TIDMACP

RNS Number : 1508Z

Armadale Capital PLC

12 May 2023

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

12 May 2023

Armadale Capital Plc

('Armadale' or 'the Company')

Final Results and Notice of AGM

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

announce its final results for the year ended 31 December 2022

('Final Results' or 'Annual Report'). The Company also announces

that its Annual General Meeting ('AGM') will be held at Level 1,

48-50 Smith Street, Darwin, Northern Territory, Australia on 20

June 2023 at 18.00 ACST (09.30 BST) . A notice of AGM, together

with printed copies of the Company's full Annual Report for the

year ended 31 December 2022, will be posted to shareholders on 16

May 2023. Copies will also be available to view on the Company's

website: www.armadalecapitalplc.com .

Strategic Report

For the year ended 31 December 2022

Operational and Corporate Highlights for Period Ending 31

December 2022

Significant progress made in delivering key accretive milestones

in advancing the Mahenge Liandu Graphite Project in Tanzania

1. In February 2022 the Company applied for three incremental

exploration licences which are prospective for graphite

mineralisation and materially enhance the Mahenge Liandu Project's

exploration potential.

2. In March, the Company, pursuant to environmental compliance

requirements of the mining license, successfully completed the

installation of a weather station and has commenced the monthly

collection of data. The station records data at 5 second intervals

and covers all weather parameters including temperature, pressure,

wind, moon phase, humidity, solar radiation and rainfall. All data

is automatically uploaded to the cloud. This data is critical to

establishing the base line information required to assist with the

planning of the mining operations on the Project.

3. In addition, the Company has also installed a total of 7

stream gauges and one barotroll in the water streams located at the

mine site in March 2022 which will be used for the hydrological

studies which will assist in the location and design of

infrastructure for the operations. The devices record 3 parameters

which are temperature, pressure and depth at 5 second intervals.

The data from all devices are being manually downloaded at a

frequency rate of once per month.

4. As Part of the ongoing FEED study, the Company cleared pads

for geotech drilling at the proposed plant Site and tailing dam

location. 10 pads were cleared at the tailing storage facility area

and 6 pads were cleared at the plant site area as a part of

geotechnical studies and the Company is now preparing for Diamond

Drilling in the proposed areas

5. A test pit program has been completed at the proposed plant

site, tailing storage facility and the access road areas. A total

of 41 test pits with 3 meters depth have been excavated, DCP

tested, strata logged, sampled and backfilled. 11 pits have been

excavated at plant site, 25 pits excavated at tailing storage

facility and 5 pits excavated at the access road to the mine

site.

6. The Company was granted the prospecting license PL 119961/

2022 by the ministry of minerals on 28 June 2022, for the

exploration of graphite minerals. The license area comprises of

19.99 square kilometres, located at Isongo and Liandu villages of

Ulanga District, in Morogoro Region.

7. Through the year, the Company's primary focus was on securing

project development funding for the Mahenge Liandu Graphite project

while advancing the permitting and local community engagement.

8. The Company has received an encouraging level of interest in

funding the Mahenge Liandu Graphite project and has advanced its

discussions with a number of potential finance partners with

respect to securing project development funding.

Post Period End

9. The Company continues to collect environmental baseline data

as is required for the compliance of the mining lease and to assist

in the design and planning of the proposed mining operations. In

addition, the base line data for temperature, pressure, wind, moon

phase, humidity, solar radiation, rainfall and stream flow data

assists the local community to have access to regional weather data

for local planning requirements in the Mahenge region.

10. Planning underway for Geotech drilling, with the sites now

prepared for the drill rig. The information from the proposed

drilling program will enable the detailed design of the plant and

tails storage area. This information will enhance the data from the

test pits that were completed last year.

11. Logistics routes for the product continue to be assessed to

determine the optimum methods to ensure the final product will

enter the market at the desired price level.

12. Discussions are ongoing with the Government of Tanzania

regarding the framework for the 16% ownership, with draft

Shareholder agreements, Articles of Association and Joint Financial

model being submitted to both parties for review.

