Armadale Capital Plc Issue of Equity

27 November 2017 - 6:00PM

UK Regulatory

TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

27 November 2017

Armadale Capital Plc ('Armadale' or 'the Company')

Issue of Equity

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, announces that further to the

announcement of 20 October 2017, it has allotted 500,000 ordinary

shares of 0.1p each in the capital of the Company ('Ordinary

Shares') in relation to advisory fees relating to the arrangement

of the Company's financing facility.

The Company has applied for admission of the 500,000 new

Ordinary Shares to trading on AIM. Dealings are expected to become

effective on 30 November 2017 ('Admission').

Following Admission, the Company will have 243,140,034 Ordinary

Shares in issue. The Company has no shares in treasury, therefore

the figure of 243,140,034 should be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change of their

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

**ENDS**

Enquiries:

Armadale Capital Plc +44 20 7236 1177

Tim Jones, Company Secretary

Nomad and broker: finnCap Ltd +44 20 7220 0500

Christopher Raggett / Simon Hicks

Joint Broker: Beaufort Securities Limited +44 20 7382 8300

Jon Belliss

Press Relations: St Brides Partners Ltd +44 20 7236 1177

Susie Geliher / Charlotte Page

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant inferred mineral resource estimate of 40.9Mt @ 9.41% TGC.

At least 32Mt of this resource has an average grade of 10.47% TGC,

one of the largest high-grade resources in Tanzania, and work to

date has demonstrated Mahenge Liandu's potential as a commercially

viable deposit with significant tonnage, high-grade coarse flake

and near surface mineralisation (implying a low strip ratio)

contained within one contiguous ore body.

Other assets Armadale has an interest in include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com

LEI: 213800495EK876JETD10Classification: 2.2 Inside

Information

View source version on businesswire.com:

http://www.businesswire.com/news/home/20171126005050/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

November 27, 2017 02:00 ET (07:00 GMT)

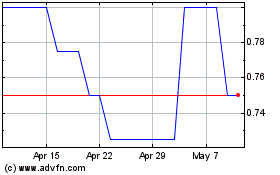

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Apr 2024 to May 2024

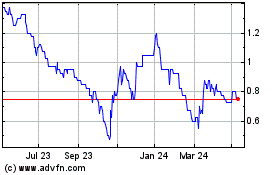

Armadale Capital (LSE:ACP)

Historical Stock Chart

From May 2023 to May 2024