TIDMBIDS

RNS Number : 2830D

Bidstack Group PLC

20 June 2023

The headline for the Bidstack Group Plc announcement released on

20 June 2023 at 7:00 under RNS No 2223D should read "Final Results

and Annual Report". The announcement text is unchanged and is

reproduced in full below.

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR") as applied in

the United Kingdom. Upon publication of this Announcement, this

information is now considered to be in the public domain.

20(th) June 2023

Bidstack Group Plc

("Bidstack" or the "Company" or the "Group")

Final Results for the year ended 31 December 2022

Annual Report & Accounts 2022

Bidstack Group Plc (AIM: BIDS), the in-game brand activation

platform, is pleased to announce its final results for the

financial year ended 31 December 2022 ("Annual Report").

The 2022 Annual Report & Accounts will be available for

download today at

http://www.bidstack.com/financial-reports/annual-report-2022/ and

will be posted to shareholders shortly thereafter.

Financial Performance Highlights

-- Revenue up 101% at GBP5.3m* (FY21:GBP2.6m)

-- Gross profit up 298% at GBP3.7m (FY21: GBP0.95m)

-- Gross margin improvement to 72%** (FY21: 36%)

-- Loss after tax GBP7.7m (FY21: GBP6.3m)

-- Cash balance at 31 December 2022 up 21% at GBP8.7m (31 December 2021: GBP7.1m)

*Unaudited gross billings, including all revenues and Azerion

minimum revenue guarantee invoiced for FY22, were c.GBP9.3m (FY21:

GBP2.6m), in line with contractual arrangements previously

indicated. However, as a result of the net accounting treatment of

revenues in accordance with IFRS 15, Bidstack's reported revenues

for FY22 are GBP5.3m.

** Gross margin has risen significantly as a result of the net

accounting treatment of revenues and corresponding costs of sales

towards servicing the Azerion contract in accordance with IFRS 15.

Excluding this treatment the unaudited adjusted gross margin would

be closer to 40%.

Operational Performance Highlights

-- Successful placing raising proceeds of c.GBP10.5m in October

2022, including a significant investment by Irdeto B.V., a world

leader in digital platform cybersecurity, taking a 13.5% stake in

the Company;

-- Growing global network of premium developers and publishers

with over 250 titles (FY21: 58) across in-game, in-menu and

rewarded video. This includes an addition of two further titles

with a AAA game publisher and a multi-year renewal with Sports

Interactive's Football Manager;

-- Growing revenue per agency holding group as the number of

blue chip brands rise as intrinsic in-game becomes a key growth

initiative;

-- Partnership with Unity, a cross platform game engine as a

Unity Verified Solution recommended tool for game developers across

all platforms;

-- Onboarding of additional resellers with MMP Worldwide (MENA),

AdScholars (India), Totally Awesome (APAC), TNK Factory (South

Korea) and Omega Media (Vietnam);

-- Internet Advertising Bureau (IAB)/The Media Rating Council

(MRC) have recognised standards for in-game advertising.

Advertisers now have clear benchmarks on how to measure campaign

success; and

-- Enterprise customers licensing Bidstack's technology such as

mobile ad-tech company Adways and multi-year deal with metaverse

franchise SimWin Sports.

Post Period End Highlights

-- Revenues for H1 2023 expected to be approximately GBP2.0m (H1

2022 GBP2.05m) showing Bidstack's strong recovery following

re-engagement with agencies and programmatic platforms after the

termination of the Azerion commercial partnership in December 2022.

The prior year comparison included a minimum revenue guarantee

which contrasts with the high quality of commercial revenue

generated through the Company's internal sales team this year;

-- Following a comprehensive business review the Company has

implemented a cost efficiency and restructuring programme to reduce

average monthly cash burn by approximately 40% going forward;

-- Bidstack filed comprehensive claims against Azerion in Dutch

courts demanding the full amounts owed by Azerion under the

agreement of 16 December 2021; and

-- The Group is currently negotiating a convertible loan

facility with a strategic investor and expects to be able to make

further updates in due course.

Trading Update

-- Launch of programmatic "open marketplace" advertising with

live connections across The Trade Desk, Magnite, Media Math and

Xandr;

-- A pipeline of brand and performance programmatic platforms

including OpenX, Equative, Stackadapt and Adform to be integrated

in the coming year;

-- Roster of resellers with experience in gaming and new media

channels across APAC, MENA, LATAM and EMEA are being onboarded;

-- Reinforcing product with attribution and viewability through

integrations with Kochava and solutions with IAS and MOAT;

-- Highlights across the gaming network include Ubisoft's

marquee mobile franchise Hungry Shark Evolution and organic growth

within publishers such as Miniclip adding further titles. Publisher

retention and feedback remains strong driven by account management,

advertising activity and platform development; and

-- First-ever NFL club to partner with Bidstack Sports and adopt

Bidstack's technology to operate real world and virtual stadiums in

partnership with StatusPRO's NFL Pro Era, a fully licensed virtual

reality game.

-- Multiple negotiations progressing across sports leagues, teams and publishers.

