TIDMAST

RNS Number : 1868L

Ascent Resources PLC

09 September 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION IN, INTO OR FROM ANY JURISDICTION WHERE

TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

9 September 2021

Ascent Resources plc

("Ascent" or "the Company")

Interim results for the period ended 30 June 2021

Ascent Resources plc (LON:AST), the AIM quoted onshore

Caribbean, Hispanic American and European energy and natural

resources focussed company ("Company") is pleased to report its

interim results for the six months ended 30 June 2021.

Highlights:

-- Launch of ESG Metals Strategy as a new target sector within

its natural resource focussed business with maiden deal expected in

H2 2021.

-- Signing of a non-binding head of terms with Enyo Law LLP, a

specialist arbitration and litigation legal firm, to advance a

fully funded non-recourse damages-based agreement for the

arbitration proceedings against the Republic of Slovenia.

-- Raised GBP1m before expenses by way of an oversubscribed

subscription and placement with existing and new investors.

Enquiries:

Ascent Resources plc Via Vigo Consulting

Andrew Dennan, CEO

WH Ireland, Nominated Adviser

& Broker

James Joyce / Sarah Mather 0207 220 1666

Novum Securities, Joint Broker

John Belliss 0207 399 9400

Chairman and CEO's statement

Despite the continuing global pandemic, Ascent has advanced

across multiple fronts following the restructuring of its Board,

strategy, and portfolio last year. The business's new strategic

platform is now taking shape, with the opportunities that

brings.

First, the Company has made a significant step forward in

securing funding for its international arbitration proceedings

against the Republic of Slovenia with the signature of non-binding

heads of terms with Enyo Law LLP. These heads define the terms

under which the specialist arbitration and litigation legal firm

shall represent the Company on a fully contingent basis through a

damages-based agreement for the pursuit of the claim in arbitration

in relation to breaches of relevant investment treaties arising out

of and in connection with the Notice of Dispute sent on 23 July

2020. The Company is currently negotiating final binding

documentation for this funding.

Secondly, the Company broadened its strategy to include the ESG

Metals asset class and is now in the process of originating and

negotiating its maiden transaction. The Directors believe this is a

new exciting and burgeoning target sector to grow the Company.

Slovenia

As announced in March, the Company is advancing towards

initiating international arbitration proceedings against the

Republic of Slovenia under the Energy Charter Treaty and

UK-Slovenia Bilateral Investment Treaty. In June, the Company

announced that it had signed a non-binding, heads of terms with

Enyo Law LLP, a specialist arbitration and litigation legal firm

(the "Firm"). This agreement intends to engage the Firm to pursue

the Company's claims on a success-only fee arrangement. Upon

completion of definitive documentation, the Firm will only be paid

out of the proceeds of the arbitration in the event of a successful

damages award or execution of a binding settlement agreement if

achieved sooner. This non-equity dilutive, non-recourse and full

funding proposal is the preferred solution from the Company's

perspective, notwithstanding that the Company has other alternative

offers also under discussion.

Operations at the Petišovci project continue to produce gas ,

albeit at lower levels as a result of the field performance decline

and current inability to re-stimulate the producing PG-10 and

PG-11A wells. Total production f or the six months to 30 June 2021

was 751.14 thousand cubic metres of gas and 33,512 litres of

condensate. Gas sales continue with production being sold to local

industrial buyers. The region is currently experiencing very high

gas prices with the average Day Ahead Market gas price being Eur

51.0 / MWh as at 1 September, 2021. The JV expects to continue

producing, thereby taking advantage of strong current prices.

ESG Metals Strategy

As announced in February, the Company has broadened its natural

resources mandate to include a focus on ESG Metals, which it sees

as a new and burgeoning target sector to grow the Company. ESG

Metals includes secondary mining and re-treatment and recovery

opportunities which the Company sees as being consistent with

Environmental, Social and Governance ("ESG") principles. Typically,

these involve the reclassification, through highly efficient

recovery techniques, of stockpiled surface mining waste (previously

viewed as a liability for mining companies) as a valuable asset for

reprocessing and commercial sale to industry, governments and

metals traders.

