TIDMAGTA

RNS Number : 2174Y

Agriterra Ltd

29 December 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Agriterra Limited / Ticker: AGTA / Index: AIM / Sector:

Agriculture

Agriterra Limited ('Agriterra' or the 'Company')

Interim Results

Agriterra Limited, the AIM listed African agricultural company,

announces its unaudited results for the six months ended 30

September 2023.

Chair's Statement

I am pleased to provide an update on our performance in the

first half of the 2024 financial year ('HY-2024'). These results

will be made available on the Company's website.

Operational update

Grain division

The Grain division commenced the period without sufficient

reserves of maize in silo to link to the new season. Accordingly,

with no banking facilities in place, early season maize purchases

were funded by customer prepayments and advances, securing 4,500

tons in the first 3 months of the period. The Grain division's

objective was to breakeven during this low milling period whilst

securing sufficient stocks for the season.

The division secured a commercial overdraft in July 2023

amounting to US$2 million to finance further maize purchases.

However it was unable to draw on the full facility as the bank was

unable to disburse the full amount due to Central Bank monetary

policy to restrict the money supply. The division secured a

shareholder loan in August for US$2 million to fund maize

purchases.

In August 2023, the Grain division undertook a restructuring

exercise with the objective of breaking even at 900 tons per month

by:

-- Revising the pricing strategy to achieve at least 25% gross margin on cost on maize.

-- Reducing fixed overheads from MZN 6 million (approximately

US$ 93,000) per month to MZN 3 million (approximately US$ 47,000)

by:

o Retrenching 54 staff members thereby reducing personnel cost

MZN 2 million (approximately US$ 31,000) per month.

o Reducing other operations cost by MZN 1 million (approximately

US$ 16,000) per month.

The cash flow constraints in the early part of the period

adversely impacted Grain division sales volumes at 4,188 tons

(HY-2023: 7,947 tonnes) generating revenue of US$ 2.2 million

(HY-2023: US$ 3.6 million).

The business, as at 30 September 2023, has in silo a total stock

of 6,609 tons of maize (HY-2023: 7,444 tons), which will be rolled

over continuously to fund maize requirements through to April 2024.

This will necessitate the purchase of a further 5,000 tons to meet

the milling requirements until the next harvest. Due to late

purchasing and general shortage of maize, average cost of maize

increased from MZN 12.2 per kg (approximately US$ 0.19) to MZN 19.1

per kg (approximately US$ 0.30) for the current season. However the

shortage of maise has increased the price of meal and the division

expects to be able to meet its margin targets in the second half of

the year as demand improves.

Operating costs increased by US$ 0.1 million to US$ 0.6 million

due to retrenchment cost incurred in August 2023. EBITDA decreased

to a loss of US$ 0.2 million (HY-2023: EBITDA profit of US$ 0.2

million) due to lower volumes and margins in the first quarter.

Finance costs decreased to US$ 0.2 million (HY-2023: US$ 0.8

million) reflecting the full benefits of the refinancing of

commercial debt with shareholder loans in the prior year.

Depreciation cost remained constant at US$ 0.24 million. Grain

incurred a loss of US$ 0.68 million for the 6 months period ending

30 September 2023 (HY-2023: Loss US$ 0.87 million).

Beef division

The strategy in the beef division shifted midway through the

period. This change was driven by several factors:

-- Influx of cheap beef from South Africa due to the weakening

of the South African Rand against the Metical which had an impact

on the beef market in the Southern parts of Mozambique, especially

Maputo, the Capital.

-- Rising transport costs which has impacted on the landed cost

of cattle in the feedlot as well as costs of getting the finished

product to market. These rising costs can be attributed to:

o Deteriorating transport network

o Rising fuel costs

o Ageing fleet

In response, decisions were made to start shifting the sales

strategy of beef from the more formal high-end market to less

formal mass market, and price the product aggressively, whilst also

maintaining our current strategy of conditioning animals in the

feedlot and maintaining a presence within the formal market.

To achieve this, we have implemented the following:

-- Start targeting areas much closer to our operational base for cattle buying.

-- Buying animals at the feedlot and abattoir for slaughter directly.

-- Start investing in new fleet of cattle trucks to improve transport efficiencies.

