UNITED STATES

SECURITIES AND ECHANGE COMMISSION

Washington, C.D. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the

Securities Exchange Act of 1934

Amendment No.1

Check the appropriate box:

[X] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as

permitted by Rule 14c-5(d)2))

[ ] Definitive Information Statement

TRANSAKT LTD.

(Name of

Registrant as Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] |

No fee required |

| |

|

| [ ] |

Fee computed on table below per Exchange Act Rules

14c-5(g) and 0-11 |

| |

|

| 1. |

Title of each class of securities to which transaction

applies: |

| |

|

| 2. |

Aggregate number of securities to which transaction

applies: |

| |

|

| 3. |

Per unit price or other underlying value of transaction,

computed pursuant to Exchange Act Rule O- 11 (Set forth the amount on

which the filing fee is calculated and state how it was determined):

|

| |

|

| 4. |

Proposed maximum aggregate value of transaction:

|

| |

|

| 5. |

Total fee paid: |

| |

|

| [ ] |

Fee paid previously with preliminary materials.

|

| |

|

| [ ] |

Check box if any part of the fee is offset as provided by

Exchange Act Rule O-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| 1. |

Amount Previously Paid: |

| |

|

| 2. |

Form Schedule or Registration Statement No.: |

| |

|

| 3. |

Filing Party: |

| |

|

| 4. |

Date Filed: |

- 2 -

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to

Regulation 14C of the Securities Exchange Act of 1934 as amended

TRANSAKT LTD.

Unit 8, 3/F., Wah Yiu Industrial

Centre, 30-32 Au Pui Wan Street, Fo Tan,

N.T. Hong Kong

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE

REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of

Directors of TransAKT Ltd., a Nevada corporation (“we”, “our”, “us”, the

“corporation"), to the holders of record at the close of business on the record

date, November 9, 2015 of our outstanding common stock, $0.001 par value per

share, pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of

1934, as amended. This Information Statement is being furnished to such

stockholders for the purpose of informing the stockholders in regards to:

| |

• |

the approval of a reverse stock split of our issued and

outstanding shares on the basis of up to 20 old shares for 1 new share, to

be implemented at the discretion of the Board of Directors by November 9,

2016 (the "Reverse Stock Split"); no fractional shares will be

issued in connection with the Reverse Stock Split, in the case of a

fractional share, the fractional share will be rounded up;

|

Our Board of Directors (sole director) approved the Reverse

Stock Split on November 9, 2015.

On November 9, 2015, subsequent to the approval by our Board of

Directors of the Reverse Stock Split, the holder of the majority of the

outstanding shares of our corporation entitled to vote gave us written consent

for the Reverse Stock Split.

Following the expiration of the twenty-day (20) period mandated

by Rule 14c and the provisions of Chapter 78 of the Nevada Revised Statutes, and

subject to the prior approval of The Financial Industry Regulatory Authority

("FINRA"), our corporation intends to give effect to the Reverse Stock

Split. We will not give effect to the Reverse Stock Split until at least twenty

(20) days after the filing and mailing of this Information Statement and subject

to the prior approval of FINRA . Although stockholders have approved the Reverse

Stock Split, we may abandon or delay the Reverse Stock Split if our Board of

Directors determines that it is no longer in the best interests of our

corporation or our stockholders. If the Reverse Stock Split is not implemented

by our Board of Directors by November 9, 2016, the proposal will be deemed

abandoned, without further effect. In that case, our Board of Directors may

again seek stockholder approval at a future date if it deems a reverse stock

split to be advisable at that time.

If our Board of Directors decides to implement the Reverse

Stock Split, it will become effective upon approval of The Financial Industry

Regulatory Authority ("FINRA").

Record Date and Expenses

The entire cost of furnishing this Information Statement will

be borne by our corporation. We will request brokerage houses, nominees,

custodians, fiduciaries and other like parties to forward this Information

Statement to the beneficial owners of our common stock held of record by them.