Outlook

The US sales team is now fully integrated providing materially

improved revenue visibility. Bidstack is also increasing the

strength of its relationships with key games publishers and

developers through cross-selling the Group's products. In addition

Bidstack's reseller network is expanding and automated open

marketplace revenue is starting to appear.

The Directors believe that Bidstack's strategy positions the

Company well for future growth with its growing global footprint

being serviced by additional resellers and the Company's

programmatic open marketplace offering now taking root. Bidstack is

making robust progress with its key commercial partners and is

attracting interest from other significant industry players. As the

market continues to develop, further accretive and multi-year

enterprise partnership opportunities are coming to fruition.

For FY23, the Board currently expects the Group's results to be

in line with market expectations.

James Draper, CEO of Bidstack, said:

"FY22 was a year where Bidstack made the operational shift from

early stage to a scale up business. Bidstack grew its market share

in the industry, which can be measured across indicators such as

the growing number of agencies activating blue chip global

advertisers, our new markets, our increased portfolio of games and

the growing size of average campaign budgets.

The US team is now well integrated and hitting the ground

running providing the business with ever improving visibility of

growing revenue. There is solid momentum in relation to the

publishers and game developers as we cross-sell our products and

organically grow the portfolio of games.

Current trading reflects our rapid commercial adjustment

following the termination of the sales agency arrangements with

Azerion. Following a thorough debrief of the market intelligence

gained through our relationship with Azerion and, having reignited

our agency relationships directly, we are now beginning to roll-out

our new look reseller network and automated open market revenue is

beginning to flow into our network.

As we look ahead to H2 2023, the intrinsic in-game market

remains resilient as major catalysts, such as additional gaming

platforms, begin to explore in-game advertising. We believe this

will increase the volume of high-fidelity titles within our network

and drive increased revenues. Larger screens will command a higher

price point from marketers. Publishers are expressing their desire

to utilise our technology for monetisation, content management

systems (CMS) and as a marketing channel. We have rolled out

promising proof of concepts in the sports genre, unifying

publishers, licence holders and sports teams.

We have reviewed our cost base and reduced our average monthly

cash burn significantly going forward, to preserve and extend our

runway. The alignment ensures that our resources are being

maximised for sustainable and accelerated revenue generation.

We are obsessed at Bidstack in ensuring our technology is fully

utilised by our clients, the game developers. Generating brand

activation revenue, improving player engagement through one-to-one

messaging from publisher-to-gamer via our CMS, and a toolset that

through our sports offering, can save them money whilst improving

the authenticity of the gaming environment."

-S-

Contacts

Bidstack Group Plc

James Draper, CEO

SPARK Advisory Partners Limited (Nomad)

Mark Brady / Neil Baldwin / James Keeshan

+44 (0) 203 368 3550

Stifel Nicolaus Europe Limited (Broker)

Fred Walsh / Tom Marsh

+44 (0) 20 7710 7600

Extracts from the Annual Report

Chairman's Statement

Introduction

This is my first statement since becoming Chairman of Bidstack

in September 2022 and I would like to thank Donald Stewart, the

outgoing Chair for all his hard work during his tenureship since

the public listing in August 2018 and I am pleased that he remains

a Non-Executive Director of Bidstack.

Looking back at 2022, it has been a year in which Bidstack has

strengthened its position in many important areas as a leading

platform in native in-game advertising activation technology. It

has also been a year, where, coming into 2023, Bidstack has set

itself up to become more strategic, more predictable in terms of

earnings and profit and more in control of its commercial

operations through direct sales to its clients and partners thus

maximising global growth opportunities.

The 2022 financial numbers speak for themselves:

-- Revenue up +101% to c.GBP5.3m* (FY21: GBP2.6m)

-- Gross margin at c.72%** (FY21: 36%)

-- Cash balance at 31 December 2022 up 21% at GBP8.7m (31 December 2021: GBP7.1m)

-- Loss after tax GBP7.7m (31 December 2021: GBP6.3m)

(*Gross billings including all gross revenues and gross Azerion

minimum revenue guarantee for FY22 were GBP9.3m (FY21: GBP2.6m), in

line with our contractual arrangements.)

(** Gross margin arising as a result of the net accounting

treatment of revenues and corresponding costs of sales towards

servicing the Azerion contract in accordance with IFRS15. Excluding

this treatment the Board believe that adjusted gross margin would

be closer to 40%)

There are a considerable number of key highlights on which I

will comment:

At a time when fundraising was generally very difficult in the

industry:

-- A successful placing, raising proceeds of GBP10.5m in October

2022, demonstrating the confidence of our existing investors. This

included a significant first investment by Irdeto B.V., a world

leader in video games protection and anti-piracy technology taking

a 13.5% stake.

Making huge strides by:

-- Growing the Bidstack global network of leading developers and

publishers with over 250 titles (FY21: 58) across in-game, in-menu

and rewarded video. This includes an addition of 2 further titles

with a AAA global game publisher and a multi-year renewal with

Sports Interactive's Football Manager.