In addition to the above, a cost reduction exercise was

undertaken at the end of July with a view of reducing our monthly

operating expenses by 1,000,000 MZN per month (approximately US$

16,000) as well as reducing our staff compliment by 45, in an

effort to economise and streamline the operation.

The number of animals in stock had reduced to 723 head by 30

Sept 23. This is partly as result of our shift in strategy to buy

more animals for direct slaughter and reduce the amount and cost of

keeping animals in the feedlot. Cashflow has had some challenges,

primarily due to tough economic conditions as well as country wide

municipal elections, with much funding from Government being

diverted to campaigning rather than settling outstanding debts to

their suppliers, which in turn impacts on primary producers like

ourselves. Steps have been taken to rectify this and we are now

seeing an improvement.

Beef division generated US$ 1.5 million revenue over the period,

a reduction of US$ 145,000 against the same period last year. 430

tons of beef were sold during the period, compared to a budget of

652 tons. A gross profit of 20.67% was achieved, which is the third

year whereby a GP of over 20% has been achieved.

Cash resources available at this time amounted to US$ 0.25

million which amounts to an additional 750 head of cattle at

current prices. The cumulative for loss the period amounted to US$

0. 4 million, an increase of US$ 0.1 million.

After some delays, we have started a new company Carnes de

Manica and sales commenced in October 2023. This is another field

to Pork initiative and once it is fully established, we anticipate

an additional US$ 0.13 million to be added to the revenue stream

annually. Current number of pigs in stock is 299 head.

Two new cattle trucks and trailers have been purchased at a cost

of US$ 0.12 million with funds raised from Peterhouse Capital. We

anticipate the arrival of these trucks in late Nov. This will help

in improving our efficiencies and reducing our transport costs

within the beef division.

Snax Division

Snax division continues to supply the market with superior

quality products of which we have launched a new chicken flavoured

puff ring over this period. The new product has been well received

as now constitutes about 15% of total sales. Onion rings remain the

market favourite and a new 100g family size packet is being

launched. The new packing machine has been ordered and we expect

this to be on site late December 2023 and installed, ready for

production in January 2024. In terms of production we have produced

515 00 bales of product over the period.

Snax division generated revenue amounting to US$ 1.03 million

(HY-2023: US$ 1.27 million) over the period with a gross profit of

20.17% (HY-2023: 19.6%). Decrease in sales revenue is mainly

attributable to the tough economic conditions and less disposable

household incomes, with families spending less on non-essential

food stuffs. Profit for the period was US$ 0.30 million (HY-2023:

US$ 0.74 million).

DECA Snax is a joint venture and based on International

Financial Reporting Standards, revenue is not consolidated but the

profit portion attributable to the group is included as share of

profit in equity accounted investee in the Consolidated Income

Statement. Profits have been negatively impacted by the rising

costs of raw materials, packaging and transport. Maize prices in

particular have had a significant impact. Profit attributable to

the group is US$ 0.15 million (HY-23: US$ 0.35 million).

Group Results

Group revenue for the half-year ended 30 September 2023

decreased by 28% to US$ 3.6 million (HY-2023: US$ 5.0 million).

Decrease in sales revenue is mainly resulting from decrease in

sales for Grain division.

Gross profit decreased to US$ 0.5 million (HY-2023: US$ 1.1

million) achieving a group gross margin of 15% (HY-2023: Gross

margin of 22%). Decrease in gross margin is resulting from high

cost of maize which reduced Grain division margins to 9%. Group

operating expenses increased from US$ 1,603 to US$ 1,727 due to

retrenchment cost as compared to prior period. Following the

restructuring exercise, it is anticipated that operating expenses

will fall significantly from October 2023.

Finance costs decreased by 40% to US$ 0.55 million (HY-2023: US$

0.92 million) as a result of refinancing of commercial debt with

shareholder loans incurring interest at SOFR+3%. Overall interest

rate on shareholder loan is around 10% per annum as compared to the

current commercial debt interest rate of 25% per annum.

During the period, inventories have increased by US$ 1.92

million to US$ 2.47 million as compared to 31 March 2023. Grain

division is keeping low inventory levels as a result of the revised

strategy to reduce stock holding cost and finance cost in Grain

division. Net debt at 30 September 2023 was US$ 12.7 million (31

March 2023: US$ 10.9 million).

