UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D

Under the Securities

Exchange Act of 1934

(Amendment No.

___)*

|

VANTAGE

HEALTH

|

|

(Name

of Issuer)

|

|

Common

Stock, $0.001 par value

|

|

(Title of Class of

Securities)

|

|

John

E. Groman

c/o Surinder Ahluwalia

Ahluwalia Law Group

1212 Hancock Street, Suite LL10

Quincy, MA 02169

Telephone: (617) 874-1390

|

|

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

|

|

June

11, 2014

|

|

(Date of Event which

Requires Filing of this Statement)

|

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

[ ]

Note

: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of

this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

1.

|

Names

of Reporting Persons

|

|

|

|

|

|

John E.

Groman

|

|

2.

|

Check the Appropriate

Box if a Member of a Group

(See Instructions

)

|

|

|

(a) [ ]

|

|

|

|

|

|

(b) [ ]

(joint filers)

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds

(See Instructions)

|

|

|

|

|

|

OO

|

|

5.

|

Check BOX if Disclosure

of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e) [ ]

|

|

|

|

|

6.

|

Citizenship or

Place of Organization

|

|

|

|

|

|

U.S.A.

|

|

|

|

|

Number

of

Shares

Beneficially

Owned

by Each

Reporting

Person

With

|

7.

|

Sole

Voting Power

|

|

|

|

|

|

18,460,798 shares

1

|

|

8.

|

SHARED VOTING POWER

|

|

|

|

|

|

0 shares

|

|

9.

|

Sole Dispositive Power

|

|

|

|

|

|

18,460,798 shares

1

|

|

10.

|

Shared Dispositive Power

|

|

|

|

|

|

|

0 shares

|

|

11.

|

Aggregate Amount

Beneficially Owned by Each Reporting Person

|

|

|

|

|

|

18,460,798

shares

1

|

|

12.

|

Check

BOX if the Aggregate Amount in Row (11) Excludes Certain Shares

(See Instructions) [ ]

|

|

|

|

|

13.

|

Percent of Class

Represented by Amount in Row

(11)

|

|

|

|

|

|

9.86%

|

|

14.

|

Type of Reporting

Person

(See Instructions)

|

|

|

|

|

|

IN

|

|

|

1

Mr. Groman

is the beneficial owner of Common Stock in the Issuer consisting of 9,500,000 shares of Common Stock and Warrants to purchase

3,000,000 shares of Common Stock. Bella Sante is the owner of 6,773,634 shares of Common Stock in the Issuer. John Groman is the

beneficial owner of 88% of Bella Sante, Inc. In total, the Reporting Person has sole voting power over 18,460,798 shares of Common

Stock in the Issuer, consisting of 15,460,798 shares of Common Stock and 3,000,000 Warrants.

Item 1. Security and Issuer.

The securities to

which this statement on Schedule 13D (this “Statement”) relates are the common stock, $.01 par value (the “Common

Stock”), of Vantage Health, a Nevada corporation (the “Issuer). The address of the principal executive offices of

the Issuer is 2395 Broadway Street, Redwood City, CA 94063.

Item 2. Identity and Background.

(a) through (c) and

(f). This Statement is filed by John E. Groman an individual and majority shareholder of Bella Sante Inc.(“Reporting Person”).

The address of the principal business and principal office of the Reporting Person is Surinder Ahluwalia Ahluwalia Law Group 1212

Hancock Street, Suite LL10 Quincy, MA 02169. Mr. Groman is a United States citizen and is currently a shareholder of the Issuer.

(d) and (e). During

the past five years, none of the Reporting Person has been convicted in a criminal proceeding (excluding traffic violations or

similar misdemeanors). During the past five years, none of the Reporting Person has been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding such person was or is subject to a judgment,

decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws or finding any violation with respect to such laws.

Item 3. Source

or Amount of Funds or Other Consideration.

This statement relates to Common Stock in

the Issuer that the Reporting Person has the right to acquire in sixty days. These securities in the Issuer are described as follows:

|

|

●

|

Common

Stock in the Issuer totaling 15,460,798 of which, 9,500,000 shares of Common Stock are

beneficially owned by Mr. Groman and 6,773,634 are owned by Bella Sante, of which John

Groman has an 88% ownership, which means his beneficial interest is 5,960,798 shares

of Vantage Common stock.

|

|

|

●

|

Warrants

in the Issuer for the right to purchase 3,000,000 shares of Common Stock at an exercise

price of $0.1181.

|

Item 4. Purpose

of Transaction.

The purpose of this Schedule 13D is to report

the Beneficial Ownership by the Reporting Person of 15,460,798

shares of the Issuer’s issued and outstanding Common

Stock and a Warrant to purchase 3,000,000 shares of Common Stock of the Issuer as of July 3, 2014.

Except as provided below, the Reporting Person

does not have any current plans or proposals which would relate to or would result in:

(a) the acquisition by any person of additional

securities of the Issuer, or the disposition of securities of the Issuer;

(b) any extraordinary corporate transaction,

such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

(c) a sale or transfer of a material amount

of the assets of the Issuer or any of its subsidiaries;

(d) any change in the present board of directors

or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing

vacancies on the board;

(e) any material change in the present capitalization

or dividend policy of the Issuer;

(f) any other material change in the Issuer’s

business or corporate structure including, but not limited to, if the Issuer is a registered closed-end investment company, any

plans or proposals to make any changes in its investment policy for which a vote is required by Section 13 of the Investment Company

Act of 1940;

(g) changes in the Issuer’s charter,

bylaws or instruments corresponding thereto or other actions which may impede acquisition of control of the Issuer by any person;

(h) causing a class of securities of the Issuer

to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system

of a registered national securities association;

(i) a class of equity securities of the Issuer

becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

(j) any action similar to any of those enumerated

above.

Item 5. Interest

in Securities of the Issuer.

|

(a)

|

The

Reporting Person is currently the beneficial owner of 15,460,798 shares of Common Stock

of the Issuer, and a Warrant to purchase 3,000,000 shares of Common Stock. The combination

of both representing approximately 9.86% of the Issuer’s common stock (based upon

187,319,555 outstanding shares of common stock as of July 3, 2014.)

|

|

(b)

|

The Reporting Person has sole voting and dispositive power

over the Shares identified in response to Item 5(a) above.

|

|

(c)

|

See response by Reporting Person to Item 4, above.

|

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

On June 11, 2013,

Bella Sante entered into a Securities Purchase Agreement for 6,773,634 shares of Common Stock for $0.08858. On June 11, 2014 Mr.