Expanding, commercial activity in North America where a

significant portion of Bidstack's potential business exists by:

-- An increased focus on the US market. The commercial team in

the US now comprises ten people.

At the same time, making significant inroads into all UK and

European markets by:

-- Educating and growing markets such as the UK, France,

Netherlands, Spain, Germany, Nordics, Portugal and Belgium in

advertising across Bidstack's extensive gaming inventory

Expanding Bidstack's global reach by:

-- The onboarding of additional resellers with MMP Worldwide

(MENA), AdScholars (India), Totally Awesome (APAC), TNK Factory

(South Korea) and Omega Media (Vietnam) and;

In the area of advancing technology and standardisation in the

industry:

-- By forming a partnership with Unity, a cross platform game

engine as a Unity Verified Solution recommended monetisation

solution for game developers across all platforms;

-- By catalysing the Internet Advertising Bureau (IAB)/The Media

Rating Council (MRC) to recognise standards for in game

advertising. Advertisers now have clear benchmarks on how to

measure campaign success;

-- Acceleration of the adoption of Bidstack's SDK by developers

and publishers as breadth of ad-formats in addition to in-game,

in-menu now includes rewarded video, the most transacted ad unit in

gaming;

-- Early success with enterprise customers licensing Bidstack's

technology such as mobile ad-tech company Adways and metaverse

franchise SimWin; and

-- This is the launch of our enterprise platform business and

across 2023 we expect to announce multiple partnerships through our

"low touch", high margin solution.

Operational challenges

The road in 2022 has not, however, been without obstacles on the

way.

I will comment on the principal one.

The appointment of Azerion in 2021, as a global reseller of

Bidstack's offerings, boosted Bidstack's sales capabilities in

Europe but Azerion materially underperformed against mutual

expectations in North America as well as across the rest of the

world. Bidstack took immediate action to mitigate Azerion's

shortfall by appointing its own experienced US sales team.

Azerion failed to remit properly invoiced sums due to Bidstack

under the terms of the contract between the parties, resulting in

Bidstack being awarded attachments (freezing injunctions) against

Azerion in December 2022 and then defending Azerion's petition to

have these removed in the Court of Amsterdam in January 2023.

Following the judgement of the Dutch court in January, Azerion has

provided Bidstack with bank guarantees for the amounts due to

Bidstack under its initial claims. Azerion's purported termination

of the contract on 30 December 2022 increased the quantum of

Bidstack's claims materially. Following advice, the Board believes

that, unfortunately, a court hearing on these claims is not likely

to occur before Q4 2023.

Whilst this legal action is regrettable, it has meant that

Bidstack now has far greater control over enabling the Company to

become more agile globally.

With Bidstack's improving revenue visibility and a growing

client list, the Board is confident in Bidstack's ability to

operate independently of any Azerion relationship.

As previously stated, Bidstack intends to vigorously continue

pursuing Azerion in respect of its claims for unpaid invoices and

breaches of contract.

Outlook, highlights for 2023 and beyond

As a Board we are excited by the future of the industry the

Company has helped create, the use-cases for our technology. The

management team, led by our Founder and Chief Executive James

Draper, are focused on achieving our commercial and financial

objectives.

Finally, thank you to our loyal and 'cornerstone' institutional

and retail investors and our dedicated employees and partners for

your support throughout 2022.

Dr David Reeves

Chairman

Consolidated statement of comprehensive income

for the year ended 31 December 2022

Note Year ended Year ended

31 December 31 December

2022 2021

GBP GBP

Revenue 4 5,267,155 2,623,413

Cost of sales (1,484,512) (1,674,190)

------------ -----------

Gross profit 3,782,643 949,223

Administrative expenses 5 (12,545,716) (8,681,927)

------------ -----------

Exceptional items 6 - (222,555)

------------ -----------

Total administrative expenses (12,545,716) (8,904,482)

------------ -----------

Operating loss (8,763,073) (7,955,259)

Finance income 9 749 180

Finance costs 9 (2,998) (3,392)

Loss before taxation (8,765,322) (7,958,471)

Taxation 10 1,079,136 1,661,027

------------ -----------

Loss for the year (7,686,186) (6,297,444)

Other comprehensive income

Items that will or may be reclassified

to profit or loss:

Exchange gains on translation

of foreign operations 113,358 10,589

Tax relating to items that may

be reclassified 10 - -

------------ -----------

Other comprehensive income for

the year, net of tax 113,358 10,589

------------ -----------

Total comprehensive loss for

the year (7,572,828) (6,286,855)

============ ===========

Loss per share - basic and diluted

(pence) 11 (0.62) (1.21)