The Company sees waste management, remediation and restoration

of land impacted by historic and ongoing mining activities as a

critical element in the global ESG agenda and integral to the

transition to a low carbon economy. The Company is looking at a

number of potential projects in Hispanic and Latin Americas, the

Caribbean, and South Africa, as well as Europe. In particular, the

Company believes there are good opportunities in gold, silver,

platinum, base metals and ferrochrome, where the economics are

especially attractive and the opportunity set has the ability of

delivering lowest cost quartile sustainable metal production from

legacy mining tailings, with low geological risk. Such

opportunities have the potential to provide strong cash returns

without exploration risk and only require modest upfront capital

outlay.

Cuba Market Entry

The Company continues to retain optionality to enter the Cuban

Oil and Gas industry, once COVID 19 restrictions are lifted and

possibly after the outcome of recent civil unrest is clarified. As

announced in August last year, the Company transmitted the draft

documentation in relation to its operating credentials to Union

Cuba-Petroleo ("CUPET"), Cuba's national oil company, and the

Oficina Nacional de Recursos Minerales ("ORNM") and since then has

received positive initial feedback towards accreditation as an

onshore operator subject to funding.

Corporate

During the period in review the Company raised GBP1 million at

an issue price of 10.1 pence per share by way of an oversubscribed

subscription and placing of new shares to institutional investors

and existing shareholders to fund the Company's general working

capital and ESG Metals business development activity.

Outlook

The team continue to work diligently across our key corporate

priorities which include funding the Slovenia ECT claim and

delivering a maiden ESG metals transaction. We look forward to

delivering success for our shareholders at Ascent Resources plc and

to re-engaging face to face with them now that COVID restrictions

in Europe have eased.

James Parsons Andrew Dennan

Executive Chairman Chief Executive Officer

8 September 2021 8 September 2021

CEO's report

Financial performance

Revenue for the first six month of 2021 was GBPnil, as per the

prior period. Closing cash at 30 June 2021 was GBP766,000 compared

to GBP304,000 in the prior period.

During the period the Company raised GBP1m before costs in an

equity placing in February 2021. There was a cash outflow from

operations of GBP824,000 and an inflow of GBP1,475,000 from

financing, resulting in net cash flow of GBP651,000.

Operational performance

Production KPI's Jan 2021 Feb 2021 Mar 2021 Apr 2021 May 2021 Jun 2021

--------------------------- --------- --------- ---------- --------- --------- ---------

Total gas (k scm) 131.82 136.17 155.10 143.08 99.17 85.80

--------------------------- --------- --------- ---------- --------- --------- ---------

Total gas (MMcf) 4.66 4.81 5.48 5.05 3.50 3.03

--------------------------- --------- --------- ---------- --------- --------- ---------

Average daily gas

(k scm) 4.25 4.86 5.00 4.77 3.20 2.86

--------------------------- --------- --------- ---------- --------- --------- ---------

Average daily gas

(Mcf) 150.17 171.74 176.69 168.43 112.97 101.00

--------------------------- --------- --------- ---------- --------- --------- ---------

Total condensate (liters) 2,808.00 2,354.00 17,496.00 5,346.00 3,834.00 1,674.00

--------------------------- --------- --------- ---------- --------- --------- ---------

CGR (liters per 1000

scm gas) 21.30 17.29 112.80 37.36 38.66 19.51

--------------------------- --------- --------- ---------- --------- --------- ---------

BOE - gas 802.39 828.87 944.09 870.93 603.65 522.26

--------------------------- --------- --------- ---------- --------- --------- ---------

BOE - condensate 17.63 14.78 109.87 33.57 24.08 10.51

--------------------------- --------- --------- ---------- --------- --------- ---------

Total BOE 820.02 843.65 1053.97 904.50 627.73 532.78

--------------------------- --------- --------- ---------- --------- --------- ---------

Total production for the six months to 30 June 2021 was 751.14

thousand cubic metres of gas and 33,512 litres of condensate.