Outlook for H2-2024

The Grain business is entering H2-2024 with 6,609 tons of grain

in silo which is not sufficient to take us to the next harvest. The

division is supplementing by importing 4000 tons of maize from

South Africa and rolling to the extent possible maize sold during

the period. Beef division sales revenue is expected to increase by

20% as compared to the first half year. All divisions have been

striving to be self-sustaining at low capacity utilisation and now

are expanding into profitable operations as volumes increase after

rightsizing. Management will continuously monitor operations for

profitability and seize new market opportunities creating a group

basket of products to effectively lower overheads per product in

the medium to long term.

Grain remains the core group business and management will seek

to add value by creating additional product lines building on the

success of Deca Snax.

CSO Havers

Chair

29 December 2023

For further information please VISIT www.agriterra-ltd.com or

contact:

Agriterra Limited Strand Hanson Limited

Caroline Havers caroline@agriterra-ltd.com Ritchie Balmer / Tel: +44 (0) 207

James Spinney / David 409 3494

Asquith

--------------------------- ----------------------- -----------------

Peterhouse Capital

Limited

----------------------- -----------------

Duncan Vasey / Eran Tel: +44 (0) 207

Zucker 469 0930

----------------------- -----------------

Consolidated statement of profit or loss and other comprehensive

income

Consolidated income statement

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

Note US$000 US$000 US$000

CONTINUING OPERATIONS

Revenue 2 3,575 4,964 11,494

Cost of sales (3,054) (3,883) (8,758)

(Decrease)/Increase in fair value of

biological assets - - (288)

Gross profit 521 1,081 2,448

Operating expenses (1,727) (1,603) (3,381)

Other income 143 56 122

Profit on disposal of property, plant

and equipment - - -

--------------

Operating loss (1,063) (466) (811)

Net finance costs 3 (550) (918) (1,462)

Share of profit in equity-accounted

investees, net of tax 15 35 37

--------------

Loss before taxation (1,598) (1,349) (2,236)

Taxation - - 127

-------------- -------------- ----------

Loss for the period 2 (1,598) (1,349) (2,109)

Loss for the period attributable to

owners of the Company (1,598) (1,349) (2,109)

============== ============== ==========

LOSS PER SHARE

Basic and diluted loss per share - US

Cents 4 (2.22) (6.35) (9.29)

============== ============== ==========

Consolidated Statement of comprehensive income

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

US$000 US$000 US$000

Loss for the period (1,598) (1,349) (2,109)

Items that may be reclassified subsequently

to profit or loss:

Foreign exchange translation differences (705) (490) (161)

Other comprehensive (loss)/income for

the period (705) (490) (161)

-------------- -------------- ----------

/Total comprehensive (loss)/income

for the period attributable to owners

of the Company (2,303) (1,839) (2,270)

============== ============== ==========

Consolidated statement of financial position

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

Note US$000 US$000 US$000

Non-current assets

Property, plant and equipment 23,973 24,682 24,267

Intangible assets 1 10 3

Equity-accounted investees 108 91 93

24,082 24,783 24,363

------------- ------------- ----------

Current assets

Biological assets 292 421 496

Inventories 2,472 2,125 550

Trade and other receivables 1,628 1,190 1,055

Cash and cash equivalents 307 350 174

4,699 4,086 2,275

------------- ------------- ----------

Total assets 28,781 28,869 26,638

------------- ------------- ----------

Current liabilities

Borrowings 5 1,179 4,287 2,666

Trade and other payables 1,963 1,530 658

3,142 5,817 3,324

------------- ------------- ----------

Net current assets 1,557 (1,731) (1,049)

------------- ------------- ----------

Non-current liabilities

Borrowings 5 11,820 6,968 7,196

Deferred tax liability 6,115 6,243 6,111

------------- ------------- ----------

17,935 13,211 13,307

------------- ------------- ----------

Total liabilities 21,077 19,028 16,631

------------- ------------- ----------

Net assets 7,704 9,841 10,007

============= ============= ==========

Share capital 6 63,343 3,373 3,993

Share premium 6 - 151,442 151,419

Share based payments reserve 67 67 67

Revaluation reserve 11,935 12,186 12,061

Translation reserve (16,874) (16,498) (16,169)

Accumulated losses (50,767) (140,729) (141,364)

------------- ------------- ----------

Equity attributable to equity holders of the parent 7,704 9,841 10,007

============= ============= ==========

The unaudited condensed consolidated financial statements of

Agriterra Limited for the six months ended 30 September 2023 were

approved by the Board of Directors and authorised for issue on 29

December 2023.

