Biotech Stock Closing in on Human

Trials

May 17, 2019 -- InvestorsHub NewsWire -- Microcap Speculators --

Growth based biotech stocks are one of the few sectors that aren’t

negatively affected by Trump’s trade war. Below are a few to

start your research on.

One company getting closer to a human trial, Propanc

Biopharma, Inc. (USOTC:

PPCB), initiated development of a bio-analytical assay

intended to quantify the active ingredients of the company's lead

product candidate, PRP, in preparation for human trials in March

‘19. This is just one step closer for a company that has been

making steady progress over the past year or so.

The companies we’re highlighting today include:

Propanc Biopharma, Inc. (USOTC:

PPCB), Aurora Cannabis, Inc. (NYSE:

ACB), ImmunoGen, Inc. (NASDAQ:

IMGN), PDS Biotechnology Corporation (NASDAQ:

PDSB), and Advaxis, Inc. (ADXS).

Propanc Biopharma, Inc. (USOTC:

PPCB)

(Market Cap:

$3.155M;

Share Price:

$0.0078), a

clinical stage biopharmaceutical company focusing on development of

new and proprietary treatments for cancer patients suffering from

solid tumors such as pancreatic, ovarian and colorectal cancers,

was granted FDA Orphan Drug Designation status for its PRP

treatment of pancreatic cancer almost a year back. This

qualifies the company for seven-year FDA-administered market Orphan

Drug Exclusivity (ODE), tax credits of up to 50% of R&D costs,

potential for R&D grants, waived FDA fees, protocol assistance

and possible clinical trial tax incentives if conducted in the

U.S. The company is also close to first-in-human studies.

PPCB announced that the company has appointed Dr.

Ralf Brandt to its Scientific Advisory Board (SAB). He

will provide significant translational research expertise and

clinical support advisory support services to the company's drug

development pipeline.

PPCB is developing a novel approach to prevent recurrence and

metastasis of solid tumors by using pancreatic proenzymes that

target and eradicate cancer stem cells in patients suffering from

pancreatic, ovarian and colorectal cancers.

PPCB has a growing patent portfolio that larger healthcare

companies could be very interested in. It is among many

biotech’s that could be considered a bit oversold due to current

market conditions.

________

Aurora Cannabis, Inc. (NYSE:

ACB) (Market Cap: $9.134B; Share Price:

$8.89) reported a 20% jump in quarterly net revenue

on Tuesday, as Canada's legalization of recreational cannabis late

last year boosted demand.

The Edmonton, Alberta-based company's net revenue rose to C$65.2

million ($48.44 million) from C$54.2 million ($40.27 million) in

the second quarter. ($1 = 1.3459 Canadian dollars).

________

ImmunoGen, Inc. (NASDAQ:

IMGN) (Market Cap:

$294.576M;

Share Price:

$1.97) plunged more than

30% on Wednesday after the company revealed that the U.S. Food and

Drug Administration has recommended further trials to "evaluate the

safety and efficacy" of one of its cancer-fighting

treatments. ImmunoGen said in statement that it had requested

a meeting with FDA officials to discuss the results of its Phase 3

FORWARD I trial and a potential path to registration for

mirvetuximab monotherapy - a treatment it has been developing for

patients with certain forms of ovarian cancer.

________

PDS Biotechnology Corporation (NASDAQ:

PDSB) (Market Cap: $41.288M; Share

Price: $7.72) announced a peer-reviewed publication

supporting the novel mechanisms of action of its proprietary

Versamune® platform in cancer immunotherapy. The

article “Antigen Priming with Enantiospecific Cationic Lipid

Nanoparticles Induces Potent Antitumor CTL Responses through Novel

Induction of a Type I IFN Response” was published online on

May 3, 2019 in the Journal of Immunology, and describes the way

PDS’ Versamune® platform recruits and activates killer T-cells

to recognize and effectively attack cancer cells while

simultaneously making cancer cells more susceptible to T-cell

attack. The article will appear in print in the June 2019

issue of the Journal.

________

Advaxis, Inc. (ADXS) (Market Cap: $24.178M; Share

Price: $3.02), a late-stage biotechnology

company focused on the discovery, development and commercialization

of immunotherapy products, today announced that the U.S. Food and

Drug Administration (FDA or Agency) has lifted the partial clinical

hold on AIM2CERV, the company’s Phase 3 clinical trial of

axalimogene filolisbac (AXAL) for the treatment of patients with

high-risk locally advanced cervical cancer. In its letter,

the FDA acknowledged that the company satisfactorily

addressed all hold questions.

Legal Disclaimer:

This article was written by Regal Consulting, LLC (“Regal

Consulting”). Regal Consulting expects to be paid $3,000 for

the article directly from PPCB. All payments were made

directly by Propanc Biopharma, Inc. (USOTC:

PPCB) to Regal Consulting, LLC. to provide investor

relations services, of which this article is a part of. Regal

Consulting also paid one thousand dollars cash to

microcapspeculators.com to distribute this article. Regal

Consulting may have a position in the securities mentioned in this

article at the time of publication, and may increase or decrease

its position without notice. This article is based on public

information and the opinions of Regal Consulting. PPCB was given an

opportunity to edit this article. This article contains

forward-looking statements that are subject to certain risks and

uncertainties that could cause actual results to differ materially

from any results predicted herein. Regal Consulting is not

registered with any financial or securities regulatory authority,

and does not provide or claim to provide investment advice.

http://www.regalconsultingllc.com/full

legal disclaimer/

Full Legal Disclaimer Click Here.

Contact Information:

Company Name: ACR Communication LLC.

Contact Person: Media Manager

Email: info@microcapspeculators.com

Phone: 1-702-720-6310

Country: United States

SOURCE: Microcap Speculators

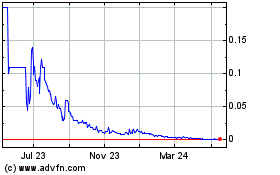

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

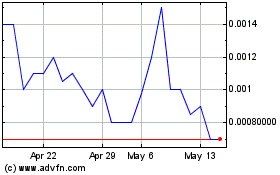

Propanc Biopharma (PK) (USOTC:PPCB)

Historical Stock Chart

From Jan 2024 to Jan 2025