- 3 -

Our Board of Directors has fixed the close of business on

November 9, 2015 as the record date for the determination of shareholders who

are entitled to receive this Information Statement. There were 613,447,306

shares of our common stock outstanding on November 9, 2015 and no preferred

shares outstanding. We anticipate that a definitive copy of this Information

Statement will be mailed on or about December 18, 2015 to all shareholders of

record as of the record date.

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY

STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE

AMENDMENT TO OUR ARTICLES OF INCORPORATION.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT

TO SEND US A PROXY.

PLEASE NOTE THAT THIS IS NOT AN OFFER TO PURCHASE YOUR SHARES.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS

TO BE ACTED UPON

Except as disclosed elsewhere in this Information Statement,

since January 1, 2014, being the commencement of our last financial year, none

of the following persons has any substantial interest, direct or indirect, by

security holdings or otherwise in any matter to be acted upon:

| 1. |

any director or officer of our corporation; |

| |

|

| 2. |

any proposed nominee for election as a director of our

corporation; and |

| |

|

| 3. |

any associate or affiliate of any of the foregoing

persons. |

The shareholdings of our directors and officers are listed

below in the section entitled "Principal Shareholders and Security Ownership of

Management". To our knowledge, no director has advised that he intends to oppose

the Amendment, as more particularly described herein.

PRINCIPAL SHAREHOLDERS AND SECURITY OWNERSHIP OF

MANAGEMENT

As of November 9, 2015, we had a total of 613,447,306 shares of

common stock ($0.001 par value per share) issued and outstanding.

The following table sets forth, as of November 9, 2015, certain

information with respect to the beneficial ownership of our voting securities by

each stockholder known by us to be the beneficial owner of more than 5% of our

voting securities and by each of our current directors and executive officers.

Each person has sole voting and investment power with respect to voting

securities, except as otherwise indicated. Beneficial ownership consists of a

direct interest in the voting securities, except as otherwise indicated.

Name and Address of Beneficial Owner |

Amount and Nature of

Beneficial Ownership |

Percentage

of

Class(1) |

James Wu

Former President, Chief Executive

Officer,

and Director (3)

2 FL NO 28 Lane

231 Fu-Hsin N Rd

Taipei, Taiwan |

17,485,862 |

2.85%

|

Cheng Chun-Chih

Former Director (Chairman of Taiwan

Halee

International Co. Ltd.) (4)

NO 3 Lane

141 Sec 3 Pei-Shen Rd

Shen-Ken Hsiaung

Taipei Hsieng, Taiwan |

5,000,000 |

(2) |

Ho Kang-Wing

President, Chief Executive Officer,

and

Director

503 5F Silvercord Tower 2,

30 Canton

Rd

Tsimshatsui Kowloon, HKG |

25,000,000 |

4.08% |

Dr. Shiau Tzong-Huei

Former Director (Chief

Technical Officer of

Taiwan

Halee and Chairman of

TransAKT Taiwan

Corp.) (5)

NO 3 Lane 141 Sec 3

Pei-Shen Rd

Shen-Ken Hsiaung

Taipei Hsieng, Taiwan" |

1,000,000 |

(2) |

Taifen Day

Former Chief Financial Officer

(6)

420 12 Ave N.W.

Calgary, Alberta T2M 0C9

Canada |

Nil |

(2) |

Yam Chi-Wah

Chief Financial Officer

Flat E

7/F Block 21 Laguna City

Kwun Tong, Kowloon, Hong Kong |

2,500,000 |

(2) |

He Jingtian

Director

11 Jinghong Road Hujing

Garden

Daliang Shunde

528300 Foshan Gd

China |

28,000,000 |

4.564% |

He Jiaxian

Director

11 Jinghong Road Hujing

Garden

Daliang Shunde

528300 Foshan Gd

China |

15,000,000 |

2.45% |

Tam Yuk-Ching

Director

23 Sam Mun Tsai Road,

The Beverly Hills

Boulevard Du Lac, House 212, Tai Po, Nt

Hong

Kong |

28,000,000 |

4.564% |

All Directors and Executive Officers as a

Group |

121,985,862

Common

Shares |

19.89% |

| Name and Address of Beneficial Owner |

Amount and Nature of

Beneficial Ownership |

Percentage

of

Class(1) |

Liu Ju-Wen

2nd Floor-2 No 8 Lane 80 San-Min Rd

Song-San District

Taipei City, Taiwan |

39,119,400 |

6.38% |

| Other Shareholders |

39,119,400 Common

Shares |

6.38%

|

| |

(1) |

Based on 613,447,306 shares of common stock issued and

outstanding as of November 9, 2015. Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting and