Gas sales to INA remain suspended as wellhead pressure is below

the export pipeline pressure. The sales contract remains valid and

should the Company increase production gas sales may be able to be

resumed. The Company produced gas in the year to date which was

sold locally to an industrial buyer through a low-pressure

pipeline, however the revenue from this is less than the fixed

costs of the field and pursuant to a deal agreed in Q4 2019 the

Company is not currently receiving any revenue from this declining

production, with the proceeds being retained by the operating

service provider to pay towards their fixed costs.

Consolidated Income Statement

for the Period ended 30 June 2021

Period ended Period ended

30 June 30 June

2021 2020

Notes GBP '000s GBP '000s

Revenue - -

Cost of sales (25) (59)

Depreciation of oil & gas assets (194) (230)

---------------- ----------------

Gross profit (219) (289)

Administrative expenses (826) (945)

---------------- ----------------

Loss from operating activities (1,045) (1,234)

Finance income - -

Finance cost (10) (9)

---------------- ----------------

Net finance costs (10) (9)

Loss before taxation 2 (1,055) (1,243)

Income tax expense - -

---------------- ----------------

Loss for the period after tax (1,055) (1,243)

Loss for the period attributable to

equity shareholders (1,055) (1,243)

Earnings per share

Basic & fully diluted loss per share

(GBP) 4 (0.01) (0.03)

Consolidated Statement of Comprehensive Income

for the Period ended 30 June 2021

Period ended Period ended

30 June 30 June

2021 2020

GBP '000s GBP '000s

Loss for the period (1,055) (1,243)

Other comprehensive income

Foreign currency translation differences

for foreign operations (776) 1,835

Total comprehensive gain / (loss) for the

period (1,831) 592

Consolidated Statement of Changes in Equity

for the Period ended 30 June 2021

Share Share Merger Equity Share Translation Retained Total

capital premium Reserve reserve based reserve earnings

payment

reserve

GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s GBP '000s

Balance at 1

January 2020 7,604 72,330 570 - 1,873 (300) (41,964) 40,113

Comprehensive -

income

Loss for the

period - - - - - - (1,243) (1,243)

Other

comprehensive

income

Currency

translation

differences - - - - - 1,835 - 1,835

Total

comprehensive

income - - - - - 1,835 (1,243) 592

Transactions

with owners

Issue of

shares during

the

year net of

costs 113 678 - - - - - 791

Issue of

shares on

acquisition 30 173 - - - - - 203

Share-based

payments and

expiry of

options - - - - 206 - - 206

Balance at 30

June 2020 7,747 73,181 570 - 2,079 1,535 (43,207) 41,905

--------------- ------------ ------------- ---------- ---------- ---------- ------------ ---------- ----------

Balance at 1

January 2020 7,604 72,330 570 - 1,873 (300) (41,964) 40,113

Comprehensive -

income

Loss for the

period - - - - - - (2,831) (2,831)

Other

comprehensive

income

Currency

translation

differences - - - - - 1,327 - 1,327

Total

comprehensive

income - - - - - 1,327 (2,831) (1,504)

Transactions

with owners

Issue of

ordinary

shares 324 1,713 - - - - - 2,037

Costs related

to share

issues - (180) - - - - - (180)

Equity value

of

convertible

loan note - - - 73 - - - 73

Share based

payments - - - - 256 - 200 456

Balance at 31

December 2020 7,928 73,863 570 73 2,129 1,027 (44,595) 40,995

--------------- ------------ ------------- ---------- ---------- ---------- ------------ ---------- ----------

Balance at 1

January 2021 7,928 73,863 570 73 2,129 1,027 (44,595) 40,995

Comprehensive -

income

Loss for the

period - - - - - - (1,055) (1,055)