Groman received a Warrant to purchase 3,000,000 shares of Common Stock.

The Warrants held

by Mr. Groman are exercisable at $0.1181 per share, at any time during their seven-year term (expiration is June 2021), subject

to adjustments.

Until

the Warrant holder acquires Common Stock upon exercise of the Warrants, the Warrant holders will have no rights with respect to

the Common Stock underlying such Warrants. Upon the acquisition of Common Stock upon cashless exercise of the Warrants, the holders

thereof will be entitled to exercise the rights of a Common Stock holder with respect to such Common Stock only as to matters

for which the record date for such matter occurs after the exercise date of the Warrants.

Item 7. Material to Be Filed as Exhibits.

The following documents

are filed as exhibits:

|

Exhibit

Number

|

|

Description

|

|

A

B

|

|

Securities

Purchase Agreement dated June 11, 2014 between Vantage Health Inc and Bella Sante Inc.

Warrant Agreement, dated June 11,

2014, between Vantage Health Inc. and John Groman

|

SIGNATURE

After reasonable

inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

|

Date: July

7, 2014

|

Bella

Sante Inc.,

|

|

|

|

|

|

By:

|

/s/

John Groman

|

|

|

Name:

|

John Groman

|

|

|

Title:

|

CEO

|

|

|

|

|

|

Date: July

7, 2014

|

By:

|

/s/

John Groman

|

|

|

Name:

|

John Groman

|

EXHIBIT A

SHARE

PURCHASE AGREEMENT

This Share Purchase Agreement (the “Agreement”)

is made and entered into as of the ____ day of ________, _______ 20___ (“Effective Date”), by and among (i) Vantage

Health, Inc., a Nevada corporation (“VNTH”), and (ii) __________________, a corporation and the purchaser of said

Common Stock (the “Investor”).

1.

Purchase of Common Stock; Payment Terms; Covenants

.

(a)

Subject to and in reliance upon the representations, warranties, terms and conditions of this Agreement, effective on and as of

the Effective Date, the Investor will purchase and the Company will sell, assign, transfer and deliver to the Investor an aggregate

of _______________ shares of the Company’s shares of common stock, $0.01 par value (the “Common Stock”), for

an aggregate purchase price of $______________ (“Purchase Price”), or at $________ per share (the “Per Share

Purchase Price”, in reliance on the exemption from the registration requirements of the Securities Act of 1933, as amended

(the “Securities Act”), provided by Rule 506 of Regulation D as promulgated under the Securities Act.

(b)

Assuming the due execution and delivery of this Agreement by the parties, together with delivery by the Investor of an executed

copy of the Accredited Investor Questionnaire attached hereto as

Annex A

, and in consideration of the sale of the Common

Stock to the Investor, the Investor hereby agrees to pay the Company on and as of the Effective Date, the Purchase Price in good

and immediately available funds.

(c)

The Company agrees that on and effective as of the Effective Date, the sale, assignment, transfer and conveyance of the Common

Stock shall be reflected in the books and records of the Company and the Company shall issue the appropriate share certificates,

as provided herein, reflecting and evidencing the Investor’s ownership of the Common Stock and agrees to take such further

action and execute, file and deliver any and all other documentation as is necessary to consummate the transactions contemplated

by this Agreement.

2.

Investor Representations and Warranties

. The Investor acknowledges, represents and warrants to the Company as follows:

(a)

The Investor is aware that the Common Stock is a speculative investment, which involves a high degree of risk, including, but

not limited to, the risk of economic losses from operations of the Company and the total loss of the Purchase Price.

(b)

The Investor is aware that there is no assurance as to the future performance of the Company.

(c)

The Investor acknowledges that there may be certain adverse tax consequences to him in connection with his purchase of the Common

Stock, and the Company has advised the Investor to seek the advice of experts in such areas prior to making this investment.

(d)

The Investor is purchasing the Common Stock for his own account and agrees that he must bear the economic risk of his investment.

(e)

The Investor is not a member of the Financial Industry Regulatory Authority (“FINRA”); The Investor is not and has

not, for a period of 12 months prior to the date of this Subscription Agreement, been affiliated or associated with any company,

firm, or other entity which is a member of the FINRA; and the Investor does not own any stock or other interest in any member

of the FINRA (other than interests acquired in open market purchases).

(f)

The Investor believes that an investment in the Common Stock is suitable for him based upon his investment objectives and financial

needs, and the Investor has adequate means for providing for his current financial needs and contingencies and has no need for

liquidity with respect to his investment in the Common Stock.

(g)

The Investor has either met with or been given reasonable opportunity to meet with officers of the Company for the purpose of

asking questions and receiving answers from, such officers concerning the terms and conditions of the issuance of the Common Stock

and the business and operations of the Company and to obtain any additional information, to the extent reasonably available.

(h)

The Investor has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and

risks of purchasing the Common Stock, and thereby investing in the Common Stock and has obtained, in his judgment, sufficient

information from the Company to evaluate the merits and risks of an investment in the Common Stock.

(i)

The Investor is not participating in the offer as a result of or subsequent to: (i) any advertisement, article, notice or other

communication published in any newspaper, magazine or similar media or broadcast over television or radio or (ii) any seminar

or meeting whose attendees have been invited by any general solicitation or general advertising.

(j)

The Investor has had full opportunity to ask questions and to receive satisfactory answers concerning the offering and other matters

pertaining to his investment and all such questions have been answered to his full satisfaction.

(k)

The Investor has been provided an opportunity to obtain any additional information concerning the Common Stock and the Company

and all other information to the extent the Company possesses such information or can acquire it without unreasonable effort or

expense.

(l)

The Investor is an “accredited investor” as defined in Section 2(15) of the Securities Act and in Rule 501 promulgated

thereunder.