Signed on behalf of the Board of Directors:

CSO Havers

Chair

Consolidated statement of changes in equity

Share

based

Share Share payment Translation Revaluation Accumulated Total

capital premium reserve reserve reserve losses Equity

Note US$000 US$000 US$000 US$000 US$000 US$000 US$000

-------- ---------- -------- ------------ ------------ ------------ --------

Balance at 1

April 2022 3,373 151,442 67 (16,008) 12,312 (139,506) 11,680

Loss for the period - - - - - (1,349) (1,349)

Other comprehensive

income:

Exchange translation

gain on foreign

operations

restated - - - (490) - - (490)

-------- ---------- -------- ------------ ------------ ------------ --------

Total comprehensive

loss for the period - - - (490) - (1,349) (1,839)

Transactions

with owners

Revaluation

surplus realised - - - - (126) 126 -

------------

Total transactions

with owners for the

period - - - - (126) 126 -

------------

Balance at

30 September

2022 3,373 151,442 67 (16,498) 12,186 (140,729) 9,841

Loss for the

period - - - - - (760) (760)

Other comprehensive

income:

Exchange translation

gain on foreign

operations - - - 329 - - 329

------------

Total comprehensive

income for the

period - - - 329 - (760) (431)

Transactions

with owners

Issue of shares 620 (23) - - - - 597

Revaluation

surplus realised - - - - (125) 125 -

-------- ---------- -------- ------------ ------------ ------------ --------

Total transactions

with owners for the

period 620 (23) - - (125) 125 597

------------

Balance at 31 March

2023 3,993 151,419 67 (16,169) 12,061 (141,364) 10,007

Loss for the period - - - - - (1,598) (1,598)

Other comprehensive

income:

Exchange translation

(loss) on foreign

operations - - - (705) - - (705)

------------

Total comprehensive

loss for the period - - - (705) - (1,598) (2,303)

Transactions with

owners

Reclassification 59,350 (151,419) - - - 92,069 -

Revaluation surplus

realised - - - - (126) 126 -

------------

Total transactions

with owners for the

period 59,350 (151,419) - - (126) 92,195 -

------------

Balance at 30

September

2023 63,343 - 67 (16,874) 11,935 (50,767) 7,704

======== ========== ======== ============ ============ ============ ========

Consolidated cash flow statement

Year

6 months ended 6 months ended ended

30 September 30 September 31 March

2023 2022 2023

Note Unaudited Unaudited Audited

US$000 US$000 US$000

Loss before tax for the period (1,598) (1,349) (2,236)

Adjustments for:

Amortisation and depreciation 2 396 435 870

Foreign exchange (gain)/loss (315) (493) (151)

Decrease / (increase) in value of biological assets - - 288

Share of profit in associate (15) (35) (37)

Net Finance costs 550 918 1,462

Operating cash flows before movements in working capital (982) (524) 196

Net decrease / (increase) in biological assets 204 42 (321)

(Increase) / decrease in inventories (1,922) 51 1,626

(Increase) / decrease in trade and other receivables (573) (366) 52

Increase / (decrease) in trade and other payables 924 570 (302)

Net Cash used in operating activities (2,352) (227) 1,251

Cash flows from investing activities

Acquisition of property, plant and equipment (102) (58) (90)

Net cash used in investing activities (102) (58) (90)

--------------- --------------- ----------

Cash flow from financing activities

Finance costs 3 (167) (918) (1,014)

Net (repayment) / drawdown of overdrafts 5 - (6,255) (6,254)

Net (repayment) / drawdown of loans and finance leases 5 (146) 7,701 (1,726)

Net drawdown of shareholder loans 2,900 - 7,900

Net cash generated from/(used in) financing activities 2,587 528 (1,094)

--------------- --------------- ----------

Net increase in cash and cash equivalents 133 243 67

Effect of exchange rates on cash and cash equivalents - - -

--------------- --------------- ----------

Cash and cash equivalents at beginning of period 174 107 107

--------------- --------------- ----------

Cash and cash equivalents at end of period 307 350 174

=============== =============== ==========

General information

Agriterra Limited ('Agriterra' or the 'Company') and its

subsidiaries (together the 'Group') is focussed on the agricultural

sector in Africa. Agriterra is a non-cellular company limited by

shares incorporated and domiciled in Guernsey, Channel Islands. The

address of its registered office is Connaught House, St Julian's

Avenue, St Peter Port, Guernsey GY1 1GZ.