Other

comprehensive

income

Currency

translation

differences - - - - - (776) - (776)

Total

comprehensive

income - - - - - (776) (1,055) (1,831)

Transactions -

with owners

Issue of

shares during

the

year net of

costs 70 1,176 - - - - - 1,246

Share-based

payments - - - - 16 - - 16

Balance at 30

June 2021 7,998 75,039 570 73 2,145 251 (45,650) 40,424

--------------- ------------ ------------- ---------- ---------- ---------- ------------ ---------- ----------

Consolidated Statement of Financial Position

As at 30 June 2021

30 June 31 December

2021 2020

Assets Notes GBP '000s GBP '000s

Non-current assets

Property, plant and equipment 5 21,865 22,783

Exploration and evaluation costs 5 18,604 18,5763

Goodwill 653 653

Prepaid abandonment fund 300 300

-------------- --------------

Total non-current assets 41,422 42,489

Current assets

Inventory - -

Trade and other receivables 6 119 66

Cash and cash equivalents 766 115

Restricted cash - -

-------------- --------------

Total current assets 885 181

Total assets 42,307 42,670

============== ==============

Equity and liabilities

Attributable to the equity holders

of the Parent Company

Share capital 10 7,998 7,928

Share premium account 75,039 73,863

Merger reserve 570 570

Equity reserve 73 73

Share-based payment reserve 2,145 2,129

Translation reserves 251 1,027

Retained earnings (45,650) (44,595)

-------------- --------------

Total equity attributable to the shareholders 40,424 40,995

Total equity 40,424 40,995

-------------- --------------

Non-current liabilities

Borrowings 8 505 197

Provisions 317 328

Total non-current liabilities 822 525

Current liabilities

Borrowings 8 5 5

Contingent consideration due on acquisitions 9 450 450

Trade and other payables 7 606 695

Total current liabilities 1,061 1,150

Total liabilities 1,883 1,675

-------------- --------------

Total equity and liabilities 42,307 42,670

============== ==============

Consolidated Statement of Cash Flows

for the six months ended 30 June 2021

Period ended Period ended

30 June 30 June

2021 2020

GBP '000s GBP '000s

Cash flows from operations

Loss after tax for the period (1,055) (1,243)

Depreciation 194 231

Change in receivables 53 170

Change in payables (89) 80

Increase in share-based payments 38 206

Exchange differences 25 11

Finance cost 10 9

Net cash used in operating activities (824) (536)

-------------- -----------------

Cash flows from investing activities

Payments for fixed assets - (3)

Payments for investing in exploration - -

Net cash used in investing activities - (3)

-------------- -----------------

Cash flows from financing activities

Interest paid and other finance fees - -

Loans repaid (125) (12)

Proceeds from borrowings 375

Proceeds from issue of shares 1,265 848

Share issue costs (40) (70)

Net cash generated from financing

activities 1,475 736

-------------- -----------------

Net increase in cash and cash equivalents

for the year 651 227

Effect of foreign exchange differences - -

Cash and cash equivalents at beginning

of the year 115 77

Cash and cash equivalents at end of

the year 766 304

============== =================

Notes to the Interim Financial Statements

For the six months ended 30 June 2021

1. Accounting Policies

Reporting entity

Ascent Resources plc ('the Company') is a company domiciled in

England. The address of the Company's registered office is 5 New

Street Square, London EC4A 3TW. The unaudited consolidated interim

financial statements of the Company as at 30 June 2021 comprise the

Company and its subsidiaries (together referred to as the

'Group').

Basis of preparation

The interim financial statements have been prepared using

measurement and recognition criteria based on International

Financial Reporting Standards (IFRS and IFRIC interpretations)

issued by the International Accounting Standards Board (IASB) as

adopted for use in the EU. The interim financial information has

been prepared using the accounting policies which were applied in

the Group's statutory financial statements for the year ended 31

December 2020.

