Glencore Buys Stakes in Brazilian Aluminum Companies for $775 Million

27 April 2023 - 5:08PM

Dow Jones News

By Joe Hoppe

Glencore PLC said Thursday that it has agreed to acquire a 30%

stake in Alunorte SA and a 45% equity stake in Mineracao Rio do

Norte SA from Norsk Hydro ASA for a total of $775 million.

The FTSE 100-listed commodity mining and trading company said

the binding agreement to acquire the noncontrolling stakes is based

upon a proportionate look through enterprise value and a net debt

of $335 million as of March 31.

Based on Alunorte's performance and certain post-closing

adjustments, the total payment on completion including earnouts is

expected to be around $700 million. Completion is expected in the

second half of the year.

The acquisition is conditional on customary regulatory

approvals.

Glencore won't be the operator of either asset but will have

offtake rights for the life of mine from both Alunorte and MRN.

"The acquisition of the equity stakes in Alunorte and MRN

provide Glencore with exposure to lower-quartile carbon alumina and

bauxite, enhancing our capability to supply [aluminum] for the

ongoing energy transition to our customers," said Robin Scheiner,

Glencore's head of alumina and aluminum.

Alunorte is the world's largest alumina refinery outside China,

located in Bacarena, Brazil, while MRN is a bauxite mine in

Trombetas, Brazil.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

April 27, 2023 02:53 ET (06:53 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

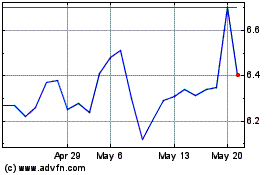

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Jan 2025 to Feb 2025

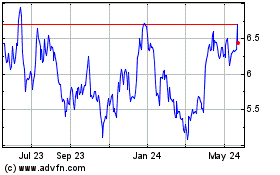

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Norsk Hydro ASA (QX) (OTCMarkets): 0 recent articles

More Norsk Hydro ASA (QX) News Articles