Toshiba Mulls Sale Of Chip-Unit Stake

28 November 2015 - 7:02PM

Dow Jones News

(FROM THE WALL STREET JOURNAL 11/28/15)

By Takashi Mochizuki and Erikc Pfanner

TOKYO -- Toshiba Corp. on Friday said it is considering selling

a minority stake in its semiconductor business to raise funds in

the wake of a drawn-out accounting scandal.

The business, which sells memory chips to Apple Inc. and other

smartphone makers, has been Toshiba's main moneymaker in recent

years as the fortunes of its personal-computer,

consumer-electronics and nuclear operations have worsened.

Chief Executive Masashi Muromachi said at a news conference that

Toshiba would consider a stock-market listing or a transaction with

another company but would keep control of the operation. "It is a

core business for us, so we won't completely detach the business

from the group," he said, adding no sale is imminent.

The semiconductor business requires continuous investment to

maintain its competitiveness against rivals such as Samsung

Electronics Co. Meanwhile, Toshiba's ability to raise funds has

been squeezed by an accounting scandal.

After acknowledging that it had overstated profits by 155

billion yen ($1.3 billion) over seven years, Toshiba shook up its

management and board this summer. However, disclosures have

continued to trickle out.

Toshiba earlier this month said its U.S. nuclear unit,

Westinghouse Electric Co., booked $1.3 billion in previously

undisclosed impairment charges for its 2012 and 2013 fiscal years.

Though many analysts see Toshiba following suit with a similar

write-down, company executives on Friday reiterated that they saw

no need to do so.

In the most detailed explanation of Westinghouse's financial

situation since Toshiba's accounting problems surfaced earlier this

year, the parent company said the U.S. unit has incurred a

cumulative operating loss of $290 million since Toshiba bought it

2006. Previously, Toshiba had said Westinghouse was profitable,

without specifying a time frame.

Toshiba said its nuclear-fuel and plant-maintenance business

remains profitable and stands to grow as the number of active

nuclear-power plants increases globally. Demand for new plants

collapsed after the Fukushima disaster in Japan in 2011, but

Toshiba officials said it should rebound as global demand for

cleaner energy rises.

"There is no way the U.S. can meet its clean-energy projections

and not increase its nuclear power generating capacity,"

Westinghouse Chief Executive Danny Roderick said in an

interview.

Toshiba said it also aims to take on reactor-decommissioning

projects, which should bring additional revenue.

The company expects to book an operating profit of 30 billion

yen from its nuclear business in the March-ending fiscal year and

projects an average operating profit of 150 billion yen a year from

fiscal 2018 through 2029. But some analysts aren't convinced.

"The presented business outlook is unrealistic in many aspects,"

said Hideki Yasuda, an equity analyst at Ace Research Institute.

"For one, Westinghouse would need to hire a whole lot of workers to

achieve the plan."

Mass hires might be a challenge when Toshiba is focusing on cost

cuts. The Tokyo Stock Exchange has placed the company on a watch

list, making it difficult for the company to issue new shares or

debt.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 28, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

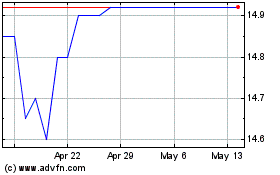

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From Apr 2024 to May 2024

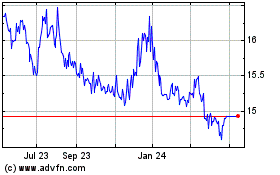

Toshiba (CE) (USOTC:TOSYY)

Historical Stock Chart

From May 2023 to May 2024