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of financial position

as at 31 December 2022

Company number 04466195

Note 31 December 31 December

2022 2021

ASSETS GBP GBP

Non-current assets

Intangible assets 12 765,454 248,760

Property, plant and equipment 14 56,623 46,519

Right of use asset 16 3,920 7,280

------------------------ ------------

Total non-current assets 825,997 302,559

======================== ============

Current assets

Trade and other receivables 18 9,319,868 2,752,036

Cash and cash equivalents 19 8,662,039 7,086,906

------------------------ ------------

Total current assets 17,981,907 9,838,942

======================== ============

Total assets 18,807,904 10,141,501

======================== ============

EQUITY AND LIABILITIES

Equity

Share capital 21 10,796,670 8,950,048

Share premium account 21 43,216,919 35,375,326

Share-based payment reserve 21 2,782,896 1,589,965

Merger relief reserve 21 6,508,673 6,508,673

Reverse acquisition reserve 21 (23,320,632) (23,320,632)

Warrant reserve 21 - 71,480

Exchange reserve 21 123,947 10,589

Retained losses 21 (29,491,052) (21,876,346)

------------------------ ------------

Total equity 10,617,421 7,309,103

======================== ============

Non-current liabilities

Lease liability 15 614 4,180

------------------------ ------------

Total non-current liabilities 614 4,180

======================== ============

Current liabilities

Trade and other payables 20 8,186,323 2,824,920

Lease liability 15 3,546 3,298

Total current liabilities 8,189,869 2,828,218

======================== ============

Total equity and liabilities 18,807,904 10,141,501

======================== ============

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of changes in equity

for the year ended 31 December 2022

Share-based Merger Reverse

Share Share payment relief acquisition Exchange Warrant Retained Total

capital premium reserve reserve reserve Reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 January

2021 6,234,261 27,984,716 1,282,556 6,508,673 (23,320,632) - 71,480 (15,578,902) 3,182,152

Issue of

shares 2,715,787 8,147,363 - - - - - - 10,863,150

Costs of

raising

equity - (756,753) - - - - - - (756,753)

Share-based

payments - - 307,409 - - - - - 307,409

Loss for the

year - - - - - - - (6,297,444) (6,297,444)

Total

comprehensive

loss for the

year - - - - - 10,589 - - 10,589

Balance as at

31 December

2021 8,950,048 35,375,326 1,589,965 6,508,673 (23,320,632) 10,589 71,480 (21,876,346) 7,309,103

============ ============ =========== =========== ============== ========= ======== ============== ============

Issue of

shares 1,839,122 8,643,873 - - - - - - 10,482,995

Issue of share

options

exercised 7,500 22,500 30,000

Costs of

raising

equity - (824,780) - - - - - - (824,780)

Share-based

payments - - 1,192,931 - - - - - 1,192,931

Unexercised

lapsed

warrants - - - - - - (71,480) 71,480 -

Loss for the

year - - - - - - - (7,686,186) (7,686,186)

Total other

comprehensive

income for

the year - - - - - 113,358 - - 113,358

Balance as

at 31

December

2022 10,796,670 43,216,919 2,782,896 6,508,673 (23,320,632) 123,947 - (29,491,052) 10,617,421

============ ============ =========== =========== ============== ========= ======== ============== ============

Warrants issued by the Company in the year ended 31 December

2018 were classified as equity on initial recognition and shown in

the warrant reserve. As at 31 December 2022 the warrants lapsed

unexercised and the amount previously recognised in the warrant

reserve has been reclassified to retained losses.

The notes to the accounts published in the Annual Report form

part of the financial statements.

Consolidated statement of cash flows

for the year ended 31 December 2022

31 December 31 December

2022 2021

Note GBP GBP

Cash flows from operating activities

Loss before taxation (8,765,322) (7,958,471)

Adjustments for:

Amortisation - Intangibles 12 71,528 31,195

Amortisation - Right of use asset 16 3,360 10,377

Depreciation 14 28,765 24,160

Equity settled share-based payments 5 1,192,931 307,409

Doubtful debts expenses - (2,073)

Interest received 9 (749) (180)

Interest paid 9 2,998 3,392

Bad debts expense 18 1,456,236 -

Exchange differences on translation

of foreign operations 113,358 10,589

(5,896,895) (7,573,602)

Changes in working capital

(Increase)/decrease in trade and other

receivables 18 (8,199,385) 409,468

Increase in trade and other payables 20 5,361,405 961,182

----------- -----------

Cash used in operations (8,734,875) (6,202,952)

Taxation received 1,254,451 892,895

----------- -----------

Net cash used in operations (7,480,424) (5,310,057)

Cash flow from investing activities

Investment in intangible assets 12 (588,222) -

Investment in property, plant and

equipment 14 (38,869) (42,291)

----------- -----------

Net cash flow used in investing activities (627,091) (42,291)

Cash flow from financing activities

Proceeds from issue of share capital 21 10,512,995 10,863,150

Cost of issue 21 (824,780) (756,753)

Interest paid 9 (2,998) (3,392)

Principal paid on finance leases 15 (3,318) (11,045)

Interest received 9 749 180

Net cash generated from financing

activities 9,682,648 10,092,140

Increase in cash and cash equivalents

in the year 1,575,133 4,739,792

Cash and cash equivalents at beginning

of year 7,086,906 2,347,114

Cash and cash equivalents at the end of

the year 8,662,039 7,086,906

=========== ===========

The notes to the accounts published in the Annual Report form

part of the financial statements.