(m)

The Investor has been urged to seek independent advice from professional advisors relating to the suitability of an investment

in the Company in view of his overall financial needs and with respect to the legal and tax implications of such investment.

(n)

The information contained in the Investor’s Accredited Investor Questionnaire, as well as any information which the Investor

has furnished to the Company with respect to his financial position and business experience, is correct and complete as of the

date of this Subscription Agreement and, if there should be any material change in such information prior to the consummation

of the transactions contemplated hereby, the Investor will furnish such revised or corrected information to the Company.

(o)

Except as specifically set forth above, the Investor acknowledges and is aware that except for any rescission rights that may

be provided under applicable laws, the Investor is not entitled to cancel, terminate or revoke this Agreement, which shall survive

the Investor’s death or disability.

(p)

The representations, warranties, and agreements of the Investor contained herein shall survive the execution and delivery of this

Agreement and the purchase of the Shares.

3.

Company Representations

. The Company, as applicable below, makes the following representations and warranties:

(a)

The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada and has

all requisite power and authority to conduct its business as currently conducted.

(b)

The Company has all requisite power and authority to execute deliver and perform this Agreement and carry out and consummate the

transactions contemplated hereby. This Agreement has been duly executed and delivered by the Company;

(c)

The execution and delivery of this Agreement by the Company has been duly authorized by all requisite corporate action;

(d)

This Agreement constitutes a valid and binding obligation of each of the Company, enforceable against each in accordance with

its terms, subject as to enforcement of remedies to applicable bankruptcy, insolvency, reorganization or similar laws affecting

generally the enforcement of creditors’ rights and the relief of debtors;

(e)

The execution, delivery and performance of this Agreement by the Company does not violate, conflict with, result in any breach

of any agreement, undertaking, covenant or obligation by which each may be bound, nor result in the creation of any lien, security

interest, charge or encumbrance upon any of the properties, assets or outstanding shares of the Company or constitute a default

under, any provision of law, any rule or regulation of any governmental authority, any judgment, decree or order of any court

binding on the Company, or any of the terms, conditions or provisions under the Company’s Certificate of Incorporation or

Bylaws or any indenture, mortgage, lease, agreement or other instrument to which the Company is a party or by which it or any

of its properties is bound or affected;

(f)

The Common Stock, when issued and delivered to the Investor in accordance with the provisions of this Agreement, will be duly

and validly issued, fully paid and non-assessable. The authorized capital stock of the Company consists of 250,000,000 shares

of Common Stock, representing all of the capital stock of the Company authorized, of which 158,550,000 are issued and outstanding;

(g)

Neither the Company nor anyone acting on behalf of the Company has engaged in any general advertising or solicitation in contravention

of the Securities Act for the offer and sale of the Common Stock or any other shares of Common Stock. Assuming the accuracy of

the Investor’s representations contained in this Agreement, the offer, sale, issuance and delivery of the Common Stock are

exempt from registration under the Securities Act and all action required to be taken prior to the offer or sale of the Common

Stock has been taken under applicable state securities laws;

(h)

The Company is in material compliance with all material laws, ordinances, and rules and regulations of governmental authorities

applicable to or affecting it, its properties or its business, and the Company has not received notice of any claimed violation

or default with respect to any of the foregoing which would reasonably be expected to have a material adverse effect on the Company;

and

(i)

The representations, warranties, and agreements of the Company contained herein shall survive the execution and delivery of this

Agreement and the sale of the Shares.

4.

Indemnification

.

(a)

The Investor hereby agrees to indemnify and hold harmless the Company and its officers, directors, shareholders, employees, agents,

and attorneys against any and all losses, claims, demands, liabilities, and expenses (including reasonable legal or other expenses,

including reasonable attorneys’ fees) incurred by each such person in connection with defending or investigating any such

claims or liabilities, whether or not resulting in any liability to such person, to which any such indemnified party may become

subject under the Securities Act, under any other statute, at common law or otherwise, insofar as such losses, claims, demands,

liabilities and expenses (a) arise out of or are based upon any untrue statement or alleged untrue statement of a material fact

made by the Investor and contained in this Agreement or the Investor’s Accredited Investor Questionnaire, or (b) arising

out of or based upon any breach by the Investor of any representation, warranty, or agreement made by the Investor contained herein.

(b)

The Company hereby agrees to indemnify, defend and hold harmless the Investor from and against any and all loss, costs, expenses,

damages and liabilities (including, without limitation, court costs and attorneys’ fees) arising out of or due to a breach

by the Company of any representations and warranties set forth in this Agreement.

(C)

The provisions of this Section 4 shall survive the execution and delivery of this Agreement and the purchase of the Shares.

5.

Severability

. In the event any parts of this Agreement are found to be void, the remaining provisions of this Agreement

shall nevertheless be binding with the same effect as though the void parts were deleted.

6.

Choice of Law and Jurisdiction

. This Agreement will be deemed to have been made and delivered in the State of New

York and the internal laws of the State of New York (without giving effect to any conflicts of law provision or rule that would

cause the application of laws of any other jurisdiction) shall govern all matters arising out of or relating to this Agreement,

including its validity, interpretation, construction, performance and enforcement. Any action or proceeding arising out of or

relating to this Agreement must be brought in the courts of the State of New York, New York County, or, if it has or can acquire

jurisdiction, in the United States District Court for the Southern District of New York. Each of the parties knowingly, voluntarily

and irrevocably submits to the exclusive jurisdiction of each such court in any such action or proceeding and waives any objection

it may now or hereafter have to venue or to convenience of forum. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES TO THE

FULLEST EXTENT PERMITTED BY APPLICABLE LAW ALL RIGHTS TO TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM (WHETHER BASED

ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THIS AGREEMENT, OR ANY TRANSACTIONS CONTEMPLATED HEREBY. EACH OF

THE PARTIES HERETO HEREBY WAIVES ANY RIGHT IT MAY HAVE TO TRANSFER OR CHANGE THE VENUE OF ANY LITIGATION BROUGHT AGAINST IT IN

ACCORDANCE WITH THIS SECTION AND FURTHER WAIVES ANY CLAIM BASED ON FORUM NON CONVENIENS.

7.