The Company's Ordinary Shares are quoted on the AIM Market of

the London Stock Exchange ('AIM').

The unaudited condensed consolidated financial statements have

been prepared in US Dollars ('US$') as this is the currency of the

primary economic environment in which the Group operates.

1. Basis of preparation

The condensed consolidated financial statements of the Group for

the 6 months ended 30 September 2023 (the 'H1-2024 financial

statements'), which are unaudited and have not been reviewed by the

Company's Auditor, have been prepared in accordance with the

International Financial Reporting Standards ('IFRS'). The

accounting policies adopted by the Group are set out in the annual

report for the year ended 31 March 2023 (available at

www.agriterra-ltd.com). The Group does not anticipate any

significant change in these accounting policies for the year ended

31 March 2024.

This interim report has been prepared to comply with the

requirements of the AIM Rules of the London Stock Exchange (the

'AIM Rules'). In preparing this report, the Group has adopted the

guidance in the AIM Rules for interim accounts which do not require

that the interim condensed consolidated financial statements are

prepared in accordance with IAS 34, 'Interim financial reporting' .

Whilst the financial figures included in this report have been

computed in accordance with IFRSs applicable to interim periods,

this report does not contain sufficient information to constitute

an interim financial report as that term is defined in IFRSs.

The financial information contained in this report also does not

constitute statutory accounts under the Companies (Guernsey) Law

2008, as amended. The financial information for the year ended 31

March 2023 is based on the statutory accounts for the year then

ended. The Auditors reported on those accounts. Their report was

unqualified and referred to going concern as a key audit matter.

The Auditors drew attention to note 3 to the financial statements

concerning the Group's ability to continue as a going concern which

shows that the Group will need to renew its overdraft facilities,

maintain its current borrowings and raise further finance in order

to continue as a going concern.

The H1-2024 financial statements have been prepared in

accordance with the IFRS principles applicable to a going concern,

which contemplate the realisation of assets and liquidation of

liabilities during the normal course of operations. Having carried

out a going concern review in preparing the H1-2024 financial

statements, the Directors have concluded that there is a reasonable

basis to adopt the going concern principle.

2. Segment information

The Board considers that the Group's operating activities during

the period comprised the segments of Grain, Beef and Snax,

undertaken in Mozambique. In addition, the Group has certain other

unallocated expenditure, assets and liabilities.

The following is an analysis of the Group's revenue and results

by operating segment:

6 months ended 30 September 2023 - Grain Beef Snax Unallo-cated Elimina-tions Total

Unaudited

US$000 US$000 US$000 US$000 US$000 US$000

------- ------- ------- ------------- -------------- --------

Revenue

External sales(2) 2,066 1,509 - - - 3,575

Inter-segment sales(1) 117 - - - (117) -

------- ------- ------- ------------- -------------- --------

2,183 1,509 - - (117) 3,575

------- ------- ------- ------------- -------------- --------

Segment results

- Operating loss (620) (316) - (256) - (1,192)

- Interest expense (184) (70) - (296) - (550)

- Share of profit in equity accounted

investees - - 15 - - 15

- Other gains and losses 128 1 - - - 129

-------

(Loss)/Profit before tax (676) (385) 15 (552) - (1,598)

Income tax - - - - - -

------- ------- ------- ------------- -------------- --------

(Loss)/Profit for the period (676) (385) 15 (552) - (1,598)

======= ======= ======= ============= ============== ========

6 months ended 30 September 2022 - Grain Beef Snax Unallo-cated Elimina-tions Total

Unaudited

US$000 US$000 US$000 US$000 US$000 US$000

------- ------- ------- ------------- -------------- --------

Revenue

External sales(2) 3,309 1,655 - - - 4,964

Inter-segment sales(1) 245 - - - (245) -

------- ------- ------- ------------- -------------- --------

3,554 1,655 - - (245) 4,964

------- ------- ------- ------------- -------------- --------

Segment results

- Operating loss (141) (264) - (127) - (532)

- Interest expense (776) (27) - (115) - (918)

