Armadale Capital PLC Notification of Changes in Major Holdings (1116K)

31 August 2021 - 4:00PM

UK Regulatory

TIDMACP

RNS Number : 1116K

Armadale Capital PLC

31 August 2021

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

31 August 2021

Armadale Capital Plc

('Armadale' or 'the Company')

Notification of Changes in Major Holdings

Armadale Capital plc, the AIM quoted investment group focused on

natural resource projects in Africa, announces that it has just

been informed that Kabunga Holdings Pty Ltd ("Kabunga") between 8

April 2021 and 15 June 2021 sold in total, 12,963,204 ordinary

shares of 0.1 pence each in the capital of the Company ("Ordinary

Shares") and then subsequently, on 20 August 2021 acquired

16,273,550 Ordinary Shares pursuant to the conversion of loan notes

by the Company, announced on 8 August 2021. Following these

transactions Kabunga holds 23,170,763 Ordinary Shares, or 4.36 per

cent. of the total voting rights of the Company.

Enquiries:

Armadale Capital Plc

Nick Johansen, Chairman

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Seamus Fricker / Teddy Whiley +44 (0) 20 7220 0500

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

HOLURORRABUWOUR

(END) Dow Jones Newswires

August 31, 2021 02:00 ET (06:00 GMT)

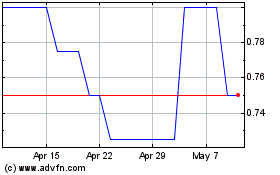

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

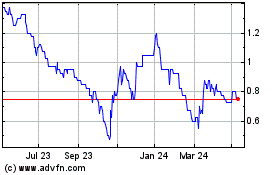

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025