Counterparts

. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original

but all of which together shall constitute one and the same instrument. The execution of this Agreement may be by actual or facsimile

signature.

8.

Notices and Addresses

. All notices, offers, acceptance and any other acts under this Subscription Agreement (except

payment) shall be in writing, and shall be sufficiently given if delivered to the addresses in person, by Federal Express or similar

courier delivery, or, if mailed, postage prepaid, by certified mail, return receipt requested, as follows:

|

Investor:

|

At

the address designated on the signature page of this Agreement

|

|

|

|

|

Company:

|

Vantage Health,

Inc.

|

|

|

401 Warren Street,

10

th

Suite 200

|

|

|

Redwood

City, CA 94063

|

or

to such other address as any of them, by notice to the others may designate from time to time. The transmission confirmation receipt

from the sender’s facsimile machine shall be conclusive evidence of successful facsimile delivery.

9.

Oral Evidence

. This Agreement constitutes the entire agreement between the parties with respect to the subject matter

hereof and supersedes all prior oral and written agreements between the parties hereto with respect to the subject matter hereof.

This Agreement may not be changed, waived, discharged, or terminated orally but, rather, only by a statement in writing signed

by the party or parties against whom enforcement or the change, waiver, discharge or termination is sought.

10.

Section Headings

. Section headings herein have been inserted for reference only and shall not be deemed to limit

or otherwise affect, in any matter, or be deemed to interpret in whole or in part, any of the terms or provisions of this Agreement.

11.

Survival of Representations, Warranties

and Agreements

.

Each of the representations, warranties

and agreements contained herein shall survive the delivery of, and the payment for, the Common Stock.

12.

Securities Not Registered

.

THE

SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY

STATES AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF SAID ACT AND SUCH LAWS.

THE SECURITIES ARE SUBJECT TO RESTRICTION ON TRANSFERABILITY AND RESALE AND MAY NOT BE PLEDGED, TRANSFERRED OR RESOLD EXCEPT AS

PERMITTED UNDER SAID ACT AND SUCH LAWS PURSUANT TO REGISTRATION OR EXEMPTION THEREFROM. THE SECURITIES HAVE NOT BEEN APPROVED

OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE

ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THIS AGREEMENT.

ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

(Remainder

of page intentionally left blank. Signature page to follow.)

IN

WITNESS WHEREOF

, the parties, acting with due and proper authority, have executed this Agreement, as of the Effective Date.

|

|

VANTAGE

HEALTH

, Inc.

|

|

|

|

|

|

|

By:

|

|

|

|

Name:

|

|

|

|

Title:

|

|

|

|

|

|

|

|

Investor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax ID

Number:

|

|

|

|

|

|

|

Notice

Address:

|

ANNEX

A

CERTIFICATION

REGARDING ACCREDITED INVESTOR STATUS

I

am an “accredited investor” within the meaning of Rule 501 of Regulation D under the Securities Act and am acquiring

the Securities for my own account, or for one or more investor accounts for which I am acting as fiduciary or agent and each such

investor account is an “accredited investor,” and satisfy one or more of the categories of “accredited investor”

indicated below (

the undersigned must initial the appropriate line(s)

):

___

Category 1. A bank, as defined in Section 3(a)(2) of the U.S. Securities Act, whether acting in its individual or fiduciary capacity;

or

___

Category 2. A savings and loan association or other institution as defined in Section 3(a)(5)(A) of the U.S. Securities Act, whether

acting in its individual or fiduciary capacity; or

___

Category 3. A broker or dealer registered pursuant to Section 15 of the United States Securities Exchange Act of 1934; or

___

Category 4. An insurance company as defined in Section 2(13) of the U.S. Securities Act; or

___

Category 5. An investment company registered under the United States Investment Company Act of 1940; or

___

Category 6. A business development company as defined in Section 2(a)(48) of the United States Investment Company Act of 1940;

or

___

Category 7. A small business investment company licensed by the U.S. Small Business Administration under Section 301 (c) or (d)

of the United States Small Business Investment Act of 1958; or

___

Category 8. A plan established and maintained by a state, its political subdivisions or any agency or instrumentality of a state

or its political subdivisions, for the benefit of its employees, with total assets in excess of U.S. $5,000,000; or

___

Category 9. An employee benefit plan within the meaning of the United States Employee Retirement Income Security Act of 1974 in

which the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank, savings

and loan association, insurance company or registered investment adviser, or an employee benefit plan with total assets in excess

of U.S. $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons who are accredited investors;

or

___

Category 10. A private business development company as defined in Section 202(a)(22) of the United States Investment Advisers

Act of 1940; or

___

Category 11. An organization described in Section 501(c)(3) of the United States Internal Revenue Code, a corporation, a Massachusetts

or similar business trust, or a partnership, not formed for the specific purpose of acquiring the securities offered, with total

assets in excess of U.S. $5,000,000; or

___

Category 12. Any director or executive officer of the Corporation; or

___

Category 13. A natural person whose individual net worth, or joint net worth with that person’s spouse, at the date hereof

exceeds U.S.$1,000,000, excluding the net equity value of such individual’s primary residence, if any, but including as

a liability the amount by which any indebtedness secured by such residence exceeds the fair market value of such residence (within

the meaning of such terms as used in the definition of “accredited investor” contained in Rule 501 of the Securities

Act);

[1]

or

___

Category 14. A natural person who had an individual income in excess of U.S.$200,000 in each of the two most recent years or joint

income with that person’s spouse in excess of U.S.$300,000 in each of those years and has a reasonable expectation of reaching

the same income level in the current year; or

___

Category 15. A trust, with total assets in excess of U.S.$5,000,000, not formed for the specific purpose of acquiring the securities

offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) under the U.S. Securities Act;

or

___

Category 16. Any entity in which all of the equity owners meet the requirements of at least one of the above categories;

I

understand that the foregoing information may be used to determine whether or not I am an “accredited investor” as

that term is defined in Rule 501(a) of Regulation D (17 C.F.R. § 230.501(a)). Consequently, I hereby certify that the information

contained herein and the documents that I have submitted to the Company, if any, to verify such information are true, accurate

and complete to the best of my knowledge. I will promptly notify the Company of any changes in the information contained herein.

