7,381 for assaying and $6,931 for field expenses on the Majuba Hill project.

During the six months ended June 30, 2014, the Company incurred $45,060 for geological consulting fees, $74,937 for assaying, and $27,884 for field expenses on the Majuba Hill project.

East Manhattan Wash gold project, Nye County, Nevada

In December, 2007, MAX entered into an Option Agreement to acquire a 100 % interest in the East Manhattan Wash (“EMW”) claims in the Manhattan Mining District, Nye County, Nevada from MSM LLC, a Nevada corporation. The EMW property is comprised of 78 claims (1,560 acres) located 40 miles north of the town of Tonopah.

During June 2014, MAX received approval from the U.S. Forest Service to begin drilling at EMW after July 15, 2014. Drilling commenced July 19, 2014 and targeted a surface soil anomaly exposed over a surface area in excess of 1,650 m by 450 m that was identified by soil sampling programs that were conducted by MAX between 2009 and 2013. Mineralization appears to be free gold in a volcanic lithic welded tuff that will be drill tested to determine the overall depth of the gold mineralization, extend the known mineralization below cover, and determine the overall grade. This shallow seven hole drill program was completed in early August, with assay results pending.

Exploration History

More than 1,000,000 ounces of gold have been mined in the Manhattan Mining District. Production has included the nearby Manhattan mine (1974-1990), an open-pit operation that produced 236,000 ounces of gold at an average grade of 0.08 ounce per ton (“opt”). The Echo Bay East and West Pit deposits operated in the early 1990s, producing 260,000 ounces at an average grade of 0.06 opt. The Round Mountain Mine (Kinross/Barrick), situated eight miles north of East Manhattan Wash, is a conventional open pit operation that has produced more than 12 million ounces of gold to date.

In March 2009, the Company announced the results of the first large (bulk) sample taken from the EMW claims. This bulk sample weighed 793 pounds and was crushed to particles of less than 1 millimetre in size. The sample was then processed on a Wilfley Table to concentrate the heavy minerals. From this concentrate, a fired bead was made to produce a gold/silver “button”. This button, which weighed 2.67 grams, was then analyzed using a NITON x-ray analyzer and was found to contain approximately 80% gold and 20% silver. On a per ton basis, this is equivalent to 6.1 grams of gold/silver per ton, or 4.9 g/t gold and 1.2 g/t silver.

Following up the results of the bulk sample, MAX completed three large volume soil sampling grids in May of 2009 at EMW. The sampling program was designed to delineate the geometry of the native gold mineralization in three areas of interest. Significant values in the samples that were taken ranged from 0.05 ppm to 0.32 ppm gold with two of the zones being open in at least three directions.

The first two grids are located in a volcanic rhyolite lithic tuff hosting coarse gold. These areas, the “Gold Pit” and the “Old Drill Hole” grids, were sampled first by clearing a 1 meter by 1 meter area of surface debris then removing the organic (A) and root (B) soil horizons in turn. The sample was collected and consisted of a mixture of the soils directly above the bedrock (C horizon) and a portion of the bedrock below the soil. The sample was then sieved to ¼ inch minus then bagged.

These holes ranged from 12 inches to 48 inches in depth. Each hole location was identified with a 16 inch wooden stake labelled with an aluminum tag and backfilled to minimize disturbance. This technique was used to look at a small representative area and obtain any coarse gold trapped in the bedrock fractures.

In the first area, the Old Drill Hole grid, 30 samples were taken. The values ranged from nil to 0.32 ppm gold. The mineralized zone was 1200 feet long and 600 feet wide and was open in all four directions. Further work was undertaken to define the full areal extent of mineralization in this zone.

At the Gold Pit grid, located approximately 500 feet west of the Old Drill Hole grid, the area of significant mineralization was 1000 feet long by 250 feet wide. Again, the values range from nil to 0.32 ppm Au. The geology of the “Gold Pit” area consists of lithic rhyolitic and lapilli tuffs. These tuffs are locally argillically altered with minor local silicification.

A metallurgical sample was also taken and the entire sample contained 0.018 opt Au. This sample was found to contain visible native gold in the concentrate, middling’s, and the reject, with equal values in each of the three sizes. The gold found is from fine to coarse grained in size and did not seem to be in any one size fraction.

