Current Report Filing (8-k)

12 December 2019 - 6:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 9, 2019

VPR

BRANDS, LP

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-54435

|

|

45-1740641

|

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

3001

Griffin Road, Fort Lauderdale, FL 33312

(Address

of principal executive offices)

(954)

715-7001

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

1.01.

|

Entry

into a Material Definitive Agreement.

|

On

December 9, 2019, VPR Brands, LP, a Delaware limited partnership (the “Company”), issued a promissory note in the

principal amount of $100,001 (the “Note”) to Kevin Frija, who is the Company’s Chief Executive Officer, President,

principal financial officer, principal accounting officer and Chairman of the Board, and a significant stockholder of the Company.

The principal amount due under the Note bears interest at the rate of 24% per annum, and the Note permits Mr. Frija to deduct

one ACH payment from the Company’s bank account in the amount of $500 per business day until the principal amount due and

accrued interest is repaid. Any unpaid principal amount and any accrued interest is due on December 9, 2020. The Note is unsecured.

The

foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the Note, a

copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

|

Item

2.03.

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The

information provided above in Item 1.01 above is incorporated by reference into this Item 2.03.

|

Item

9.01

|

Financial

Statements and Exhibits

|

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

December 11, 2019

|

VPR

BRANDS, LP

|

|

|

|

|

|

|

By:

|

/s/

Kevin Frija

|

|

|

|

Kevin

Frija

|

|

|

|

Chief

Executive Officer and Chief Financial Officer

|

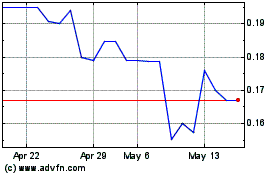

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Dec 2024 to Jan 2025

VPR Brands (QB) (USOTC:VPRB)

Historical Stock Chart

From Jan 2024 to Jan 2025