13. Ongoing review of quoted portfolio, where the Directors

believe there are opportunities for capital gains

14. Continue to actively review other exciting investment

opportunities.

During the year under review, Armadale continued to operate as a

diversified investing group focused on natural resource projects in

Africa. To this end, its portfolio is divided into two groups:

-- actively managed investments where the Company has majority ownership of the investment; and

-- passively managed investments where the Company has a

minority investment, typically in a quoted company, and does not

have management control.

Currently, the Company's key actively managed investment is the

Mahenge Liandu Graphite Project in Tanzania. At present, the

Company is actively marketing the Project to potential industry

partners and end users (offtakers) of graphite products. The

Company is also pursuing a range of potential options relating to

development finance for the project

PASSIVELY MANAGED INVESTMENTS

Mantengu Mining Limited (formerly Mine Restoration Investments

Limited) South Africa

The Company's holding of shares in Mantengu Mining Limited

("MML") (formerly Mine Restoration Investments Limited), which were

fully written off when MML entered administration, have been

reinstated at their fair value of GBP105,000 following a reverse

takeover by MML and a relisting of its shares on the Johannesburg

Stock Exchange.

Quoted Portfolio

The Company has a portfolio of quoted investments, valued at

GBP1,245,000 on 4 May 2023, principally in resource companies where

the Directors believe there are opportunities for capital gain. The

Company continues to keep its portfolio under review. The Company's

strategy with its quoted portfolio is to gain exposure in projects

that have the potential to create short to medium term returns for

the Company as well as diversify the Company's exposure to a

broader range of commodities while being able to enter and exit the

position with minimal cost and time.

SUSTAINABLE DEVELOPMENT

The Company is committed to sustainable development and

conducting its business ethically. Given that the Company invests

in the mining industry, one of its key focuses is on maintaining a

high level of health and safety, environmental responsibility, and

support for the communities close to its investments.

CORPORATE INFORMATION

Principal Risks and Uncertainties

There are known risks associated with the mineral industry,

especially in Africa. The Board regularly reviews the risks to

which the Group is exposed and endeavours to minimise them as far

as possible. The following summary, which is not exhaustive,

outlines some of the risks and uncertainties currently facing the

Group:

-- Although reducing throughout the year under review, COVID-19

continues to have risks for the Group in terms of its ability to

travel to and from its projects and ability for key personnel to

access its projects. As previously reported, the impact of COVID-

19 on the project is so far minimal as the Company's site

activities were substantially completed in 2019.

-- Through the Mahenge Liandu Graphite Project the Group is very

exposed to graphite. Graphite is a relatively new commodity whose

market is being driven by demand in renewable energy. The Company

believes it is thus vulnerable to changing global energy

policies.

-- The impact of Brexit on companies operating in the UK is

still being monitored. Thus far Brexit has not impacted the Group's

ability to raise funds.

-- The exploration for and development of mineral resources

involves technical risks, infrastructure risks and logistical

challenges, which even a combination of careful evaluation and

knowledge may not eliminate.

-- There can be no assurance that the Group's project will be

fully developed in accordance with current plans.

-- Future development work and subsequent financial returns

arising may be adversely affected by factors outside the control of

the Group.

-- The availability and access to future funding within the global economic environment.

-- The Group operates in multiple national jurisdictions and is

therefore vulnerable to changes in government policies which are

outside its control. The mining regulation changes in Tanzania are

still being evaluated, however they seem to have minimal impact on

investment in graphite mining. The Group continues to monitor the

implementation of the changes to evaluate and mitigate sovereign

risks.

Principal Risks and Uncertainties

-- The Group is exposed to gold as the holder of a royalty on

gold production from its previously held gold project. The Group's

potential future royalty stream will be affected by fluctuations in

the prevailing market price of gold and to variations of the US

dollar in which gold sales will be denominated.

Some of the mitigation strategies the Group applies in its

present stage of development include, among others:

-- Proactive management to reducing fixed costs.

-- Rationalisation of all capital expenditures.