Extracts from the notes to the financial statements

2 Summary of significant accounting policies

Basis of preparation

The consolidated financial statements consolidate those of the

Company and its subsidiaries (together the "Group"). The financial

statements have been prepared on a going concern basis in

accordance with UK-adopted international accounting standards and

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

The effect on the economy may impact the Group in varying ways,

which could lead to a direct bearing on the Group's ability to

generate future cash flows for working capital purposes. The

inability to gauge the length of such disruption further adds to

this uncertainty. For these reasons the generation of sufficient

operating cash flows remain a risk. Management is closely

monitoring commercial and technical aspects of the Group's

operations to mitigate risk and believes the Group will have access

to sufficient working capital to continue operations for the

foreseeable future.

Consolidation

The consolidated financial statements consolidate the financial

statements of the Company and the results of its subsidiary

undertakings Bidstack Limited, Pubguard Ltd, Bidstack SIA, Bidstack

Technologies Ltd, Bidstack Sports Limited and Bidstack Inc., made

up to 31 December 2022.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases.

Although the consolidated financial information has been issued

in the name of Bidstack Group Plc, the legal parent, it represents

in substance continuation of the financial information of the legal

subsidiary, Bidstack Ltd.

Going concern

The Board continues to adopt the going concern basis in the

preparation of the financial statements as it is confident of the

Group continuing operations into the foreseeable future, although

material uncertainty exists in relation to the group's ability to

raise funds to sustain its operations.

The Board's forecasts for the Group include revenue from

existing business, additional future revenues from anticipated new

lines of business, potential future capital in-flows, continued

operating losses, projected cash-burn of the Group (and taking

account of reasonably possible changes in trading performance and

also changes outside of expected trading performance) for a minimum

period of at least twelve months from the date of approval of these

financial statements.

The Group forecasts assume that further equity fundraising will

take place in the next twelve months in order to implement its

growth strategy and operate as a going concern. The Group is

currently negotiating a convertible loan facility with a strategic

investor to address its short term cash requirements. Although the

Group has had past success in fundraising and continues to attract

interest from investors, making the Board confident that such

financing options will be available to provide the required

capital, there can be no guarantee that such fundraising will be

available and, accordingly, this constitutes a material uncertainty

over going concern.

In addition to the above, the Board has considered various

alternative operating strategies should these be necessary in the

light of actual trading performance not matching the Group's

forecasts given current macro-economic conditions and is satisfied

that such revised operating strategies could be adopted, if and

when necessary. Therefore, the Directors consider the going concern

basis of preparation is appropriate.

2 Summary of significant accounting policies (continued)

Going concern (continued)

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chairman's statement on pages 2 to 5.

The financial statements at 31 December 2022 show that the Group

generated an operating loss for the year of GBP8.8 million (2021:

GBP7.9 million); with cash used in operating activities of GBP7.5

million (2021: GBP6.2 million). Group balance sheet also showed

cash reserves at 31 December 2022 of GBP8.6 million (2021: GBP7.1

million). The Group is dependent on further equity fundraising in

order to operate as a going concern for at least twelve months from

the date of approval of the financial statements.

New and amended standard, and interpretations issued and

effective for the financial year beginning 1 January 2022.

The adoption of the following mentioned amendments, which were

all effective for the period beginning 1 January 2022, have not had

a material impact on the Group's and Company's financial

statements:

-- Amendments to IAS 16 Property, Plant and Equipment: Proceeds before Intended Use;

-- Annual Improvements to IFRS Standards 2018-2020 (Amendments

to IFRS 1, IFRS 9, IFRS 16 and IAS 41);

-- Amendments to IFRS 3 References to Conceptual Framework);

-- Amendments to IAS 37 Provisions, Contingent Liabilities and Contingent Assets

New standards, interpretations and amendments not yet

effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Group has decided

not to adopt early.

The following amendments are effective for the period beginning

1 January 2023:

-- Amendments to IAS 1 Presentation of Financial Statements:

Classification of Liabilities as Current or Non-current and

Amendments to IAS 1: Classification of Liabilities as Current or

Non-current - Deferral of Effective Date - effective 1 January

2023*

-- Amendments to IAS 1 Presentation of Financial Statements and

IFRS Practice Statement 2: Disclosure of Accounting Policies -

effective 1 January 2023

-- Amendments to IAS 8 Accounting policies, Changes in

Accounting Estimates and Errors -Definition of Accounting Estimates

- effective 1 January 2023

-- Amendments to IAS 12 Income Taxes - Deferred Tax Related to

Assets and Liabilities arising from a Single Transaction -

effective 1 January 2023

The following amendments are effective for the period beginning

1 January 2024:

-- IFRS 16 Leases (Amendment - Liability in a Sale and Leaseback)

-- IAS 1 Presentation of Financial Statements (Amendment -

Classification of Liabilities as Current or Non-current)

-- IAS 1 Presentation of Financial Statements (Amendment -

Non-current Liabilities with Covenants)

Bidstack Group Plc is currently assessing the impact of these

new accounting standards and amendments.