AGREED

this ______ day of ________ 20__, by ______________, a corporation

|

|

|

|

|

Signature

|

|

|

|

|

|

|

|

|

Typed

or Printed Name

|

[1]

Any indebtedness secured by such primary residence that the Investor incurred within the 60 day period preceding the date

of the sale of securities pursuant to this Subscription Agreement (other than indebtedness incurred as a result of the acquisition

of the primary residence) will be included as a liability for purposes of this calculation, even if the total amount of indebtedness

securing such primary residence does not exceed the value of such residence.

EXHIBIT B

THIS WARRANT AND THE SHARES ISSUABLE UPON

THE EXERCISE OF THIS WARRANT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. EXCEPT AS OTHERWISE SET FORTH

HEREIN OR IN AN AGREEMENT, NEITHER THIS WARRANT NOR ANY OF SUCH SHARES MAY BE SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF

AN EFFECTIVE REGISTRATION STATEMENT FOR SUCH SECURITIES UNDER SAID ACT OR AN OPINION OF COUNSEL, IN FORM, SUBSTANCE AND SCOPE,

REASONABLY ACCEPTABLE TO THE COMPANY’S COUNSEL, THAT REGISTRATION IS NOT REQUIRED UNDER SUCH ACT OR UNLESS SOLD PURSUANT

TO RULE 144 OR REGULATION’S UNDER SUCH ACT.

|

|

Right

to Purchase x,xxx,xxx Shares of Common Stock, par value $ 01 per share

|

Date of Issuance: _______, 20__

STOCK PURCHASE WARRANT

THIS CERTIFIES THAT

,

for value received, ________________, an individual, or their registered assigns, is entitled to purchase from Vantage Health

Inc., a Nevada corporation (the “Company”), at any time or from time to time during the period specified in Paragraph

2 hereof, x,xxx,xxx

fully paid and nonassessable shares of the Company’s Common Stock, par value $.01 per share (the

“Common Stock”), at an exercise price per share equal to $_______

(the “Exercise Price”). The term

“Warrant Shares,” as used herein, refers to the shares of Common Stock purchasable hereunder. The Warrant Shares and

the Exercise Price are subject to adjustment as provided in Paragraph 4 hereof. The term “Warrant” or “Warrants”

means this Warrant. This Warrant is subject to the following terms, provisions, and conditions:

1.

Manner of Exercise; Issuance

of Certificates; Payment for Shares.

Subject to the provisions hereof, this Warrant

may be exercised by the holder hereof, in whole or in part, by the surrender of this Warrant, together with a completed exercise

agreement in the form attached hereto (the “Exercise Agreement”), to the Company during normal business hours on any

business day at the Company’s principal executive offices (or such other office or agency of the Company as it may designate

by notice to the holder hereof), and upon payment to the Company in cash, by certified or official bank check or by wire transfer

for the account of the Company of the Exercise Price for the Warrant Shares specified in the Exercise Agreement or, if the resale

of the Warrant Shares by the holder is not then registered pursuant to an effective registration statement under the Securities

Act of 1933, as amended (the “Securities Act”), or an exemption from registration is not available for the resale

of the Warrant Shares, delivery to the Company of a written notice of an election to effect a “Cashless Exercise”

(as defined in Section 10(c) below) for the Warrant Shares specified in the Exercise Agreement. The Warrant Shares so purchased

shall be deemed to be issued to the holder hereof or such holder’s designee, as the record owner of such shares, as of the

close of business on the date on which this Warrant shall have been surrendered, the completed Exercise Agreement shall have been

delivered, and payment shall have been made for such shares as set forth above. Unless otherwise provided for herein, the Company

shall not be obligated to pay to the holder any cash or other consideration or otherwise “net cash settle” this Warrant.

Certificates for the Warrant Shares so purchased, representing the aggregate number of shares specified in the Exercise Agreement,

shall be delivered to the holder hereof within a reasonable time, not exceeding five (5) business days, after this Warrant shall

have been so exercised. The certificates so delivered shall be in such denominations as may be requested by the holder hereof

and shall be registered in the name of such holder or such other name as shall be designated by such holder. If this Warrant shall

have been exercised only in part, then, unless this Warrant has expired, the Company shall, at its expense, at the time of delivery

of such certificates, deliver to the holder a new Warrant representing the number of shares with respect to which this Warrant

shall not then have been exercised.

Notwithstanding anything

in this Warrant to the contrary, in no event shall the holder of this Warrant be entitled to exercise a number of Warrants (or

portions thereof) in excess of the number of Warrants (or portions thereof) upon exercise of which the sum of (i) the number of

shares of Common Stock beneficially owned by the holder and his affiliates (other than shares of Common Stock which may be deemed

beneficially owned through the ownership of the unexercised Warrants and the unexercised or unconverted portion of any other securities

of the Company subject to a limitation on conversion or exercise analogous to the limitation contained herein) and (ii) the number

of shares of Common Stock issuable upon exercise of the Warrants (or portions thereof) with respect to which the determination

described herein is being made, would result in beneficial ownership by the holder and his affiliates of more than 4.9% of the

outstanding shares of Common Stock. For purposes of the immediately preceding sentence, beneficial ownership shall be determined

in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, and Regulation 13D-G thereunder, except as

otherwise provided in clause (i) of the preceding sentence. Notwithstanding anything to the contrary contained herein, the limitation

on exercise of this Warrant set forth herein may not be amended without the written consent of the holder hereof and the Company.

2. Period of Exercise.

This Warrant is exercisable

at any time or from time to time on or after the date herein and before 5:00 p.m., New York, New York time on the seventh (7

th

)

anniversary of the date of issuance (the “Exercise Period”).

3. Certain Agreements of the

Company.

The Company hereby covenants and agrees as follows:

(a)

Shares to be Fully

Paid

.

All Warrant Shares will, upon issuance in accordance with the terms of this Warrant, be validly issued, fully paid,

and nonassessable and free from all taxes, liens, and charges with respect to the issue thereof.

(b)

Reservation of

Shares

.

During the Exercise Period, the Company shall at all times have authorized, and reserved for the purpose of issuance

upon exercise of this Warrant, a sufficient number of shares of Common Stock to provide for the exercise of this Warrant in full.