-- Maintaining strong relationships with government (employing

local staff and partial government ownership), which improves the

Group's position as a preferred small mining partner.

-- Engagement with local communities to ensure our activities

provide value to the communities where we operate.

-- Alternative and continued funding activities with a number of

options to secure future funding to continue as a going

concern.

The Directors regularly monitor such risks and will take actions

as appropriate to mitigate them. The Group manages its risks by

seeking to ensure that it complies with the terms of its

agreements, and through the application of appropriate policies and

procedures, and via the recruitment and retention of a team of

skilled and experienced professionals.

Key Performance Indicators

The Group's current key performance indicators ('KPIs') are the

performance of its underlying investments, measured in terms of the

development of the specific projects they relate to, the increase

in capital value since investment and the earnings generated for

the Group from the investment. The Directors consider that it is

still too early in the investment cycle of any of the investments

held, for meaningful KPIs to be given.

Success is also measured through the identification and

investment in suitable additional opportunities that fit the

Group's investment objectives.

Section 172 Statement

Section 172(1): A director of a company must act in the way he

considers, in good faith, would be most likely to promote the

success of the company for the benefit of its members as a whole,

and in doing so have regard (amongst other matters) to -

Section 172(1) (b) the interests of the company's employees,

Company's Comment: While the Company is largely staffed by

contractor employees (rather than direct employees of the Company),

the directors consider that continuing active work on the Mahenge

Liandu Graphite Project to be in the best interest of such staff to

utilise their skills and develop their local communities. The board

seeks regular feedback from its key stakeholders (including staff

and advisers) to ensure that the corporate culture of the Company

remains highly ethical in terms of our Company's values and

behaviours.

Section 172(1) (c) the need to foster the company's business

relationships with suppliers, customers and others,

Company's Comment: The directors ensure that suppliers are

available and meeting commitments and there is good communication

with staff as a key requirement for high levels of engagement. This

is done by periodic and ad-hoc briefings and discussions.

Reasons to engage shareholders are to meet regulatory

requirements and understand shareholder sentiments on the business,

its prospects and performance of management.

This is done by regulatory news releases, keeping the investor

relations section of the website up to date, annual and half-year

reports and presentations and AGM.

Section 172(1) (d) the impact of the company's operations on the

community and the environment,

Company's Comment: The Company's activities impact communities

in the places where we operate and elsewhere. The Company engages

communities with employment / business development arrangements

within guidelines. Through preparation and compliance with

environmental and social management plans, which include the

regulatory requirements for the Company on its Mahenge Liandu

Graphite Project, the directors ensure that wherever possible its

activities have a positive impact on the community and avoid

adverse environmental impacts.

The Company has engaged the services of a local manager in

Liandu who provides information to the community about our intended

project activities and is responsible for managing local affairs

and feedback to the Company.

Section 172(1) (e) the desirability of the company maintaining a

reputation for high standards of business conduct, and

Company's Comment: The directors consider standards of business

conduct in all dealings of the Company. The members of the board

have a collective responsibility and obligation to promote the

interests of the Company and are collectively responsible for

defining standards of business conduct which includes corporate

governance arrangements. The board provides strategic leadership

for the Company and operates within the scope of our corporate

governance framework and sets the strategic goals for the

Company.

Section 172(1) (f) the need to act fairly as between members of

the company.

Company's Comment: The board takes feedback from a wide range of

shareholders (large and small) and endeavours at every opportunity

to pro-actively engage with all shareholders (via regular news

reporting-RNS) and engage with any specific shareholders in

response to particular queries they may have from time to time. The

board considers that its key decisions during the year have

impacted equally on all members of the Company.

Board

There were no changes in the Board during the year under review

or post period end. The Board continues to consider potential

replacements for former Board members with a focus on a potential

appointment of a UK based Board member.

Financial Results

For the year ended 31 December 2022 the Group did not earn any

revenues as its business related solely to the making of

investments in non-revenue producing resource projects and

companies.

The Group made a loss after tax of GBP0.206 million (2021:

GBP0.333 million) for the year ended 31 December 2022. Expenditure

on the Mahenge Liandu project during the year amounted to GBP0.468

million (2021: GBP0.272 million), which was capitalised as

additional exploration and evaluation assets.

