Report of Foreign Issuer (6-k)

25 January 2017 - 10:05PM

Edgar (US Regulatory)

1934 ACT FILE NO. 001-14714

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January 2017

Yanzhou Coal

Mining Company Limited

(Translation of Registrant’s name into English)

298 Fushan South Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Yanzhou Coal Mining Company Limited

|

|

|

|

|

|

Date

January 25, 2017

|

|

|

|

By /s/ Jin Qingbin

|

|

|

|

|

|

Name:

|

|

Jin Qingbin

|

|

|

|

|

|

Title:

|

|

Company Secretary

|

Certain statements contained in this announcement may be regarded as forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements

involve inherent risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company and the availability of a trading market for its securities to be materially different from any future

performance, financial condition, results of operations or trading market implied by such forward-looking statements. Further information regarding these risks and uncertainties is included in the Company’s filings with the U.S. Securities and

Exchange Commission. The forward-looking statements included in this announcement represent the Company’s views as of the date of this announcement. Except as required by law, the Company undertakes no obligation to update or revise publicly

any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. These forward-looking statements should not be

relied upon as representing the Company’s views as of any date subsequent to the date of this announcement.

Hong Kong Exchanges and Clearing

Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever

arising from or in reliance upon the whole or any part of the contents of this announcement.

YANZHOU COAL MINING COMPANY LIMITED

(A joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 1171)

PRESS RELEASE

YANZHOU

COAL MINING COMPANY LIMITED ANNOUNCES INTENTION TO DELIST FROM THE NYSE

Company aims to reduce complexity and costs. H Shares will

continue to trade on the Hong Kong Stock Exchange and in the US over the counter as Level 1 ADRs

Financial reporting to be provided

in accordance with SEC Rule

12g3-2(b)

Yanzhou Coal Mining Company Limited (the “Company”) (NYSE: YZC;

HKSE: 1171) announced today that it intends to delist its American Depositary Shares (“ADSs”) representing the Company’s H Shares from the New York Stock Exchange (“NYSE”) and to deregister and terminate its reporting

obligations with the Securities and Exchange Commission (“SEC”). The Company’s Board of Directors approved the decision at its meeting on January 24, 2017. The Company expects the delisting to become effective on or about

February 16, 2017 following the close of the market in New York City.

The principal purpose of delisting is to reduce complexity in financial

reporting and administrative costs. In particular, the Company’s Board of Directors believes that the costs of compliance with U.S. periodic

1

reporting requirements and other obligations arising out of its NYSE listing are no longer justifiable in light of the thin level of trading in the ADSs. The Company remains committed to serve

its investor base in the U.S. and plans to maintain an unlisted American Depositary Receipt program on a Level I basis, which may enable investors to hold their H Shares in the form of ADSs and to trade their ADSs in the United States in the over

the counter market. The Company’s H Shares will continue to be traded on the Hong Kong Stock Exchange.

Today, the Company will provide written

notice to the NYSE of its intent to delist. The Company plans to file the related Form 25 with the SEC on or about February 6, 2017 and expects delisting to become effective ten days later. From and after that time the Company’s ADSs will

no longer be traded on the NYSE.

Once the delisting has become effective and the Company meets the criteria for deregistration, it intends to file Form

15F with the SEC in order to terminate registration of the H Shares and the ADSs representing the H Shares under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Deregistration is expected to become effective 90 days

after the filing of Form 15. While the Company’s deregistration application is pending, its reporting obligations under the Exchange Act will be suspended and, upon effectiveness of deregistration, such reporting obligations will terminate.

The Company reserves the right, for any reason, to delay these filings or to withdraw them prior to their effectiveness, and to otherwise change its

plans in this regard.

The Company will continue to make English translations of its annual reports, financial statements, financial press releases and

the other information required by SEC Rule

12g3-2(b)

available on its website at

www.yanzhoucoal.com.cn.

|

|

|

By order of the Board

|

|

Yanzhou Coal Mining Company Limited

|

|

Li Xiyong

|

|

Chairman of the Board

|

Zoucheng, Shandong Province, the PRC

25 January, 2017

As at the date of this announcement,

the directors of the Company are Mr. Li Xiyong, Mr. Li Wei, Mr. Wu Xiangqian, Mr. Wu Yuxiang, Mr. Zhao Qingchun, Mr. Guo Dechun and Mr. Guo Jun, and the independent

non-executive

directors of the Company are Mr. Wang Lijie, Mr. Jia Shaohua, Mr. Wang Xiaojun and Mr. Qi Anbang.

About the Company:

For more information, please contact:

Yanzhou Coal Mining Company Limited

Zhao Qingchun, Director

Tel: +86 537 538 3310

Address: 298 Fushan South Road,

Zoucheng, Shandong Province, 273500 PRC

2

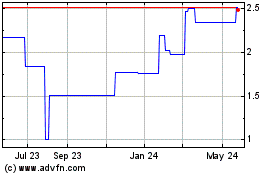

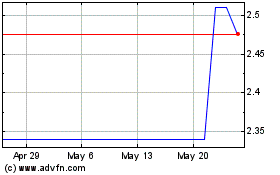

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Nov 2023 to Nov 2024