In early November 2009, MAX received the assays from additional soil sampling completed at EMW. The sampling was designed to further delineate the geometry of the native gold mineralization in the two main areas of interest, the “Gold Pit” and the “Old Drill Hole Grid”, which sampling now indicates are joined. A total of 138 samples were taken, with significant values ranging from 0.05 ppm to 1.5 ppm (1.5 g/t) gold. The total mineralized zone now encompasses an area 5,500 by 1,500 feet in size while still remaining open to the north, east, and west.

MAX staff also sampled historic prospector pits to the southeast of the Old Drill Hole Grid and returned high gold values (0.96 g/t) from soils around the pits that indicate that the mineralized zone continues and may be linked to another mineralized zone sampled by MAX further south, the “Southeast Extension”.

In September 2010, MAX completed additional soil sampling that was designed to further delineate the geometry of the native gold mineralization at EMW, which previously encompassed the “Gold Pit”, the “Old Drill Hole Grid” and now includes the “Southeast Extension”. This sampling has filled in the open areas within these grids, where 163 new samples were taken with significant values ranging from 0.05 ppm to 1.27 ppm (1.27 g/t) gold. While the total mineralized zone now exposed at surface encompasses an area in excess of 1,650 m by 450 m in size, the mineralized area is much larger but is covered by either overburden or alluvium.

The Gold Pit, Old Drill Hole Grid and Southeast Extension are located in a volcanic rhyolite lithic tuff hosting coarse gold. The sampling between the three pits has now enabled MAX to identify structural linear features seen in air photo images along with argillic alteration that appears to define where strong gold values may be found. Historic pits dug by earlier prospectors have helped to define the areas of mineralization and to confirm the presence of gold. A soil sampling map is available on our web site at www.maxresource.com.

In August 2013 MAX announced assay results from additional bulk sampling completed at EMW. This bulk sampling was undertaken to prepare for drilling planned for this fall, subject to permitting. Just north of this area, the very small streams all contain free gold that can be recovered by conventional gold panning techniques. During the current program, two 10 kg samples were taken, one from the same area as the 2009 bulk sample and the second from an area approximately 150 meters to the east. The first 10 kg sample returned 1.5 g/t au and the second sample returned 0.87 g/t Au.

During June 2014, MAX received approval from the U.S. Forest Service to begin drilling at its East Manhattan Wash gold project in Nevada after July 15, 2014. Drilling commenced July 19, 2014 and targeted a surface soil anomaly exposed over a surface area in excess of 1,650 m by 450 m that was identified by soil sampling programs that were conducted by MAX between 2009 and 2013. Mineralization appears to be free gold in a volcanic lithic welded tuff that will be drill tested to determine the overall depth of the gold mineralization, extend the known mineralization below cover, and determine the overall grade. This shallow seven hole drill program was completed in early August, with assay results pending.

During the year ended December 31, 2013, the Company incurred $28,653 for geological consulting fees, $2,534 for assaying costs and field expenses of $2,013 on the East Manhattan project.

During the six months ended June 30, 2014, the Company incurred $5,567 for geological consulting fees and $2,400 for assaying costs on the East Manhattan project.

Private placement

During the six months ended June 30, 2014, the Company completed a non-brokered private placement of 6,320,000 units at $0.05 per unit for gross proceeds of $316,000. Each unit is comprised one common share and one share purchase warrant. Each warrant entitles the holder to purchase one additional common share at an exercise price of $0.12 per share until March 26, 2016. If at any time prior to the expiry date of the warrants, the closing price of the common shares of the Company on the TSX Venture Exchange (“TSX-V”) is equal to or greater than $0.25 for 30 consecutive days, then the Company may elect to provide notice to the warrant holders that the warrants will expire 30 days from the date of the notice. Finders’ fees of $6,650 and 133,000 share purchase warrants, valued at $4,289, were paid in connection with this private placement. Each share purchase warrant is exercisable at $0.12 into one common share for a two year period.

The net proceeds from this private placement were used to fund exploration activities conducted this spring and summer at the Company’s Majuba Hill (silver/copper/gold) and East Manhattan Wash (gold) projects in Nevada and for general working capital.

19

Grant of incentive stock options

During May 2014, MAX granted incentive stock options the will enable the holders to acquire up to 2,300,000 common shares at a price of $0.10 per share until May 7, 2016.

A total of 1,700,000 of these options were granted to directors and consultants and vest immediately. The remaining 600,000 incentive stock were granted to Paradox Public Relations Inc., the Company’s investor relations consultants, and are subject to vesting provisions in accordance with TSX-V policies.

Results of Operations