New Standards adopted as at 1 January 2021

Accounting pronouncements which have become effective from 1

January 2021 are:

-- IFRS 3 Business Combinations - definition of a business

-- IAS 1 and IAS 8 - definition of material

-- IFRS 9, IFRS 7 and IAS 39 - interest rate benchmark

-- IFRS 7 - Insurance contracts

These accounting pronouncements do not have a significant impact

on the Group's financial results or position.

All amounts have been prepared in British pounds, this being the

Group's presentational currency.

The interim financial information for the six months to 30 June

2021 and 30 June 2020 is unaudited and does not constitute

statutory financial information. The comparatives for the full year

ended 31 December 2020 are not the Group's full statutory accounts

for that year. The information given for the year ended 31 December

2020 does not constitute statutory financial statements as defined

by Section 435 of the Companies Act. The statutory accounts for the

year ended 31 December 2019 have been filed with the Registrar and

are available on the Company's web site www.ascentresources.co.uk .

The auditors' report on those accounts was unqualified. It did not

contain a statement under Section 498(2)-(3) of the Companies Act

2006.

Going Concern

The Financial Statements of the Group are prepared on a going

concern basis.

COVID-19 has had limited direct impact on Ascent's assets in

Slovenia but there may be delays in obtaining the necessary

governmental approvals and processes. Production operations in

Slovenia have been unaffected to date.

The forecasts are sensitive to the timing and cash flows

associated with the continuing situation in Slovenia, and

discretionary spend incurred with executing on the ESG Metals

Strategy through acquisition and advancing the Cuban initiative,

including deferred consideration that would become payable if the

Company elects to enter a PSC for Block 9b. As such, the Company

will need to raise new capital within the forecast period to fund

such discretionary spend.

Based on historical and recent support from new and existing

investors the Board believes that such funding, if and when

required, could be obtained through new debt or equity

issuances.

However, there can be no guarantee over the outcome of these

options and as a consequence there is a material uncertainty of the

Group's ability to raise the necessary finance, which may cast

doubt on the Group's ability to operate as a going concern.

Further, the Group may be unable to realise its assets and

discharge its liabilities in the normal course of business.

Principal Risks and Uncertainties:

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 11-12 of the

Annual Review 2020, a copy of which is available on the Company's

website at www.ascentresources.co.uk.

2. Operating loss is stated after charging

Period ended Period ended

30 June 30 June

2021 2020

GBP '000s GBP '000s

Employee costs 475 241

Share based payment charge 16 206

Included within Admin Expenses

Audit Fees 40 35

Fees payable to the company's auditor - -

other services

------------- -------------

40 35

3. Earnings per share

Period ended Period ended

30 June 30 June

2021 2020

GBP '000s GBP '000s

Result for the period

Total loss for the period attributable

to equity shareholders (1,055) (1,243)

Weighted average number of ordinary Number Number

shares

For basic earnings per share 106,483,897 42,776,190

Earnings per share (GBP) (0.01) (0.03)

4. Property, plant & equipment and Exploration and Evaluation assets

Computer Developed Total Property Exploration

Equipment Oil & Gas Plant & & evaluation

Assets Equipment

Cost GBP000s GBP000s GBP000s GBP000s

At 1 January 2020 6 23,483 23,489 18,576

Additions 4 - - 653

Effect of exchange rate movements - 1,592 1,592 216

At 30 June 2020 10 25,075 25,085 19,445

----------- ----------- --------------- --------------

At 1 January 2020 6 23,483 23,489 18,576

Additions - 3 3 -

Effect of exchange rate movements - 1,111 1,111 177

At 31 December 2020 6 24,494 24,600 18,753

----------- ----------- --------------- --------------

At 1 January 2020 6 24,494 24,600 18,753

Additions - - - -

Effect of exchange rate movements - (624) (624) (149)