Funds raised during the year amounted to GBP1.3 million from the

exercise of warrants and options.

At 31 December 2022, the Group had cash of GBP1,046,000 (2021:

GBP886,000) and nil debt finance (2020: nil). At 4 May 2023 the

Group had cash of GBP737,000 and listed investments worth

GBP1,245,000.

Outlook

The year under review shows that Mahenge Liandu continues to

represent an exciting opportunity for the Group. As identified in

the going concern note to the Directors' Report, the Company's

ability to achieve its strategy with respect to the project is

dependent on the further fundraising. The Directors continue to

keep other investment opportunities, in line with the Group's

investment objectives, under review, which the board believe could

deliver significant value to shareholders.

Nicholas Johansen

Director

11 May 2023

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

--------------------------------------- -------- --------

Administrative expenses (309) (330)

-------- --------

Change in fair value of investments 103 8

-------- --------

Operating loss (206) (322)

-------- --------

Finance costs - (11)

-------- --------

Loss before taxation (206) (333)

-------- --------

Taxation - -

-------- --------

Loss after taxation (206) (333)

-------- --------

Other comprehensive income

======== ========

Items that may be reclassified to

profit or loss:

---------------------------------------- ======== ========

Exchange differences on translating

foreign entities 252 (61)

---------------------------------------- -------- --------

Total comprehensive profit/(loss)

attributable to the equity holders

of the parent company 46 (394)

======== ========

Loss per share attributable to the Pence Pence

equity holders of the parent company

-------- --------

Basic and diluted loss per share (0.04) (0.07)

======== ========

Consolidated Statement of Financial Position

At 31 December 2022

2022 2021

GBP'000 GBP'000

Assets

Non-current assets

--------- ---------

Exploration and evaluation assets 5,483 4,727

--------- ---------

Investments 562 138

--------- ---------

6,045 4,865

----------------------------------- --------- ---------

Current assets

--------- ---------

Trade and other receivables 150 150

--------- ---------

Cash and cash equivalents 1,046 886

--------- ---------

1,196 1,036

----------------------------------- --------- ---------

Total assets 7,241 5,901

========= =========

Equity and liabilities

--------- ---------

Equity

--------- ---------

Share capital 3,324 3,275

--------- ---------

Share premium 25,153 23,906

--------- ---------

Shares to be issued 286 286

--------- ---------

Share option and warrant reserve 362 925

--------- ---------

Foreign exchange reserve 318 66

--------- ---------

Retained earnings (22,279) (22,636)

--------- ---------

Total equity 7,164 5,822

--------- ---------

Current liabilities

--------- ---------

Trade and other payables 77 79

--------- ---------

Total Liabilities 77 79

--------- ---------

Total equity and liabilities 7,241 5,901

========= =========

Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Shares Share Foreign Retained Total

Capital Premium to be Option Exchange Earnings

issued and Warrant Reserve

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- -------- ------------- ---------- ---------- ----------

At 1 January 2021 3,208 22,348 286 762 127 (22,406) 4,325

--------- --------- -------- ------------- ---------- ---------- --------

Loss for the period - - - - - (333) (333)

--------- --------- -------- ------------- ---------- ---------- --------

Other comprehensive

loss - - - - (61) - (61)

--------- --------- -------- ------------- ---------- ---------- --------

Total comprehensive

loss for the year - - - - (61) (333) (394)

--------- --------- -------- ------------- ---------- ---------- --------

Issue of shares

and warrants 67 1,558 - 266 - - 1,891

--------- --------- -------- ------------- ---------- ---------- --------

Transfer on exercise

of warrants - - - (103) - 103 -

--------- --------- -------- ------------- ---------- ---------- --------

Total other movements 67 1,558 - 163 - 103 1,891

--------- --------- -------- ------------- ---------- ---------- --------

At 31 December

2021 3,275 23,906 286 925 66 (22,636) 5,822

========= ========= ======== ============= ========== ========== ========

Loss for the period - - - - - (206) (206)