investment power with respect to securities. Except as otherwise

indicated, we believe that the beneficial owners of the common stock

listed above, based on information furnished by such owners, have sole

investment and voting power with respect to such shares, subject to

community property laws where applicable. |

| |

|

|

| |

(2) |

Less than 1%. |

| |

|

|

| |

(3) |

James Wu served as our President, Chief Executive

Officer, and Director from October 25, 2004 until March 12,

2015. |

| |

|

|

| |

(4) |

Dr. Shiau Tzong-Huei served as our Director from December

14, 2006 until March 12, 2015. |

| |

|

|

| |

(5) |

Cheng Chun-Chih served as our Director from December 14,

2006 until March 12, 2015. |

| |

|

|

| |

(6) |

Taifen Day served as our Chief Financial Officer from

July 27, 2006 until March 12, 2015. |

REVERSE STOCK SPLIT

Action and Effect

Our Board of Directors approved the Reverse Stock Split so that

it may, at its option, during the next 12 months, consolidate our outstanding

shares, thereby potentially increasing the per share market value of our common

stock, which would make us more attractive as a business combination target.

However, in many cases, the market price of a corporation’s shares declines

after a reverse stock split.

On November 9, 2015, subsequent to the approval by Board of

Directors of the Reverse Stock Split, the holders of the majority of the

outstanding shares of our corporation entitled to vote gave us their written

consent to implement the Reverse Stock Split at the option of the Board of

Directors by November 9, 2016.

Although stockholders have approved the Reverse Stock Split, we

may abandon or postpone the proposal if our Board of Directors determines that

it is no longer in the best interests of our corporation or our stockholders. If

the Reverse Stock Split is not implemented by our Board of Directors by November

9, 2016, the proposal will be deemed abandoned, without further effect. In that

case, our Board of Directors may again seek stockholder approval at a future

date if it deems a reverse stock split to be advisable at that time.

If our Board of Directors decides to implement the Reverse

Stock Split, it will become effective upon approval of The Financial Industry

Regulatory Authority ("FINRA").

DISSENTERS RIGHTS

Under the General Corporation Law of the State of Nevada,

shareholders of our common stock are not entitled to dissenter's rights of

appraisal with respect to our proposed Amendment.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the

Exchange Act, and in accordance therewith file reports, proxy statements and

other information including annual and quarterly reports on Form 10-K and 10-Q

with the Securities and Exchange Commission (the “Commission”). Reports and

other information filed by us can be inspected and copied at the public

reference facilities maintained at the Commission at 100 F Street NW,

Washington, D.C. 20549. Copies of such material can also be obtained upon

written request addressed to the Commission, Public Reference Section, 100 F

Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains

a website on the Internet (http://www.sec.gov) that contains the filings of

issuers that file electronically with the Commission through the EDGAR system.

Signature

Dated: December 21, 2015

By Order of the Board of Directors

TRANSAKT LTD.

By: /s/ Ho Kang-Wing

Ho Kang-Wing

President, Chief Executive Officer and

Director

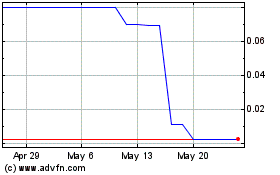

TransAKT (PK) (USOTC:TAKD)

Historical Stock Chart

From Oct 2024 to Nov 2024

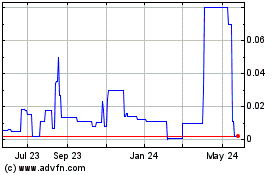

TransAKT (PK) (USOTC:TAKD)

Historical Stock Chart

From Nov 2023 to Nov 2024