2 Summary of significant accounting policies (continued)

Revenue Recognition

Under IFRS 15, revenue is recognised to depict the transfer of

promised goods or services to a customer in an amount that reflects

the consideration to which the Company expects to be entitled in

exchange for those goods and services. The underlying principle is

a five-step approach to identify a contract, determine performance

obligations, the consideration and the allocation thereof, and

timing of revenue recognition. IFRS 15 also includes guidance on

the presentation of assets and liabilities arising from contracts

with customers, which depends on the relationship between Company's

performance and the customers' payment.

The Group recognises revenue from the follow activities:

-- Revenue from Media contracts; whereby Group's inventory is sold to advertisers directly or programmatically;

-- Revenue from Sponsorship contracts; whereby the Group enter

into a contract with the brand direct or advertising agency to

provide a customized campaign in a chosen video game;

-- Revenue from Licensing contracts; whereby the Group enters

into a contract that provides the exclusive licensing agreement of

the Pubguard Technology;

-- Revenue from Minimum Guarantee; whereby the Group entered

into an exclusive contract with Azerion as its provider of reseller

services in relation to Bidstack SDK formats.

Revenue from contracts with customers is recognised when or as

the Company satisfies a performance obligation by transferring a

promised good or service to a customer. A good or service is

transferred when the customer obtains control of that good or

service.

The Group identified the performance obligations that related to

the above stated revenue activities as follows:

-- Revenue from Media contracts; based on agreed impressions

that have been delivered between the campaign start and end

date;

-- Revenue from Sponsorship contracts; the delivery of a

customised placement of advertising into the agreed game;

-- Revenue from Licensing contracts; the point at which the

brand rights were made available, and the point that exclusive

licensing access to the Pubguard technology was provided;

-- Revenue from Minimum Guarantee; for the provision of an

agreed amount of in-game advertising inventory over the duration of

the contract.

For each performance obligation that is satisfied over time, the

Group applies a single method of measuring progress towards

complete satisfaction of the obligation. The objective is to depict

the transfer of control of the goods or services to the customer.

To do this, the Group have adopted an appropriate output method.

For the Group, that is the rights to access and use the brand

assets and the provision of in-game advertising inventory over the

period of the contract.

The Group identifies the transaction price that relate to the

above stated revenue generating activities as follows:

-- Revenue from Media contracts; based on the Group's rate card

by CPM multiplied by the agreed number of impressions;

-- Revenue from Sponsorship contracts; based on the cost set by

the game developer. The Group implements a cost plus model for

sponsorship;

-- Revenue from Licensing contracts; determined by the contract over the duration of the term;

-- Revenue from Minimum Guarantee; the minimum guarantee's

transaction price is included within the contract .

2 Summary of significant accounting policies (continued)

Revenue Recognition

The Group have applied a practical expedient which allows an

entity to apply the accounting for a contract with a customer to a

portfolio of contracts with similar characteristics if the entity

reasonably expects the effects on the financial statements of

applying IFRS 15. The Group have assessed the contracts and is

comfortable that the effects on the financial statements of

applying IFRS 15 would not differ materially from applying this

Standard to the individual contracts (or performance obligations)

within that portfolio.

The Company assesses the contract with the customer to identify

the separate performance obligations which would consist of an

'access rights' and the 'provision of in-game advertising

inventory'. The Company transfer of the in-game advertising

inventory sold usually coincides with the delivery of that

inventory and the customer being able to utilise it. The Company

principally satisfies its performance obligations at that point in

time and recognises revenue on delivery.

The Group recognises a contract asset when revenue has been

recognised on satisfying performance obligations but have not yet

been billed to the customer. Contract assets relate to impressions

that have been delivered but not billed to the customers. Contract

liabilities are recognised when the Group has an obligation to

transfer goods or services to the customer for which consideration

has been received from the customer. Contract liabilities relate to

advanced payments from customers against a campaign.

Net finance costs

Finance costs comprise interest on bank loans and other interest

payable. Interest on bank loans and other interest is charged to

the Statement of Comprehensive Income over the term of the debt

using the effective interest rate method so that the amount charged

is at a constant rate on the carrying amount.

Finance income comprises interest receivable on loans to related

parties. Interest income is recognised in the Statement of

Comprehensive Income as it accrues using the effective interest

method.

Taxation

Tax on the profit or loss for the year comprises current and

deferred tax. Tax is recognised in the Statement of Comprehensive

Income except to the extent that it relates to items recognised

directly in equity, in which case it is recognised in equity .

Current tax is recognised as the amount of corporation tax

payable in respect of taxable profit for the current or past

reporting periods using tax rates and laws that have been enacted

or substantively enacted by the reporting date.

Deferred tax is recognised in respect of all timing differences

at the reporting date, except as otherwise indicated.

Deferred tax assets are only recognised to the extent that it is

probable that they will be recovered against the reversal of

deferred tax liabilities or other future taxable profits.