========= ========= ======== ============= ========== ========== ========

Other comprehensive

income - - - - 252 - 252

--------- --------- -------- ------------- ---------- ---------- --------

Total comprehensive

income for the year - - - - 252 (206) 46

--------- --------- -------- ------------- ---------- ---------- --------

Issue of shares 49 1,247 - - - - 1,296

--------- --------- -------- ------------- ---------- ---------- --------

Transfer on exercise

and expiry of warrants - - - (563) - 563 -

--------- --------- -------- ------------- ---------- ---------- --------

Total other movements 49 1,247 - (563) - 563 1,296

--------- --------- -------- ------------- ---------- ---------- --------

At 31 December

2022 3,324 25,153 286 362 318 22,279 7,164

--------- --------- -------- ------------- ---------- ---------- --------

Consolidated Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

------------------------------------------- -------- --------

Cash flows from operating activities

-------- --------

Loss before taxation (206) (333)

-------- --------

Adjustment for:

-------- --------

Change in fair value of investments (102) (8)

-------- --------

Finance costs - 11

-------- --------

(308) (330)

------------------------------------------- -------- --------

Changes in working capital

Receivables (11) 1

-------- --------

Payables 12 (39)

-------- --------

Net cash used in operating activities (307) (368)

======== ========

Cash flows from investing activities

-------- --------

Expenditure on exploration and evaluation

assets (518) (399)

-------- --------

Purchase of listed investments (411) -

-------- --------

Sale of listed investments 89 152

-------- --------

Net cash used in investing activities (840) (247)

======== ========

Cash flows from financing activities

-------- --------

Proceeds from share issues 1,307 1,249

-------- --------

Net cash from financing activities 1,307 1,249

======== ========

Net increase in cash and cash equivalents 160 634

-------- --------

Cash and cash equivalents at 1 January 886 252

-------- --------

Cash and cash equivalents at 31

December 1,046 886

======== ========

G oing Concern

The financial statements have been prepared on the going concern

basis as, in the opinion of the Directors, there is a reasonable

expectation that the Group and the Company will continue in

operational existence for the foreseeable future.

At 31 December 2022, the Group had cash of GBP1,046,000 (2021,

GBP886,000) and no debt finance (2021, nil).

At 4 May 2023, the Company had cash of GBP737,000 and listed

investments with a traded value of GBP1,245,000. The Directors have

prepared a cash flow forecast for the next twelve months which

shows that the cash in hand together with expected further receipts

is sufficient to meet current commitments in respect of exploration

expenditure and corporate overheads for a period of at least twelve

months, after which further fundraising will be required.

The Company's ability to continue as a going concern and to

achieve its long term strategy of developing its exploration

projects is dependent on further fundraising. Against the

background of the encouraging progress with the Mahenge Liandu

graphite project and the Company's history of raising funds through

the issue of equity, the Directors consider that there is a

reasonable expectation that the required capital will be raised.

However, there are currently no binding agreements in place. Should

the Directors be unable to raise sufficient funds, the Company may

be unable to realise its assets and discharge its liabilities in

the normal course of business.

These factors indicate the existence of a material uncertainty

which may cast doubt over the Group's and Company's ability to

continue as a going concern. The financial statements do not

include the adjustments that would result if the Group or Company

were unable to continue as a going concern.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

More information can be found on the website

www.armadalecapitalplc.com .

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and Broker: finnCap Ltd

Christopher Raggett / Teddy Whiley / Seamus Fricker +44 (0) 20 7220 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKDBPNBKDQPD

(END) Dow Jones Newswires

May 12, 2023 02:00 ET (06:00 GMT)

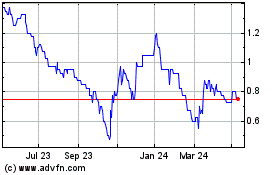

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

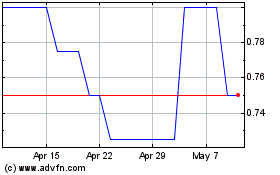

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025