(c)

Listing

.

The

Company shall promptly secure the listing of the shares of Common Stock issuable upon exercise of the Warrant upon each national

securities exchange or automated quotation system, if any, upon which shares of Common Stock are then listed (subject to official

notice of issuance upon exercise of this Warrant) and shall maintain, so long as any other shares of Common Stock shall be so

listed, such listing of all shares of Common Stock from time to time issuable upon the exercise of this Warrant; and the Company

shall so list on each national securities exchange or automated quotation system, as the case may be, and shall maintain such

listing of, any other shares of capital stock of the Company issuable upon the exercise of this Warrant if and so long as any

shares of the same class shall be listed on such national securities exchange or automated quotation system.

(d)

Certain Actions

Prohibited

.

The Company will not, by amendment of its charter or through any reorganization, transfer of assets, consolidation,

merger, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance

of any of the terms to be observed or performed by it hereunder, but will at all times in good faith assist in the carrying out

of all the provisions of this Warrant and in the taking of all such action as may reasonably be requested by the holder of this

Warrant in order to protect the exercise privilege of the holder of this Warrant against dilution or other impairment, consistent

with the tenor and purpose of this Warrant. Without limiting the generality of the foregoing, the Company (i) will not increase

the par value of any shares of Common Stock receivable upon the exercise of this Warrant above the Exercise Price then in effect,

and (ii) will take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue

fully paid and nonassessable shares of Common Stock upon the exercise of this Warrant.

(e)

Successors and

Assigns

.

This Warrant will be binding upon any entity succeeding to the Company by merger, consolidation, or acquisition

of all or substantially all the Company’s assets.

4. Adjustment of Exercise Price

and Shares.

During the Exercise Period,

the Exercise Price and the number of Warrant Shares shall be subject to adjustment from time to time as provided in this Paragraph

4.

In the event that any

adjustment of the Exercise Price as required herein results in a fraction of a cent, such Exercise Price shall be rounded up to

the nearest cent.

(a)

Subdivision or

Combination of Common Stock

.

If the Company at any time subdivides (by any stock split, stock dividend, recapitalization,

reorganization, reclassification or other similar transaction) the shares of Common Stock into a greater number of shares, then,

after the date of record for effecting such subdivision, the number of shares available for purchase under this Warrant in effect

immediately prior to such subdivision will be proportionately increased and the corresponding Exercise Price shall be proportionately

reduced. If the Company at any time combines (by reverse stock split, recapitalization, reorganization, reclassification or other

similar transaction) the shares of Common Stock into a smaller number of shares, then, after the date of record for effecting

such combination, the number of shares available for purchase under this Warrant in effect immediately prior to such combination

shall be proportionately decreased and the corresponding Exercise Price shall be proportionately increased.

(b)

Consolidation,

Merger or Sale

.

In case of any consolidation of the Company with, or merger of the Company into any other corporation,

or in case of any sale or conveyance of all or substantially all of the assets of the Company other than in connection with a

plan of complete liquidation of the Company, then as a condition of such consolidation, merger or sale or conveyance, adequate

provision will be made whereby the holder of this Warrant will have the right to acquire and receive, at the Company’s option

and in its sole discretion, either (a) upon exercise of this Warrant in lieu of the shares of Common Stock immediately theretofore

acquirable upon the exercise of this Warrant, such shares of stock, securities or assets as may be issued or payable with respect

to or in exchange for the number of shares of Common Stock immediately theretofore acquirable and receivable upon exercise of

this Warrant had such consolidation, merger or sale or conveyance not taken place or (b) cash equal to the value of the Warrant

as determined in accordance with the Black-Scholes option pricing formula. In any such case, the Company will make appropriate

provision to insure that the provisions of this Paragraph 4 hereof will thereafter be applicable as nearly as may be in relation

to any shares of stock or securities thereafter deliverable upon the exercise of this Warrant. The Company will not effect any

consolidation, merger or sale or conveyance unless prior to the consummation thereof, the successor corporation (if other than

the Company) assumes by written instrument the obligations under this Paragraph 4 and the obligations to deliver to the holder

of this Warrant such shares of stock, securities or assets as, in accordance with the foregoing provisions, the holder may be

entitled to acquire.

(c)

Distribution of

Assets

.

In case the Company shall declare or make any distribution of its assets (including cash) to holders of Common

Stock as a partial liquidating dividend, by way of return of capital or otherwise, then, after the date of record for determining

shareholders entitled to such distribution, but prior to the date of distribution, the holder of this Warrant shall be entitled

upon exercise of this Warrant for the purchase of any or all of the shares of Common Stock subject hereto, to receive the amount

of such assets which would have been payable to the holder had such holder been the holder of such shares of Common Stock on the

record date for the determination of shareholders entitled to such distribution.

(d)

No Fractional

Shares

.

No fractional shares shall be issued upon the exercise of this Warrant as a consequence of any adjustment pursuant

hereto. All Warrant Shares (including fractions) issuable upon exercise of this Warrant may be aggregated for purposes of determining

whether the exercise would result in the issuance of any fractional share. If, after aggregation, the exercise would result in

the issuance of a fractional share, the number of Warrant Shares to be issued will be rounded up to the nearest whole share.

(e)

Other Notices

.

In case at any

time:

(i)

the Company

shall declare any dividend upon the Common Stock payable in shares of stock of any class or make any other distribution (including

dividends or distributions payable in cash out of retained earnings) to the holders of the Common Stock;

(ii)

there shall

be any capital reorganization of the Company, or reclassification of the Common Stock, or consolidation or merger of the Company

with or into, or sale of all or substantially all its assets to, another corporation or entity; or

(iii)

there shall

be a voluntary or involuntary dissolution, liquidation or winding up of the Company;

then, in each such case, the Company shall

give to the holder of this Warrant (a) notice of the date on which the books of the Company shall close or a record shall be taken

for determining the holders of Common Stock entitled to receive any such dividend, distribution, or subscription rights or for

determining the holders of Common Stock entitled to vote in respect of any such reorganization, reclassification, consolidation,

merger, sale, dissolution, liquidation or winding-up and (b) in the case of any such reorganization, reclassification, consolidation,

merger, sale, dissolution, liquidation or winding-up, notice of the date (or, if not then known, a reasonable approximation thereof

by the Company) when the same shall take place. Such notice shall also specify the date on which the holders of Common Stock shall

be entitled to receive such dividend, distribution, or subscription rights or to exchange their Common Stock for stock or other

securities or property deliverable upon such reorganization, reclassification, consolidation, merger, sale, dissolution, liquidation,

or winding-up, as the case may be. Such notice shall be given at least 30 days prior to the record date or the date on which the

Company’s books are closed in respect thereto. Failure to give any such notice or any defect therein shall not affect the

validity of the actions referred to in clauses (i), (ii) and (iii) above.