- Share of profit in equity accounted

investees - - 35 - - 35

- Other gains and losses 47 19 - - - 66

-------

(Loss)/Profit before tax (870) (272) 35 (242) - (1,349)

Income tax - - - - - -

------- ------- ------- ------------- -------------- --------

(Loss)/Profit for the period (870) (272) 35 (242) - (1,349)

======= ======= ======= ============= ============== ========

Year ended 31 March 2023 - Audited Grain Beef Snax(1) Unallo-cated Elimina-tions Total

US$000 US$000 US$000 US$000 US$000 US$000

------- ------- -------- ------------- -------------- --------

Revenue

External sales(2) 8,365 3,129 - - - 11,494

Inter-segment sales(1) 225 - - - (225) -

------- ------- -------- ------------- -------------- --------

8,590 3,129 - - (225) 11,494

------- ------- -------- ------------- -------------- --------

Segment results

- Operating loss 2 (659) - (308) - (965)

- Interest expense (958) (63) - (441) - (1,462)

- Other gains and losses 95 59 - - - 154

-Share of profit in equity-accounted

investees - - 37 - - 37

------- ------- -------- ------------- -------------- --------

(Loss)/Profit before tax (861) (663) 37 (749) - (2,236)

------- ------- -------- ------------- -------------- --------

Income tax 115 12 - - - 127

------- ------- -------- ------------- -------------- --------

(Loss)/Profit after tax (746) (651) 37 (749) - (2,109)

======= ======= ======== ============= ============== ========

(1) Inter-segment sales are charged at prevailing market prices

(2) Revenue represents sales to external customer and is

recorded in the country of domicile of the Company making the

sales. Sales from the Grain and the Beef divisions are principally

for supply to the Mozambique market.

The segment items included within continuing operations in the

consolidated income statement for the periods are as follows:

Grain Beef Unallo-cated Elimina-tions Total

US$000 US$000 US$000 US$000 US$000

------- ------- ------------- -------------- -------

6 months ended 30 September 2023 - Unaudited

Depreciation and amortisation 236 160 - - 396

======= ======= ============= ============== =======

6 months ended 30 September 2022 - Unaudited

Depreciation and amortisation 257 178 - - 435

==== ==== ====

Year ended 31 March 2023 - Audited

Depreciation and amortisation 514 356 - - 870

==== ==== ====

3. NET FINANCE COSTS

6 months ended 6 months ended Year

30 September 30 September ended

2023 2022 31 March

Unaudited Unaudited 2023

Audited

US$000 US$000 US$000

--------------- --------------- ----------

Interest expense:

Bank loans, overdrafts and finance leases 550 918 1,462

Interest income:

Bank deposits - - -

--------------- --------------- ----------

550 918 1,462

=============== =============== ==========

4. LOSS per share

The calculation of the basic and diluted loss per share is based on the following data:

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

US$000 US$000 US$000

------------- ------------- -----------

Loss for the period/year for the purposes of basic and diluted

earnings per share attributable

to equity holders of the Company (1,598) (1,349) (2,109)

============= ============= ===========

Weighted average number of Ordinary Shares for the purposes of basic

and diluted loss per

share 71,829,007 21,240,618 22,240,618

============= ============= ===========

Basic and diluted loss per share - US cents (2.22) (6.35) (9.29)

============= ============= ===========

The Company has issued options over ordinary shares which could

potentially dilute basic loss per share in the future. There is no

difference between basic loss per share and diluted loss per share

as the potential ordinary shares are anti-dilutive.

5. Borrowings

30 September 2023 30 September 2022 31 March

2023

Unaudited Unaudited Audited

US$000 US$000 US$000

------------------ ------------------ ---------

Non-current

Shareholder loan 11,317 6,215 6,534

Bank loans 503 595 574

Leases - 158 88

------------------ ------------------ ---------

11,820 6,968 7,196

Current

Shareholder loan - 1,800 1,500

Bank loans 1,058 2,377 1,056

Leases 121 110 110

1,179 4,287 2,666

------------------ ------------------ ---------

12,999 11,255 9,862

================== ================== =========

Group

During the period, Agriterra Limited secured shareholder loans

amounting to US$ 2.9 million from Magister Investments Limited at

an interest rate of SOFR+6% to reduce the finance grain working

capital as well acquisition of the biscuit plant. The new

shareholder loans were issued during the period to add to the

following existing shareholder loan;

-- US$ 6.1 million convertible loan facility with a 3 year tenure maturing August 2024.