Deferred tax is calculated using the tax rates and laws that

have been enacted or substantively enacted by the reporting date

that are expected to apply to the reversal of the timing

difference.

With the exception of changes arising on initial recognition of

a business combination, the tax expense/(income) is presented

either in the income statement, other comprehensive income or

equity depending on the transaction that resulted in the tax

expense/(income).

2 Summary of significant accounting policies (continued)

Taxation ( continued)

Deferred tax liabilities are presented within provisions for

liabilities and deferred tax assets within debtors. Deferred tax

assets and deferred tax liabilities are offset only if:

- the Group has a legally enforceable right to set off current

tax assets against current tax liabilities, and

- the deferred tax assets and deferred tax liabilities relate to

corporation tax levied by the same taxation authority on either the

same taxable entity or different taxable entities which intend

either to settle current tax liabilities and assets on a net basis,

or to realise the assets and settle the liabilities

simultaneously.

- Research and Development Tax Credits are recognised as

receivables when an inflow of economic benefit is certain, until

then a contingent asset in respect of probable Corporation Tax is

disclosed.

Valuation of investments

Investment in subsidiary undertakings are accounted for at cost

less impairment. Advances to subsidiaries are initially recorded at

fair value based on a market rate of interest and subsequently at

amortised cost. The difference between funds advanced and fair

value is recorded in investments.

Impairment of fixed asset investments

Fixed asset investments are assessed for the presence of

impairment indicators, if any indicators are present then an

impairment review is conducted. An impairment review of Goodwill is

conducted annually, any resulting impairment loss is measured and

recognised on a consistent basis.

Leased assets

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

- Leases of low value assets; and

- Leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the incremental borrowing rate on

commencement of the lease is used.

On initial recognition, the carrying value of the lease

liability also includes:

- amounts expected to be payable under any residual value guarantee;

- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of the termination

option being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

- lease payments made at or before commencement of the lease;

- initial direct costs incurred; and

2 Summary of significant accounting policies (continued)

- the amount of any provision recognised where the Group is

contractually required to dismantle, remove or restore the leased

asset.

Leased assets (continued)

Subsequent to initial measurement, lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term. When

the Group revises its estimate of the term of any lease (because,

for example, it re-assesses the probability of a lessee extension

or termination option being exercised), it adjusts the carrying

amount of the lease liability to reflect the payments to make over

the revised term, which are discounted at the same discount rate

that applied on lease commencement.

An equivalent adjustment is made to the carrying value of the

right-of-use asset, with the revised carrying amount being

amortised over the remaining (revised) lease term.

Goodwill

Goodwill represents the difference between amounts paid on the

cost of a business combination and the fair value of Bidstack

Group's share of the identifiable assets and liabilities of the

acquiree at the date of acquisition. Subsequent to initial

recognition, Goodwill is measured at cost less accumulated

impairment losses.

Intangible assets

An intangible asset, which is an identifiable non-monetary asset

without physical substance, is recognised to the extent that it is

probable that the expected future economic benefits attributable to

the asset will flow to the Group and that its cost can be measured

reliably, the asset is deemed to be identifiable when it is

separable or when it arises from contractual or other legal

rights.

Amortisation is charged on a straight-line basis and is included

in administrative expenses through the profit or loss. The rates

applicable, which represent the Directors' best estimate of the

useful economic life, are:

- Website costs - 5 years

- Trademarks - 10 years

- Brand - 5 years

- Software - 5 years

- Research and Development - 5 years

Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. As well as the purchase price, cost includes directly

attributable costs. Depreciation is provided on all items of

property, plant and equipment, so as to write off their carrying

value over their expected useful economic lives. It is provided at

the following rates:

- Computer equipment - 33.33% straight line

- Office equipment - 20% straight line

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks and other short-term highly liquid investments that

are readily convertible into known amounts of cash and which are

subject to an insignificant risk of changes in value.

2 Summary of significant accounting policies (continued)

Financial assets (continued)

The Group classifies all of its financial assets as loans and

other receivables. Financial assets do not comprise prepayments.

Management determines the classification of its financial assets at

initial recognition.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments. They are initially recognised at

fair value and are subsequently stated at amortised cost using the

effective interest method, less any impairment. Interest income is

recognised by applying the effective interest rate, except for

short-term receivables when the recognition of interest would be

immaterial.

The Group's financial assets held at amortised cost comprise

trade and other receivables and cash and cash equivalents in the

Statement of Financial Position.

Financial liabilities

Trade and other payables are recognised initially at fair value

and are subsequently measured at amortised cost,

using the effective interest method.

Share Capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new share or options are

shown in equity as deduction net of tax before proceeds.

Share-based payments

Where share options are awarded to employees, the fair value of

the options at the date of grant is charged to the income statement

over the vesting period. Non-market vesting conditions are taken

into account by adjusting the number of equity instruments expected

to vest at each balance sheet date so that, ultimately, the

cumulative amount recognised over the vesting period is based on

the number of options that eventually vest. Market vesting

conditions are factored into the fair value of the options

granted.

