AEW UK REIT plc: Sale announcement and update statement (1053989)

26 May 2020 - 4:00PM

UK Regulatory

AEW UK REIT plc (AEWU)

AEW UK REIT plc: Sale announcement and update statement

26-May-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

26 May 2020

AEW UK REIT Plc (the "Company")

Sale announcement and update statement

Further to its announcement on 20 April 2020, the Company today provides a

further update in respect of recent activity.

Sales and Asset Management Update

The Investment Manager's active management approach continues to be a major

feature of the Company's strategy and, notwithstanding the current uncertain

situation relating to COVID-19, it is pursuing a number of potentially

accretive negotiations.

Most notably, it has now completed the sale of its asset at Geddington Road,

Corby, for a price of GBP18.8 million. The asset was acquired in February 2018

for GBP12.4 million and has been fully let to Gefco UK Limited since this time

producing net income yield against the purchase price of 10%. The 35 acre

site, which due to its specialist use has been held within the Company's

allocation to 'Other' sectors, has been the Company's largest asset by value

with a valuation level as reported in the Company's half year report for the

period ended 30 September 2019 in the region of GBP10-15 million. The lease to

Gefco had an unexpired term of just over 1 year at the date of sale. The

Company has not invested any capital expenditure in the asset during its

hold period.

Alex Short, Portfolio Manager, AEW UK REIT, commented: "The completion of

this sale will deliver to the Company an IRR in excess of 30% which,

particularly at the current time, highlights the defensive nature of the

Company's strategy. Seeking mispriced assets and those that have higher

alternative use values as well as high levels of income, has been a feature

of the strategy since IPO. As the portfolio matures these assets create

opportunities for significant value to be added and, as evidenced by the

Corby disposal, we are now seeing a number of these positions reach

fruition".

Following completion of the above sale, the Company holds cash of c GBP27

million and reports an estimated loan to value ratio of 25.6%, including

cash (31 March 2020: 26.0%). As a further result of the sale, the Company's

annual rental income will fall by GBP1.32 million until further investments

are made. The Investment Manager's fee will also reduce proportionately as

management fees are not charged by AEW on amounts held in cash. The Board,

in conjunction with the Manager, is evaluating the optimum use of cash

balances in the current environment. The Investment Manager continues to

monitor opportunities for investment and believes that market conditions may

facilitate an increased number of attractive pipeline opportunities. In the

meantime, the Company's high cash weighting reflects its conservative

approach to the current situation and provides it with increased

flexibility.

The Company also reports the following asset management transactions that

have completed so far in 2020:

Bath Street, Glasgow - in January 2020, the Company completed a new letting

of 6,700 sq ft to SPS Doorguard Ltd. The lease provides a 10 year term with

a tenant break option at year 5 and a rent of GBP92,250 per annum. The unit

had been vacant prior to letting.

Queen Square, Bristol - During February 2020 a new letting of 1,300 sq ft

was completed. The letting of the un-refurbished suite proves a new high

rental tone for the building of GBP27.14 per sq ft, 55% higher than the

previous level of passing rent. The new letting provides annual income of

GBP17,250.

Oak Park, Droitwich - In March 2020, the Company completed a lease renewal

with tenant Egbert Taylor on two industrial units. The renewal takes the

tenant's weighted average unexpired lease term from 2.7 years to 4.7 years

but also reduces its demised accommodation from 190,000 sq ft to 100,000 sq

ft. Total income received on the asset has fallen from GBP600,000 to GBP500,000

per annum but rental value per sq ft has increased by 57%. The Investment

Manager is exploring potential for higher value alternative uses on the

remainder of the site.

Pearl Assurance House, Nottingham - in March 2020, a reversionary lease was

completed with Lakeland Ltd on a 4,300 sq ft retail unit providing an

unexpired lease term of c 6 years. The reversionary lease documents the

rebasing of Lakeland's rent from GBP155,000 to GBP90,000 per annum in line with

its estimated rental value.

Bank Hey Street, Blackpool - During May 2020, the Company signed a

reversionary lease with existing tenant JD Wetherspoon. This documents the

removal of the tenant's break option in 2025 and provides an additional 10

year lease term taking the earliest expiry from 2025 to 2050. The annual

rent payable by the tenant has reduced from GBP96,750 to GBP90,000 but the lease

now provides five yearly fixed increases reflecting 1% per annum.