At 30 June 2021 6 23,870 23,876 18,604

----------- ----------- --------------- --------------

Depreciation

At 1 January 2020 (6) (1,414) (1,420) -

Charge for the year (1) (231) (232) -

Effect of exchange rate movements - 55 55 -

At 30 June 2020 (7) (1,618), (1,625) -

----------- ----------- --------------- --------------

At 1 January 2020 (6) (1,414) (1,420) -

Charge for the year - (397) (397) -

Effect of exchange rate movements - - - -

At 31 December 2020 (6) (1,811) (1,817) -

----------- ----------- --------------- --------------

At 1 January 2021 (6) (1,811) (1,817) -

Charge for the year - (194) (194) -

Effect of exchange rate movements - - - -

At 30 June 2021 (6) (2,005) (2,011) -

----------- ----------- --------------- --------------

Carrying value

At 30 June 2021 - 21,865 21,865 18,604

----------- ----------- --------------- --------------

At 31 December 2020 - 22,973 22,873 18,753

----------- ----------- --------------- --------------

At 30 June 2020 4 23,457 23,460 19,445

----------- ----------- --------------- --------------

5. Trade & other receivables

30 June 31 December

2021 2020

GBP '000s GBP '000s

Trade receivables - -

VAT recoverable 53 49

Prepaid abandonment liability 300 300

Prepayments & accrued income 9 17

362 366

========== ============

Less non-current portion (300) (300)

---------- ------------

Current portion 62 66

6. Trade & other payables

30 June 31 December

2021 2020

GBP '000s GBP '000s

Trade payables 538 573

Tax and social security payable 68 56

Other payables - -

Accruals and deferred income 66 66

606 695

========== ============

7. Borrowings

30 June 31 December

2021 2020

Group GBP '000s GBP '000s

Non-current

Convertible loan notes 505 197

55 197

---------- ------------

30 June 31 December

Group 2021 2019

Curren t GBP '000s GBP '000s

Convertible loan notes 5 5

Borrowings - -

Liability at the end of the period 5 5

---------- ------------

The non-current borrowings relate to the loan arrangement with

Riverfort Global opportunities that was refinanced in February

2020. The outstanding loan of GBP375,020 as at February 2020 was

re-negotiated to a two-year coupon free bullet with conversion

rights for the lender at 7.5 pence per share. No conversion can

occur until the share price exceeds 10 pence per share for five

consecutive days. The Group made convertible loan note repayments

in the year of GBP105,000 to Riverfort Global opportunities,

resulting in an ending convertible loan note balance of GBP270,000,

comprising GBP197,000 recognised as the debt component and a

further GBP73,000 recognised in Equity Reserve.

The current borrowings relate to the loan facility arrangement

with Align Research. The outstanding loan of GBP307,500, of which

GBP57,500 was received subsequent to the period end.

8. Contingent consideration due on acquisitions

30 June 31 December

2021 2020

Group GBP '000s GBP '000s

Non-current

Ascent Hispanic Resources UK Limited 450 450

450 450

---------- ------------

The fair value of contingent consideration was based on the

present value of cash flows and the market value of the shares to

be issued.

9. Share Capital

30 June 31 December

2021 2020

GBP '000s GBP '000s

Authorised

2,000,000,000 ordinary shares of 0.5p

each 10,000 10,000

Allotted, called up and fully paid

3,019,648,452 deferred shares of 0.195p

each 5,888 5,888

1,737,110,763 deferred shares of 0.09p

each 1,563 1,563

109,376,804 ordinary shares of 0.5p

each (2020: 95,283,281 ordinary shares

of 0.2p each) 547 477

7,998 7,928

Reconciliation of share capital movement Ordinary shares Ordinary shares No.

No.

Opening 95,283,281 3,019,648,452

Share consolidation - (2,989,451,968)

Issue of Trameta consideration shares 91,167

Issue of shares during the year 14,093,523 64,995,630

Closing 109,376,804 95,283,281

================ ====================

The deferred shares have no voting rights and are not eligible

for dividends.