(f)

Certain Definitions

.

(i) “

Market

Price

,”

as of any date, (i) means the average of the last reported sale prices for the shares of Common Stock on

the OTCBB or the “pink sheets” for the five (5) Trading Days immediately preceding such date as reported by Bloomberg,

or (ii) if the OTCBB or the “pink sheets” is not the principal trading market for the shares of Common Stock, the

average of the last reported sale prices on the principal trading market for the Common Stock during the same period as reported

by Bloomberg, or (iii) if market value cannot be calculated as of such date on any of the foregoing bases, the Market Price shall

be the fair market value as reasonably determined in good faith by (a) the Board of Directors of the Company or, at the option

of the holder of this Warrant, (b) an independent investment bank of nationally recognized standing in the valuation of businesses

similar to the business of the Company. The manner of determining the Market Price of the Common Stock set forth in the foregoing

definition shall apply with respect to any other security in respect of which a determination as to market value must be made

hereunder.

(ii) “

Common

Stock

,”

for purposes of this Paragraph 4, includes the Common Stock, par value $.01 per share, and any additional

class of stock of the Company having no preference as to dividends or distributions on liquidation, provided that the shares purchasable

pursuant to this Warrant shall include only shares of Common Stock, par value $.01 per share, in respect of which this Warrant

is exercisable, or shares resulting from any subdivision or combination of such Common Stock, or in the case of any reorganization,

reclassification, consolidation, merger, or sale of the character referred to in this Paragraph 4, the stock or other securities

or property provided for in such Paragraph.

5. Issue Tax.

The issuance of certificates

for Warrant Shares upon the exercise of this Warrant shall be made without charge to the holder of this Warrant or such shares

for any issuance tax or other costs in respect thereof, provided that the Company shall not be required to pay any tax which may

be payable in respect of any transfer involved in the issuance and delivery of any certificate in a name other than the holder

of this Warrant.

6. No Rights or Liabilities

as a Shareholder.

This Warrant shall not entitle

the holder hereof to any voting rights or other rights as a shareholder of the Company. No provision of this Warrant, in the absence

of affirmative action by the holder hereof to exercise this Warrant and purchase Warrant Shares, and no mere enumeration herein

of the rights or privileges of the holder hereof, shall give rise to any liability of such holder for the Exercise Price or as

a shareholder of the Company, whether such liability is asserted by the Company or by creditors of the Company.

7. Transfer, Exchange, and Replacement

of Warrant.

(a)

Restriction on

Transfer

.

This Warrant and the rights granted to the holder hereof are transferable, in whole or in part, upon surrender

of this Warrant, together with a properly executed assignment in the form attached hereto, at the office or agency of the Company

referred to in Paragraph 7(e) below, provided, however, that any transfer or assignment shall be subject to the conditions set

forth in Paragraph 7(f). Until due presentment for registration of transfer on the books of the Company, the Company may treat

the registered holder hereof as the owner and holder hereof for all purposes, and the Company shall not be affected by any notice

to the contrary.

(b)

Warrant Exchangeable

for Different Denominations

.

This Warrant is exchangeable, upon the surrender hereof by the holder hereof at the office

or agency of the Company referred to in Paragraph 7(e) below, for new Warrants of like tenor representing in the aggregate the

right to purchase the number of shares of Common Stock which may be purchased hereunder, each of such new Warrants to represent

the right to purchase such number of shares as shall be designated by the holder hereof at the time of such surrender.

(c)

Replacement of

Warrant

.

Upon receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction, or mutilation

of this Warrant and, in the case of any such loss, theft, or destruction, upon delivery of an indemnity agreement reasonably satisfactory

in form and amount to the Company, or, in the case of any such mutilation, upon surrender and cancellation of this Warrant, the

Company, at its expense, will execute and deliver, in lieu thereof, a new Warrant of like tenor.

(d)

Cancellation;

Payment of Expenses

.

Upon the surrender of this Warrant in connection with any transfer, exchange, or replacement as provided

in this Paragraph 7, this Warrant shall be promptly canceled by the Company. The Company shall pay all taxes (other than securities

transfer taxes) and all other expenses (other than legal expenses, if any, incurred by the holder or transferees) and charges

payable in connection with the preparation, execution, and delivery of Warrants pursuant to this Paragraph 7.

(e)

Register

.

The Company shall maintain, at its principal executive offices (or such other office or agency of the Company as it may designate

by notice to the holder hereof), a register for this Warrant, in which the Company shall record the name and address of the person

in whose name this Warrant has been issued, as well as the name and address of each transferee and each prior owner of this Warrant.

(f)

Exercise or Transfer

Without Registration

.

If, at the time of the surrender of this Warrant in connection with any exercise, transfer, or exchange

of this Warrant, this Warrant (or, in the case of any exercise, the Warrant Shares issuable hereunder), shall not be registered

under the Securities Act of 1933, as amended (the “Securities Act”) and under applicable state securities or blue

sky laws, the Company may require, as a condition of allowing such exercise, transfer, or exchange, (i) that the holder or transferee

of this Warrant, as the case may be, furnish to the Company a written opinion of counsel, which opinion and counsel are reasonably

acceptable to the Company, to the effect that such exercise, transfer, or exchange may be made without registration under said

Act and under applicable state securities or blue sky laws, (ii) that the holder or transferee execute and deliver to the Company

an investment letter in form and substance reasonably acceptable to the Company and (iii) that the transferee be an “accredited

investor” as defined in Rule 501(a) promulgated under the Securities Act; provided that no such opinion, letter or status

as an “accredited investor” shall be required in connection with a transfer pursuant to Rule 144 under the Securities

Act. The first holder of this Warrant, by taking and holding the same, represents to the Company that such holder is acquiring

this Warrant not with a view to the distribution thereof.

