SSE 1Q Profit Hit by GBP80 Million After Warm Weather Reduces Gas Demand

19 July 2018 - 4:53PM

Dow Jones News

By Adam Clark

SSE PLC (SSE.LN) said Thursday that its adjusted operating

profit for the first quarter was 80 million pounds ($104.5 million)

lower than expected, hit by low renewable-energy production and

reduced gas demand.

"In addition to dry, still and warm weather, the financial year

so far has also been characterized by persistently high gas prices.

All of this has resulted in a higher cost of energy,

lower-than-expected output of electricity from renewable sources

and lower volumes of energy being consumed," SSE said.

The U.K. energy supplier said hydro output was 20% lower than

planned in the quarter to June 30, and wind output was 15% lower

than planned. Meanwhile, domestic gas demand was 10% lower than

expected.

SSE said the first-quarter underperformance may hit its

full-year results, depending on market conditions. However, the

company reiterated its intention to recommend a full-year dividend

of 97.5 pence a share for fiscal 2019, up 3% from the prior

year.

In May, SSE reported a 39% fall in pretax profit for fiscal 2018

to GBP1.09 billion, despite an 8% rise in revenue to GBP31.23

billion.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

July 19, 2018 02:38 ET (06:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

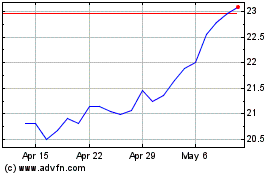

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Apr 2024

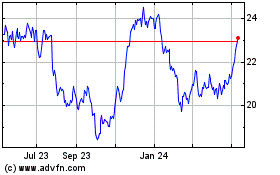

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Apr 2023 to Apr 2024