Shares issued during the year

Issuance of equity throughout the year:

-- On 6 January 2021, the Company issued 208,991 ordinary shares

('Consultancy Shares'), to a supplier for financial modelling and

business development services rendered in the months of November

and December, at an average issue price of 5.74 pence per share

being calculated as the monthly volume weighted average price

calculations for the respective months in which the services were

rendered.

-- On 11 January 2021, the Company received a Warrant Exercise

notice over 833,333 new ordinary shares for a consideration of

GBP62,500. The Warrants are being exercised by Align Research in

consideration for surrendering an equivalent value of loan notes.

Additionally, the Company has agreed to issue 66,667 new shares at

7.5 pence, being the coupon conversion price, in lieu of the 8%

cash coupon that is incurred on the converted loan amount.

-- On 4 February 2021, the Company received a warrant exercise

notice over 1,000,000 new ordinary shares for a consideration of

GBP55,000.

-- On 4 February 2021, the Company received a Warrant Exercise

notice over 833,333 new ordinary shares for a consideration of

GBP62,500. The Warrants are being exercised by Align Research in

consideration for surrendering an equivalent value of loan notes.

Additionally, the Company has agreed to issue 66,667 new shares at

7.5 pence, being the coupon conversion price, in lieu of the 8%

cash coupon that is incurred on the converted loan amount.,

-- On 4 February 2021, the Company received a Warrant Exercise

notice over 900,000 new ordinary shares for a consideration of

GBP67,500. The Warrants are being exercised by Align Research and

the Company has therefore today issued 900,000 new shares.

-- On 10 February 2021, the Company received a warrant exercise

notice over 187,500 new ordinary shares for a consideration of

GBP7,500.

-- On 11 February 2021, the Company issued 9,997,032 new

ordinary shares of 0.5p at a price of 10.1p through an

oversubscribed placing, raising gross proceeds of GBP1,009,700.

10. Share based payments

The Company has provided the Directors, certain employees and

institutional investors with share options and warrants

('options'). Options are exercisable at a price equal to the

closing market price of the Company's shares on the date of grant.

The exercisable period varies and can be up to seven years once

fully vested after which time the option lapses.

Details of the share options outstanding during the year are as

follows:

Shares Weighted Average

price (pence)

Outstanding at 1 January 2020 152,576,254 2.38

Outstanding at 31 December 2020 7,348,142 253.72

Exercisable at 31 December 2020 1,450,763 248.72

Outstanding at 1 January 2021 7,348,142 253.72

Granted during the year - -

Outstanding at 30 June 2021 7,348,142 253.72

Exercisable at 30 June 2021 1,450,763 248.72

The value of the options is measured by the use of a binomial

pricing model. The inputs into the binomial model made in 2020 were

as follows.

Share price at grant date 2.9p - 778p

Exercise price 5.0p - 2000p

Volatility 50%

Expected life 3-5 years

Risk free rate 0.5%

Expected dividend yield 0%

Expected volatility was determined by calculating the historical

volatility of the Group's share price over the previous 5 years.

The expected life is the expiry period of the options from the date

of issue.

Options outstanding at June 2020 have an exercise price in the

range of 2.9p and 778p (and a weighted average contractual life of

4.5 years.

Details of the warrants outstanding during the year are as

follows:

Shares Weighted Average

price (pence)

Outstanding at 1 January 2021 22,068,420 5.44

Granted during the year - -

Exercised during the year (3,754,166) 6.79

Outstanding at 30 June 2021 18,314,254 5.44

Exercisable at 30 June 2021 17,889,772 5.45

11. Events after the reporting period

There have been no significant events subsequent to the

reporting period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCUUGDGBI

(END) Dow Jones Newswires

September 09, 2021 02:00 ET (06:00 GMT)

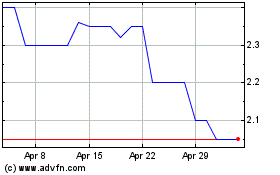

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024