8. Notices.

All notices, requests, and

other communications required or permitted to be given or delivered hereunder to the holder of this Warrant shall be in writing,

and shall be personally delivered, or shall be sent by certified or registered mail or by recognized overnight mail courier, postage

prepaid and addressed, to such holder at the address shown for such holder on the books of the Company, or at such other address

as shall have been furnished to the Company by notice from such holder, or by facsimile or electronic transmission. All notices,

requests, and other communications required or permitted to be given or delivered hereunder to the Company shall be in writing,

and shall be personally delivered, or shall be sent by certified or registered mail or by recognized overnight mail courier, postage

prepaid and addressed, to the office of the Company at 575 Madison Avenue, New York, NY 10022, Attention: Chief Executive Officer,

or at such other address as shall have been furnished to the holder of this Warrant by notice from the Company, or by facsimile

or electronic transmission. All notices, requests, and other communications shall be deemed to have been given either at the time

of the receipt thereof by the person entitled to receive such notice at the address of such person for purposes of this Paragraph

8, or, if mailed by registered or certified mail or with a recognized overnight mail courier upon deposit with the United States

Post Office or such overnight mail courier, if postage is prepaid and the mailing is properly addressed, as the case may be, or

upon confirmation of transmission received by the sender if sent via facsimile or electronic transmission.

9.

Governing Law.

THIS WARRANT SHALL BE ENFORCED,

GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO AGREEMENTS MADE AND TO BE PERFORMED

ENTIRELY WITHIN SUCH STATE, WITHOUT REGARD TO THE PRINCIPLES OF CONFLICT OF LAWS. THE PARTIES HERETO HEREBY SUBMIT TO THE EXCLUSIVE

JURISDICTION OF THE UNITED STATES FEDERAL COURTS LOCATED IN NEW YORK, NEW YORK WITH RESPECT TO ANY DISPUTE ARISING UNDER THIS

WARRANT OR THE TRANSACTIONS CONTEMPLATED HEREBY. BOTH PARTIES IRREVOCABLY WAIVE THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE

OF SUCH SUIT OR PROCEEDING. BOTH PARTIES FURTHER AGREE THAT SERVICE OF PROCESS UPON A PARTY MAILED BY FIRST CLASS MAIL SHALL BE

DEEMED IN EVERY RESPECT EFFECTIVE SERVICE OF PROCESS UPON THE PARTY IN ANY SUCH SUIT OR PROCEEDING. NOTHING HEREIN SHALL AFFECT

EITHER PARTY’S RIGHT TO SERVE PROCESS IN ANY OTHER MANNER PERMITTED BY LAW. BOTH PARTIES AGREE THAT A FINAL NON-APPEALABLE

JUDGMENT IN ANY SUCH SUIT OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON SUCH JUDGMENT

OR IN ANY OTHER LAWFUL MANNER. THE PARTY WHICH DOES NOT PREVAIL IN ANY DISPUTE ARISING UNDER THIS WARRANT SHALL BE RESPONSIBLE

FOR ALL FEES AND EXPENSES, INCLUDING ATTORNEYS’ FEES, INCURRED BY THE PREVAILING PARTY IN CONNECTION WITH SUCH DISPUTE.

10.

Miscellaneous.

(a)

Amendments

.

This Warrant and any provision hereof may only be amended by an instrument in writing signed by the Company and the holder

hereof.

(b)

Descriptive Headings

.

The descriptive headings of the several paragraphs of this Warrant are inserted for purposes of reference only, and shall

not affect the meaning or construction of any of the provisions hereof.

(c)

Cashless Exercise

.

Notwithstanding anything to the contrary contained in this Warrant, if the resale of the Warrant Shares by the holder is not

then registered pursuant to an effective registration statement under the Securities Act, this Warrant may be exercised by presentation

and surrender of this Warrant to the Company at its principal executive offices with a written notice of the holder’s intention

to effect a cashless exercise, including a calculation of the number of shares of Common Stock to be issued upon such exercise

in accordance with the terms hereof (a “Cashless Exercise”). In the event of a Cashless Exercise, in lieu of paying

the Exercise Price in cash, the holder shall surrender this Warrant for that number of shares of Common Stock determined by multiplying

the number of Warrant Shares to which it would otherwise be entitled by a fraction, the numerator of which shall be the difference

between the then current Market Price per share of the Common Stock and the Exercise Price, and the denominator of which shall

be the then current Market Price per share of Common Stock. For example, if the holder is exercising 100,000 Warrants with a per

Warrant exercise price of $0.75 per share through a Cashless Exercise when the Common Stock’s current Market Price per share

is $2.00 per share, then upon such Cashless Exercise the holder will receive 62,500 shares of Common Stock.

(d)

Remedies

.

The Company acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the holder, by vitiating

the intent and purpose of the transaction contemplated hereby. Accordingly, the Company acknowledges that the remedy at law for

a breach of its obligations under this Warrant will be inadequate and agrees, in the event of a breach or threatened breach by

the Company of the provisions of this Warrant, that the holder shall be entitled, in addition to all other available remedies

at law or in equity, and in addition to the penalties assessable herein, to an injunction or injunctions restraining, preventing

or curing any breach of this Warrant and to enforce specifically the terms and provisions thereof, without the necessity of showing

economic loss and without any bond or other security being required.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF,

the

Company has caused this Warrant to be signed by its duly authorized officer.

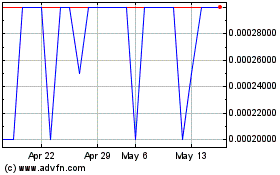

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Jun 2024 to Jul 2024

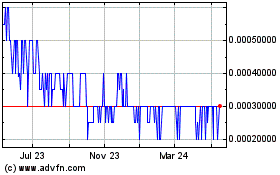

Nano Mobile Healthcare (PK) (USOTC:VNTH)

Historical Stock Chart

From Jul 2023 to Jul 2024