Financing

Whilst the Company passed its banking covenant tests with significant

headroom in April, in order to be prudent in the current market environment,

the Company has obtained consent from its lender, RBS International, to

waive the interest cover tests within its loan agreement for July and

October with the next proposed test date being January 2021. The lender also

conveyed a willingness to review the position again in December based on

circumstances then prevailing. The Company is not required to place funds on

account or to comply with additional terms in order to qualify for the

waiver. During the period of the waiver, the Company expects to maintain its

usual interest payments on the loan.

The Company also confirms that it has traded down it's 2% interest rate cap,

using the embedded value to buy an interest rate cap with nominal amount

GBP51.5 million, being the entirety of its drawn loan amount. The new strike

rate is 1% and the term remains October 2023, the expiry of the current

facility. The new interest rate cap provides protection against interest

rate rises at a 1% lower rate each year for a one-off cost of GBP63k equating

to 4 bps per year.

Rent Collection Update

The Investment Manager has continued to maintain close contact with all

tenants over recent weeks. At the date of this announcement, 75% of rent has

so far been collected, expressed as a percentage of the March quarter's

total rental income; however, this figure is expected to increase to 87%

once payments have been received both from tenants making monthly payments

and those on longer term payment plans which have not yet fallen due.

Subject to the agreement of potential asset management transactions, this

would increase to 90%. Amounts that remain outstanding as at the date of

this announcement (i.e. those which have fallen due but have not yet been

paid) are being pursued by the Company and are subject to ongoing engagement

between the Manager and the tenant. There are some tenants who are

experiencing difficulties in the current environment and the Company is

sympathetic to their situation. Unfortunately, there are a few larger

tenants who have significant financial resources and the ability to pay who

are refusing to do so or even to enter into dialogue. The Company shall be

pursuing these tenants when legally able to do so and charging the full

default interest rate allowed within their lease agreements.

Current Position As at 22 May 2020 As at 22 May 2019

Received 75% 96%

Monthly Payments Expected 5% 3%

Prior to Quarter End - 23

June

Longer term payment plan 7% 0%

agreed

87% 99%

Under Negotiation - 2% 0%

pending the agreement of

potential asset management

transactions

90% 99%

Outstanding 10% 1%

Total 100% 100%

It should be noted that the figures above reflect an evolving picture with

further payments being received each day.

In addition to the above the Manager reports that none of the Company's

tenants have filed for administration at the date of this announcement.

For further information, please contact:

AEW UK

Alex Short alex.short@eu.aew.com

+44(0) 20 7016 4848

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0) 7738 724 630

Lucas Bramwell +44 (0) 7939 694 437

Liberum Capital

Gillian Martin / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total return to

shareholders by investing predominantly in smaller commercial properties

(typically less than GBP15 million), on shorter occupational leases in strong

commercial locations across the United Kingdom. The Company was listed on

the Official List of the UK Listing Authority and admitted to trading on the

Main Market of the London Stock Exchange on 12 May 2015, raising GBP100.5m.

Since IPO it has raised a further GBP58m.

The Company is currently invested in office, retail, industrial and leisure

assets, with a focus on active asset management, repositioning the

properties and improving the quality of the income stream.

AEWU is currently paying an annualised dividend of 8p per share.

www.aewukreit.com [1] [2]

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team comprising 26

individuals covering investment, asset management, operations and strategy.

It is part of AEW Group, one of the world's largest real estate managers,

with EUR69.5bn of assets under management as at 31December 2019. AEW Group

comprises AEW SA and AEW Capital Management L.P., a U.S. registered

investment manager and their respective subsidiaries. In Europe, as at 31

December 2019, AEW Group managed EUR33bn of real estate assets on behalf of

a number of funds and separate accounts with over 400 staff located in 9

offices. The Investment Manager is a 50:50 joint venture between the

principals of the Investment Manager and AEW. In May 2019, AEW UK Investment

Management LLP was awarded Property Manager of the Year at the Pensions and

Investment Provider Awards.

www.aewuk.co.uk [3]

LEI: 21380073LDXHV2LP5K50

ISIN: GB00BWD24154

Category Code: MSCH

TIDM: AEWU

LEI Code: 21380073LDXHV2LP5K50

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 65656

EQS News ID: 1053989

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=7d23199c15e31dd555f9a069a2fd699b&application_id=1053989&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=f860bf7fd2365d92319e195bfd6b6f8c&application_id=1053989&site_id=vwd&application_name=news

3: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=3dcece580bf8b63de6000dcaabfd645a&application_id=1053989&site_id=vwd&application_name=news

(END) Dow Jones Newswires

May 26, 2020 02:00 ET (06:00 GMT)

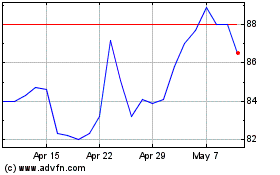

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025