AfriTin Mining Ltd Issue of Shares (1935Y)

17 August 2018 - 10:47PM

UK Regulatory

TIDMATM

RNS Number : 1935Y

AfriTin Mining Ltd

17 August 2018

17 August 2018

AfriTin Mining Limited

("AfriTin" or the "Company")

Issue of Shares

The AfriTin Board has approved the issue of 1 591 304 Ordinary

shares of no par value to Hannam & Partners Advisory Limited at

3.45p in lieu of a payment of GBP54,900, being part of their fees

in relation to the capital raise that took place in June 2018.

Application has been made to admit the New Ordinary Shares to

trading on AIM and it is anticipated that the application will be

effected and dealings will commence on 24 August 2018.

Following the issue of the shares, the total number of shares in

issue will be 519,588,525 Ordinary Shares of no par value. There

are no Shares held in treasury. This total voting rights figure may

be used by shareholders as the denominator for the calculations by

which they will determine whether they are required to notify their

interests in, or a change to their interest in, AfriTin under the

Disclosure and Transparency Rules.

For further information, please visit www.afritinmining.com or

contact:

AfriTin Limited

Anthony Viljoen, CEO +27 (11) 268 6555

Nominated Adviser and Joint Broker

WH Ireland Limited

Katy Mitchell

Adrian Hadden

James Sinclair-Ford +44 (0) 207 220 1666

Joint Broker

NOVUM Securities Limited

Jon Belliss +44 (0)20 7399 9400

Financial PR (United Kingdom)

Tavistock +44 (0) 207 920 3150

Jos Simson / Barney Hayward

Financial PR (South Africa)

Lifa Communications

Cath Drummond / Gabriella von

Ille +27 (11) 268 5781

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining is the first pure tin company listed in London

and its vision is to create a portfolio of world-class,

conflict-free, tin producing assets. The Company's flagship asset

is the Uis brownfield tin mine in Namibia, formerly the world's

largest hard-rock tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current two-fold strategy: fast track Uis

brownfield tin mine in Namibia to commercial production in 2018

ramping up to 5,000 tonnes of concentrate, and consolidation of

other quality African tin assets. The Company strives to capitalise

on the solid supply/demand fundamentals of tin by developing a

critical mass of tin resource inventory, achieving production in

the near term and further scaling production by consolidating tin

assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOELLFSFTRIDLIT

(END) Dow Jones Newswires

August 17, 2018 08:47 ET (12:47 GMT)

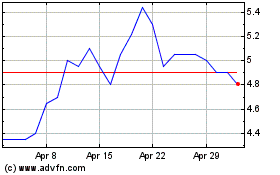

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2024 to May 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From May 2023 to May 2024