-- US$ 1.8 million convertible loan facility with a 12 month

tenure maturing in August 2023, loan has been rolled over with an

option to automatically rollover for more periods.

Grain division

Grain division has two outstanding commercial bank loans

amounting to US$ 1.6 million. Bank loan with an outstanding balance

of US$ 0.9 million was issued in May 2019. The loan facility which

was originally issued as an overdraft facility has been

restructured several times and now is a term loan incurring an

interest rate of Bank's prime lending rate less 1.75% and matures

in July 2023. The group subsequently repaid the outstanding loan in

October 2023 using a shareholder loan. The second debt facility

with an outstanding balance of US$ 0.7 million is a 5 year term

loan maturing on 31 December 2025. The facility was restructured

into a term loan on 1 December 2021 with an interest of prime

lending rate plus 1.5%. These facilities are secured by land and

buildings.

In addition, Grain division has a finance lease for 6 vehicles

maturing on 05 December 2023 with an outstanding balance amounting

to MZN 1.6 million (approximately US$ 25,000). Grain division

incurs interest of 18.6% on this facility. During the period MZN

1.6 million (approximately US$ 25,000) of the outstanding balance

was repaid.

Beef division

The outstanding balance on agricultural equipment finance lease

is MZN 6.1 million (approximately US$ 0.1 million). During the

period, MZN 3.3 million (approximately US$ 51,000) of the principal

balance was repaid. The finance lease is repayable over 5 years

maturing in July 2024 and is secured against certain agricultural

equipment.

Reconciliation to cash flow statement

At 31 Cash flow Interest Foreign At 30

March accrued Exchange September

2023 2023

US$000 US$000 US$000 US$000 US$000

Non-current shareholder

loan 8,034 2,900 384 (1) 11,317

Non-current bank loans 574 (71) - - 503

Non-current finance leases 88 (88) - - -

Current bank loans 1,056 2 - - 1,058

Current finance leases 110 11 - - 121

9,862 2,754 384 (1) 12,999

======= ========== ========= ========== ===========

6. Share capital

Authorised Allotted and fully paid

Number Number US$000

------------ ------------------------ -------

Ordinary Shares

At 30 September 2022 23,450,000 21,240,618 3,135

Issued during the period 50,588,389 50,588,389 620

------------ ------------------------ -------

At 31 March 2023 74,038,389 71,829,007 3,755

Reclassification - - 59,350

------------ ------------------------ -------

At 30 September 2023 74,038,389 71,829,007 63,105

At 31 March 2023 and September 2023 - - -

Deferred shares of 0.1p each 155,000,000 155,000,000 238

Total share capital 229,038,389 226,829,007 63,343

============ ======================== =======

The Company has one class of ordinary share which carries no

right to fixed income.

The deferred shares carry no right to any dividend; no right to

receive notice, attend, speak or vote at any general meeting of the

Company; and on a return of capital on liquidation or otherwise,

the holders of the deferred shares are entitled to receive the

nominal amount paid up after the repayment of GBP1,000,000 per

ordinary share. The deferred shares may be converted into ordinary

shares by resolution of the Board.

At 30 September 2023, the Company offset accumulated losses of

US$ 92,069,000 against the share premium account and the balance of

US$ 59,350,000 remaining on the share premium account has been

combined with the share capital account to comply with Guernsey

company law.

7. Post balance sheet events

On 15 November 2023, Magister Investments Limited advanced a

further $1.7 million to enable the Group to repay its remaining

Metical denominated bank borrowings. The loan has a coupon of

SOFR+6% and a term of 1 year, renewable at the lender's option

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAEANAAFDFFA

(END) Dow Jones Newswires

December 29, 2023 05:30 ET (10:30 GMT)

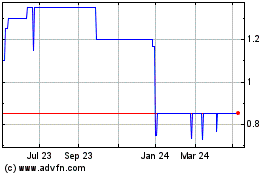

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

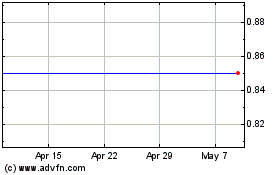

Agriterra Ld (LSE:AGTA)

Historical Stock Chart

From Nov 2023 to Nov 2024