As long as all other vesting conditions are satisfied, a charge

is made irrespective of whether the market vesting conditions are

satisfied. The cumulative expense is not adjusted for failure to

achieve a market vesting condition.

Where the terms and conditions of options are modified before

they vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the income statement over the remaining vesting period. Where

equity instruments are granted to persons other than employees, the

income statement is charged with fair value of goods and services

received.

Functional and presentation currency

Items included in the financial statements of the Group are

presented in Pounds Sterling (GBP) which is also the Parent

Company's functional currency.

Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where items are re-measured. Foreign

exchange gains and losses resulting from the settlement of

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the Statement of Comprehensive Income

4 Segmental information

During the year ended 31 December 2022 and the year ended 31

December 2021, the Group operated one business segment, that of the

provision of native in-game advertising across the US and in

EMEA.

The revenue has been segmented based on geographical regions US

and EMEA, and by revenue type. This is used by the chief operating

decision makers to perform their role.

31 December 31 December

2022 2021

GBP GBP

Revenue by Geographical Region

US 167,627 863,691

EMEA 5,099,528 1,759,722

5,267,155 2,623,413

=========== ===========

The Group's revenue included 1 (2021: 5) customers making up

more than 10% each during the year.

31 December 31 December

2022 2021

GBP GBP

Revenue by Type

Customer 1 4,112,331 642,270

Customer 2 - 377,375

Customer 3 - 361,758

Customer 4 - 289,239

Customer 5 - 267,914

All other customers 1,154,824 684,857

Total revenue 5,267,155 2,623,413

=========== ===========

The Group recognises a contract asset when revenue has been

recognised on satisfying performance obligations but have not yet

been billed to the customer. Contract assets relate to impressions

that have been delivered but not billed to the customers. Contract

liabilities are recognised when the Group has an obligation to

transfer goods or services to the customer for which consideration

has been received from the customer. Contract liabilities relate to

advanced payments from customers against a campaign. Further

details of the Group's contract assets and liabilities can be found

in Note 18 and Note 20, respectively.

The Group does not ordinarily have returns, refunds or other

similar obligations in respect of their performance obligations as

the Group's obligations are around the delivery of impressions or a

hardcoded customised asset. The Group ensures that the customers

are happy to proceed in advance of going live. Should there be a

discrepancy between what the customer sees as delivered on their

3(rd) party verification system and what the Group has billed, a

credit note is issued.

As at 31 December 2022, the Group did not have any unsatisfied

long-term contracts.

11 Loss per share

Basic and diluted loss per share

The calculation of basic and diluted loss per share is based on

the loss attributable to ordinary shareholders of GBP7,686,186

(2021: loss of GBP6,297,444) and the weighted average number of

ordinary shares in issue for the year of 1,235,295,798 (2021:

519,507,993 ). The basic and diluted earnings per share are the

same given the loss for the year, making the outstanding share

options and warrants anti-dilutive.

21 Share capital and reserves

Allotted, called up and Ordinary Share Share

fully paid 0.5p shares capital Premium

No. GBP GBP

As at 01 January 2022 931,531,573 8,950,048 35,375,326

Issue of placing shares 369,324,411 1,846,622 8,666,373

Cost of raising equity - - (824,780)

As at 31 December 2022 1,300,855,984 10,796,670 43,216,919

========================== ============= ========== ===========

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of Shareholders.

The following describes the nature and purpose of each reserve

within owner's equity:

Share capital : Amount subscribed for shares at nominal

value.

Share premium : Amount subscribed for share capital in excess of

nominal value, less costs of share issue.

Share-based payment reserve: The share-based payment reserve

comprises the cumulative expense representing the extent to which

the vesting period of share options has passed and management's

best estimate of the achievement or otherwise of non-market

conditions and the number of equity instruments that will

ultimately vest.

Merger relief reserve: Effect on equity of the consideration

shares issued over their nominal value.

Reverse acquisition reserve: Effect on equity of the reverse

acquisition of Bidstack Limited.

Warrant reserve: The warrant reserve comprises the cumulative

expense representing the extent to which the vesting period of

warrants has passed and management's best estimate of the

achievement or otherwise of non-market conditions and the number of

equity instruments that will ultimately vest.

Exchange reserve: The exchange reserve represents foreign

exchange differences in re-translation.

Retained losses: Cumulative realised profits less cumulative

realised losses and distributions made, attributable to the equity

Shareholders of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SELSWSEDSESM

(END) Dow Jones Newswires

June 20, 2023 03:18 ET (07:18 GMT)

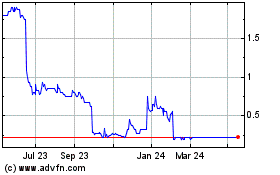

Bidstack (LSE:BIDS)

Historical Stock Chart

From Dec 2024 to Jan 2025

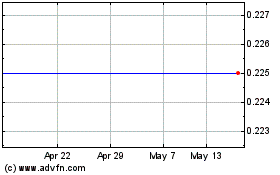

Bidstack (LSE:BIDS)

Historical Stock Chart

From Jan 2024 to Jan 2025